- মৌলিক বিশ্লেষণ

কেন মার্কেট স্থবির অবস্থায় রয়েছে এবং ট্রেডাররা কীসের জন্য অপেক্ষা করছে? (সাইডওয়েজ রেঞ্জে বিটকয়েন ও ইথেরিয়ামের মূল্যের কনসোলিডেশন চলমান থাকতে পারে)

আজ গুড ফ্রাইডে, যেটি বিশ্বের সব খ্রিস্টান ধর্মাবলম্বীর জন্য একটি পবিত্র দিন। ইস্টার মানদের ছুটির কারণে মার্কেটে ট্রেডিং কার্যক্রম উল্লেখযোগ্যভাবে কমে গেছে, তবে এটি মার্কেটের ট্রেডারদের বর্তমান আচরণের মূল কারণলেখক: Pati Gani

10:09 2025-04-18 UTC+2

0

বিটকয়েন এবং ইথেরিয়ামের মূল্য এখনো সাইডওয়েজ চ্যানেলের মধ্যেই রয়ে গেছে, এবং মূল্য এই রেঞ্জ থেকে বের হতে না পারলে ক্রিপ্টোকারেন্সি মার্কেটে আরও পুনরুদ্ধারের সম্ভাবনা হুমকির মুখে পড়তে পারে। তবে, নতুনলেখক: Miroslaw Bawulski

09:36 2025-04-18 UTC+2

0

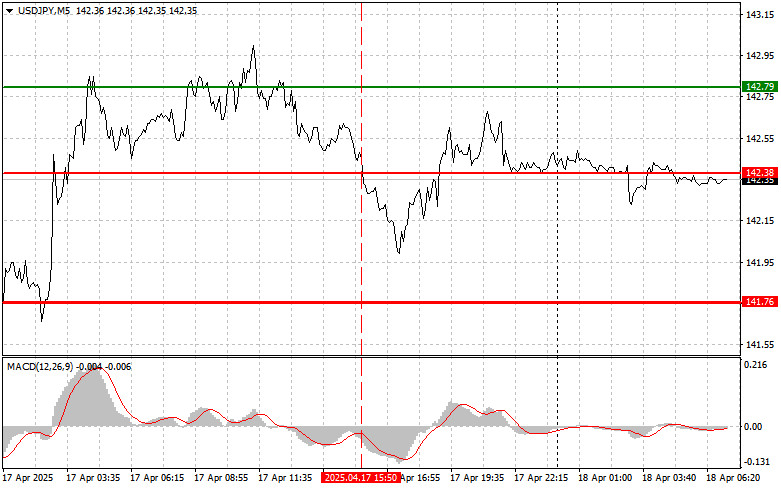

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৮ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

জাপানী ইয়েনের ট্রেডিংয়ের পর্যালোচনা এবং টিপস যখন MACD সূচকটি ইতোমধ্যেই শূন্যের বেশ নিচে অবস্থান করছিল তখন এই পেয়ারের মূল্য 142.38 এর লেভেল টেস্ট করেছিল, যার ফলে এই পেয়ারের মূল্যের নিম্নমুখীলেখক: Jakub Novak

