- পূর্বাভাস

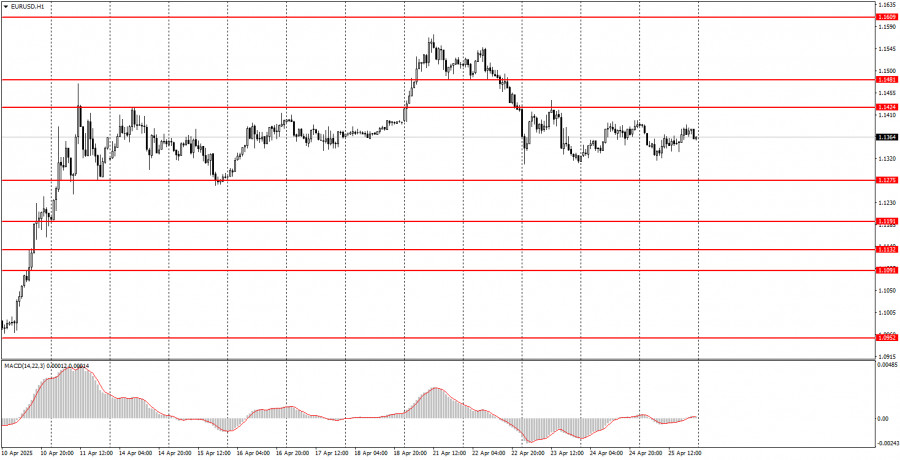

EUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৮ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

দিনের দ্বিতীয়ার্ধে যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ নিচে নিচে গিয়েছিললেখক: Jakub Novak

09:37 2025-04-28 UTC+2

1

মৌলিক বিশ্লেষণ২৮ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

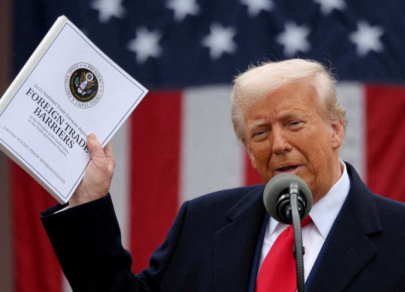

সোমবার কোনো সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে না। গত সপ্তাহে মার্কেটের ট্রেডাররা সামষ্টিক অর্থনৈতিক প্রতিবেদনের প্রতি তেমন কোনো প্রতিক্রিয়া দেখায়নি, তাই সোমবারও বিশেষ কিছু প্রত্যাশা করার নেই। অবশ্য, ডোনাল্ড ট্রাম্পলেখক: Paolo Greco

08:07 2025-04-28 UTC+2

0

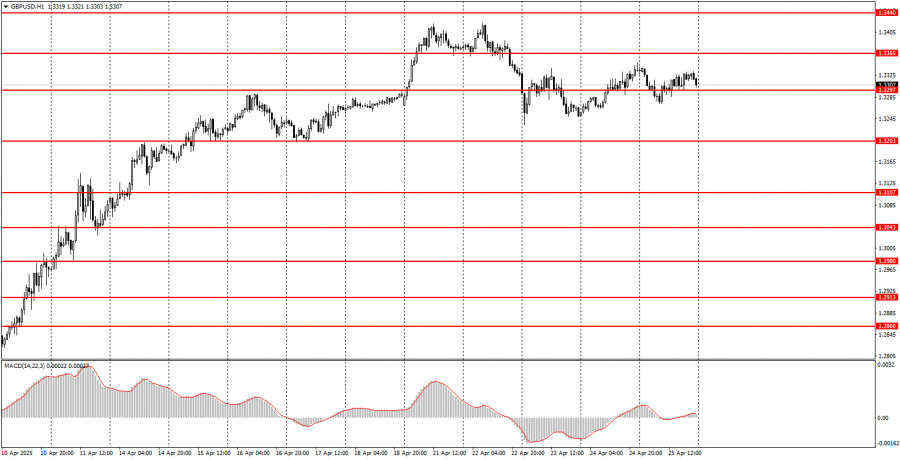

ট্রেডিং পরিকল্পনা২৮ এপ্রিল কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

