- স্টক বিশ্লেষণ

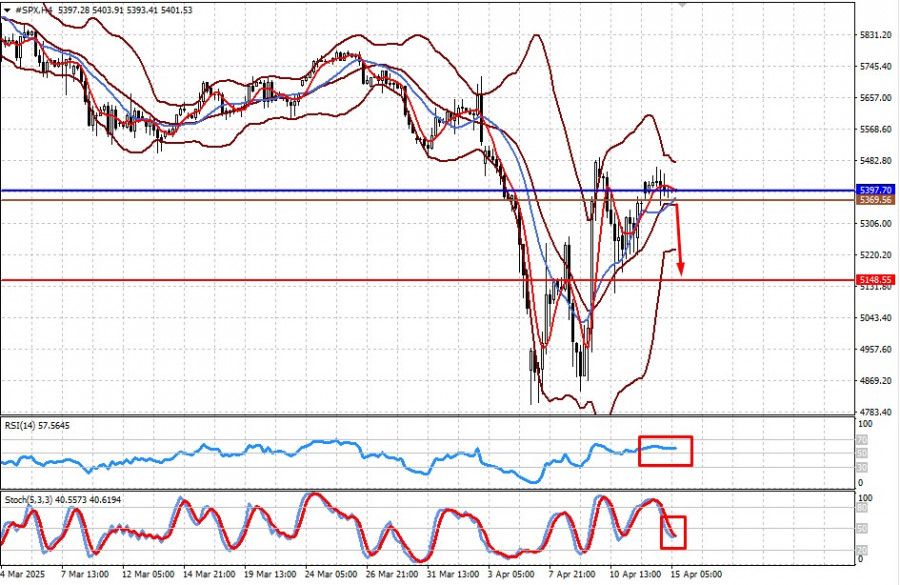

মার্কিন স্টক মার্কেটের আপডেট – ১৫ এপ্রিল: S&P 500 এবং নাসডাক সূচকের ঊর্ধ্বমুখী প্রবণতার গতি হ্রাস পাচ্ছে

গতকাল নিয়মিত সেশনের শেষে, মার্কিন স্টক সূচকগুলো পজিটিভ টেরিটরিতে থাকা অবস্থায় ট্রেডিং শেষ হয়েছে। S&P 500 সূচক 0.79%, নাসডাক 100 সূচক 0.64%, এবং ডাউ জোন্স ইন্ডাস্ট্রিয়াম এভারেজ 0.78% বৃদ্ধি পেয়েছে।লেখক: Jakub Novak

12:00 2025-04-15 UTC+2

1

মৌলিক বিশ্লেষণট্রাম্প জিতবেন না হারবেন—মাঝামাঝি কোনো অবস্থা কি নেই? (#SPX এবং বিটকয়েনে সম্ভাব্য নতুন দরপতনের ইঙ্গিত)

সোমবার, যখন ডোনাল্ড ট্রাম্প যুক্তরাষ্ট্রের বাণিজ্য অংশীদারদের ওপর আরোপিত শুল্ক নিয়ে খানিকটা পিছু হঠার ইঙ্গিত দেন তখন মার্কেটে কিছুটা স্থিতিশীলতা ফিরে এসেছিল। এতে মনে হতে পারে যে মার্কিন প্রেসিডেন্টলেখক: Pati Gani

10:30 2025-04-15 UTC+2

4

বিটকয়েনের মূল্য বেশ শক্তিশালীভাবে বৃদ্ধি পেয়েছে এবং প্রায় 86,000 লেভেলের কাছাকাছি পৌঁছেছে। ইথেরিয়ামের মূল্যেরও কিছুটা ঊর্ধ্বমুখী মুভমেন্ট দেখা গিয়েছিল, তবে মার্কিন ট্রেডিং সেশনের শেষে মূল্য যতটা বৃদ্ধি পেয়েছিল তার বেশিরভাগইলেখক: Miroslaw Bawulski