09:28 2025-04-18 UTC+2

1

- পূর্বাভাস

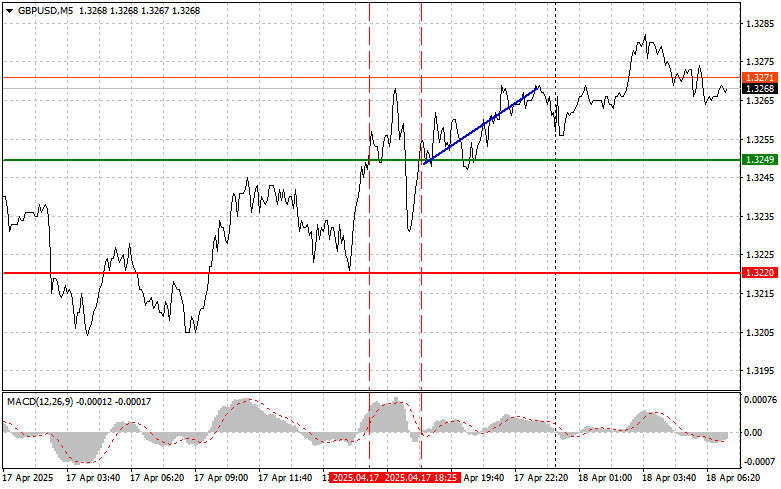

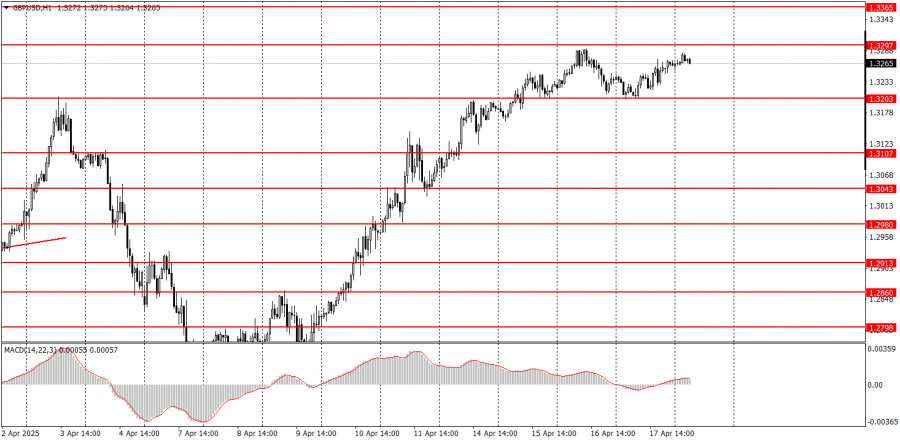

GBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৮ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

যখন MACD সূচকটি ইতোমধ্যেই শূন্যের বেশ ওপরে অবস্থান করছিল, তখন এই পেয়ারের মূল্য 1.3249 লেভেল টেস্ট করে—যার ফলে এই পেয়ারের মূল্যের ঊর্ধ্বমুখী হওয়ার সম্ভাবনা সীমিত হয়ে পড়ে। এই কারণেই আমিলেখক: Jakub Novak

