- টানা দ্বিতীয় দিনের মতো কোনো সুস্পষ্ট মৌলিক কারণ না থাকা সত্ত্বেও স্বর্ণ কিছু বিক্রেতাদের আকৃষ্ট করছে। সম্ভাব্যভাবে, এটি যুক্তরাষ্ট্রের গুরুত্বপূর্ণ নন-ফার্ম পে-রোল (NFP) প্রতিবেদনের আগে ট্রেডিং পজিশনের পুনরায় সমন্বয় এবং

লেখক: Irina Yanina

11:56 2025-04-04 UTC+2

31

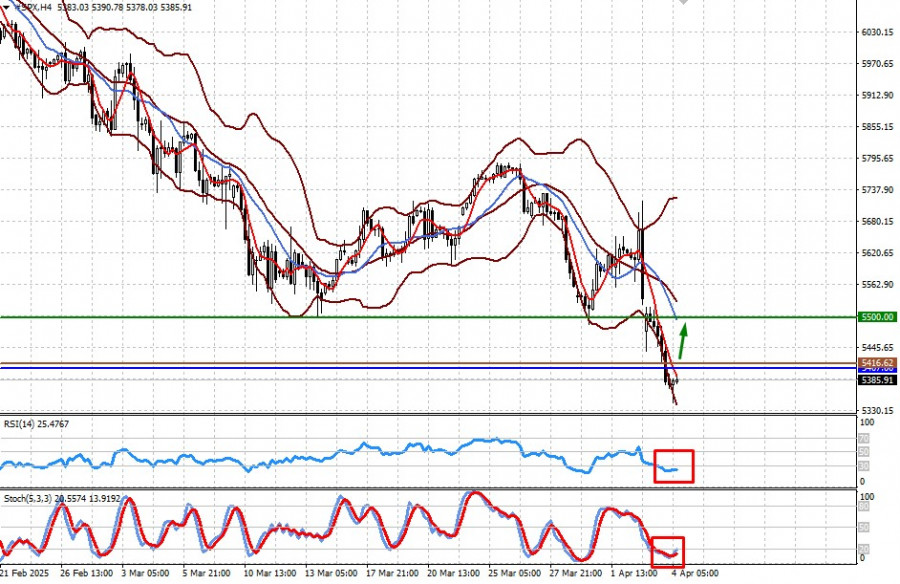

গতকালের নিয়মিত ট্রেডিং সেশনের শেষে, মার্কিন স্টক সূচকসমূহ নিম্নমুখী হয়েছে। S&P 500 সূচক 4.84% হ্রাস পেয়েছে, আর নাসডাক 100 সূচক 5.97% হ্রাস পেয়েছে। ডাও জোন্স ইন্ডাস্ট্রিয়াল সূচক 3.98% হ্রাস পেয়েছে।লেখক: Jakub Novak

11:45 2025-04-04 UTC+2

28

ডোনাল্ড ট্রাম্পের নতুন আমদানি শুল্ক ঘোষণার পর মার্কেটে ব্যাপকভাবে স্টক বিক্রির প্রবণতা দেখা দেয়, যার ফলে যুক্তরাষ্ট্রের স্টক মার্কেটে বড় ধরনের দরপতন ঘটে। ডাও, নাসডাক এবং S&P 500 সূচকলেখক: Ekaterina Kiseleva

11:21 2025-04-04 UTC+2

21

- মৌলিক বিশ্লেষণ

স্বর্ণের মূল্যের ঊর্ধ্বগতি থেমেছে। এর পেছনের কারণ কী? (স্থানীয় পর্যায়ে #SPX ও বিটকয়েনের কারেকটিভ পুলব্যাকের সম্ভাবনা রয়েছে)

যুক্তরাষ্ট্রের প্রেসিডেন্টের বিশ্বব্যাপী শুল্ক আরোপের সরাসরি ঘোষণায় যে বিশ্ববাজারে যে বিপর্যয় শুরু হয়েছে, তা এশিয়ান ট্রেডিং সেশনেও অব্যাহত রয়েছে। যদিও দরপতনের গতি কিছুটা কমেছে, তবে এখনো এই নিম্নমুখী প্রবণতা দুর্বললেখক: Pati Gani

11:00 2025-04-04 UTC+2

21

গতকাল দিনের শেষভাগে যুক্তরাষ্ট্রের স্টক মার্কেটে ব্যাপক বিক্রির ফলে যে তীব্র চাপ তৈরি হয়েছিল, বিটকয়েন এবং ইথেরিয়াম তা আবারও সফলভাবে সামাল দিতে পেরেছে — বিশেষত যখন ক্রিপ্টোকারেন্সি মার্কেটের সঙ্গে স্টকলেখক: Miroslaw Bawulski

