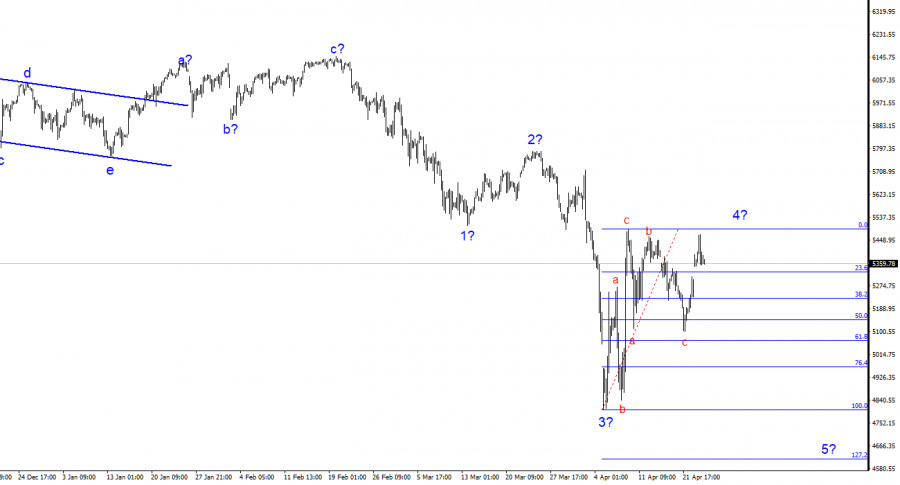

- 24-ঘণ্টার চার্টে #SPX এর ওয়েভ প্যাটার্ন মোটামুটি স্পষ্ট। বৈশ্বিক ফাইভ-ওয়েভ স্ট্রাকচারটি এত বিস্তৃত যে এটি টার্মিনাল স্ক্রিনের লোয়ার স্কেলেও পুরোপুরি ধরছে না। সহজ কথায়, যুক্তরাষ্ট্রের স্টক সূচকগুলো দীর্ঘ সময় ধরে

লেখক: Chin Zhao

10:49 2025-04-24 UTC+2

0

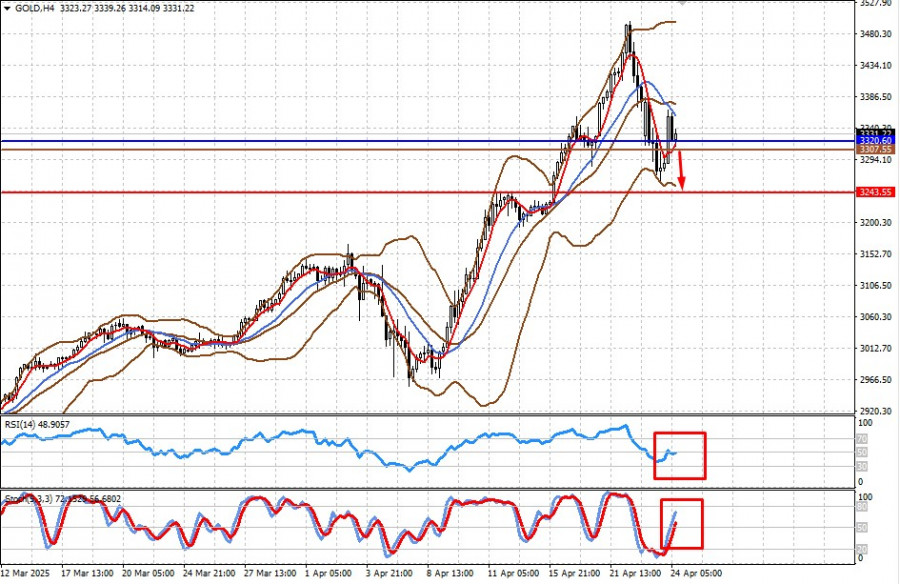

সম্প্রতি স্বর্ণের মূল্যের উল্লেখযোগ্য কারেকশন দেখা গেছে, যা মার্কেটে যুক্তরাষ্ট্র ও চীনের মধ্যে শুল্ক আরোপ এবং সামগ্রিক বাণিজ্যযুদ্ধ নিয়ে বাস্তব আলোচনার শুরুর প্রত্যাশার সাথে সঙ্গতিপূর্ণ। ট্রেজারি সেক্রেটারি বেসেন্টের বক্তব্যে তিনিলেখক: Pati Gani