09:20 2025-04-18 UTC+2

0

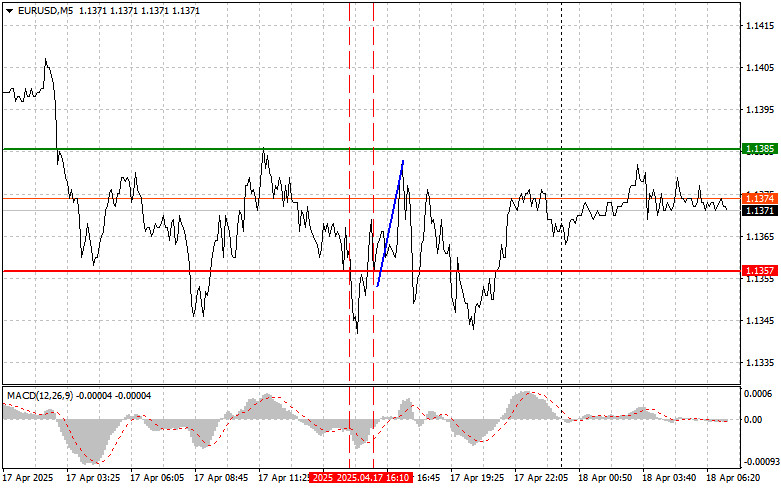

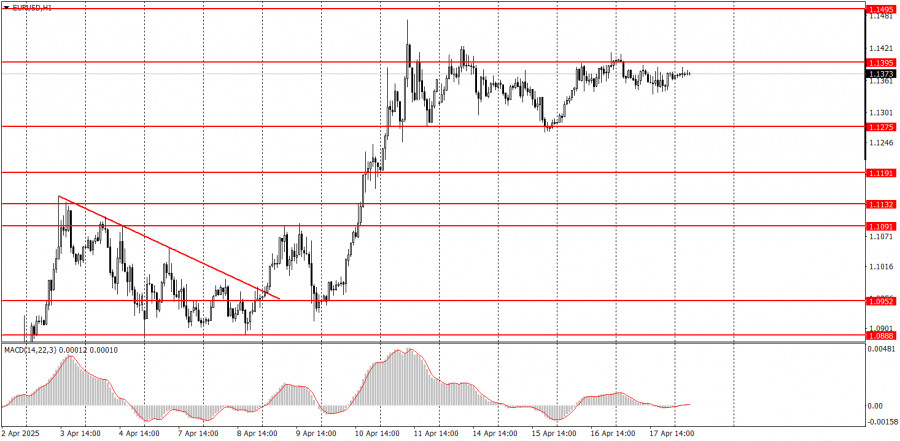

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ১৮ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি ইতোমধ্যেই শূন্যের বেশ নিচে অবস্থান করছিল, তখন এই পেয়ারের মূল্য 1.1357 এর লেভেল টেস্ট করে—যার ফলে এই পেয়ারের মূল্যের নিম্নমুখী হওয়ার সম্ভাবনা সীমিত হয়ে পড়ে। এই কারণেইলেখক: Jakub Novak

09:08 2025-04-18 UTC+2

0

স্টক বিশ্লেষণমার্কিন স্টক মার্কেটের পূর্বাভাস – ১৮ এপ্রিল: S&P 500 ও নাসডাক সূচক স্থিতিশীল হওয়ার চেষ্টা করছে

গতকাল নিয়মিত ট্রেডিং সেশন শেষে মার্কিন স্টক মার্কেটের সূচকসমূহে মিশ্র ফলাফল দেখা গেছে। S&P 500 সূচক 0.13% বৃদ্ধি পেয়েছে, অন্যদিকে নাসডাক 100 সূচক 0.13% হ্রাস পেয়েছে। ডাও জোন্স ইন্ডাস্ট্রিয়াল অ্যাভারেজলেখক: Jakub Novak

08:55 2025-04-18 UTC+2

0

- বিটকয়েন এবং ইথেরিয়ামের মূল্য এখনো ঊর্ধ্বমুখী হতে এবং বুলিশ প্রবণতায় ফিরে আসতে সংগ্রাম করছে—এপ্রিল মাস থেকে এই দুটি টোকেনের মূল্য যেই সাইডওয়েজ চ্যানেলের মধ্যে অবস্থান করছে, তার নিম্ন সীমার দিকে

লেখক: Jakub Novak

08:26 2025-04-18 UTC+2

0

মৌলিক বিশ্লেষণ১৮ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

শুক্রবার যুক্তরাষ্ট্র, ইউরোজোন, জার্মানি বা যুক্তরাজ্যে কোনো সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে না। তাই, ধরে নিন মার্কেটের ট্রেডাররা সামষ্টিক অর্থনৈতিক প্রেক্ষাপটে মনোযোগ দিতে চাইলেও, আজ সেই ধরনের কোনো প্রেক্ষাপটই নেই।লেখক: Paolo Greco

08:17 2025-04-18 UTC+2

0

ট্রেডিং পরিকল্পনা১৮ এপ্রিল কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বৃহস্পতিবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট বৃহস্পতিবার পুরো দিনজুড়ে GBP/USD পেয়ারের মূল্যের ঊর্ধ্বমুখী প্রবণতার সাথে ট্রেডিং অব্যাহত ছিল। এমনকি মূল্য সর্বোচ্চ লেভেলের কাছাকাছি পৌঁছালেও ব্রিটিশ পাউন্ডের মূল্যের কোনো ধরনেরলেখক: Paolo Greco

07:56 2025-04-18 UTC+2

0