10:07 2025-04-15 UTC+2

0

- পূর্বাভাস

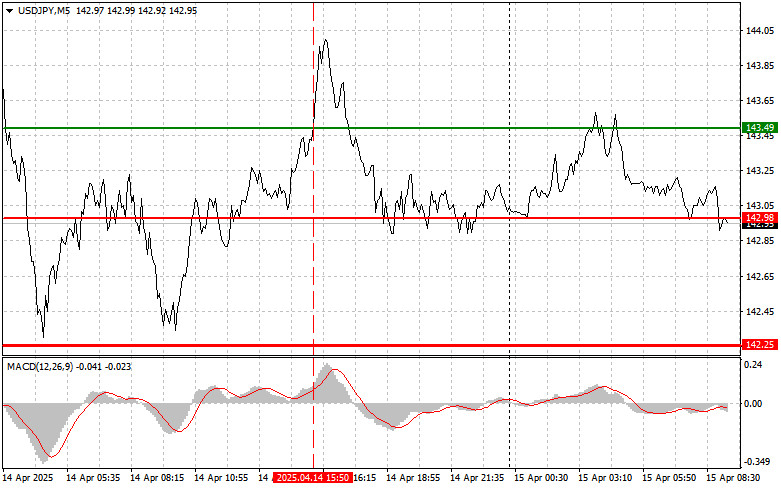

USD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৫ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি শূন্যের বেশ ওপরে উঠে গিয়েছিল, তখন এই পেয়ারের মূল্য 143.49 এর লেভেল টেস্ট করেছিল, যার ফলে এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনা সীমিত হয়ে পড়ে। এই কারণেইলেখক: Jakub Novak

09:39 2025-04-15 UTC+2

0

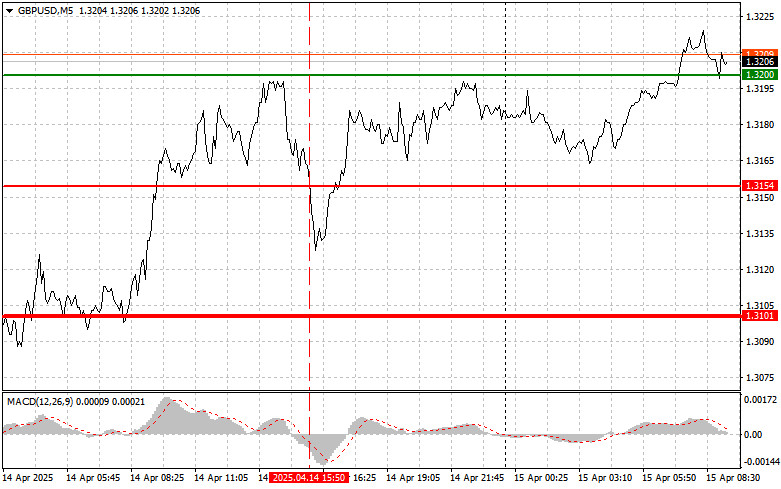

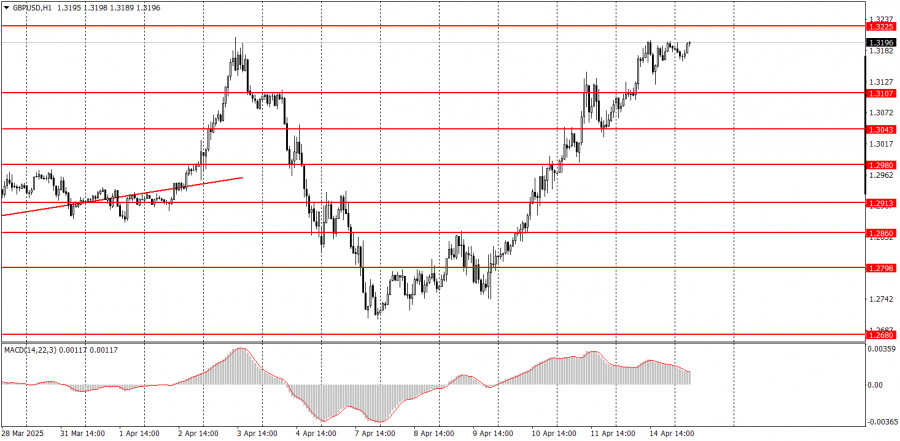

পূর্বাভাসGBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৫ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

ব্রিটিশ পাউন্ডের ট্রেডের বিশ্লেষণ এবং টিপস যখন MACD সূচকটি ইতোমধ্যেই শূন্যের অনেক নিচে নেমে গিয়েছিল, তখন এই পেয়ারের মূল্য 1.3154 এর লেভেল টেস্ট করেছিল, যার ফলে এই পেয়ারের মূল্যের নিম্নমুখীলেখক: Jakub Novak