10:42 2025-04-24 UTC+2

0

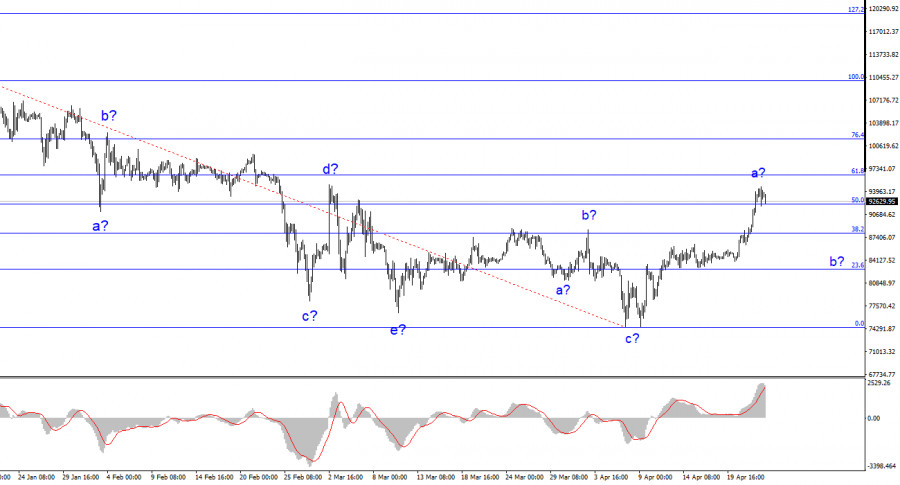

BTC/USD-এর 4-ঘণ্টার চার্টে ওয়েভ প্যাটার্ন কিছুটা জটিল হয়ে উঠেছে। আমরা একটি কারেকটিভ নিম্নমুখী স্ট্রাকচারের গঠন লক্ষ্য করেছি, যা $75,000 লেভেলের আশেপাশে সম্পন্ন হয়েছে। এর পরে, একটি তুলনামূলকভাবে শক্তিশালী ঊর্ধ্বমুখী মুভমেন্টলেখক: Chin Zhao

10:20 2025-04-24 UTC+2

0

- যখন ডোনাল্ড ট্রাম্প চীনের সাথে সমঝোতার চেষ্টা করছেন, তখন ফেডারেল রিজার্ভের গভর্নর অ্যাড্রিয়ানা কুগলার বলেছেন যে বর্তমান আরোপিত শুল্ক নীতিমালা মূল্যস্ফীতিকে ঊর্ধ্বমুখী করতে পারে এবং এর অর্থনৈতিক প্রভাব পূর্বের প্রত্যাশার

লেখক: Jakub Novak

10:12 2025-04-24 UTC+2

0

মার্কেটে ঊর্ধ্বমুখী প্রবণতা দেখা যাচ্ছে এবং মার্কিন ডলারের দর ইউরো ও অন্যান্য ঝুঁকিপূর্ণ সম্পদের বিপরীতে বৃদ্ধি পেয়েছে, কারণ মার্কিন প্রেসিডেন্ট ডোনাল্ড ট্রাম্প জানিয়েছেন যে তিনি ফেডারেল রিজার্ভের চেয়ারম্যান জেরোম পাওয়েলকেলেখক: Jakub Novak

10:02 2025-04-24 UTC+2

0

বিটকয়েনের মূল্য $94,000 লেভেলের ওপরে থাকতে ব্যর্থ হয়েছে এবং $92,500 এর জোনে কারেকশন হয়েছে, যেখানে এটির মূল্য তুলনামূলকভাবে আরও স্থিতিশীল অবস্থান নিয়েছে বলে মনে হচ্ছে। ইথেরিয়ামের মূল্যও সংক্ষিপ্তভাবে $1,830লেখক: Miroslaw Bawulski

