- পূর্ববর্তী ট্রেডিং সেশনে S&P 500 এবং নাসডাক সূচকে প্রবৃদ্ধি সাথে লেনদেন শেষ করেছে, যেখানে এশিয়া এবং ইউরোপীয় এক্সচেঞ্জগুলোতে ওঠানামা দেখা গেছে। বিনিয়োগকারীরা এখন আসন্ন অর্থনৈতিক প্রতিবেদন এবং প্রযুক্তি জায়ান্ট যেমন

লেখক: Ekaterina Kiseleva

12:13 2025-04-28 UTC+2

1

ইউরোপীয় কেন্দ্রীয় ব্যাংকের (ECB) কর্মকর্তারা আরও সুদের হার কমানোর জন্য প্রস্তুতি নিচ্ছেন, কারণ তারা প্রত্যাশা করছেন যে যুক্তরাষ্ট্রের শুল্ক নীতিমালা ইউরোপের অর্থনীতির ওপর গুরুতর এবং দীর্ঘমেয়াদি ক্ষতিকর প্রভাব ফেলতে পারে—এমনকিলেখক: Jakub Novak

11:34 2025-04-28 UTC+2

1

মৌলিক বিশ্লেষণআসন্ন সপ্তাহটি অন্যান্য অ্যাসেটের জন্য ইতিবাচক হলে ডলার এবং স্বর্ণের জন্য নেতিবাচক হতে পারে (আমরা S&P 500 ফিউচার্সের CFD কন্ট্রাক্ট এবং বিটকয়েনের আরও দর বৃদ্ধির প্রত্যাশা করছি)

আসন্ন সপ্তাহে গুরুত্বপূর্ণ অর্থনৈতিক প্রতিবেদন প্রকাশের সম্ভাবনা রয়েছে, যা মার্কেটের গতিশীলতায় উল্লেখযোগ্য প্রভাব ফেলতে পারে—তবে আসলেই কি তা ঘটবে? ডোনাল্ড ট্রাম্পের সৃষ্ট ভূরাজনৈতিক বিশৃঙ্খলার প্রেক্ষাপটে, যা যুক্তরাষ্ট্র এবং বিশ্ব অর্থনীতিরলেখক: Pati Gani

11:10 2025-04-28 UTC+2

1

- স্টক বিশ্লেষণ

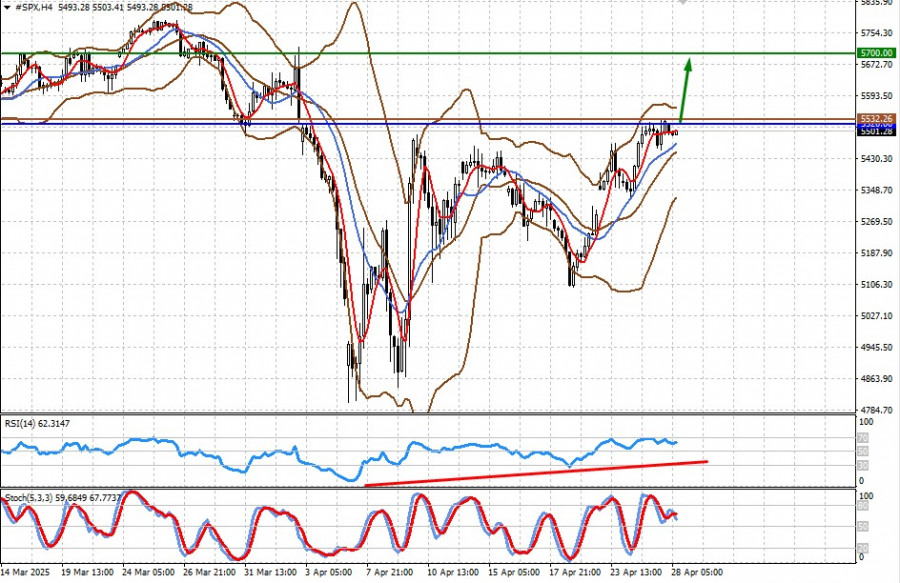

মার্কিন স্টক মার্কেটের পরিস্থিতি, ২৮ এপ্রিলে: S&P 500 এবং নাসডাক সূচকের প্রবৃদ্ধি থেমেছে

