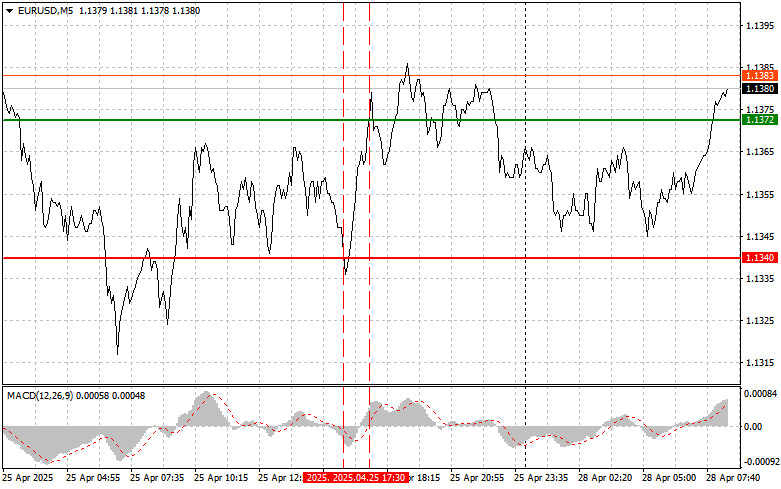

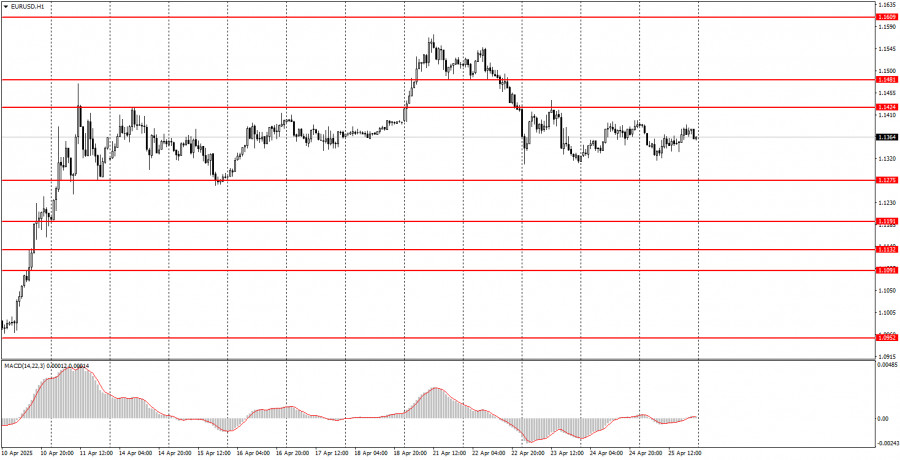

Last week, the EUR/USD pair traded in a nearly 400-pip price range. The weekly low was 1.0779, and the high was 1.1147. The pair ended the week nearly in the middle of that range, at 1.0961.

While technically, the EUR/USD bulls won this round (as the opening price was 1.0826), this victory is symbolic since the bears neutralized the upward momentum. Under current conditions, the prospects for a bullish trend appear unclear—just like the potential for a sustained price decline. Everything depends on Donald Trump, or more specifically, on the fate of the "big tariffs" scheduled to take effect on April 9. U.S. inflation data due on Thursday and Friday may also play a significant role. These are the key events of the coming week.

![Exchange Rates 07.04.2025 analysis]()

On Saturday, April 5, the so-called "baseline" 10% tariffs officially took effect in the U.S., affecting a broad array of imported goods. These duties faced minimal opposition, aside from some street protests in the U.S., so their implementation is unlikely to significantly impact the EUR/USD exchange rate. The primary focus is on the major individual tariffs, which will target approximately 60 countries and are scheduled to be activated this Wednesday.

The keyword here is "scheduled." The coming week will show whether events will unfold along the path of escalation or de-escalation—a possible delay in implementation following the outcome of negotiations.

Yesterday, Donald Trump began discussing tariff relief with several countries, including India, Vietnam, and Israel. Additionally, Indonesia and Cambodia have expressed readiness to lower their tariffs.

If these talks succeed, the dollar could get a temporary reprieve, and EUR/USD sellers may try to pull the pair back into the 1.08 range. However, one should be cautious with these downward pullbacks unless Washington reaches meaningful agreements with major U.S. trade partners like China, the EU, and Canada. No progress has been made, and the dollar remains vulnerable due to rising recession risks.

