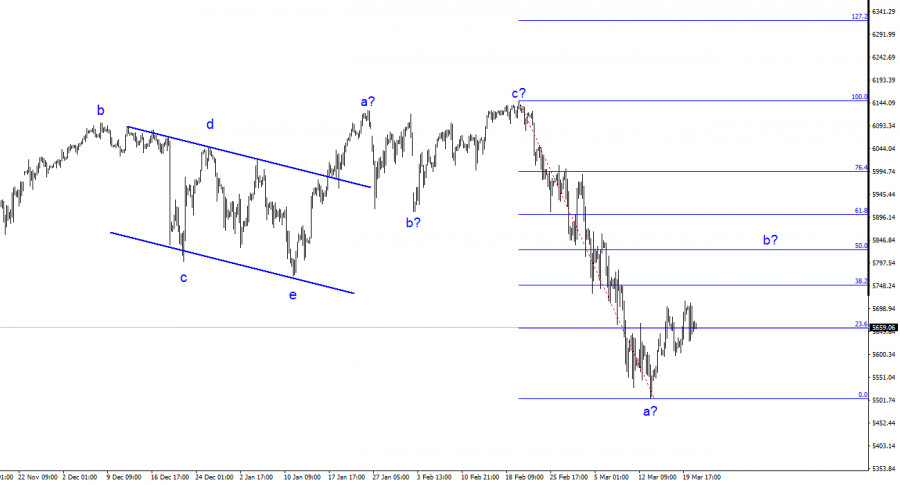

- ২৪-ঘণ্টার চার্টে #SPX-এর ওয়েভ স্ট্রাকচার যথেষ্ট স্পষ্ট। প্রথম এবং সবচেয়ে গুরুত্বপূর্ণ বিষয় হল বৃহৎ পরিসরে ফাইভ-ওয়েভ গঠন, যা এতটাই প্রশস্ত যে এটি প্ল্যাটফর্ম স্ক্রিনে সবচেয়ে ছোট স্কেলেও পুরোপুরি ফিট হয়

লেখক: Chin Zhao

10:45 2025-03-21 UTC+2

50

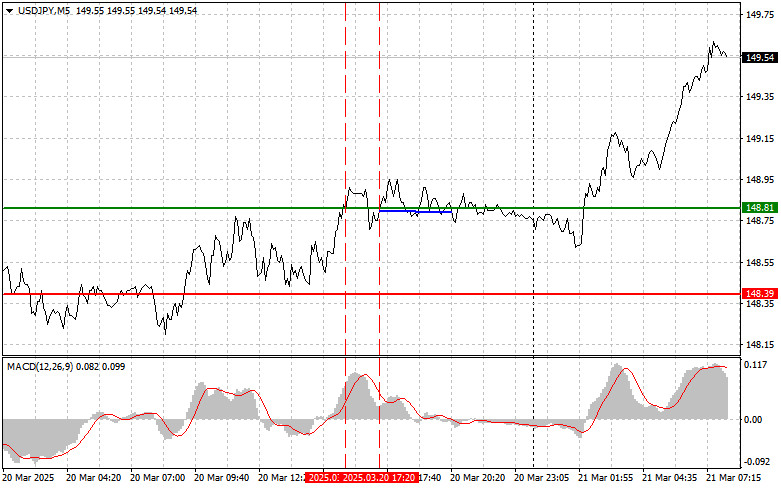

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২১ মার্চ। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি ইতোমধ্যে শূন্যের উল্লেখযোগ্য উপরে অবস্থান করছিল তখন এই পেয়ারের মূল্য 148.81 এর লেভেল টেস্ট করেছিল, যা এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনাকে সীমিত করে তোলে। এই কারণেইলেখক: Jakub Novak

