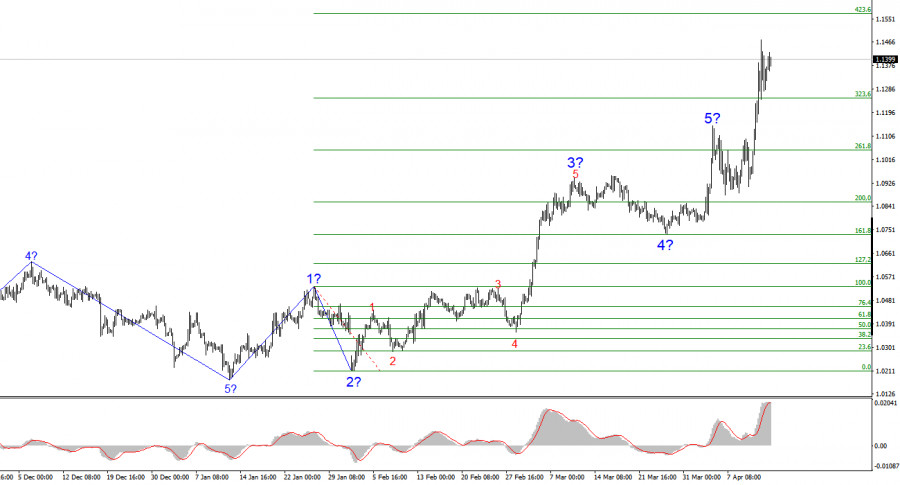

- لقد تحولت بنية الموجة لزوج الجنيه الإسترليني/الدولار الأمريكي إلى تشكيل صعودي اندفاعي، بفضل دونالد ترامب. تبدو نمط الموجة مشابهة تقريبًا لنمط زوج اليورو/الدولار الأمريكي. حتى 28 فبراير، كنا نلاحظ بنية

المحرر: Chin Zhao

19:09 2025-04-14 UTC+2

7

لقد تحولت بنية الموجة على الرسم البياني لمدة 4 ساعات لزوج اليورو/الدولار الأمريكي إلى تشكيل صعودي. أعتقد أنه لا يوجد شك كبير في أن هذا التحول حدث فقط بسبب سياسةالمحرر: Chin Zhao

19:05 2025-04-14 UTC+2

0

تحليل التداول وإرشادات لتداول الين الياباني حدث اختبار مستوى 142.69 عندما كان مؤشر MACD قد تحرك بالفعل بشكل كبير تحت خط الصفر، مما حد من الإمكانات الهبوطية للزوج. لهذا السبب،المحرر: Jakub Novak

19:01 2025-04-14 UTC+2

0

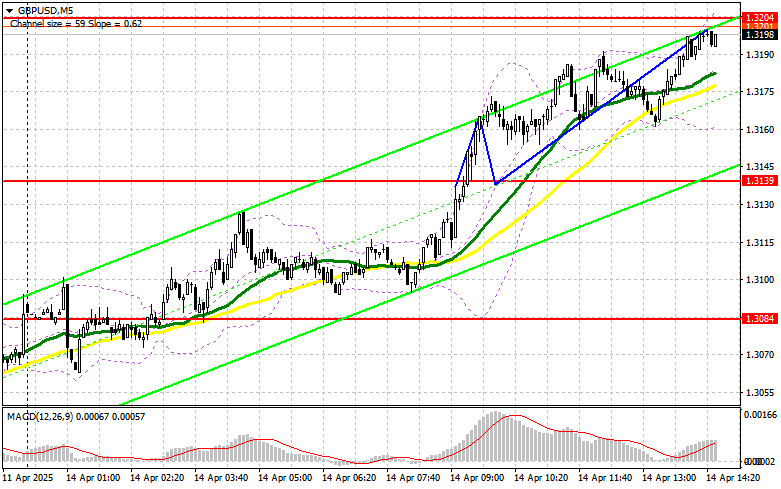

- تحليل التداول وإرشادات لتداول الجنيه الإسترليني حدث اختبار مستوى 1.3136 عندما كان مؤشر MACD قد تحرك بالفعل بعيدًا فوق خط الصفر، مما حد من الإمكانات الصعودية للزوج. نظرًا لعدم وجود

