- মৌলিক বিশ্লেষণ

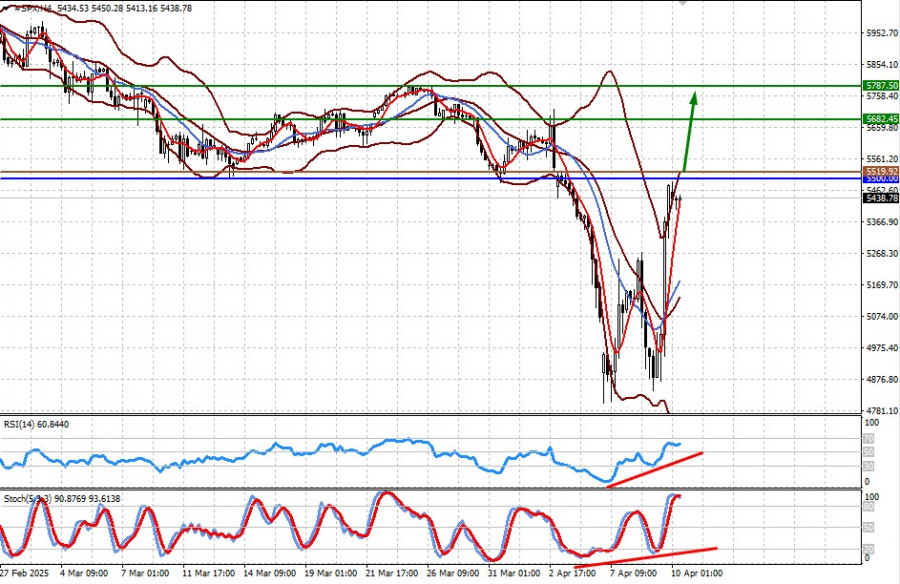

চীনের সাথে বাণিজ্যযুদ্ধে ট্রাম্পের কৌশলী অবস্থান (SPX এবং AUD/USD-এর পুনরুদ্ধার অব্যাহত থাকতে পারে)

মার্কিন প্রেসিডেন্ট এখনও বাণিজ্য, ভূরাজনীতি ও বৈশ্বিক অর্থবাজারে সক্রিয়ভাবে কৌশলী অবস্থান নিচ্ছেন। বিনিয়োগকারীরা জানতে চাচ্ছেন: বুধবার আসলে কী ঘটেছিল? হোয়াইট হাউস কেন হঠাৎ করে বাণিজ্যযুদ্ধে যুদ্ধবিরতি বা ৯০ দিনের বিরতিরলেখক: Pati Gani

10:34 2025-04-10 UTC+2

0

বিটকয়েন এবং ইথেরিয়াম উভয়েরই মূল্য উল্লেখযোগ্যভাবে বৃদ্ধি পেয়েছে—ট্রাম্প হঠাৎ করে নিজের অবস্থান পরিবর্তন করার খবরে এই দুই ক্রিপ্টোকারেন্সির মূল্য 6% থেকে 10% পর্যন্ত বেড়ে যায়। BTC-তে বর্তমানে একটি শক্তিশালী FOMOলেখক: Miroslaw Bawulski

09:53 2025-04-10 UTC+2

0

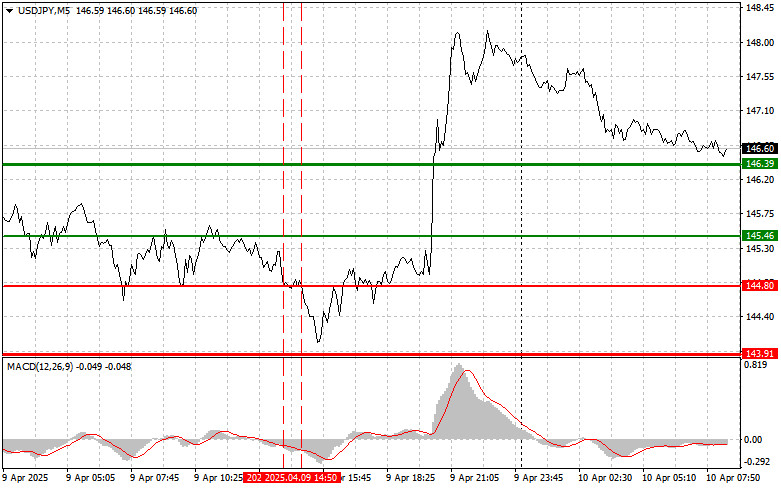

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১০ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

জাপানী ইয়েনের ট্রেডিংয়ের পর্যালোচনা এবং টিপস যখন MACD সূচকটি শূন্যের উল্লেখযোগ্য নিচে নেমে যায়, তখন USD/JPY পেয়ারের মূল্য 144.80 এর লেভেল টেস্ট করে—যা এই পেয়ারের মূল্যের নিম্নমুখী হওয়ার সম্ভাবনাকে সীমিতলেখক: Jakub Novak

