- সপ্তাহের শুরুতে, জাপানের PMI প্রতিবেদনের দুর্বল

লেখক: Irina Yanina

14:55 2025-03-24 UTC+2

4

অর্থবাজারে প্রতিটি দিন যেন বাজারের আধিপত্য নিয়ে এক যুদ্ধ। যেদিন ট্রেডাররা মূল্যের উত্থান উদ্যাপন করে, পরদিনই পরিস্থিতি ঘুরে যেতে পারে। শুক্রবার, ন্যাচারাল গ্যাস ফিউচারের দর হঠাৎই বেড়ে যায়, যা বুলিশলেখক: Natalia Andreeva

14:33 2025-03-24 UTC+2

1

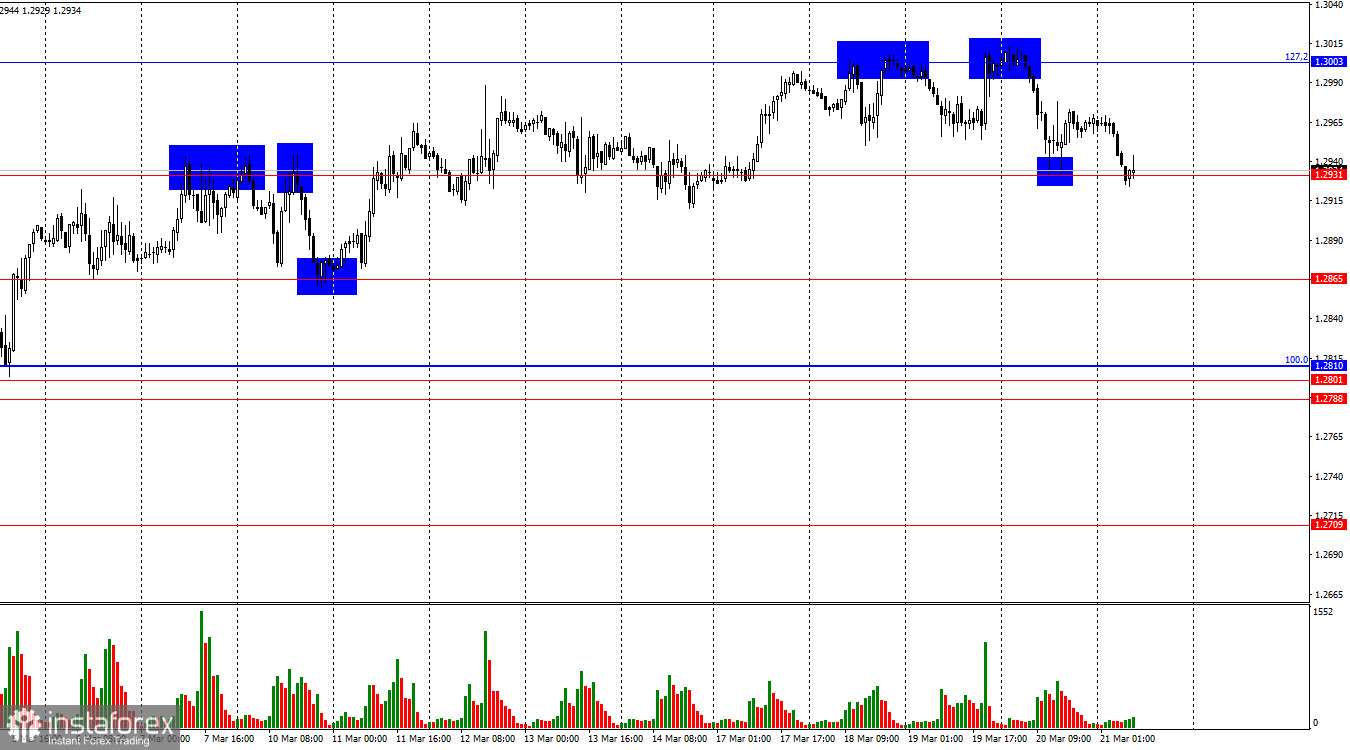

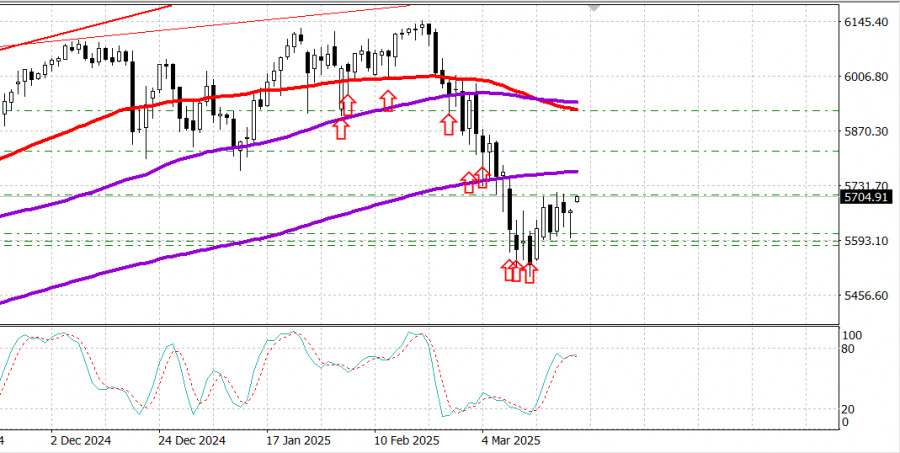

