The legend in the InstaSpot team!

Legend! You think that's bombastic rhetoric? But how should we call a man, who became the first Asian to win the junior world chess championship at 18 and who became the first Indian Grandmaster at 19? That was the start of a hard path to the World Champion title for Viswanathan Anand, the man who became a part of history of chess forever. Now one more legend in the InstaSpot team!

Borussia is one of the most titled football clubs in Germany, which has repeatedly proved to fans: the spirit of competition and leadership will certainly lead to success. Trade in the same way that sports professionals play the game: confidently and actively. Keep a "pass" from Borussia FC and be in the lead with InstaSpot!

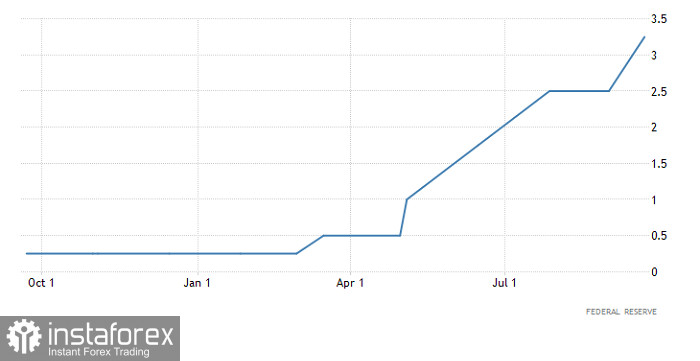

The growing tension and confrontation in Europe, as well as massive capital inflow to the US, has put pressure on EUR/USD. It intensified further after the Federal Reserve raised interest rates by 75 basis points and announced a similar one for the next meeting. The central bank reasoned that although inflation is slowing down, it is happening more slowly than expected. Thus, it is necessary to continue raising interest rates.

Interest rate (United States):

Unsurprisingly, dollar became heavily overbought, which means that for further growth, traders needs to release steam in the form of a rebound or a correction. It is possible that this is exactly what will happen today, after the Bank of England raises rates by 50 basis points. Such results will certainly lead to the growth of pound and, given the market's need for a rebound, it will pull euro along with it.

Interest rate (UK):

EUR/USD, in the course of an intense downward move, almost fell to the level of 0.9800. This signals the overheating of short positions in the market, which means that there may be a rebound towards the previously passed level of 0.9900.

GBP/USD has prolonged the current downward trend in the market by trading actively at 1985. This shows that the pair is oversold, and could see a technical rebound soon.

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

InstaSpot分析评论将让您充分了解市场趋势! 作为InstaSpot的客户,您将获得大量的免费服务以实现有效的交易。

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.