শুক্রবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট শুক্রবারও একটি বাণিজ্য চুক্তি সম্পন্ন হবে। তবে, একই সাথে চীন জানিয়েছে যে তারা ট্রাম্পের সাথে কোনো আলোচনায় এখনও যোগ দেয়নি।লেখক: Paolo Greco

06:57 2025-04-28 UTC+2

1

- ট্রেডিং পরিকল্পনা

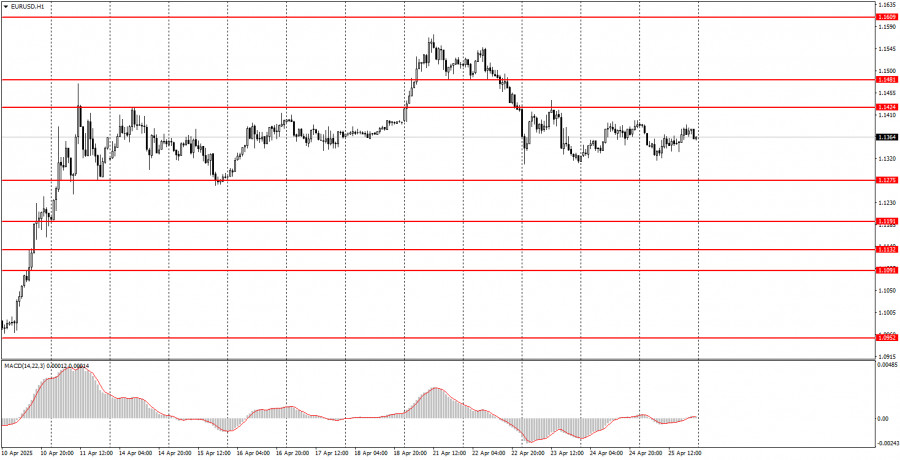

২৮ এপ্রিল কীভাবে EUR/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

শুক্রবারের ট্রেডের বিশ্লেষণ EUR/USD পেয়ারের 1H চার্ট শুক্রবার EUR/USD কারেন্সি পেয়ারের মূল্যের সাইডওয়েজ ট্রেডিং অব্যাহত ছিল। মার্কেটের ট্রেডাররা এখনো সকল সামষ্টিক অর্থনৈতিক প্রতিবেদন উপেক্ষা করে চলেছে, এবং গত সপ্তাহে আবারওলেখক: Paolo Greco

06:46 2025-04-28 UTC+2

1

স্টক বিশ্লেষণমার্কিন স্টক মার্কেটের পরিস্থিতি – ২৫ এপ্রিল: পুনরায় S&P 500 এবং নাসডাক সূচকে প্রবৃদ্ধি শুরু হয়েছে

সর্বশেষ নিয়মিত সেশনের শেষে, মার্কিন স্টক সূচকগুলোতে ঊর্ধ্বমুখী প্রবণতার সাথে লেনদেন শেষ হয়েছে। S&P 500 সূচক 2.03% বেড়েছে, নাসডাক 100 সূচক 2.74% বৃদ্ধি পেয়েছে। ডাও জোন্স ইন্ডাস্ট্রিয়াল অ্যাভারেজ 1.23% প্রবৃদ্ধিলেখক: Jakub Novak

12:02 2025-04-25 UTC+2

49

মৌলিক বিশ্লেষণকেন স্বর্ণের দাম উল্লেখযোগ্যভাবে কমতে পারে? (স্বর্ণের দরপতনের সম্ভাবনা রয়েছে, অন্যদিকে নাসডাক 100 ফিউচার্স কন্ট্রাক্টের CFD-এর দর বৃদ্ধি পেতে পারে)

