- মৌলিক বিশ্লেষণ

কেন স্বর্ণের দাম উল্লেখযোগ্যভাবে কমতে পারে? (স্বর্ণের দরপতনের সম্ভাবনা রয়েছে, অন্যদিকে নাসডাক 100 ফিউচার্স কন্ট্রাক্টের CFD-এর দর বৃদ্ধি পেতে পারে)

বাস্তবিক অর্থে বাণিজ্য যুদ্ধের উত্তেজনা প্রশমনের লক্ষ্যে আলোচনার শুরু হলে নিকট ভবিষ্যতে স্বর্ণের উল্লেখযোগ্য দরপতন ঘটতে পারে। পূর্ববর্তী নিবন্ধগুলোতে আমি উল্লেখ করেছি যে, বেইজিং এবং ওয়াশিংটনের মধ্যে শুল্ক নিয়ে আলোচনারলেখক: Pati Gani

10:32 2025-04-25 UTC+2

47

গতকাল বিটকয়েনের মূল্যের $94,000 লেভেলের ওপরে স্থায়ীভাবে থাকার ব্যর্থ প্রচেষ্টা দেখিয়ে দিয়েছে যে এখনো উল্লেখযোগ্যভাবে বিটকয়েন ক্রয়ের আগ্রহ রয়েছে। ইথেরিয়ামের মূল্যও বেশ ভালোভাবে উচ্চ লেভেলে রয়েছে, যদিও গতকাল ইউরোপীয় সেশনেরলেখক: Miroslaw Bawulski

09:25 2025-04-25 UTC+2

36

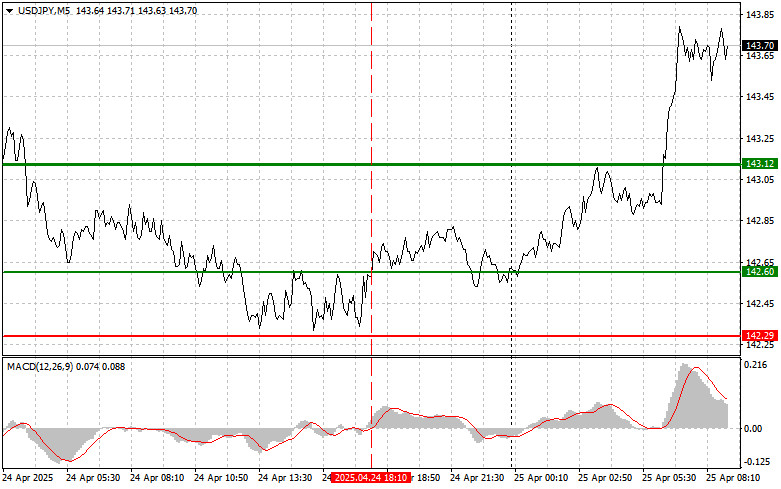

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৫ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্যলেখক: Jakub Novak

