- স্বর্ণ নিয়ে বিশ্লেষকদের পূর্বাভাস এখন আরও বেশি আশাবাদী হয়ে উঠেছে, যেন তারা প্রতিযোগিতায় নেমেছে কে বেশি উচ্চমূল্যের পূর্বাভাস দিতে পারে। ক্রমবর্ধমান ভূ-রাজনৈতিক অস্থিরতা এবং প্রেসিডেন্ট ডোনাল্ড ট্রাম্পের বর্তমান শুল্কনীতি

লেখক: Larisa Kolesnikova

15:16 2025-04-09 UTC+2

2

S&P 500 মঙ্গলবারের মার্কিন প্রধান স্টক সূচকগুলোর সারসংক্ষেপ: ডাও জোন্স: -0.8% নাসডাক: -2.2% S&P 500: -1.6%, বর্তমান অবস্থান 4,983, ট্রেডিং রেঞ্জ: 4,800–5,700 ট্রাম্প প্রশাসনের ঘোষণানুযায়ী, ৮ এপ্রিল জানানো হয় যেলেখক: Jozef Kovach

15:00 2025-04-09 UTC+2

0

স্টক বিশ্লেষণস্টক মার্কেটের পর্যালোচনা, ৯ এপ্রিল: S&P 500 এবং নাসডাক সূচক বার্ষিক সর্বনিম্ন স্তরে নেমে গেছে

মঙ্গলবারের নিয়মিত ট্রেডিং সেশন শেষে, যুক্তরাষ্ট্রের স্টক সূচকসমূহে আবারও দরপতনের মধ্যে দিয়ে দৈনিক লেনদেন শেষ হয়েছে এবং এখন বার্ষিক সর্বনিম্ন স্তর এক ধাপ দূরে অবস্থান করছে। S&P 500 সূচক 1.57%লেখক: Jakub Novak

10:52 2025-04-09 UTC+2

0

- স্টক মার্কেটে নতুন করে শুরু হওয়া ধ্বস এবার ক্রিপ্টোকারেন্সি মার্কেটেও আঘাত হেনেছে। বিনিয়োগকারীরা ভবিষ্যতে আরও বড় দরপতনের আশঙ্কায় ব্যাপকভাবে ডিজিটাল অ্যাসেট বিক্রি শুরু করেছেন—ফলে বিটকয়েন, ইথেরিয়াম ও অন্যান্য জনপ্রিয় ক্রিপ্টোকারেন্সির

লেখক: Jakub Novak

10:34 2025-04-09 UTC+2

0

মঙ্গলবার দিনের শেষভাগে বিটকয়েন ও ইথেরিয়ামের তীব্র দরপতন ঘটে, এবং আজকের এশিয়ান সেশনেও এই নিম্নমুখী প্রবণতা আরও তীব্রভাবে অব্যাহত থাকে। যুক্তরাষ্ট্রের স্টক মার্কেটে আরেক দফা বড় দরপতনের ফলে অন্যান্য ঝুঁকিপূর্ণলেখক: Miroslaw Bawulski

10:08 2025-04-09 UTC+2

0

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ৯ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

ঠিক যখন MACD সূচকটি শূন্য উপরের দিকে উঠতে শুরু করে তখন এই পেয়ারের মূল্য 147.13 এর লেভেল টেস্ট করে—যা ডলার কেনার জন্য একটি সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করে। এর ফলেলেখক: Jakub Novak

09:52 2025-04-09 UTC+2

1

- পূর্বাভাস

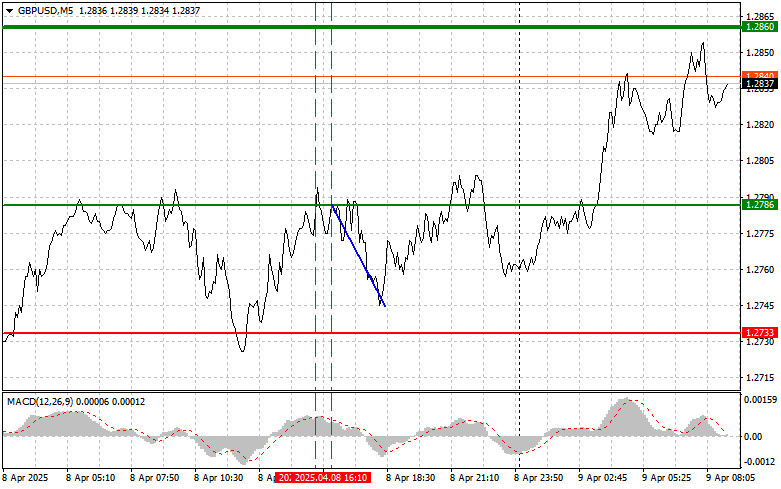

GBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ৯ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