09:48 2025-04-24 UTC+2

0

- পূর্বাভাস

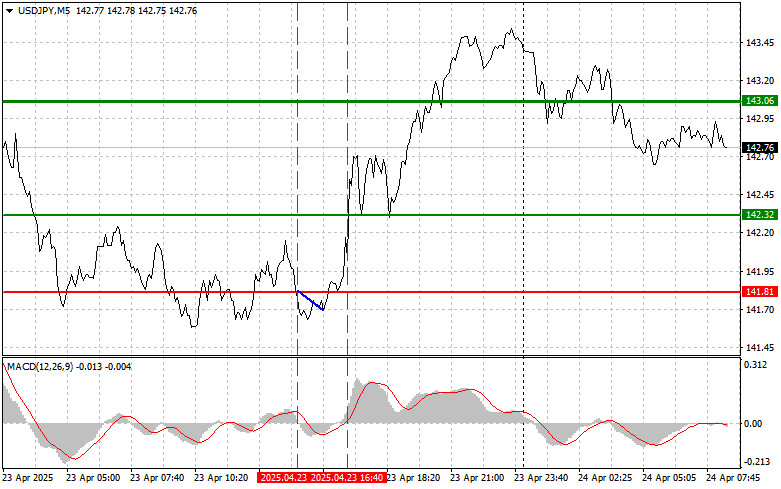

USD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৪ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্য 142.32 এর লেভেল টেস্ট করেছিল, যা আমার দৃষ্টিতে এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনাকে সীমিত করেছিল।লেখক: Jakub Novak

09:23 2025-04-24 UTC+2

0

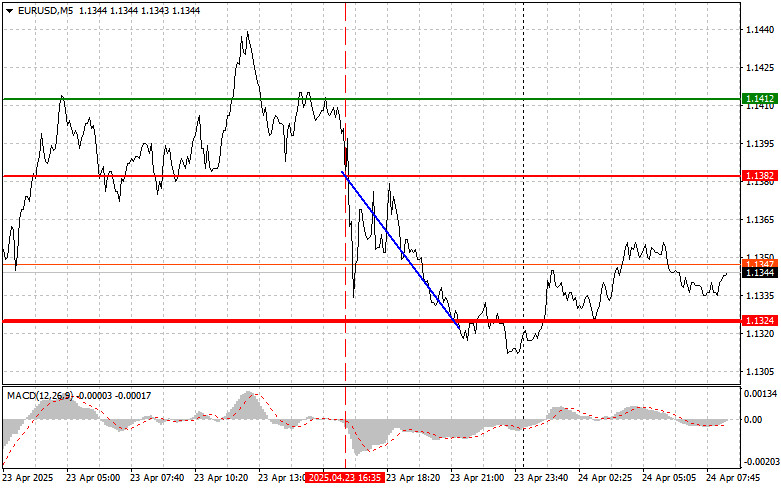

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৪ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

দিনের দ্বিতীয়ার্ধে যখন MACD সূচকটি শূন্যের নিচের নামতে শুরু করেছিল তখন এই পেয়ারের মূল্য 1.1382 এর লেভেল টেস্ট করেছিল, যা ইউরো বিক্রির জন্য সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করেছে। এর ফলেলেখক: Jakub Novak

09:15 2025-04-24 UTC+2

0

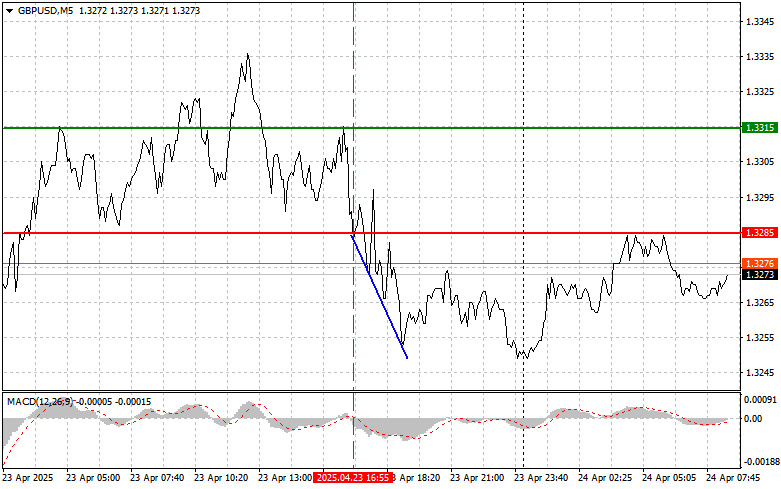

পূর্বাভাসGBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৪ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

যখন MACD সূচকটি সবেমাত্র শূন্যের নিচে নামতে শুরু করেছিল তখন এই পেয়ারের মূল্য 1.3285 এর লেভেল টেস্ট করেছিল, যা পাউন্ড বিক্রির জন্য একটি সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করেছে। এর ফলেলেখক: Jakub Novak

08:56 2025-04-24 UTC+2

0