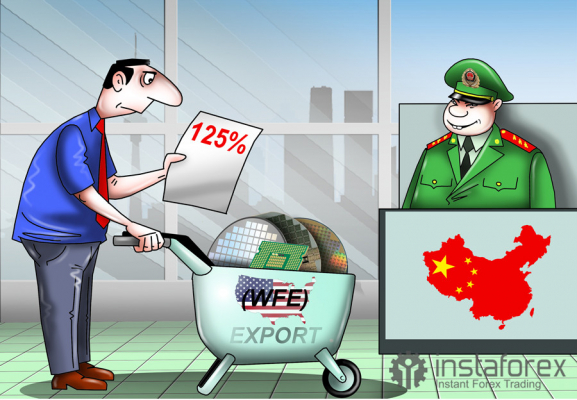

As known, China responded to the U.S. 54% tariffs with its own 34% tariffs. Beijing also added 11 American companies to its "unreliable entities" list, imposed export controls on 16 U.S. firms (effectively blocking exports of Chinese dual-use goods), and launched an anti-dumping investigation on CT scan X-ray tubes imported from the U.S.

Although Chinese officials have said they are "open to negotiations," no information has emerged about any formal negotiation process so far.

The European Union has taken a softer stance but has not yet entered formal talks. EU trade ministers are scheduled to meet on Monday (April 7) to discuss their next steps.

Canada is imposing a 25% tariff on U.S. cars that don't meet the terms of the CUSMA trade agreement. Canadian Prime Minister Mark Carney expressed confidence that the White House is unlikely to change its current tariff policy unless it becomes evident that American families and workers are seriously harmed.

Thus, even though some countries have entered negotiations, the "big tariffs" fate remains uncertain. If the key countries fail to persuade Trump to delay implementation (or agree to reduce or cancel them) by April 9, the trade war will enter a new phase of escalation. Incidentally, China's 34% counter-tariffs will take effect on April 10, leaving Washington and Beijing only three days to reach a compromise.

It's also worth noting that, as of April 3, the U.S. imposed 25% tariffs on car imports (with the same rate to be applied to auto parts starting May 3). These will continue to put pressure on the dollar and affect the American auto industry.

In other words, the financial world has reached a new crossroads: either de-escalation (via individual deals and reductions/cancellations of tariffs) or escalation (with all announced duties taking effect).

The latter scenario would significantly harm the dollar as recession fears resurface. For example, JPMorgan has already raised its U.S. recession probability forecast to 60% (up from 40% before "American Liberation Day"). According to Barclays economists, the U.S. faces the risk of stagflation: inflation is expected to exceed 4% this year, while GDP may contract in Q4—conditions consistent with a recession.

Donald Trump, incidentally, warned today that "tough times" are ahead for Americans. He says the country is undergoing an "economic revolution" that "won't be easy." However, he believes that in the end, the U.S. will reach a "historic outcome." He did not specify when that would happen.

Meanwhile, Federal Reserve Chair Jerome Powell delivered a bleak outlook in his Friday speech. He acknowledged that the tariffs imposed by the White House were much higher than expected and that the consequences are likely to be more serious. He agreed with most analysts predicting higher inflation and slower economic growth. According to Powell, the scale and duration of these adverse effects remain unclear.

Markets will view this week's U.S. inflation data through Powell's comments. Key inflation figures will be released on Thursday (CPI) and Friday (PPI). Forecasts suggest that the annual CPI in March will slow to 2.6% (down from 2.8% in February). Core CPI is expected to edge down from 3.1% to 3.0%. The Producer Price Index (PPI) is expected to show a similar dynamic, with headline PPI forecast to slow to 3.0% and core PPI to 3.2%. If inflation unexpectedly accelerates, stagflation risks will increase—especially if the "big tariffs" take effect.

In conclusion, the upcoming week is expected to be as volatile as the last. However, predicting the direction of EUR/USD is nearly impossible, as the outcome of the pending tariff negotiations remains uncertain.

*এখানে পোস্ট করা মার্কেট বিশ্লেষণ আপনার সচেতনতা বৃদ্ধির জন্য প্রদান করা হয়, ট্রেড করার নির্দেশনা প্রদানের জন্য প্রদান করা হয় না।

বিশ্লেষকদের পরামর্শসমূহের উপকারিতা এখনি গ্রহণ করুন

ট্রেডিং অ্যাকাউন্টে অর্থ জমা করুন

ট্রেডিং অ্যাকাউন্ট খুলুন

ইন্সটাফরেক্স বিশ্লেষণমূলক পর্যালোচনাগুলো আপনাকে মার্কেট প্রবণতা সম্পর্কে পুরোপুরি সচেতন করবে! ইন্সটাফরেক্সের একজন গ্রাহক হওয়ায়, দক্ষ ট্রেডিং এর জন্য আপনাকে অনেক সেবা বিনামূল্যে প্রদান করা হয়।