10:36 2025-04-04 UTC+2

18

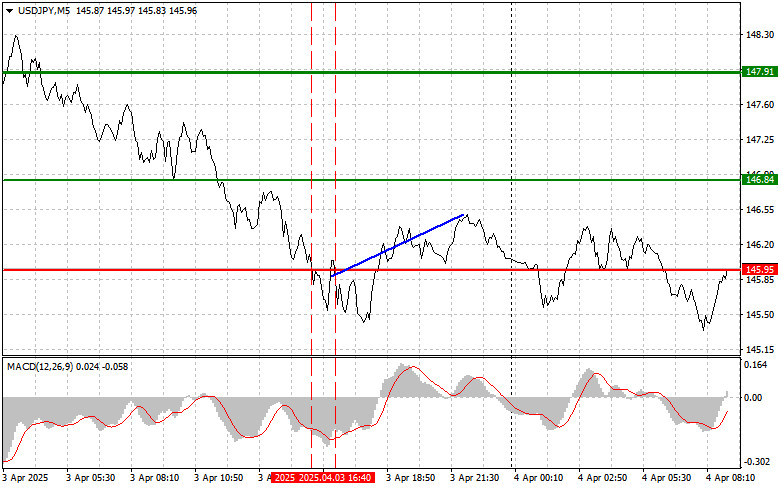

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ৪ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি শূন্যের উল্লেখযোগ্য নিচে নেমে যায়, তখন এই পেয়ারের মূল্য 145.95 এর লেভেল টেস্ট করে, যা এই পেয়ারের মূল্যের নিম্নমুখী মোমেন্টামকে সীমিত করে দেয়। 145.95 লেভেলের দ্বিতীয় টেস্টেরলেখক: Jakub Novak

10:27 2025-04-04 UTC+2

23

- পূর্বাভাস

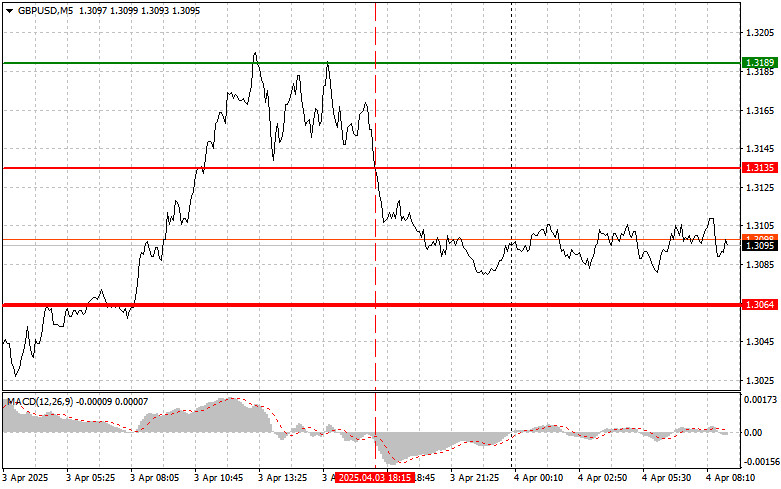

GBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ৪ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

যখন MACD সূচকটি শূন্যের উল্লেখযোগ্য নিচে নেমে যায়, তখন এই পেয়ারের মূল্য 1.3135 এর লেভেল টেস্ট করে, যা পেয়ারের মূল্যের নিম্নমুখী মোমেন্টামকে সীমিত করে দেয়। এই কারণেই আমি পাউন্ড বিক্রিলেখক: Jakub Novak

