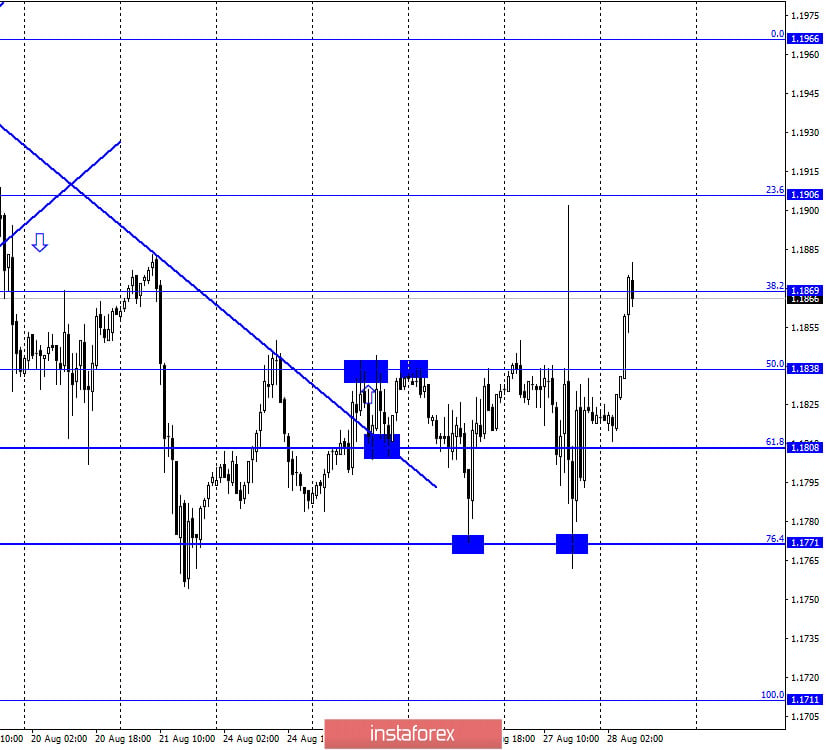

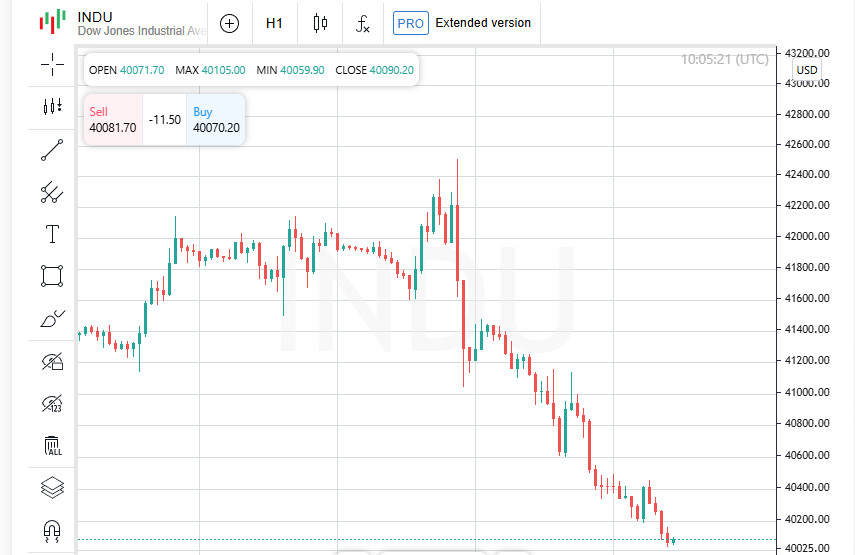

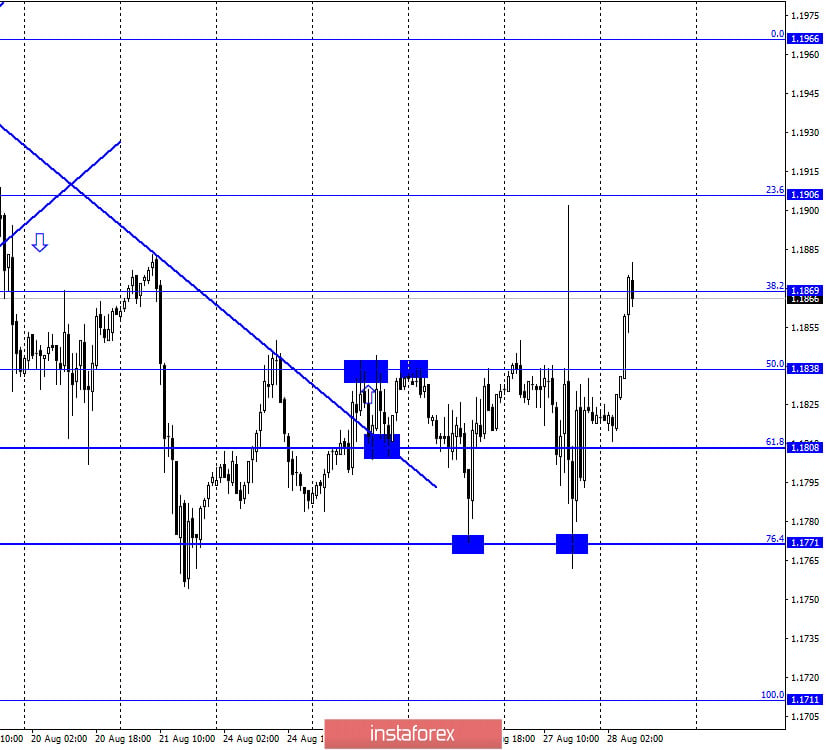

EUR/USD - 1H.

On August 27, the EUR/USD pair performed first an increase to 1.1900, then a fall to the corrective level of 76.4% (1.1771), after which a reversal in favor of the EU currency and an increase to the Fibo level of 38.2% (1.1869) with a consolidation above it. All this is due to the speech of Jerome Powell at the economic symposium I announced (and not only) in Jackson Hole. In reality, Jerome Powell touched on monetary policy issues very superficially. More attention in his speech was paid to inflation, its targeting and the results that the Fed wants to achieve with this change in attitude to the consumer price index. During the report of the Fed Chairman, it turned out that now it will be allowed to exceed 2% of inflation without an immediate increase in the key rate. That is, the Fed leaves the option not to tighten monetary policy if inflation exceeds the 2% level. This means that the US Central Bank will try to compensate with high inflation (from 2 to 3%) for periods of low inflation (as now, about 1 %). Thus, the potential first possible rate increase is pushed back to an even later date. However, I believe that this is not a "dovish" solution. Now, when America, like the rest of the world, is covered by an economic crisis, and the WHO says that the coronavirus pandemic can "terrorize" humanity for another two years, in any case, we are not talking about raising the Fed rate. So what difference does it make for traders if the Fed raises the rate in two years or three?

