- TSMC-এর পক্ষ থেকে মার্কিন চিপ নির্মাতাদের সহায়তা প্রদানের প্রস্তাবের খবর প্রকাশিত হওয়ার পর ইন্টেলের শেয়ারের মূল্য বৃদ্ধি পেয়েছে। এটি সেমিকন্ডাক্টর খাতে বিনিয়োগকারীদের আত্মবিশ্বাস বাড়িয়েছে। অন্যদিকে, একটি ব্রোকারেজ ফার্মের রেটিং কমানোর

লেখক: Ekaterina Kiseleva

12:38 2025-03-13 UTC+2

9

স্টক বিশ্লেষণমার্কিন স্টক মার্কেটের পরিস্থিতি, ১৩ মার্চ: S&P 500 এবং নাসডাক সূচকের ঊর্ধ্বমুখী প্রবণতা সাময়িক ছিল

S&P 500 এবং নাসডাক সূচকের ফিউচার আবারও দরপতনের শিকার হয়েছে, যা গতকাল প্রকাশিত মার্কিন মুদ্রাস্ফীতি প্রতিবেদনের অপ্রত্যাশিত ফলাফলের কারণে ঘটেছে। প্রতিবেদনে দেখা গেছে যে দেশটিতে মূল্যস্ফীতির চাপ হ্রাস পেয়েছে, যালেখক: Jakub Novak

10:19 2025-03-13 UTC+2

11

বিটকয়েন এবং ইথেরিয়ামের মূল্য নতুন চ্যানেলের মধ্যে আবদ্ধ রয়েছে। ইতিবাচক দিক হলো, সপ্তাহের শুরুতে পরিলক্ষিত তীব্র বিক্রয়ের প্রবণতা কমে গেছে। তবে, বিটকয়েনের আরও দর বৃদ্ধির সম্ভাবনা নিয়ে উদ্বেগ রয়েছে, কারণলেখক: Miroslaw Bawulski

10:03 2025-03-13 UTC+2

13

- পূর্বাভাস

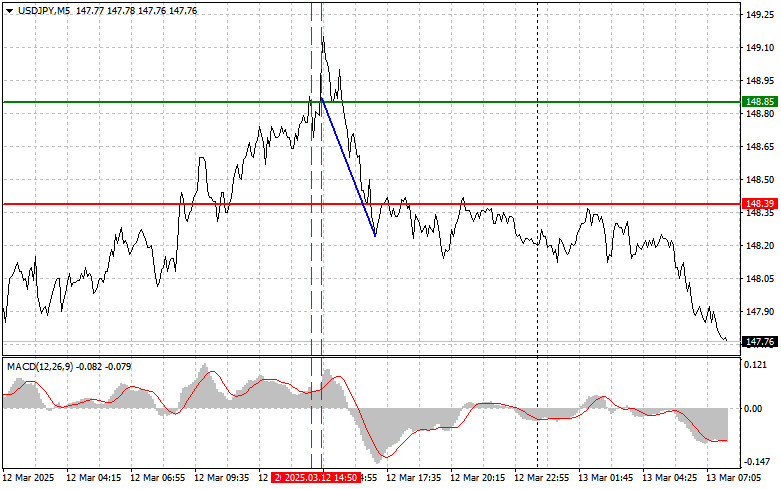

USD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৩ মার্চ। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি ইতোমধ্যেই শূন্যের উল্লেখযোগ্য উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্য 148.85 এর লেভেল টেস্ট করেছিল, যা এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনাকে সীমিত করেছিল। এই কারণেই, আমিলেখক: Jakub Novak