10:36 2025-03-21 UTC+2

59

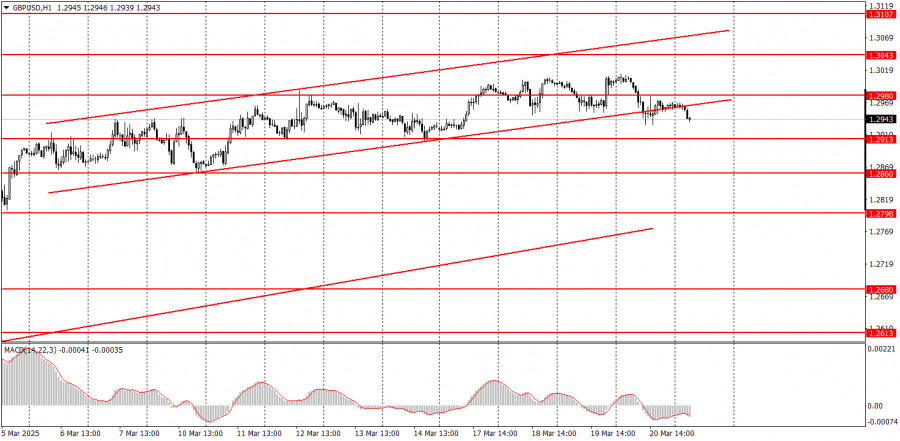

পূর্বাভাসGBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২১ মার্চ। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

ব্রিটিশ পাউন্ডের ট্রেডের বিশ্লেষণ এবং টিপস যখন MACD সূচকটি শূন্যের উল্লেখযোগ্য উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্য 1.2965 এর লেভেল টেস্ট করেছিল, যা এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনাকেলেখক: Jakub Novak

10:23 2025-03-21 UTC+2

61

- মৌলিক বিশ্লেষণ

২১ মার্চ কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

শুক্রবার কোনো সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে না। অবশেষে মার্কিন ডলারের বিপরীতে ইউরো এবং পাউন্ডের দরপতন হয়েছে। ফেডারেল রিজার্ভ মার্কেটকে শান্ত করতে ভূমিকা পালন করেছে, জানিয়েছে যে কোনো ধরনের অর্থনৈতিকলেখক: Paolo Greco

08:19 2025-03-21 UTC+2

59

ট্রেডিং পরিকল্পনা২১ মার্চ কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বৃহস্পতিবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট বৃহস্পতিবার GBP/USD পেয়ারের মূল্যও নিম্নমুখী মুভমেন্ট প্রদর্শন করেছে, তবে EUR/USD পেয়ারের বিপরীতে, বুধবার সন্ধ্যায় পাউন্ডের মূল্য স্থিরভাবে বৃদ্ধি পেয়েছে। বারবার আমরা দেখছি যেলেখক: Paolo Greco