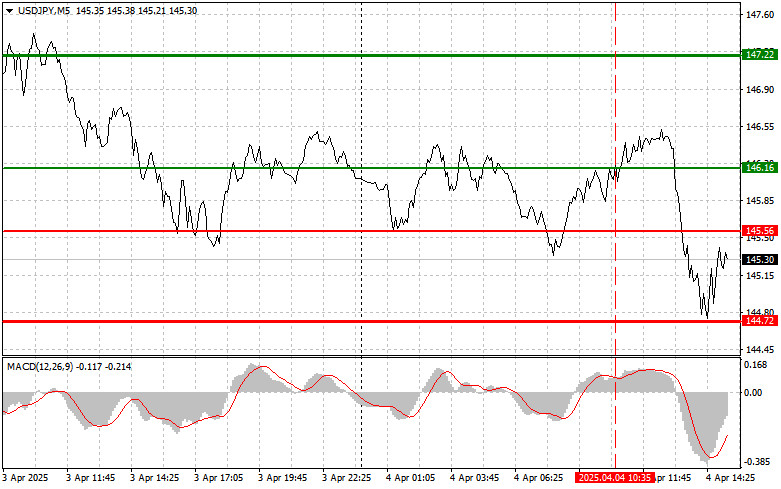

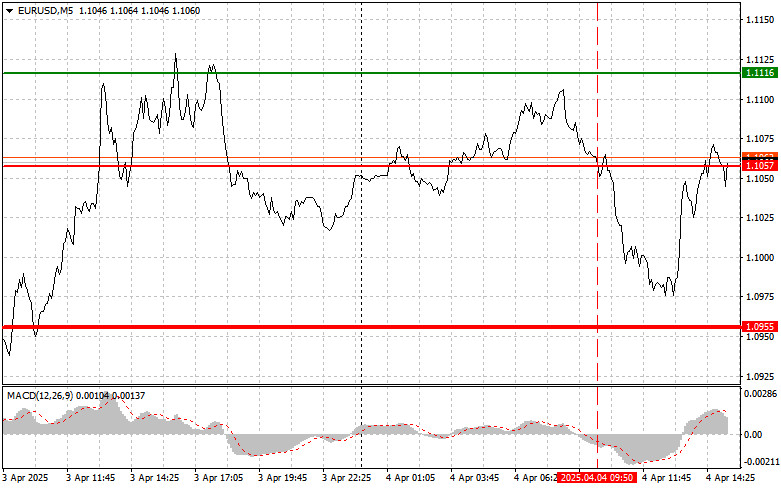

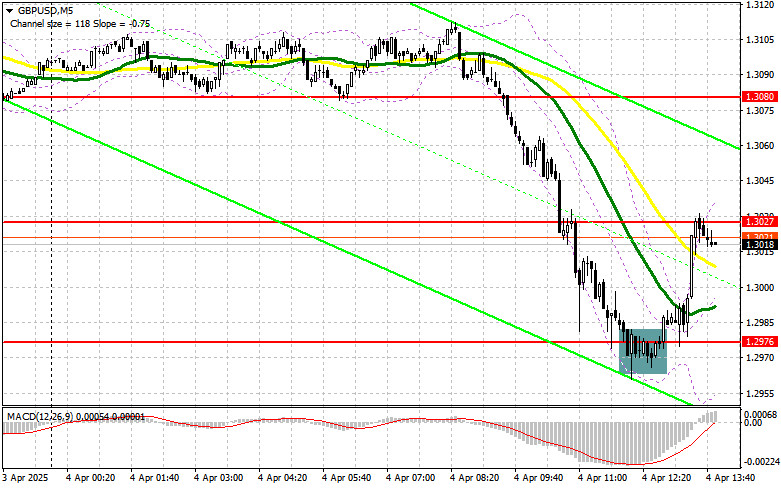

EUR/USD – 4H.

On the 4-hour chart, the quotes of the EUR/USD pair performed growth to the upper border of the side corridor and rebound from it. At the moment, the growth of quotes is resumed for the same purpose. A new rebound from this border will again work in favor of the US dollar and resume falling in the direction of the corrective level of 127.2% (1.1729). Closing the pair's rate above the sideways corridor will significantly increase the chances of further growth towards the next corrective level of 161.8% (1.2027).

EUR/USD – Daily.

On the daily chart, the quotes of the EUR/USD pair performed another reversal and anchored above the corrective level of 261.8% (1.1825). However, this level is not strong and I recommend paying more attention to the upward trend corridor, within which trading continues. The mood of traders remains "bullish".

EUR/USD – Weekly.

On the weekly chart, the EUR/USD pair performed a consolidation over the "narrowing triangle", which now allows us to count on further growth of the euro currency, which can be very strong and long-term. At the same time, the breakdown may be false. In this case, the drop in quotes will be resumed.

Overview of fundamentals:

On August 27, the US also released a report on applications for unemployment benefits, however, it was completely overshadowed by the speech of Fed President Jerome Powell.

News calendar for the United States and the European Union:

US - change in the level of expenditure and income of the population (12:30 GMT).

On August 28, the calendar of the European Union is again empty, and only a report on the income and expenses of the American population will be released in America, which is unlikely to arouse the interest of traders.

COT (Commitments of Traders) report:

The last COT report was very boring. Major market players in total (for all groups) increased short-contracts during the reporting week. However, the most interesting group of "Non-commercial" was engaged in reducing the number of long and short contracts on their hands. Speculators got rid of 4,500 contracts, so we can say that their mood has not changed at all during the reporting week. They still have 4 times more long contracts than short contracts on their hands, so in general, we can't say that their mood has become a bit more bearish. Thus, I cannot conclude that this week the pair's quotes may fall based on the COT report.

Forecast for EUR/USD and recommendations for traders:

Today, I recommend selling the euro currency with the goals of 1.1838-1.1808, if a new rebound is made from the upper line of the side corridor on the 4-hour chart. I recommend buying the pair if the closing is performed over the side corridor with the goal of 1.2027.

Terms:

"Non-commercial" - major market players: banks, hedge funds, investment funds, private, large investors.

"Commercial" - commercial enterprises, firms, banks, corporations, companies that buy currency, not for speculative profit, but to ensure current activities or export-import operations.

"Non-reportable positions" - small traders who do not have a significant impact on the price.

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

立即从分析师的建议受益

充值交易账户

开设交易账户

InstaSpot分析评论将让您充分了解市场趋势! 作为InstaSpot的客户,您将获得大量的免费服务以实现有效的交易。