- বর্তমান অর্থনৈতিক পরিস্থিতিতে EUR/USD পেয়ারের মূল্যের প্রবণতা বেশ আকর্ষণীয়—এশিয়ান সেশনে সাপ্তাহিক সর্বনিম্ন লেভেলে নামার পর আবারও পুনরুদ্ধার করেছে। EUR/USD পেয়ারের ওপর প্রধান চাপ তৈরি করছে মার্কিন ডলারের তিন বছরের সর্বনিম্ন

লেখক: Irina Yanina

15:04 2025-04-23 UTC+2

8

গতকাল বিটকয়েনের মূল্যের শক্তিশালী ঊর্ধ্বমুখী প্রবণতা পরিলক্ষিত হয়েছে। $90,000 লেভেল ব্রেক করার পর এই ক্রিপ্টোকারেন্সির মূল্য $94,000 লেভেলের দিকে বৃদ্ধি পেয়েছে, যেখানে সাময়িকভাবে মুভমেন্ট থেমে গেছে। ইথেরিয়ামের মূল্যও উল্লেখযোগ্য ঊর্ধ্বগতিলেখক: Jakub Novak

14:54 2025-04-23 UTC+2

10

মৌলিক বিশ্লেষণযুক্তরাষ্ট্র যদি চীনের সাথে বাস্তবসম্মত আলোচনা শুরু করে, তাহলে মার্কেটে ব্যাপক ঊর্ধ্বমুখী প্রবণতা দেখা যেতে পারে (এবং #NDX ও ইথেরিয়ামে দর বৃদ্ধি অব্যাহত থাকতে পারে)

মার্কেটে এক নতুন উদ্দীপনার ঢেউ ছড়িয়ে পড়েছে। অনেকেই মনে করছেন, এটি কাকতালীয় নয়: কাউকে সবকিছু থেকে বঞ্চিত করে তারপর সামান্য কিছু ফিরিয়ে দিলেই তারা খুশি হয়ে ওঠে। তাহলে, এই নতুনলেখক: Pati Gani

10:16 2025-04-23 UTC+2

10

- বিটকয়েনের মূল্য সফলভাবে $90,000 লেভেলের ওপরে উঠে গেছে, আর ইথেরিয়ামের মূল্য মাত্র একদিনেই 10% এর বেশি বৃদ্ধি পেয়ে $1800 এ পৌঁছেছে। এর মূল প্রভাবক ছিল গতকালের ডোনাল্ড ট্রাম্পের বিবৃতি, যেখানে

লেখক: Miroslaw Bawulski

10:02 2025-04-23 UTC+2

10

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৩ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

জাপানী ইয়েনের ট্রেডিংয়ের পর্যালোচনা এবং টিপস যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্য 140.68 এর লেভেল টেস্ট করেছিল, যা আমার দৃষ্টিতে এই পেয়ারের মূল্যেরলেখক: Jakub Novak

09:56 2025-04-23 UTC+2

18

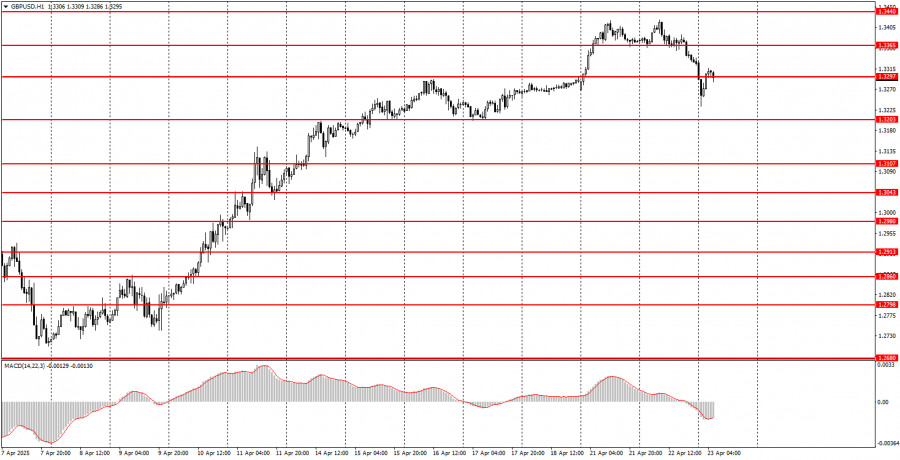

পূর্বাভাসGBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৩ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