09:27 2025-04-15 UTC+2

0

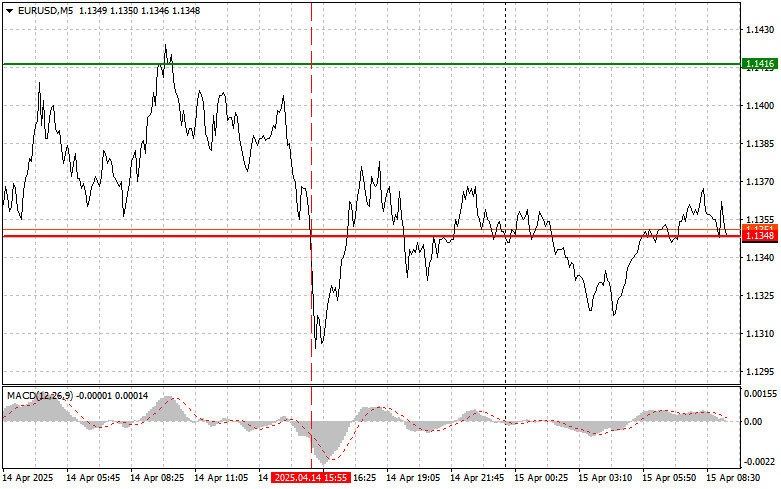

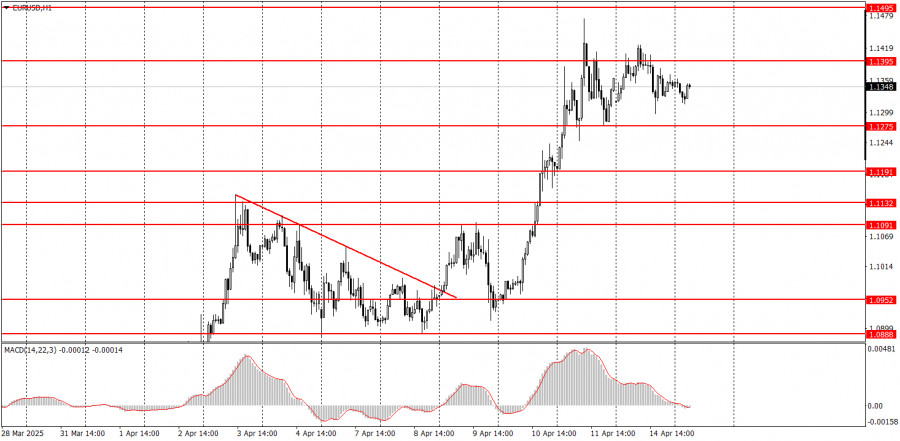

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৫ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি শূন্যের বেশ নিচে নেমে গিয়েছিল তখন এই পেয়ারের মূল্য 1.1348 এর লেভেল টেস্ট করে, যার ফলে এই পেয়ারের মূল্যের নিম্নমুখী হওয়ার সম্ভাবনা সীমিত হয়ে পড়ে। এই কারণেইলেখক: Jakub Novak

09:10 2025-04-15 UTC+2

0

- মৌলিক বিশ্লেষণ

১৫ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

মঙ্গলবার বেশ কয়েকটি সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হওয়ার কথা থাকলেও বর্তমান পরিস্থিতিতে এগুলো মার্কেটে খুব একটা প্রভাব বিস্তার করছে না। এই প্রতিবেদনগুলো স্বল্পমেয়াদি বা স্থানীয় পর্যায়ে এই পেয়ারের মূল্যের মুভমেন্টেলেখক: Paolo Greco

08:37 2025-04-15 UTC+2

1

ট্রেডিং পরিকল্পনা১৫ এপ্রিল কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

সোমবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট সোমবার, কোনো রকম সমস্যা ছাড়াই GBP/USD পেয়ারের মূল্যের ঊর্ধ্বমুখী মুভমেন্ট অব্যাহত ছিল। এর পেছনে কোনো সামষ্টিক অর্থনৈতিক কারণ ছিল না, এবং এমনকি দিনেরলেখক: Paolo Greco

08:20 2025-04-15 UTC+2

1

ট্রেডিং পরিকল্পনা১৫ এপ্রিল কীভাবে EUR/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

সোমবারের ট্রেডের বিশ্লেষণ EUR/USD পেয়ারের 1H চার্ট সোমবার, সারাদিন ধরে তুলনামূলকভাবে EUR/USD কারেন্সি পেয়ারের সাইডওয়েজ ট্রেডিং পরিলক্ষিত হয়েছে, যদিও দিনের শেষে এই পেয়ারের মূল্য কিছুটা বৃদ্ধি পেয়েছে। ইউরোপীয় ইউনিয়ন বালেখক: Paolo Greco

08:04 2025-04-15 UTC+2

2