09:40 2025-03-13 UTC+2

14

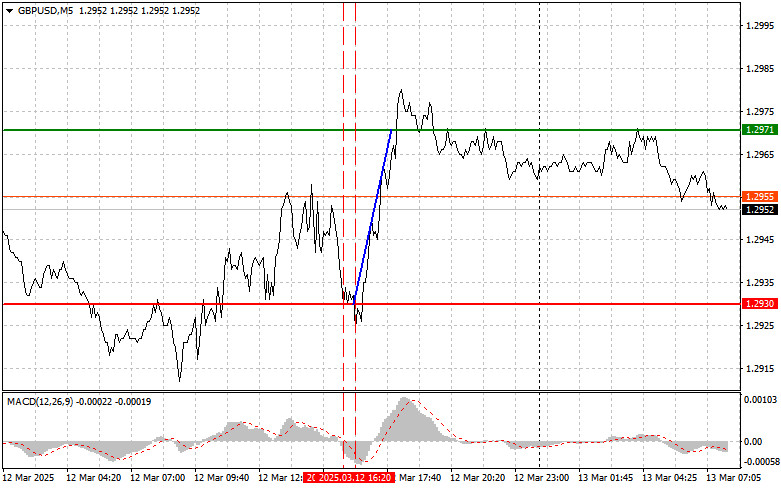

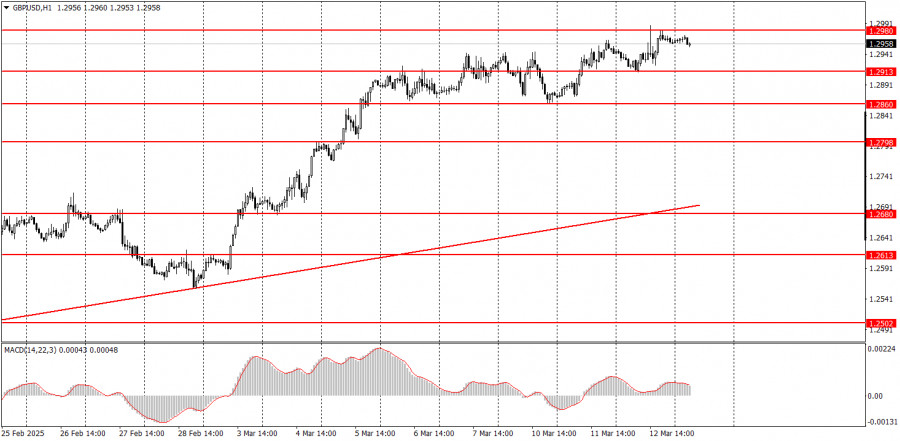

পূর্বাভাসGBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৩ মার্চ। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

ব্রিটিশ পাউন্ডের ট্রেডের বিশ্লেষণ এবং টিপস যখন MACD সূচকটি ইতোমধ্যেই শূন্যের উল্লেখযোগ্য নিচে নেমে গিয়েছিল তখন এই পেয়ারের মূল্য প্রাথমিকভাবে 1.2930 এর লেভেল টেস্ট করেছিল, যা এই পেয়ারের মূল্যের নিম্নমুখীলেখক: Jakub Novak

