Легендата в екипа на ИнстаФорекс!

Легенда! Мислите ли, че това е бомбастична реторика? Но как да наречем човек, който на 18 години стана първият азиатец спечелил световния шампионат по шах за юноши и на 19 години стана първият гросмайстор на Индия? Това беше началото на труден път към титлата на световен шампион за Вишванатан Ананд, човекът, който стана част от историята на шаха завинаги. Сега още една легенда в екипа на ИнстаФорекс!

Борусия е един от най-титулуваните футболни клубове в Германия, който многократно се е доказал пред феновете: духът на конкуренция и лидерство със сигурност ще доведе до успех. Търгувайте по същия начин, по който спортните професионалисти играят играта: уверено и активно. Запазете „пас" от ФК „Борусия" и бъдете начело с ИнстаФорекс!

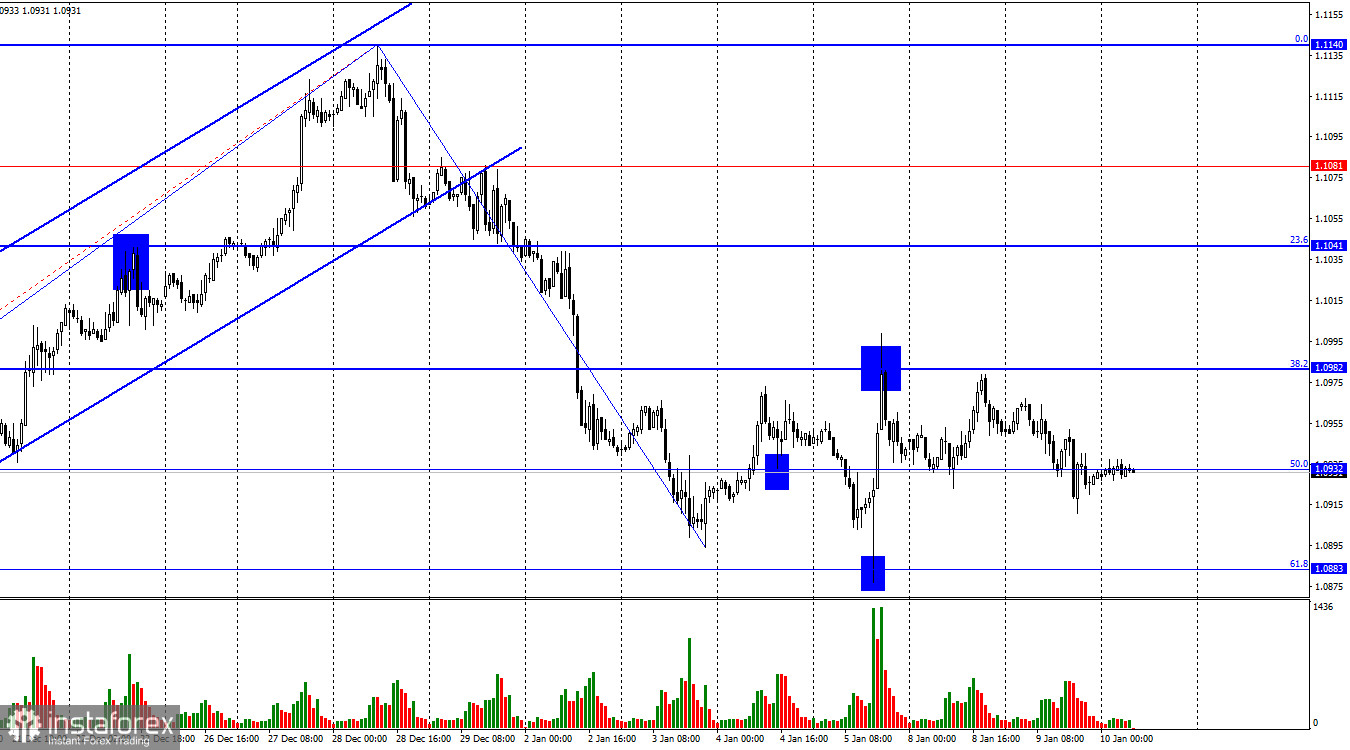

On Tuesday, the EUR/USD pair continued its downward trend. However, the recent decline in the European currency was rather conditional. The pair has been in a horizontal movement for five trading days now. The movements themselves could be stronger. Since a reversal occurred on Monday around the corrective level of 38.2% (1.0982), traders can expect a decline toward the corrective level of 61.8% (1.0883) soon.

The wave situation remains unchanged. The latest downward wave has ended precisely where the previous wave ended (around the level of 1.0890). Thus, there is a breakout of the lows from December 15, but the price has only updated the lows by a few points, which is insufficient to declare a trend change to "bearish." Therefore, the waves continue to signal the persistence of the "bullish" trend. Despite the pair's 250-point drop, there are still no signs of this trend ending. The new upward wave is rather weak and lacks the potential to break the peak from December 28. However, this fact does not indicate the end of the "bullish" trend. Another downward wave is needed, which will confidently break the lows from January 5. Until then, horizontal movement and the "bullish" trend remain in place.

There was no significant news on Tuesday. In the European Union, the unemployment rate was released, which slightly decreased in November. However, this report did not trigger any market reaction, judging by the fact that the European currency fell during the day. I want to remind you that horizontal movement implies small price fluctuations within a certain price range. Usually, these internal movements are not related to the information background. Thus, the reports on unemployment in the EU, industrial production in Germany, or Michelle Bowman's speech did not impact the euro or the dollar. And even if they did, there was no significant benefit from it.

On the 4-hour chart, the pair has settled below the corrective level of 61.8% (1.0959), allowing traders to anticipate further decline towards the next Fibonacci level at 1.0862. However, even this decline will not cancel the ascending trend corridor, which still characterizes traders' sentiment as "bullish." I will only expect a strong decline in the euro after it secures itself below this corridor. Until then, the bulls can launch a new offensive at any moment.

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 717 long contracts and closed 1368 short contracts. The sentiment of large traders remains "bullish" but is weakening overall. The total number of long contracts held by speculators now stands at 212 thousand, while short contracts total only 92 thousand. Despite the significant difference, the situation will shift toward the bears. Bulls have dominated the market for too long, and now they need a strong background of information to maintain the "bullish" trend. I don't see such a background at the moment. Professional traders may resume closing their long positions soon. The current figures allow for a resumption of the euro's decline in the coming months.

Economic Calendar for the US and the EU:

On January 10, the economic events calendar does not contain any entries. Thus, the impact of the information background on traders' sentiment will be absent for the third consecutive day.

EUR/USD Forecast and Trader Advice:

Selling the pair is possible today if it settles below the level of 1.0932 on the hourly chart, with a target of 1.0883. Buying can be considered in case of a rebound from the level of 1.0883 on the hourly chart, targeting 1.0932 and 1.0982. However, I want to remind you that the current movement is weak and horizontal, so trading should be done cautiously.

*Анализът на пазара публикуван тук има за цел да повиши информираността Ви, но не и да дава указания за търговия.

Аналитичните прегледи на ИнстаФорекс ще ви запознаят изцяло с пазарните тенденции! Като клиент на ИнстаФорекс, на вас се предоставят голям брой безплатни услуги за ефикасна търговия.

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.