Markets Tumultuous: US Stocks Plunge Amid Fed Outlook Disappointment

US stocks fell significantly on Wednesday, with all three benchmark indexes posting their biggest one-day declines in months, as the Federal Reserve's decision to cut interest rates by a quarter percentage point failed to meet some investors' expectations. The Fed's guidance for next year points to a more measured approach to monetary easing.

Rates Down, But Caution Remains

The Federal Reserve has cut its benchmark interest rate by 25 basis points, setting a range of 4.25% to 4.50%. However, the Federal Reserve's SEP suggests that the rate will be cut by just half a percentage point by the end of 2025. This estimate is based on the resilience of the labor market and the slowdown in inflation seen in recent months.

The Economy Is Overheating

"Looking at the revisions to the economic forecast, it's clear that the Fed had no other choice," said Ellen Hazen, chief market strategist at F.L. Putnam Investment Management.

According to her, current economic data looks much stronger than previously thought. "The economy is performing much more strongly than expected, and that may be a reason for the Fed to pause on further action," she added.

US Stocks in a Steep Plunge: What Happened to the Market?

Key US indices fell sharply into the red on Wednesday, showing significant losses. The Dow Jones Industrial Average plunged by 1,123.03 points (2.58%) and closed at 42,326.87. The S&P 500 fell by 178.45 points (2.95%) to 5,872.16, and the tech-heavy Nasdaq Composite lost 716.37 points (3.56%), stopping at 19,392.69.

Dow's historic fall: anti-record since 1974

The Dow Jones is experiencing its longest period of declines in decades: the decline has continued for 10 trading sessions in a row. The last time such a protracted series of losses was observed in October 1974, when the index fell for 11 days in a row. The Dow and S&P 500 also posted their biggest single-day percentage declines since August 5, while the Nasdaq posted its biggest single-day percentage decline since July 24. The performance put investors to the test.

Small Caps in Turbulence

The Russell 2000 index, which tracks small-cap stocks, plunged 4.4%. That was the sharpest drop since June 2022. Small-caps are traditionally considered more vulnerable to changes in monetary policy, but could benefit from lower interest rates going forward.

Year's Gains Remain Strong

Despite the recent turmoil, U.S. stock markets are showing solid results overall for the year. The Dow is up 12.3%, the S&P 500 is up 23%, and the Nasdaq is up more than 29%. The surge was largely driven by gains in the tech sector, increased interest in artificial intelligence, and expectations of looser monetary policy.

Investor optimism was also fueled by hopes for deregulation in the upcoming change of administration. The new team led by President-elect Donald Trump is expected to offer a more liberal approach to economic policy, which could provide additional support to markets.

Investor Concerns: Is Inflation on the Horizon Again?

Investors are expressing concerns about the possible impact of Donald Trump's economic policies. Some of the proposed measures, such as the introduction of tariffs, could become a catalyst for a new wave of inflation.

Volatility at its Highest

The CBOE Volatility Index (VIX), which measures expectations of short-term market volatility, jumped 11.75 points to a four-month high of 27.62. This indicates growing nervousness among market participants who are reacting to uncertainty in the economic outlook.

Bond yields continue to rise

The Fed's statement sent Treasury yields higher. The 10-year yield rose to 4.518%, the highest since late May. This added pressure to the markets.

Investment strategist Ross Mayfield of Baird commented: "The rise in bond yields, especially to 4.5% to 5%, has been a major challenge for the stock market. The question is how the markets interpret policy: as inflationary or growth-enhancing. Both scenarios have a strong impact on the 10-year outlook."

Fed Rate Forecast

Markets continue to weigh the likelihood that the Federal Reserve will leave rates on hold at their January meeting. However, investors have revised their 2025 rate cut expectations down from a 49 basis point cut expected immediately after the Fed's announcement.

High Rates as a Barrier to Stock Growth

High interest rates remain a major headwind for the stock market. They make safer assets like bonds more attractive and also limit companies' ability to grow their profits. This pressure is especially noticeable amid the current market volatility.

All S&P 500 Sectors Are Hit: Who's Hit the Hardest?

Wednesday was a day of red for all 11 key S&P 500 sectors. The biggest losers were real estate, down 4%, and consumer discretionary, which plunged 4.7% to lead the decline. This reflects overall market weakness amid growing uncertainty.

Cryptocurrency Sector in Free Fall

Cryptocurrency-related stocks have seen a sharp decline, which accelerated after Federal Reserve Chairman Jerome Powell said the Fed is not allowed to own Bitcoin and has no plans to initiate legislative changes to do so. At the same time, rumors about the Trump administration possibly creating a national cryptocurrency reserve have caused additional turbulence.

Among the affected companies:

- MicroStrategy (MSTR.O) lost 9.5%;

- MARA Holdings (MARA.O) fell 12.2%;

- Riot Platforms (RIOT.O) fell 14.5%.

Ratio of decliners to gainers: the market is under pressure

On the New York Stock Exchange, the number of decliners outnumbered the gainers by 9,489 to 1, while on the Nasdaq the ratio was 5.46 to 1. These figures indicate a massive outflow of investors from most assets.

Highs and lows: Who is breaking records?