09:30 2025-03-13 UTC+2

21

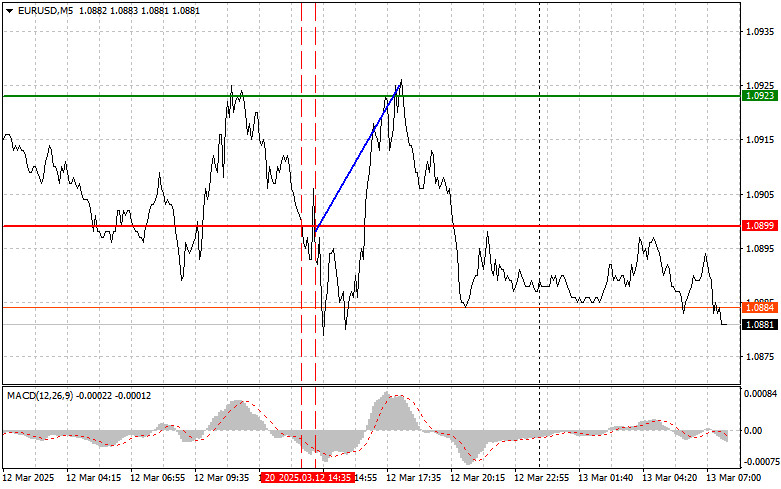

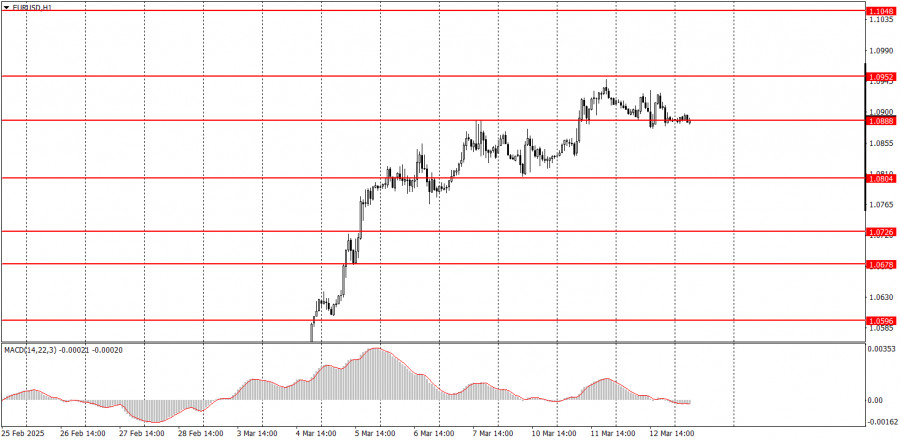

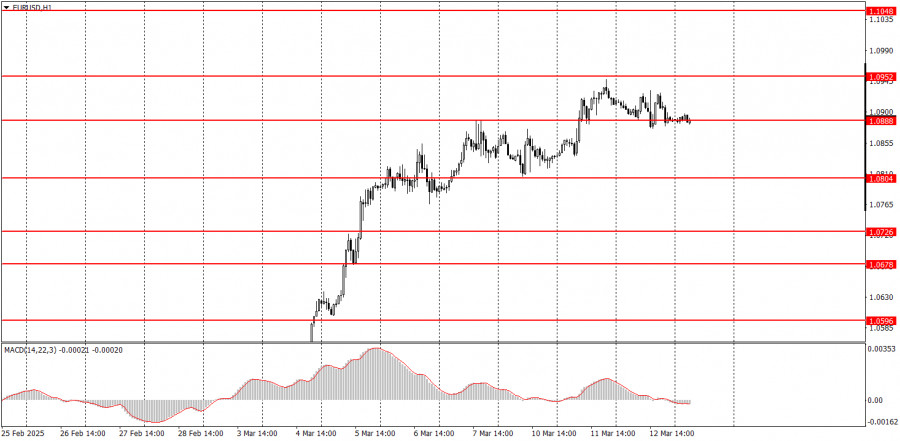

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৩ মার্চ। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

ইউরোর ট্রেডের বিশ্লেষণ এবং ট্রেডিংয়ের টিপস যখন MACD সূচকটি ইতোমধ্যেই শূন্যের উল্লেখযোগ্য নিচে নেমে গিয়েছিল তখন এই পেয়ারের মূল্য 1.0899 এর লেভেল টেস্ট করেছিল, যা আমার মতে, এই পেয়ারের মূল্যেরলেখক: Jakub Novak

09:17 2025-03-13 UTC+2

18

- মৌলিক বিশ্লেষণ

১৩ মার্চ কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

বৃহস্পতিবারের অল্প কিছু সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে বলে নির্ধারিত রয়েছে, তবে এগুলোর ফলাফল মার্কেটে গুরুত্বপূর্ণ কোনো প্রভাব ফেলবে বলে মনে হচ্ছে না। গত দেড় সপ্তাহ ধরে, মার্কেটের ট্রেডাররা মূলতলেখক: Paolo Greco

08:42 2025-03-13 UTC+2

13

ট্রেডিং পরিকল্পনা১৩ মার্চ কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বুধবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট বুধবার, GBP/USD পেয়ারের মূল্যের ঊর্ধ্বমুখী মুভমেন্ট অব্যাহত ছিল। মার্কিন মুদ্রাস্ফীতি প্রতিবেদনের ফলাফলের অন্তত সামান্য হলেও ডলারের দরপতন ঘটানো উচিত ছিল, বিশেষ করেলেখক: Paolo Greco

08:23 2025-03-13 UTC+2

8

ট্রেডিং পরিকল্পনা১৩ মার্চ কীভাবে EUR/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বুধবারের ট্রেডের বিশ্লেষণ EUR/USD পেয়ারের 1H চার্ট বুধবার, EUR/USD কারেজন্সি পেয়ারের মূল্য ঊর্ধ্বমুখী মুভমেন্টের জন্য নতুন ভিত্তি স্থাপন করতে ব্যর্থ হয়েছে। এটি আশ্চর্যের কিছু নয়, কারণ ট্রেডাররা মূলত ডোনাল্ড ট্রাম্পলেখক: Paolo Greco

07:51 2025-03-13 UTC+2

12