09:18 2025-04-25 UTC+2

42

- পূর্বাভাস

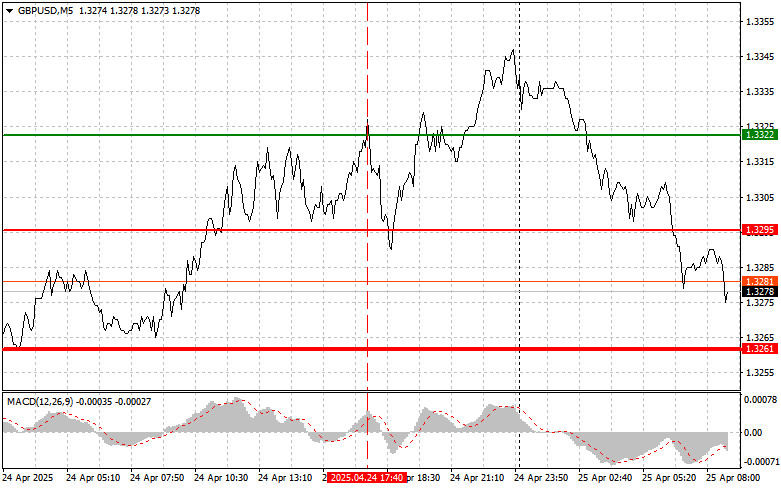

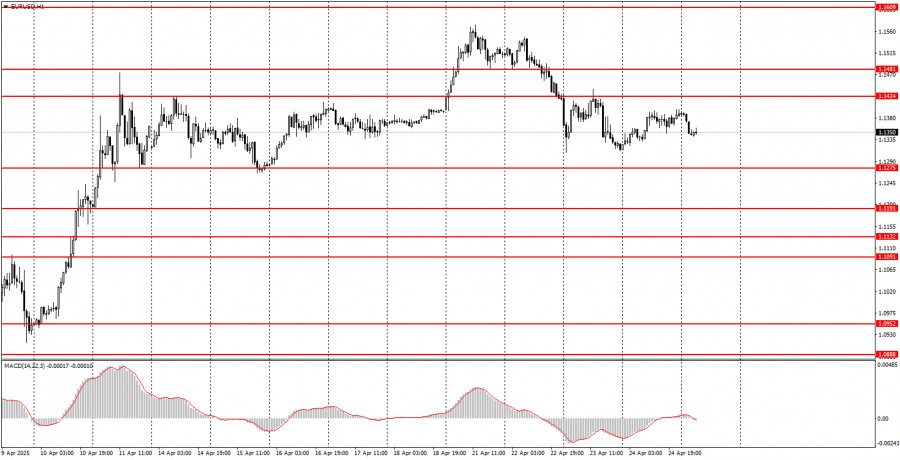

GBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৫ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ ওপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্য এই পেয়ার বিক্রির জন্য অনুরূপ পরিস্থিতি তৈরি হয়েছিল। গতকাল প্রকাশিত যুক্তরাষ্ট্রের প্রতিবেদনের ফলাফল ডলারের মূল্যের তীব্র বৃদ্ধিলেখক: Jakub Novak

09:08 2025-04-25 UTC+2

39

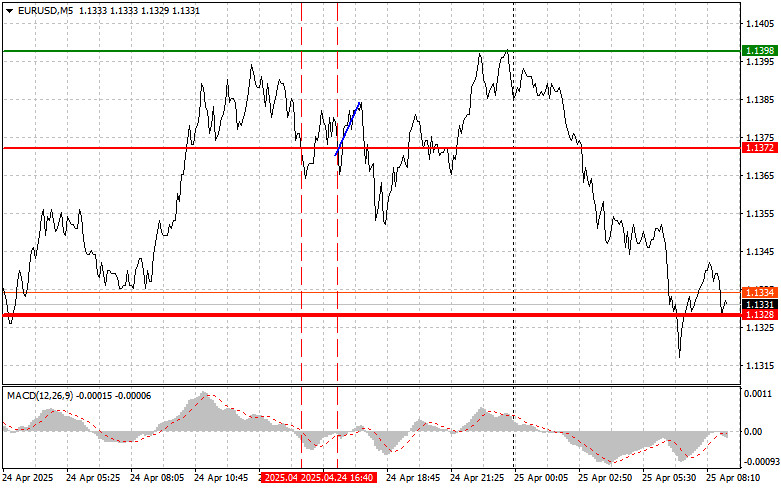

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৫ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

দিনের দ্বিতীয়ার্ধে যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ নিচে নেমে গিয়েছিল তখন এই পেয়ারের মূল্য প্রথমবারের মতোলেখক: Jakub Novak

08:57 2025-04-25 UTC+2

39

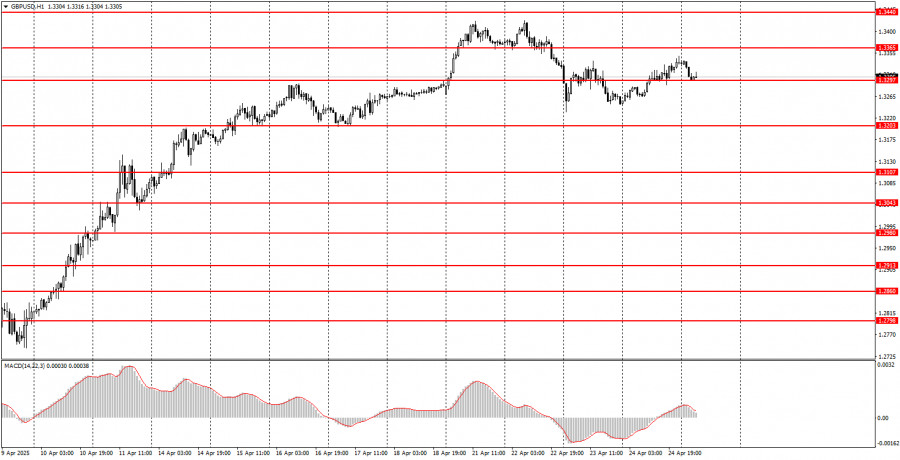

ট্রেডিং পরিকল্পনা২৫ এপ্রিল কীভাবে GBP/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বৃহস্পতিবারের ট্রেডের বিশ্লেষণ GBP/USD পেয়ারের 1H চার্ট বৃহস্পতিবার ঊর্ধ্বমুখী প্রবণতার সাথে GBP/USD পেয়ারের ট্রেডিং অব্যাহত ছিল, যদিও এই ধরনের মুভমেন্টের জন্য কোনো বাস্তবিক কারণ ছিল না। যুক্তরাজ্যে কোনো উল্লেখযোগ্য ইভেন্টলেখক: Paolo Greco

08:02 2025-04-25 UTC+2

35

- মৌলিক বিশ্লেষণ

২৫ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

শুক্রবারের কিছু সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে বলে নির্ধারিত রয়েছে, তবে এগুলো এখন আর তেমন গুরুত্বপূর্ণ নয়, কারণ মার্কেটের ট্রেডাররা এখনো 90% প্রকাশিত প্রতিবেদনকে উপেক্ষা করে চলেছে। আজকের তুলনামূলকভাবে গুরুত্বপূর্ণলেখক: Paolo Greco

