ECB on thin ice, fine-tuning its refinancing rate

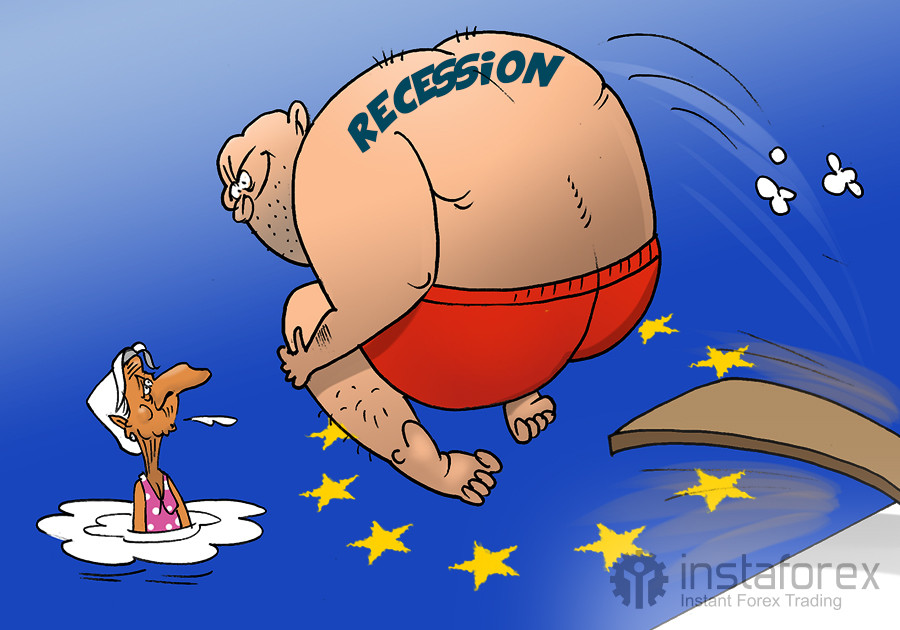

European policymakers have to digest an alarming inflation forecast for the eurozone. There are growing fears that inflation in the EU will hardly settle at around the 2% target. It means that the ECB efforts could be to little avail. ECB President Christine Lagarde warns that trade fragmentation and rising defense spending could further spur inflation acceleration in the European Union. If inflation flares up again, the fight against it will enter a new phase. The question is who will lose in this scenario...

The ECB chief admitted that under such conditions, it would be difficult for the central bank to keep inflation within the 2% range—a target that markets and analysts expect to be reached by early 2026.

The lofty import tariffs introduced by Washington add fuel to the fire. However, Lagarde also noted that US tariffs could lead to a redirection of China’s excess production capacity toward Europe. This could benefit the region and help push inflation downward. Nevertheless, the European regulator cannot guarantee that "overall inflation will always remain at 2%", Lagarde added.

For context, in January 2025, the highest annual inflation rate in the EU was recorded in Hungary (nearly 6%), while the annual CPI stood at 2.5% for the whole eurozone. The lowest inflation rates were observed in Denmark, Ireland, Italy, and Finland, while Romania and Croatia recorded higher-than-average inflation rates.