10:03 2025-04-04 UTC+2

21

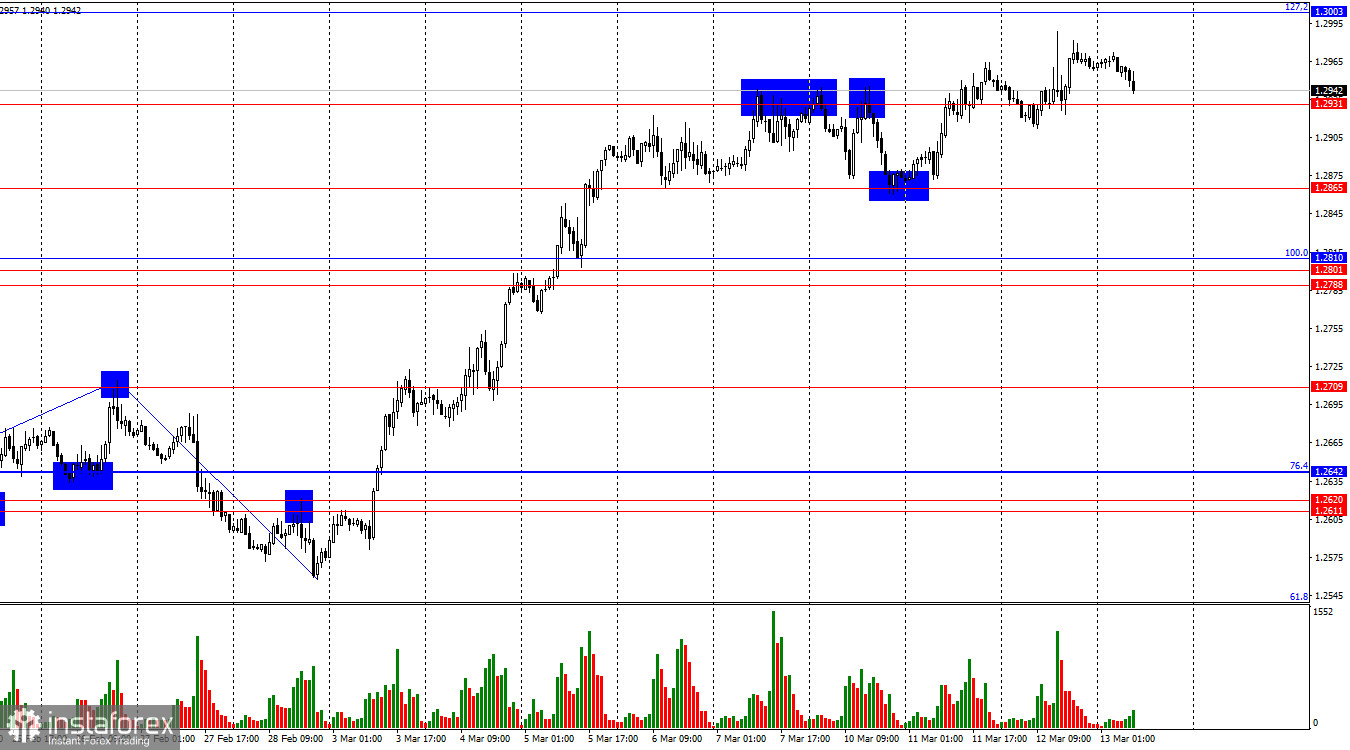

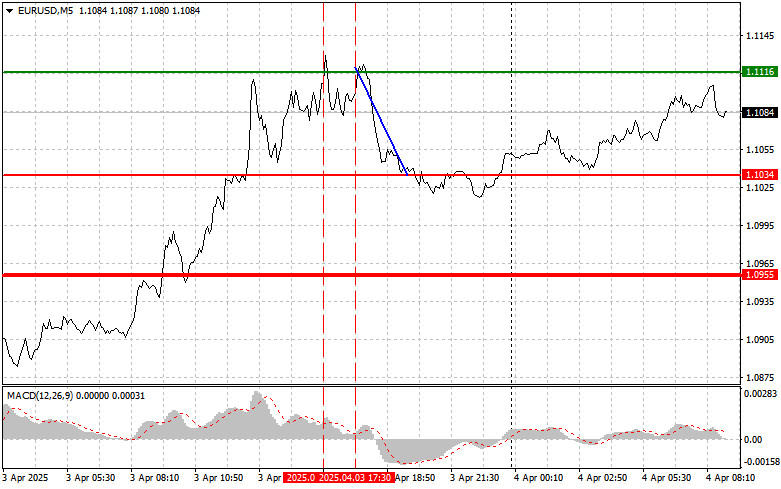

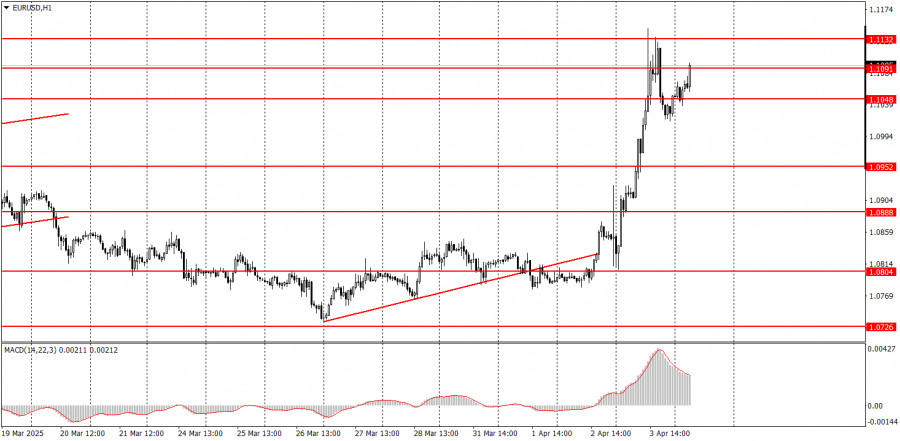

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ৪ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

ইউরোর ট্রেডের বিশ্লেষণ এবং ট্রেডিংয়ের টিপস যখন MACD সূচকটি শূন্যের উল্লেখযোগ্য উপরে উঠে গিয়েছিল, তখন এই পেয়ারের মূল্য 1.1116 লেভেল টেস্ট করে, যা এই পেয়ারের মূল্যের ঊর্ধ্বমুখী মোমেন্টামকে সীমিত করেলেখক: Jakub Novak

09:53 2025-04-04 UTC+2

20

মৌলিক বিশ্লেষণ৪ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

শুক্রবার খুব বেশি সামষ্টিক অর্থনৈতিক প্রতিবেদনের প্রকাশনা নির্ধারিত না থাকলেও, এগুলো মার্কেটে নতুন ঝড়ের সূচনা করতে পারে। বুধবার সন্ধ্যায় ডোনাল্ড ট্রাম্প যখন সারা বিশ্বের সব দেশের ওপর বাণিজ্য শুল্ক আরোপলেখক: Paolo Greco

09:25 2025-04-04 UTC+2

16