- গতকাল, S&P 500 সূচক অপ্রত্যাশিতভাবে 1.76% বেড়ে 5,769 লেভেলে পৌঁছেছে, যেখানে সূচকটি সর্বশেষ ১৩ জানুয়ারি পৌঁছেছিল। যেন পূর্বপরিকল্পিত কোনো স্ক্রিপ্ট অনুযায়ী, মারলিন অসিলেটর বুলিশ জোনের সীমানায় এসে পৌঁছেছে। এটি একটি

লেখক: Natalia Andreeva

14:36 2025-03-25 UTC+2

15

স্টক বিশ্লেষণমার্কিন স্টক মার্কেটে নতুন বুলিশ প্রবণতা। বিনিয়োগকারীরা ধারণা করছে যে নিম্নমুখী কারেকশন শেষ হয়েছে

S&P 500 স্টক মার্কেটের আপডেট, ২৫ মার্চ সোমবার মার্কিন স্টক মার্কেটের সংক্ষিপ্ত চিত্র: ডাও জোন্স: +1.4% নাসডাক: +2.3% S&P 500: +1.8% S&P 500 সূচক 5,767-এ ট্রেড করা হচ্ছে, রেঞ্জ: 5,500–6,000লেখক: Jozef Kovach

12:55 2025-03-25 UTC+2

21

সাম্প্রতিক সময়ে ক্রিপ্টোকারেন্সি মার্কেট কিছুটা ঊর্ধ্বমুখী প্রবণতা দেখা গেলেও, বিটকয়েনের মূল্যের $100,000 লেভেলে ফিরে আসার সম্ভাবনা এখনো বাস্তবসম্মত নয়। গ্লাসনোডের তথ্যানুযায়ী, বিটকয়েনের স্বল্পমেয়াদি হোল্ডারদের লোকসান এখনো এতটা বেশি নয় যেলেখক: Jakub Novak

12:06 2025-03-25 UTC+2

19

- বিটকয়েন ও ইথেরিয়ামের মূল্য গুরুত্বপূর্ণ লেভেলে পৌঁছালেও সেখানে অবস্থান ধরে রাখতে ব্যর্থ হয়েছে। বিটকয়েনের মূল্য $88,600 পর্যন্ত উঠেছিল, তবে পরে সেখান থেকে কিছুটা কারেকশন হয়ে বর্তমানে $86,600 এর আশেপাশে ট্রেড

লেখক: Miroslaw Bawulski

10:49 2025-03-25 UTC+2

14

মৌলিক বিশ্লেষণ২৫ মার্চ কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

মঙ্গলবার খুব অল্পসংখ্যক সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে বলে নির্ধারিত রয়েছে এবং এর কোনোটিই বিশেষ গুরুত্বপূর্ণ নয়। জার্মানির বিজনেস ক্লাইমেট বা ব্যবসায়িক আবহ এবং যুক্তরাষ্ট্রের নিউ হোম সেলস বা নতুনলেখক: Paolo Greco