09:42 2025-04-10 UTC+2

0

- পূর্বাভাস

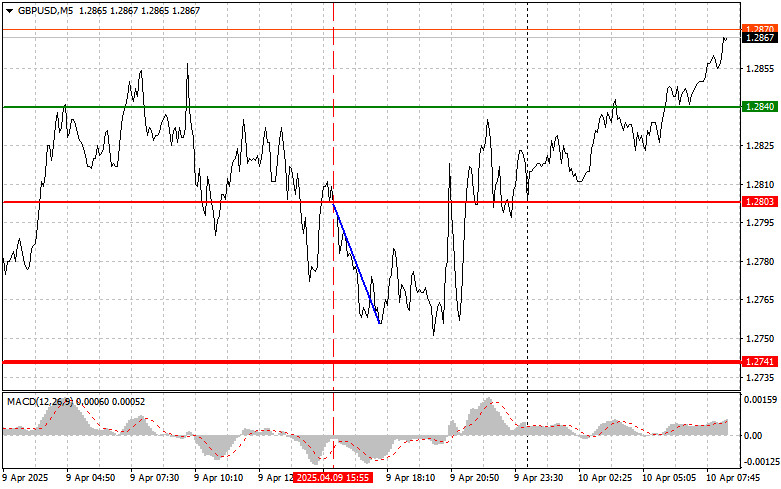

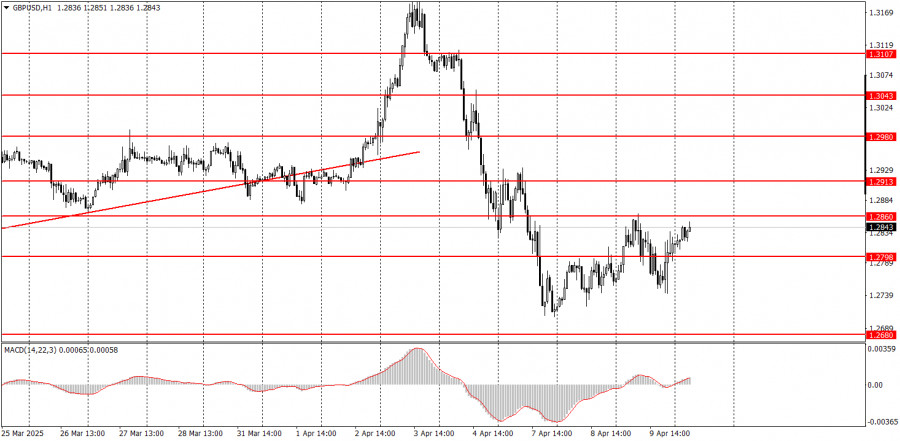

GBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১০ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

যখন MACD সূচকটি শূন্যের নিচের দিকে নামতে শুরু করে, তখন এই পেয়ারের মূল্য 1.2803 এর লেভেল টেস্ট করে—যা পাউন্ড বিক্রির জন্য একটি সঠিক এন্ট্রি পয়েন্ট নিশ্চিত করে। এর ফলেলেখক: Jakub Novak