07:54 2025-04-25 UTC+2

35

ট্রেডিং পরিকল্পনা২৫ এপ্রিল কীভাবে EUR/USD পেয়ারের ট্রেডিং করবেন? নতুন ট্রেডারদের জন্য সহজ পরামর্শ ও ট্রেডিংয়ের বিশ্লেষণ

বৃহস্পতিবারের ট্রেডের বিশ্লেষণ EUR/USD পেয়ারের 1H চার্ট বৃহস্পতিবার EUR/USD কারেন্সি পেয়ারের মূল্যের সামান্য ঊর্ধ্বমুখী প্রবণতা দেখা গেছে, যদিও দিনের দ্বিতীয়ার্ধে দরপতন দেখা দিলে সেটি আরও যৌক্তিক হতো। দিনের প্রথমার্ধে কোনোলেখক: Paolo Greco

07:34 2025-04-25 UTC+2

41

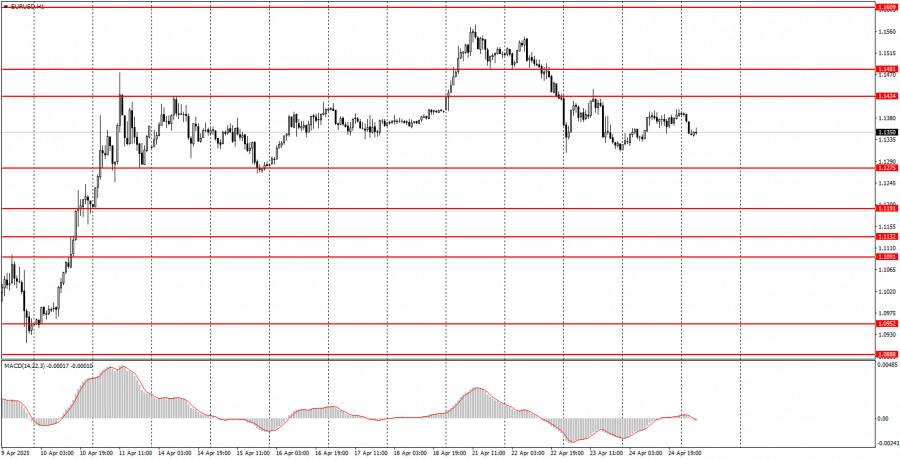

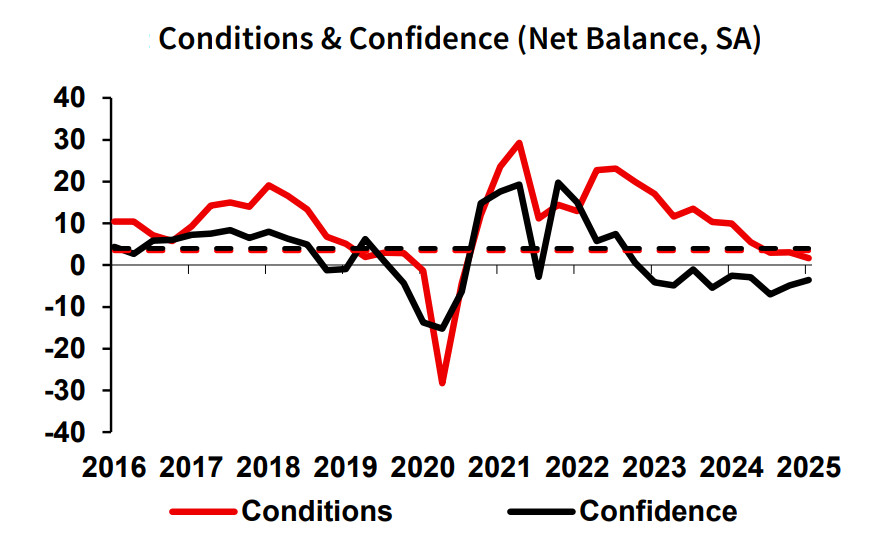

মৌলিক বিশ্লেষণযুক্তরাষ্ট্র-চীন বাণিজ্য যুদ্ধের মাত্রা বৃদ্ধি পেলে অস্ট্রেলিয়ান ডলার চাপের মুখে পড়তে পারে

মার্কিন প্রেসিডেন্ট ডোনাল্ড ট্রাম্প আবারও ফেডারেল রিজার্ভের চেয়ারম্যান জেরোম পাওয়েল সম্পর্কে মন্তব্য করেছেন, প্রকাশ্যে সুদের হার কমানোর গতির প্রতি অসন্তোষ প্রকাশ করেছেন। ফেডের নীতিমালার প্রতি আরও একটি প্রকাশ্য অসন্তোষ এবংলেখক: Kuvat Raharjo

07:00 2025-04-25 UTC+2

27