المحرر: Jakub Novak

18:56 2025-04-14 UTC+2

0

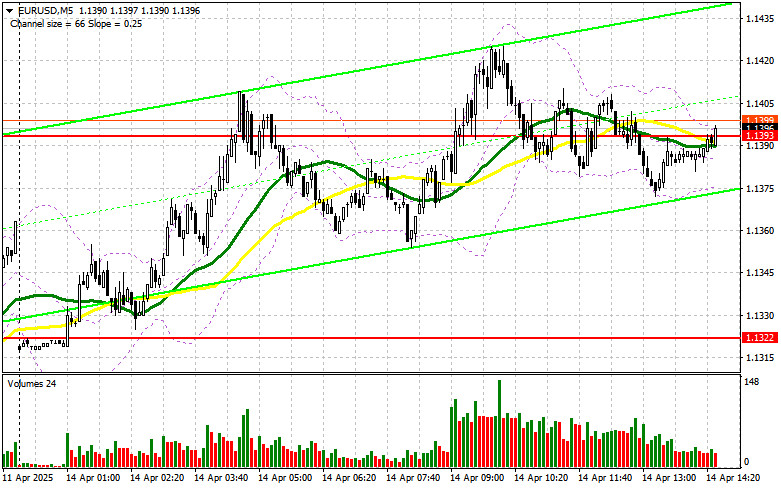

تحليل وتوصيات التداول لعملة اليورو حدث اختبار السعر عند 1.1397 عندما كان مؤشر MACD قد تحرك بالفعل بشكل كبير فوق خط الصفر، مما حد من الإمكانات الصعودية للزوج. نظرًا لعدمالمحرر: Jakub Novak

18:53 2025-04-14 UTC+2

0

في توقعاتي الصباحية، قمت بتسليط الضوء على مستوى 1.3139 وخططت لاتخاذ قرارات التداول بناءً عليه. دعونا نلقي نظرة على الرسم البياني لمدة 5 دقائق ونرى ما حدث. حدث اختراق لمستوىالمحرر: Miroslaw Bawulski

18:50 2025-04-14 UTC+2

0

- في توقعاتي الصباحية، قمت بتسليط الضوء على مستوى 1.1393 وخططت لاتخاذ قرارات الدخول بناءً عليه. دعونا نلقي نظرة على الرسم البياني لمدة 5 دقائق ونحلل ما حدث هناك

المحرر: Miroslaw Bawulski

18:47 2025-04-14 UTC+2

0

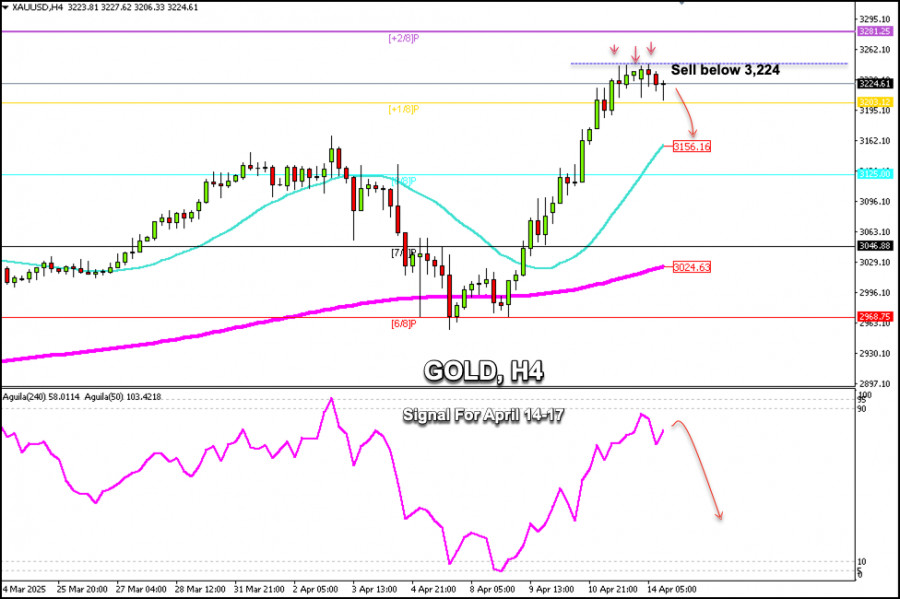

Technical analysisإشارات التداول للذهب (XAU/USD) للفترة من 14 إلى 17 أبريل 2024: البيع تحت مستوى 3,224 دولار (+1/8 Murray - 21 SMA)

خطة التداول لدينا للساعات القادمة هي بيع الذهب تحت مستوى 3,224، مع تحديد الأهداف عند 3,203 و3,156. يجب أن نكون متيقظين لأي ارتداد تقني، حيث أن النظرة العامة لا تزالالمحرر: Dimitrios Zappas

15:59 2025-04-14 UTC+2

0

لقد اجتاحت الأسواق العالمية دوامة من الرسوم الجمركية، ومركز العاصفة مرة أخرى في واشنطن. ترامب، بضربة من قلمه، يرسل المؤشرات إلى الانخفاض أو يمنحها انتعاشًا، ولكن خلف الأرقام المثيرة للإعجابالمحرر: Аlena Ivannitskaya

14:28 2025-04-14 UTC+2

0