সর্বশেষ নিয়মিত সেশনে, মার্কিন স্টক সূচকসমূহ ঊর্ধ্বমুখী হওয়ার পর লেনদেন শেষ হয়েছে। S&P 500 সূচক 0.74%, নাসডাক 100 সূচক 1.26% বৃদ্ধি পেয়েছে, এবং ডাও জোন্স ইন্ডাস্ট্রিয়াল অ্যাভারেজ 0.05% সামান্য বৃদ্ধিলেখক: Jakub Novak

10:46 2025-04-28 UTC+2

1

বিটকয়েন চাপের মুখে রয়েছে, তবে এখনো বেশ আত্মবিশ্বাসের সাথে ঊর্ধ্বমুখী প্রবণতা বজায় রয়েছে। এটির মূল্য $92,000 লেভেল থেকে রিবাউন্ড করার পর, বিটকয়েনের মূল্য আবার $94,000 জোনের দিকে ফিরে এসেছে এবংলেখক: Miroslaw Bawulski

10:31 2025-04-28 UTC+2

0

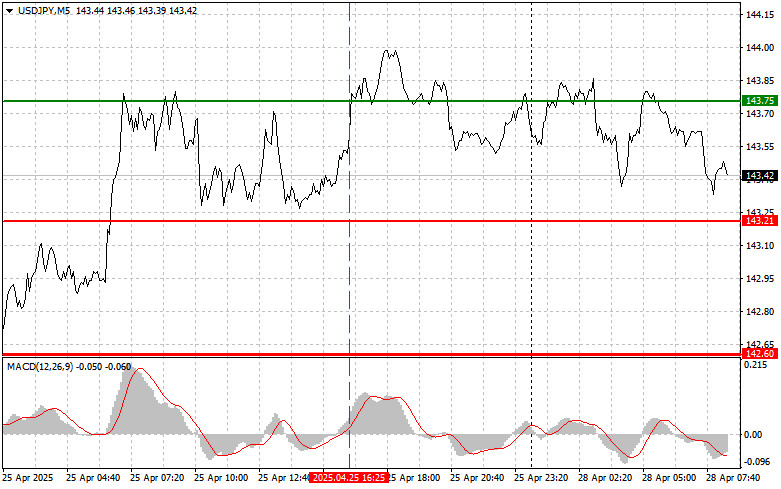

পূর্বাভাসUSD/JPY: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৮ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ ওপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্যলেখক: Jakub Novak

10:23 2025-04-28 UTC+2

1

- পূর্বাভাস

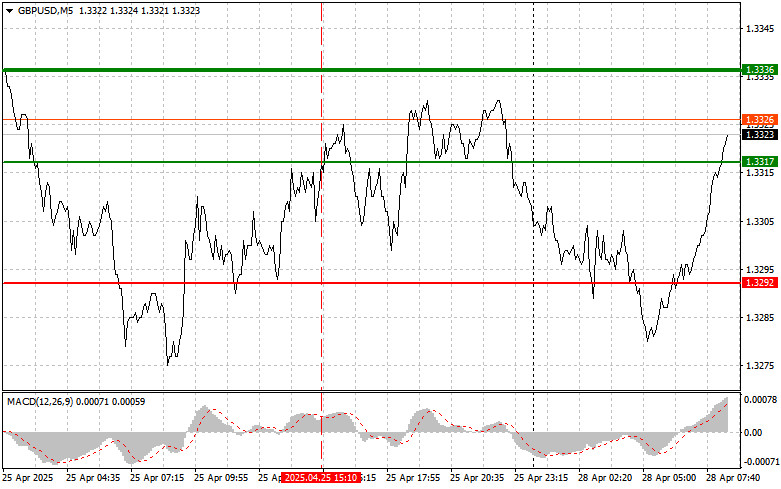

GBP/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৮ এপ্রিল। গতকালের ফরেক্স ট্রেডের পর্যালোচনা

যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ উপরে উঠে গিয়েছিল তখন এই পেয়ারের মূল্যলেখক: Jakub Novak