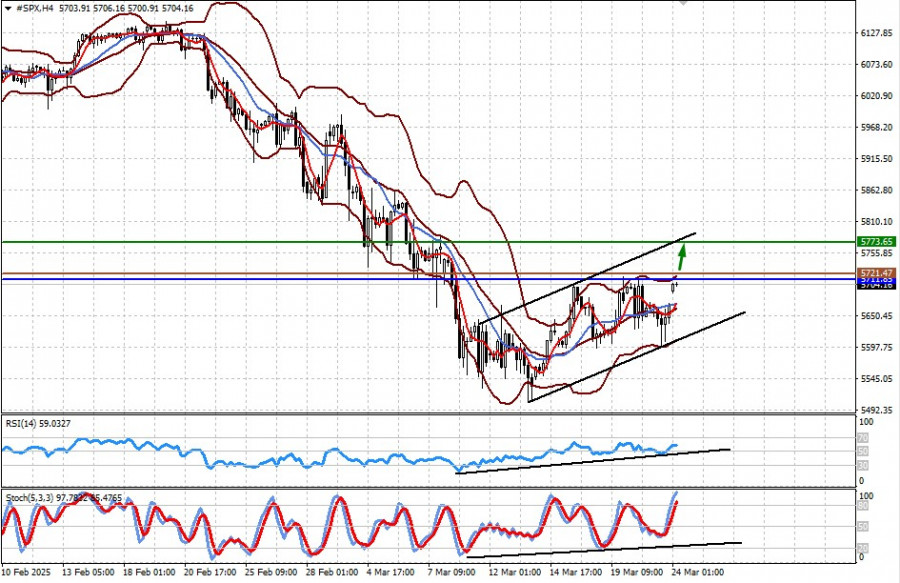

স্টক বিশ্লেষণমার্কিন স্টক মার্কেটের পরিস্থিতি, ২৪ মার্চ — ট্রাম্পের শুল্ক সংক্রান্ত সংবাদের মধ্যে S&P 500 ও নাসডাক সূচকে প্রবৃদ্ধি

আজ, মার্কিন ও ইউরোপীয় স্টক ফিউচারে ঊর্ধ্বমুখী প্রবণতার সাথে ট্রেড করা হচ্ছে, কারণ প্রেসিডেন্ট ডোনাল্ড ট্রাম্পের পরবর্তী শুল্ক আরোপের সিদ্ধান্ত পূর্বের তুলনায় অনেক বেশি নিয়ন্ত্রিত হতে পারে এমন ইঙ্গিত পাওয়ালেখক: Jakub Novak