The S&P 500 index recorded six new 52-week highs and 27 new lows. The Nasdaq Composite showed an even sharper contrast: 80 new highs versus 264 new lows, highlighting the scale of the current market swings.

Trading activity: volumes are off the charts

Trading volume on U.S. exchanges amounted to 18.59 billion shares, which is significantly higher than the average of 14.36 billion over the past 20 trading days. Such an increase in activity indicates panic and rapid repricing of assets by market participants.

Asian markets fall as pressure mounts after Fed signal

Asian stock markets fell on Thursday, tracking Wall Street's decline. The reason was a hawkish statement from the US Federal Reserve, which signaled that it will take a more restrained approach to rate cuts next year. Against this backdrop, the dollar reached a two-year high, while the yen weakened after the Bank of Japan decided to keep rates unchanged.

Broad declines across regions

MSCI's broadest index of Asia-Pacific shares outside Japan lost 1.6%. Among the hardest hit:

- Taiwan's tech-dominated index (.TWII) fell 1.2%;

- Australian shares (.AXJO) fell almost 2%, reflecting the overall pessimistic market sentiment.

Europe braces for a fall

The gloomy mood could also affect European markets. Morning index futures point to declines:

- Eurostoxx 50 forecast to fall 1.5%;

- Germany's DAX to fall 1.2%;

Yen at lows: Under pressure from strong dollar

In currency markets, the Japanese yen hit a one-month low of 155.48 per dollar, a direct result of the Bank of Japan's decision to keep interest rates on hold. The yen traded around 155.3 per dollar, close to the weaker end of the year's range. The dollar's strength and Japan's relatively low rates continue to weigh on the national currency.

In Focus: Bank of Japan Governor and the Future of Interest Rates

Investors are eagerly awaiting comments from Bank of Japan Governor Kazuo Ueda. His comments could shed light on the timing and size of potential rate hikes next year. Traders are currently forecasting a 46 basis point rate hike by the end of 2025.

Dollar Index at its High

The Fed's signal of restraint in rate cuts has become a driver of the dollar's rise. The dollar index, which reflects the strength of the American currency against its six main rivals, has reached its highest since November 2022. On Thursday, it was at 108.08.

Bond yields are rising

The yield on the 10-year US Treasury note continues to rise, reaching a seven-month peak of 4.524% on Wednesday. The yield was last at 4.514%, adding to pressure on global financial markets.

Cryptocurrencies: Bitcoin under pressure

Bitcoin temporarily fell below $100,000 after Fed Chairman Jerome Powell said the central bank was not interested in participating in government initiatives to accumulate cryptocurrency. The comment added uncertainty to the digital asset market.

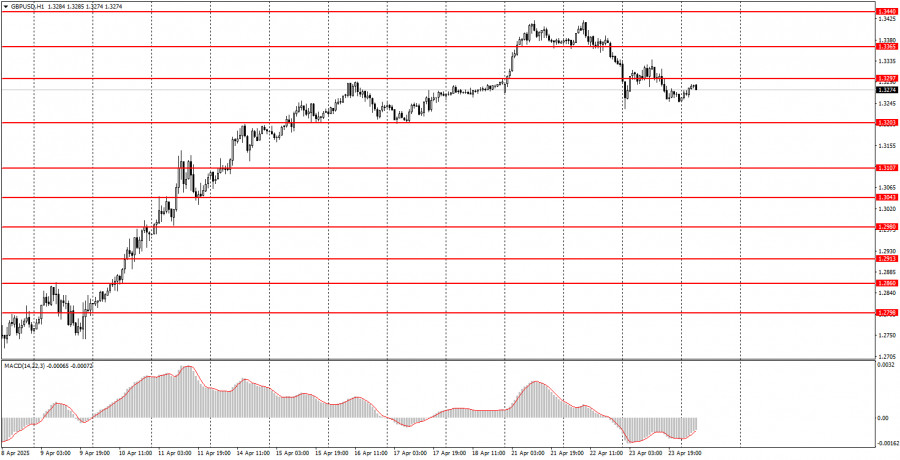

Pound Sterling and the Bank of England's decision

The British pound held steady at $1.25835 ahead of the Bank of England's meeting. The central bank is expected to keep rates at current levels despite signs of slowing economic growth. This decision could affect the future dynamics of the British currency.

Gold rises, oil falls

Gold regained ground, adding 0.8% to reach $2,609 an ounce. At the same time, oil prices went down, as the market is worried about a decrease in global demand, which is increasing pressure on energy resources.

বিশ্লেষকদের পরামর্শসমূহের উপকারিতা এখনি গ্রহণ করুন

ট্রেডিং অ্যাকাউন্টে অর্থ জমা করুন

ট্রেডিং অ্যাকাউন্ট খুলুন

ইন্সটাফরেক্স বিশ্লেষণমূলক পর্যালোচনাগুলো আপনাকে মার্কেট প্রবণতা সম্পর্কে পুরোপুরি সচেতন করবে! ইন্সটাফরেক্সের একজন গ্রাহক হওয়ায়, দক্ষ ট্রেডিং এর জন্য আপনাকে অনেক সেবা বিনামূল্যে প্রদান করা হয়।