09:50 2025-04-28 UTC+2

2

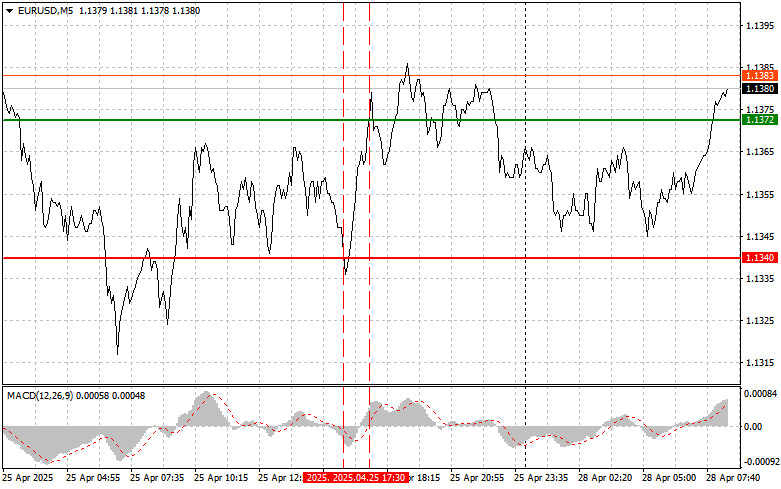

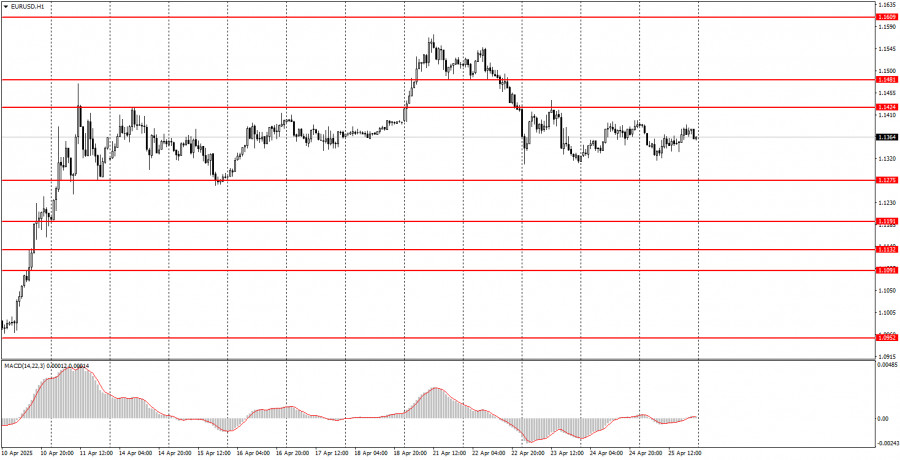

পূর্বাভাসEUR/USD: নতুন ট্রেডারদের জন্য ট্রেডিংয়ের সহজ টিপস, ২৮ এপ্রিল। গতকালের ফরেক্স ট্রেডের বিশ্লেষণ

দিনের দ্বিতীয়ার্ধে যখন MACD সূচকটি ইতোমধ্যে শূন্যের বেশ নিচে নিচে গিয়েছিললেখক: Jakub Novak

09:37 2025-04-28 UTC+2

5

মৌলিক বিশ্লেষণ২৮ এপ্রিল কোন ইভেন্টগুলোর উপর মনোযোগ দেওয়া উচিত? নতুন ট্রেডারদের জন্য ফান্ডামেন্টাল ইভেন্টের বিশ্লেষণ

সোমবার কোনো সামষ্টিক অর্থনৈতিক প্রতিবেদন প্রকাশিত হবে না। গত সপ্তাহে মার্কেটের ট্রেডাররা সামষ্টিক অর্থনৈতিক প্রতিবেদনের প্রতি তেমন কোনো প্রতিক্রিয়া দেখায়নি, তাই সোমবারও বিশেষ কিছু প্রত্যাশা করার নেই। অবশ্য, ডোনাল্ড ট্রাম্পলেখক: Paolo Greco

08:07 2025-04-28 UTC+2

2