Long-term review

It's been two week since our last article and I have some good news: the Bitcoin quote has reached the projected coordinate ($19 000), and it means that we have become even richer!

While you are counting your profit or reproaching yourself for not listening to us back in the spring and have not bought Bitcoin, we will talk about the ubiquitous HYPE.

With the arrival of autumn, the crypto market has acquired a forgotten scale, skeptics and opponents of digital gold are quickly changing their shoes, and new blood is pouring into the market with the 2017 scale. In all this storm of emotions, it is necessary to draw a clear line between 2017 and 2020, understand the market has changed, what was in the form of a rash and inflated hype 2017, and now in 2020 is an investment in the future.

For example, the largest debit electronic payment system PayPal, which recently opened access to cryptocurrencies for its customers. The movement was not based on a hype, but strategically, PayPal CEO Dan Shulman believes that eventually Bitcoin will be used more for everyday payments, rather than as a tool for speculation or savings. PayPal is ready to open thousands and even tens of thousands of stores where you can use cryptocurrencies as a payment element.

CEO of payment giant Visa Alfred Kelly recently noted that cryptocurrency will soon become an integral part of the Visa network for everyday use. He believes that the key to mass adoption of cryptocurrency is to make money available to those parts of the world with limited access to Finance, and Visa will definitely be at the center of this.

Even if you deny or distrust the crypto industry, the world is changing, and what was unattainable in 2017 is now a prospect.

Financial institutions, Funds, Wall Street, Institutional investors, everyone has their own opinion on crypto assets.

A clear proof is the list of funds that have entered their money into the crypto market. Believe me, this is only a small part of the famous members who decided to officially declare it.

The deVere Group consulting company recently conducted a survey among 700 individuals whose financial condition exceeds 1 million pounds sterling. The survey showed that 511 respondents already have investments in cryptocurrencies, or they are planning to add it to their investment portfolio in the near future.

Australian investment company Pendal Group with assets of $75 billion went even further and is already starting to trade BTC futures on the Chicago Mercantile exchange (CME). Their Manager said that government bonds are losing their appeal in the eyes of wealthy investors, and people will eventually transfer their savings to alternatives, including gold and Bitcoin.

In the bull market, everything related to crypto assets begins to grow, so it was forgotten back in 2017-2018. The XRP tool has grown by more than 170% in just five days, and this is a tool from the top five of CoinMarketCap, which is even before the jump had a staggering capitalization.

Trading prospects

The Bitcoin quote did not just break the $19,000 mark—the rate is close to the historical maximum of 2017 - $19,891. The update of heights can come at any time, the main question now is not when it will happen, but where we will fly. This is purely a philosophy since the excitement in the market is great and locally, we can fly in 1000, 3000, or even 5000 dollars. However, bear in mind that the trend does not happen without correction.

Now is the moment that allows "laggards" to enter the crypt at a discount. That's right, the correction has come, which has appeared somewhere else, but in a logical place, within the historical maximum.

There was a correction, since many traders, including myself, who have had long positions for a long time have come to the stage of the next fixation.

Imagine market participants who do not have 0.1 BTC or even 1BTC, but hundreds of coins, a hype for them is not just an increase in assets, but an opportunity to easily skim the cream from their large deposits.

In such a broad bull market, I suggest that you look at Altcoin-am from the Top 150 CoinMarketCap. After the correction, they become even more accessible, and nothing disappears from the crypt hype. Therefore, 100-200-300% of the current value can easily be earned.

General background of the crypto market:

Analyzing the Total Market Capitalization of the crypto industry, it is shown that the Total market at its peak gained more than $194 billion in weight since the beginning of November. At the moment it is ~ $502 billion, which is a lot, but it is still far from perfect.

At this time, the total market is growing on the basis of Bitcoin, Altcoin-s are still dormant, but as soon as they start to grow, the total will easily pass the mark of 1 trillion dollars.

For a better understanding of the whole process, I suggest going to the Coinmarketcap resource and opening the Bitcoin tab. There, the Market Cap BTC has already updated its historical maximum and currently the volume is $313 billion. In simple words, the dominance of the first currency is ~ 62% relative to the entire crypto market.

The index of emotions (aka fear and euphoria) of the crypto market is at the level of FOMO* (Lost Profit Syndrome*) – 93 points. This means that the market is very active and a new round of growth is possible on the positive emotions of the bull market.

Indicator analysis:

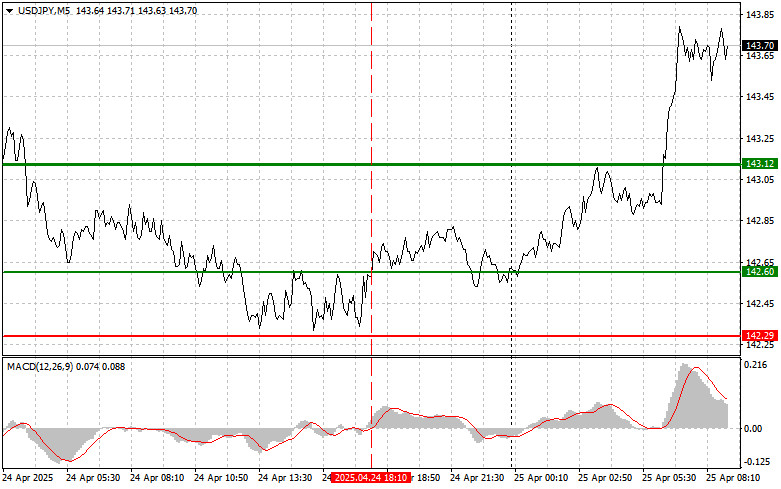

In a different sector of timeframes (TF), it is clear that the indicators of technical instruments in the four-hour period tend to sell due to a corrective movement in the market. The daily and weekly periods signal a purchase, which is confirmed by the trend.

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

立即从分析师的建议受益

充值交易账户

开设交易账户

InstaSpot分析评论将让您充分了解市场趋势! 作为InstaSpot的客户,您将获得大量的免费服务以实现有效的交易。

赚取InstaSpot的加密货币利率变化

下载MetaTrader 4并开始您的第一笔交易