বাস্তবিক অর্থে বাণিজ্য যুদ্ধের উত্তেজনা প্রশমনের লক্ষ্যে আলোচনার শুরু হলে নিকট ভবিষ্যতে স্বর্ণের উল্লেখযোগ্য দরপতন ঘটতে পারে। পূর্ববর্তী নিবন্ধগুলোতে আমি উল্লেখ করেছি যে, বেইজিং এবং ওয়াশিংটনের মধ্যে শুল্ক নিয়ে আলোচনারলেখক: Pati Gani

10:32 2025-04-25 UTC+2

53

- গতকাল বিটকয়েনের মূল্যের $94,000 লেভেলের ওপরে স্থায়ীভাবে থাকার ব্যর্থ প্রচেষ্টা দেখিয়ে দিয়েছে যে এখনো উল্লেখযোগ্যভাবে বিটকয়েন ক্রয়ের আগ্রহ রয়েছে। ইথেরিয়ামের মূল্যও বেশ ভালোভাবে উচ্চ লেভেলে রয়েছে, যদিও গতকাল ইউরোপীয় সেশনের

লেখক: Miroslaw Bawulski

09:25 2025-04-25 UTC+2

46

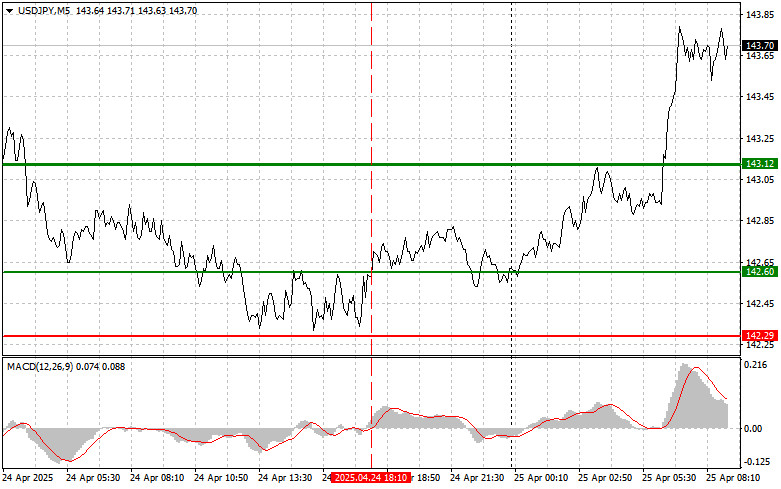

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৫ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্যলেখক: Jakub Novak

09:18 2025-04-25 UTC+2

49

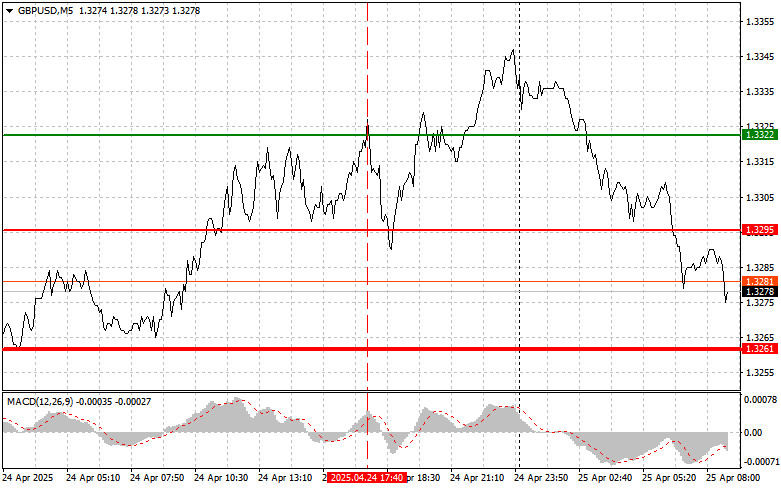

পূর্বাভাসGBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৫ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ ওপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্য এই পেয়ার বিক্রির জন্য অনুরূপ পরিস্থিতি তৈরি হয়েছিল। গতকাল প্রকাশিত যুক্তরাষ্ট্রের প্রতিবেদনের ফলাফল ডলারের মূল্যের তীব্র বৃদ্ধিলেখক: Jakub Novak

09:08 2025-04-25 UTC+2

50