08:06 2025-03-21 UTC+2

46

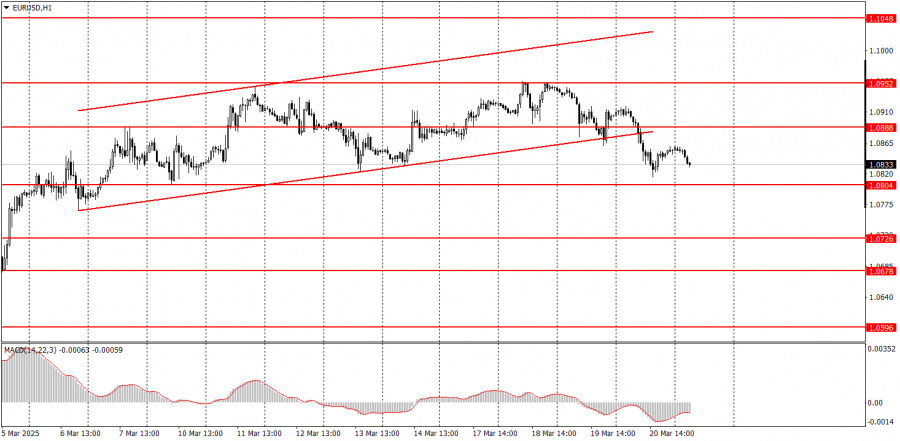

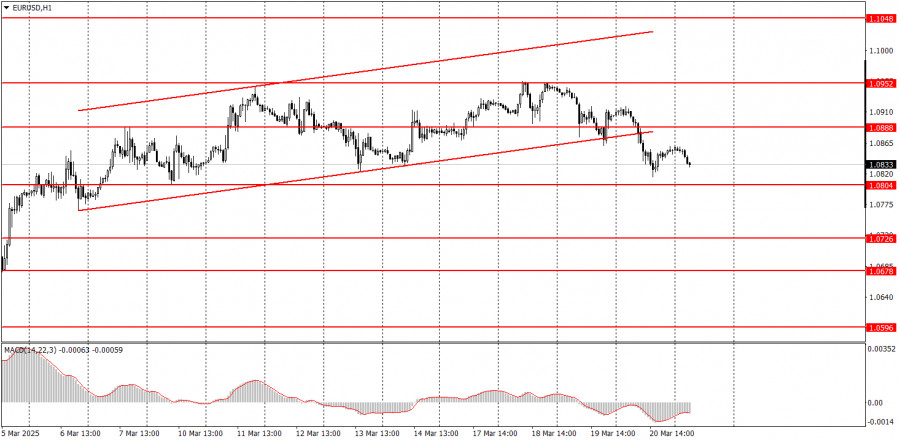

ট্রেডিং পরিকল্পনা২১ মার্চ কীভাবে EUR/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বৃহস্পতিবারের ট্রেডের বিশ্লেষণ EUR/USD পেয়ারের 1H চার্ট বৃহস্পতিবার ফেডারেল রিজার্ভের বৈঠকের ফলাফল ঘোষণার পর EUR/USD কারেন্সি পেয়ার দরপতনের সম্মুখীন হয়। অবশেষে, আমরা মার্কিন ডলারকে কিছুটা শক্তিশালী হতে দেখতে পেলাম এবংলেখক: Paolo Greco

07:51 2025-03-21 UTC+2

61

- স্বর্ণের মূল্য নতুন সর্বোচ্চ লেভেলে পৌঁছানোর পর হালকা নিম্নমুখী প্রবণতা দেখা যাচ্ছে এবং ট্রেডাররা রক্ষণাত্নক অবস্থান গ্রহণ করেছে। বর্তমানে, স্বর্ণের ক্রেতারা সতর্কতার সঙ্গে ট্রেড করছে, যা দৈনিক চার্টে ওভারবট স্ট্যাটাস

লেখক: Irina Yanina

12:02 2025-03-20 UTC+2

79

গতকাল ফেডারেল রিজার্ভের বৈঠকে উচ্চ সুদের হার বজায় রাখার ব্যাপারে নেতিবাচক মনোভাব প্রতিফলিত হয়েছে, যার ফলে বিটকয়েন এবং ইথেরিয়ামের মূল্যের বুলিশ মুভমেন্ট পুনরায় শুরু করেছে। যদিও ফেড মুদ্রাস্ফীতির কারণে কঠোরলেখক: Jakub Novak

11:32 2025-03-20 UTC+2

73

স্টক বিশ্লেষণমার্কিন স্টক মার্কেটের পরিস্থিতি, ২০ মার্চ: S&P 500 এবং নাসডাক সূচক প্রবৃদ্ধি পরিলক্ষিত হয়েছে

মার্কিন স্টক সূচকসমূহে শক্তিশালী প্রবৃদ্ধির সাথে ট্রেডিং সেশন শেষ হয়েছে। S&P 500 সূচক 1.1% বৃদ্ধি পেয়েছে এবং নাসডাক 100 সূচক 1.41% বৃদ্ধি পেয়েছে। বর্তমানে, S&P 500 ফিউচার 0.5% বৃদ্ধি পেয়েছেলেখক: Jakub Novak

11:12 2025-03-20 UTC+2

80