09:32 2025-04-10 UTC+2

0

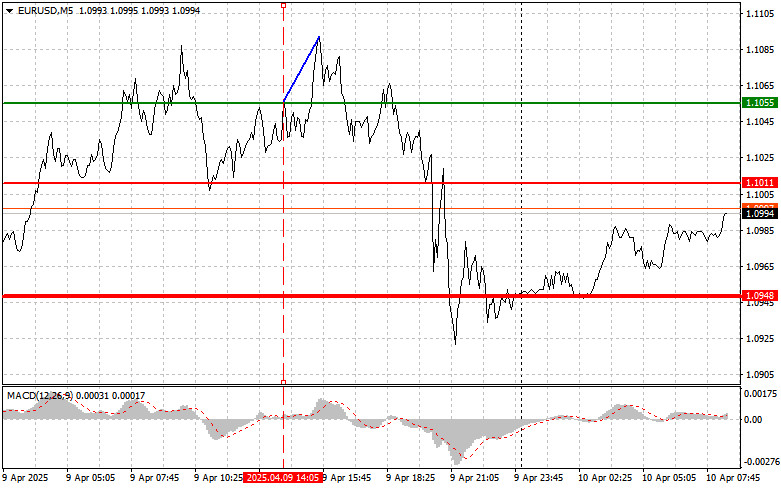

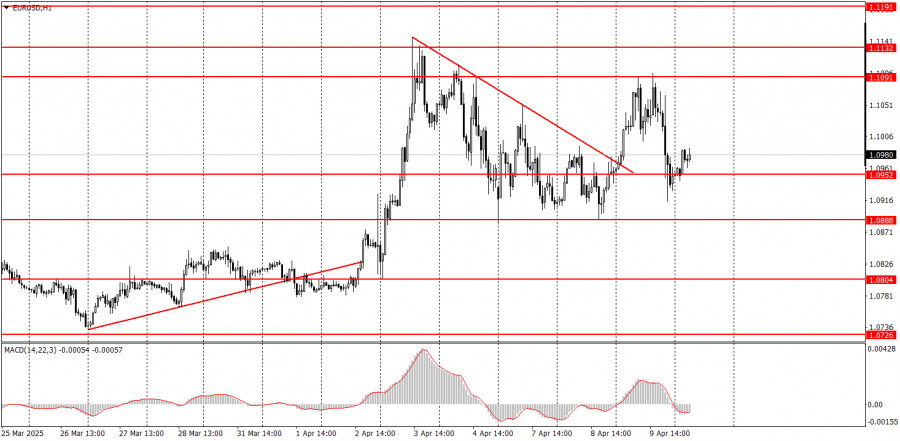

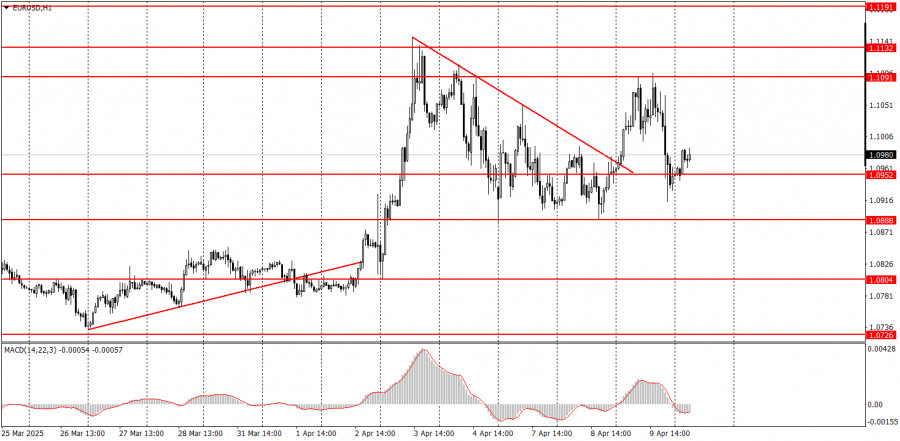

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১০ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

ইউরোর ট্রেডের বিশ্লেষণ এবং ট্রেডিংয়ের টিপস যখন MACD সূচকটি শূন্যের উপরে উঠতে শুরু করে, তখনই এই পেয়ারের মূল্য 1.1055 এর লেভেল টেস্ট করে—যা ইউরো কেনার জন্য একটি সঠিক এন্ট্রি পয়েন্টলেখক: Jakub Novak

09:12 2025-04-10 UTC+2

1

মৌলিক বিশ্লেষণ১০ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

বৃহস্পতিবার খুব কমসংখ্যক সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে বলে নির্ধারিত রয়েছে, তবে এর মধ্যে যুক্তরাষ্ট্রের মুদ্রাস্ফীতি প্রতিবেদনই ট্রেডারদের জন্য এখনও কিছুটা গুরুত্বপূর্ণ হিসেবে বিবেচনা করা যায়। বর্তমানে মুদ্রাস্ফীতি খুব একটালেখক: Paolo Greco

09:02 2025-04-10 UTC+2

0

- ট্রেডিং পরিকল্পনা

১০ এপ্রিল কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বুধবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট গত ২৪ ঘণ্টায় GBP/USD পেয়ারের মূল্য একবার ঊর্ধ্বমুখী, তারপর নিম্নমুখী, তারপর আবার ঊর্ধ্বমুখী হয়েছে। আগের মতোই, ১ ঘণ্টার টাইমফ্রেমে কোনো স্পষ্ট প্রবণতা চিহ্নিতলেখক: Paolo Greco

08:50 2025-04-10 UTC+2

0

ট্রেডিং পরিকল্পনা১০ এপ্রিল কীভাবে EUR/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বুধবারের ট্রেডের বিশ্লেষণ EUR/USD পেয়ারের 1H চার্ট বুধবার EUR/USD পেয়ারের মূল্যের শক্তিশালী ঊর্ধ্বমুখী ও নিম্নমুখী প্রবণতা পরিলক্ষিত হয়েছে। সাম্প্রতিক সময়ে এই দুই ধরনের মুভমেন্টেরই প্রধান কারণ হচ্ছে ডোনাল্ড ট্রাম্পের গৃহীতলেখক: Paolo Greco

08:17 2025-04-10 UTC+2

0

S&P 500 মার্কেটের ট্রেডারা স্টক সূচককে সাপোর্টের উপরে রাখার চেষ্টা করছে মঙ্গলবার যুক্তরাষ্ট্রের প্রধান স্টক সূচকগুলোর পারফরম্যান্স: ডাও জোন্স সূচক -0.8%, নাসডাক সূচক -2.2% এবং S&P 500 সূচক -1.6% হ্রাসলেখক: Jozef Kovach

15:41 2025-04-09 UTC+2

3