Our team has over 7,000,000 traders!

Every day we work together to improve trading. We get high results and move forward.

Recognition by millions of traders all over the world is the best appreciation of our work! You made your choice and we will do everything it takes to meet your expectations!

We are a great team together!

InstaSpot. Proud to work for you!

Actor, UFC 6 tournament champion and a true hero!

The man who made himself. The man that goes our way.

The secret behind Taktarov's success is constant movement towards the goal.

Reveal all the sides of your talent!

Discover, try, fail - but never stop!

InstaSpot. Your success story starts here!

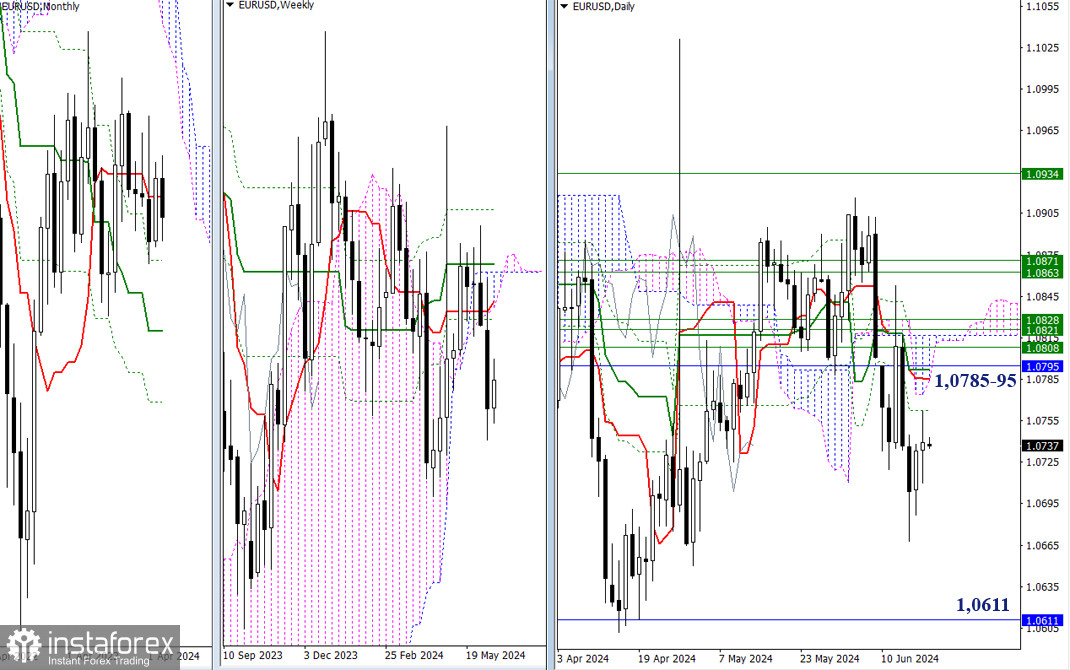

Yesterday, the bulls tested the daily resistance level of 1.0763. A sustained rise will bring EUR/USD to the next reinforced resistance area of 1.0785 – 1.0795 (daily Tenkan + Kijun + monthly short-term trend). Beyond this, the bulls will have to face several more obstacles. However, if a rebound forms from 1.0763, it is important to test the low (1.0668) and resume the decline, with the target located at the threshold of 1.0611.

On the lower timeframes, key levels have combined their efforts within a narrow range of 1.0737-44 (central Pivot level of the day + weekly long-term trend) and have pulled the market into their zone of influence. Keeping this position for several hours makes things uncertain. It is not clear as to which side has the main advantage right now. In case EUR/USD moves towards a certain direction during the day, the classic Pivot levels will serve as benchmarks. For the bulls, resistances at 1.0764 – 1.0789 – 1.0816 will be important, while the bears can look to the supports at 1.0712 – 1.0685 – 1.0660.

***

The market continues to slow down and ponder, leaning on the weekly support at 1.2665. Meanwhile, the daily Ichimoku cross levels are changing, trying to alter the pattern and purpose of this Ichimoku indicator. In this situation, they can provide resistance at the thresholds of 1.2721 (Kijun) and 1.2757 (Tenkan). Surpassing these boundaries will allow the market to move out of the uncertain area, potentially initiating a specific direction.

The bears have the main advantage on the lower timeframes, but the market is currently testing the weekly long-term trend (1.2726). Consolidating above this trend as well as a reversal can change the current balance of power in favor of the bulls. The next intraday bullish targets will be the resistances of the classic Pivot levels (1.2749 and 1.2779). A rebound from the trend and testing the recent days' low (1.2656) may bring back the bearish bias. Classic Pivot levels (1.2675 – 1.2645 – 1.2623) will provide additional intraday supports.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।

ইন্সটাফরেক্স বিশ্লেষণমূলক পর্যালোচনাগুলো আপনাকে মার্কেট প্রবণতা সম্পর্কে পুরোপুরি সচেতন করবে! ইন্সটাফরেক্সের একজন গ্রাহক হওয়ায়, দক্ষ ট্রেডিং এর জন্য আপনাকে অনেক সেবা বিনামূল্যে প্রদান করা হয়।

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.