ব্রিটিশ পাউন্ডের ট্রেডের বিশ্লেষণ এবং টিপস যখন MACD সূচকটি সবেমাত্র শূন্যের নিচে নামতে শুরু করেছিল তখন এই পেয়ারের মূল্য 1.3356 এর লেভেল টেস্ট করেছিল, যা পাউন্ড বিক্রির জন্য সঠিক এন্ট্রিলেখক: Jakub Novak

09:46 2025-04-23 UTC+2

15

- পূর্বাভাস

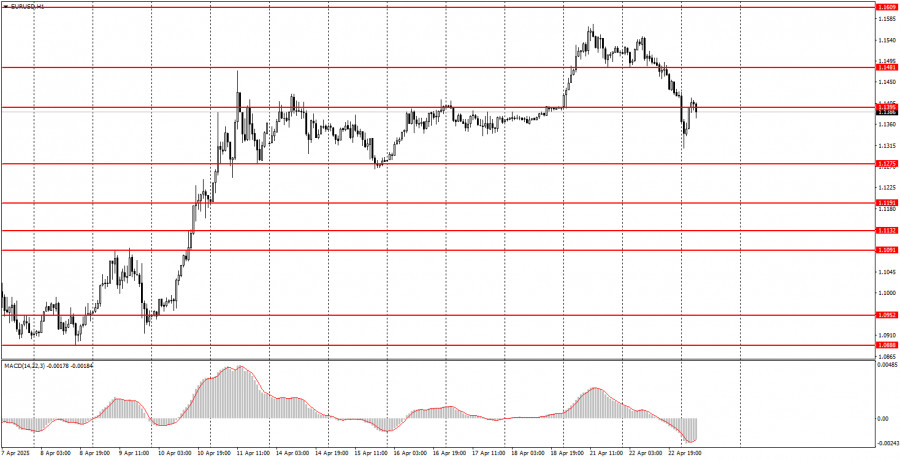

EUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৩ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

দিনের দ্বিতীয়ার্ধে যখন MACD সূচকটি শূন্যের নিচে নামতে শুরু করেছিল তখন এই পেয়ারের মূল্য 1.1460 এর লেভেল টেস্ট করেছিল, যা ইউরো বিক্রির জন্য সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করেছে। এর ফলেলেখক: Jakub Novak

09:36 2025-04-23 UTC+2

12

মৌলিক বিশ্লেষণ২৩ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

বুধবার উল্লেখযোগ্য সংখ্যক সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে। এর সবকটাই পরিষেবা এবং উৎপাদন খাতে এপ্রিল মাসের পারচেসিং ম্যানেজারস ইনডেক্স (PMI) সংক্রান্ত প্রতিবেদন। এই সূচকগুলো ইউরোপের অনেক দেশ, ইউরোজোন, যুক্তরাজ্য এবংলেখক: Paolo Greco

08:20 2025-04-23 UTC+2

11

ট্রেডিং পরিকল্পনা২৩ এপ্রিল কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

মঙ্গলবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট মঙ্গলবার GBP/USD পেয়ারের উল্লেখযোগ্য দরপতন হয়েছে। যদিও পাউন্ডের এই দরপতন কিছুটা ধীরগতিতে শুরু হয়েছিল, সন্ধ্যায় ডোনাল্ড ট্রাম্প অবশেষে ডলারের মূল্য ঊর্ধ্বমুখী করার সিদ্ধান্তলেখক: Paolo Greco

08:10 2025-04-23 UTC+2

14