10:03 2025-03-25 UTC+2

14

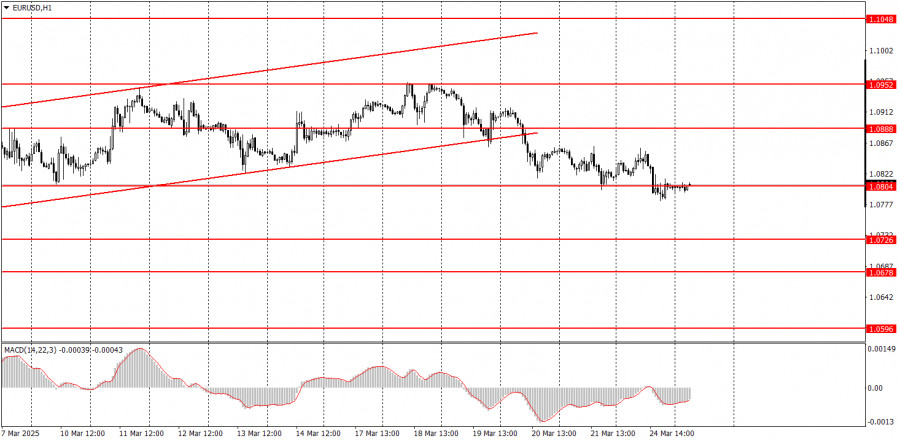

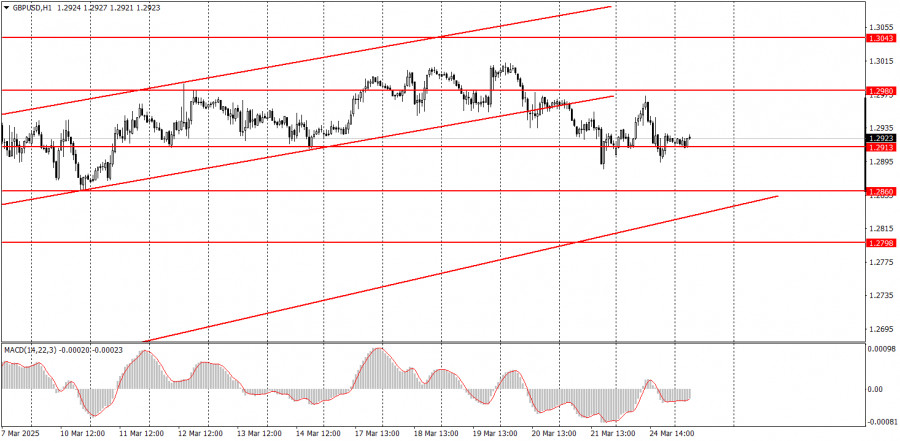

ট্রেডিং পরিকল্পনা২৫ মার্চ কীভাবে EUR/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

সোমবারের ট্রেডের বিশ্লেষণ EUR/USD পেয়ারের 1H চার্ট সোমবার EUR/USD কারেন্সি পেয়ারের মূল্যের দুর্বল নিম্নমুখী মুভমেন্ট অব্যাহত ছিল। দিন শেষে ডলার খুব বেশি শক্তিশালী হতে পারেনি, এবং সামষ্টিক অর্থনৈতিক প্রেক্ষাপট থেকেওলেখক: Paolo Greco

09:51 2025-03-25 UTC+2

17

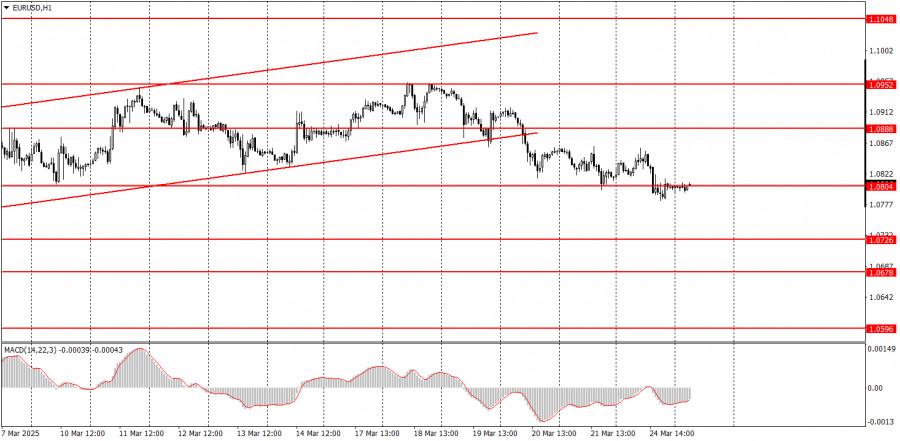

- ট্রেডিং পরিকল্পনা

২৫ মার্চ কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

সোমবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট সোমবার GBP/USD পেয়ারের মূল্যের ঊর্ধ্বমুখী এবং নিম্নমুখী — উভয় ধরনের মুভমেন্টই দেখা গেছে। এখনো এই পেয়ারের মূল্যের ঊর্ধ্বমুখী প্রবণতা বিরাজ করছে, যার প্রধানলেখক: Paolo Greco

09:27 2025-03-25 UTC+2

16

সপ্তাহের শুরুতে, জাপানের PMI প্রতিবেদনের দুর্বললেখক: Irina Yanina

14:55 2025-03-24 UTC+2

30

অর্থবাজারে প্রতিটি দিন যেন বাজারের আধিপত্য নিয়ে এক যুদ্ধ। যেদিন ট্রেডাররা মূল্যের উত্থান উদ্যাপন করে, পরদিনই পরিস্থিতি ঘুরে যেতে পারে। শুক্রবার, ন্যাচারাল গ্যাস ফিউচারের দর হঠাৎই বেড়ে যায়, যা বুলিশলেখক: Natalia Andreeva

14:33 2025-03-24 UTC+2

36