যখন MACD সূচকটি ইতোমধ্যে শূন্য বেশ উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্য 1.2786 এর লেভেল টেস্ট করে—যা এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনাকে সীমিত করে। 1.2786 লেভেলের দ্বিতীয় টেস্টেরলেখক: Jakub Novak

09:40 2025-04-09 UTC+2

2

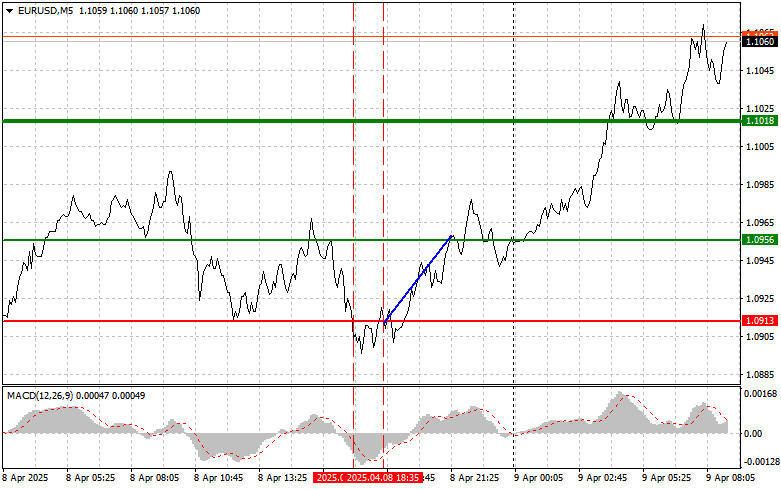

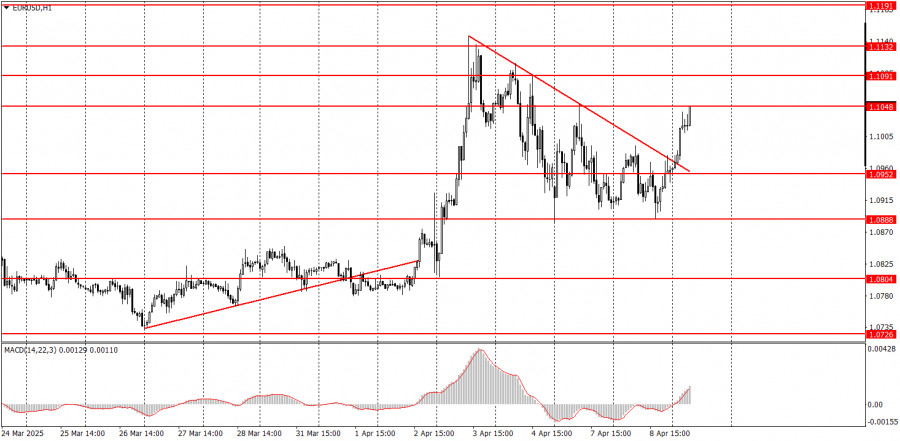

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ৯ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি শূন্যের উল্লেখযোগ্য নিচে ছিল তখন এই পেয়ারের মূল্য প্রথমবারের মতো 1.0913 এর লেভেল টেস্ট করে—যা এই পেয়ারের মূল্যের নিম্নমুখী হওয়ার সম্ভাবনাকে সীমিত করে। এই কারণেই আমি ইউরোলেখক: Jakub Novak

09:22 2025-04-09 UTC+2

1

মৌলিক বিশ্লেষণ৯ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

বুধবার কোনো গুরুত্বপূর্ণ সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে না। তবে বর্তমানে মার্কেটের ট্রেডাররা প্রচলিত সামষ্টিক অর্থনৈতিক সূচকের দিকে খুব একটা মনোযোগ দিচ্ছে না, তাই গুরুত্বপূর্ণ অর্থনৈতিক প্রতিবেদন এখন প্রাসঙ্গিক নয়।লেখক: Paolo Greco

09:06 2025-04-09 UTC+2

0