14:20 2025-03-24 UTC+2

3

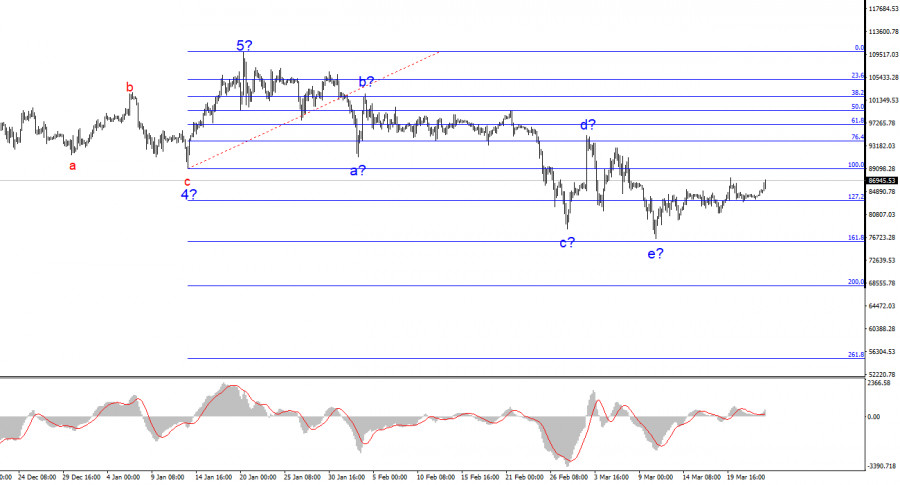

- উইকেন্ডে ট্রেডাররা বিশ্রাম নেওয়ার পর বিটকয়েন ও ইথেরিয়ামের মূল্য পুনরায় বৃদ্ধি পাচ্ছে। সাম্প্রতিক মুভমেন্টে বুলিশ প্রবণতা ফিরে আসার ইঙ্গিত পাওয়া গেলে এখনই পূর্ণাঙ্গভাবে ঊর্ধ্বমুখী প্রবণতা শুরু হয়েছে সেটা বলার

লেখক: Jakub Novak

14:07 2025-03-24 UTC+2

7

BTC/USD পেয়ারের সাম্প্রতিক দরপতন থেমে গেছে। বর্তমান ওয়েভ স্ট্রাকচার এখন স্বল্পমেয়াদে বিশ্বের প্রধান এই ক্রিপ্টোকারেন্সির মূল্যের ঊর্ধ্বমুখী প্রবণতার সম্ভাবনার ইঙ্গিত দিচ্ছে। ওয়েভ স্ট্রাকচারে কারেকশনের ইঙ্গিত পাওয়া যাচ্ছে ৪ ঘণ্টার চার্টেলেখক: Chin Zhao

12:25 2025-03-24 UTC+2

5

স্টক বিশ্লেষণমার্কিন স্টক মার্কেটের ঘুরে দাঁড়ানোর প্রচেষ্টা। ইরানের বিরুদ্ধে সম্ভাব্য মার্কিন হামলার আশঙ্কায় তেলের দর বৃদ্ধি

S&P 500 ২৪ মার্চে স্টক মার্কেটের পর্যালোচনা মার্কিন স্টক মার্কেটের ঘুরে দাঁড়ানোর প্রচেষ্টা পরিলক্ষিত হচ্ছে শুক্রবার প্রধান মার্কিন স্টক সূচকসমূহের ফলাফল: ডাও জোন্স সূচক: +0.1%, নাসডাক সূচক: +0.5%, S&Pলেখক: Jozef Kovach

11:59 2025-03-24 UTC+2

8

- আজ স্বর্ণের দাম নিম্নমুখী হলেও তা এখনো $3000 এর সাইকোলজিক্যাল লেভেলের ওপরে রয়েছে, যা একটি গুরুত্বপূর্ণ সাপোর্ট লেভেল হিসেবে কাজ করছে। উইকেন্ডে প্রকাশিত সংবাদ অনুযায়ী, যুক্তরাষ্ট্রের প্রেসিডেন্ট ডোনাল্ড ট্রাম্প

লেখক: Irina Yanina

11:48 2025-03-24 UTC+2

9

মৌলিক বিশ্লেষণট্রেডাররা দরপতন দেখতে দেখতে ক্লান্ত। বিনিয়োগকারীরা এখন প্রবৃদ্ধির ইঙ্গিত খুঁজছেন (মার্কিন অর্থনৈতিক প্রতিবেদনের ইতিবাচক ফলাফলের ভিত্তিতে #SPX ও #NDX ফিউচারের CFD কনট্রাক্টের মূল্য বৃদ্ধি পেতে পারে)

ডোনাল্ড ট্রাম্পের শুল্ক বৃদ্ধির সিদ্ধান্ত যেসব দেশগুলোর অর্থনীতিতে সরাসরি প্রভাব ফেলেছে এবং পাল্টা ব্যবস্থা নেওয়া হয়েছে— এসব বিষয় ঘিরে অনিশ্চয়তার কারণে বৈশ্বিক ফিন্যান্সিয়াল মার্কেটে এখনও দোদুল্যমান পরিস্থিতি বিরাজ করছে। যুক্তরাষ্ট্রেলেখক: Pati Gani

11:28 2025-03-24 UTC+2

4

আজ বিটকয়েন এবং ইথেরিয়ামের মূল্যের উল্লেখযোগ্য বৃদ্ধি দেখা গেছে, এটি তুলনামূলকভাবে ম্লান একটি উইকেন্ডের পর বিনিয়োগকারীদের ঝুঁকি নেওয়ার প্রবণতা বৃদ্ধির ইঙ্গিত দেয় — এমনকি এই অনিশ্চিত সময়েও। স্পট ETF-এ বিনিয়োগলেখক: Miroslaw Bawulski

11:15 2025-03-24 UTC+2

8