- Trading plan

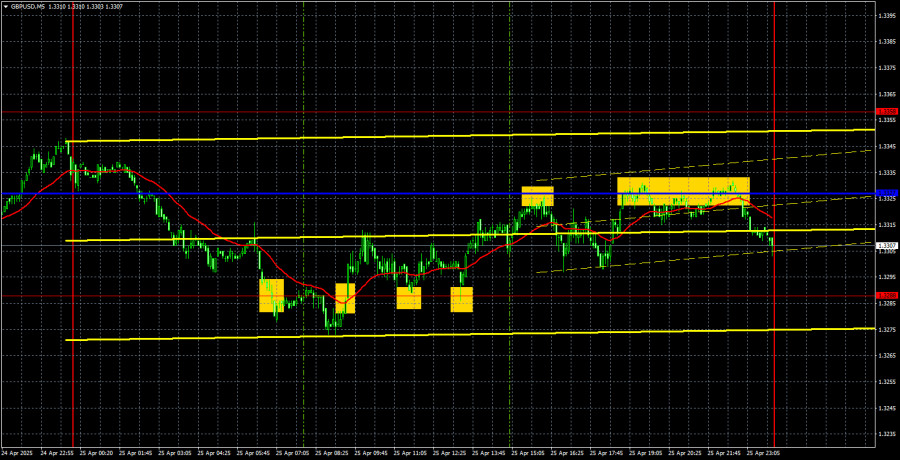

Trading Recommendations and Analysis for GBP/USD on April 28: The Pound Does Not Believe in De-escalation

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highs. The fact that the British pound refuses even a slight downward correction shows the market's disbeliefAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

1

The EUR/USD currency pair continued trading sideways throughout Friday. In the second half of last week, the euro traded exclusively between the levels of 1.1321 and 1.1391, although the overallAuthor: Paolo Greco

04:13 2025-04-28 UTC+2

1

Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforcedAuthor: Evangelos Poulakis

03:51 2025-04-28 UTC+2

12

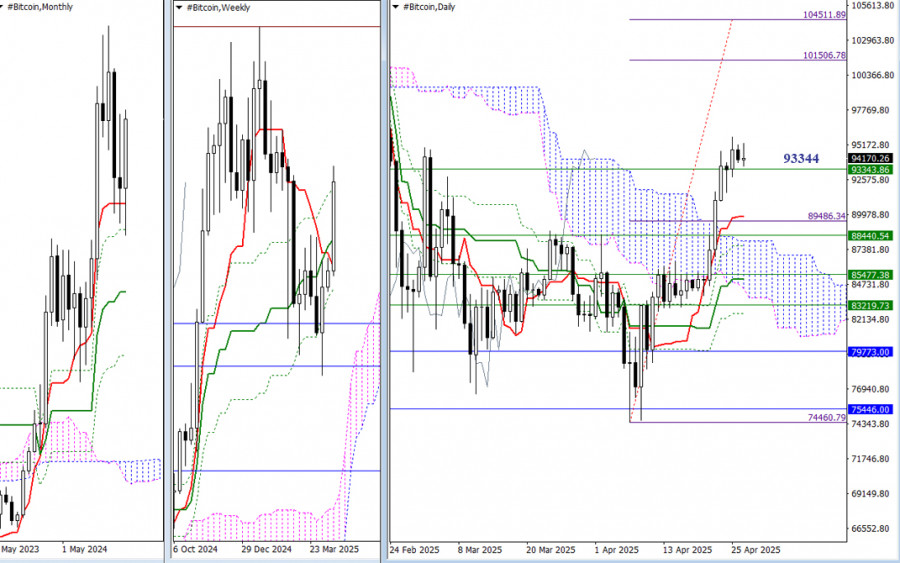

- Currently, bullish players are attempting to change the situation and achieve bullish optimism for April. Last week, resistance at the final level of the weekly Ichimoku cross (93344) was tested

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

5

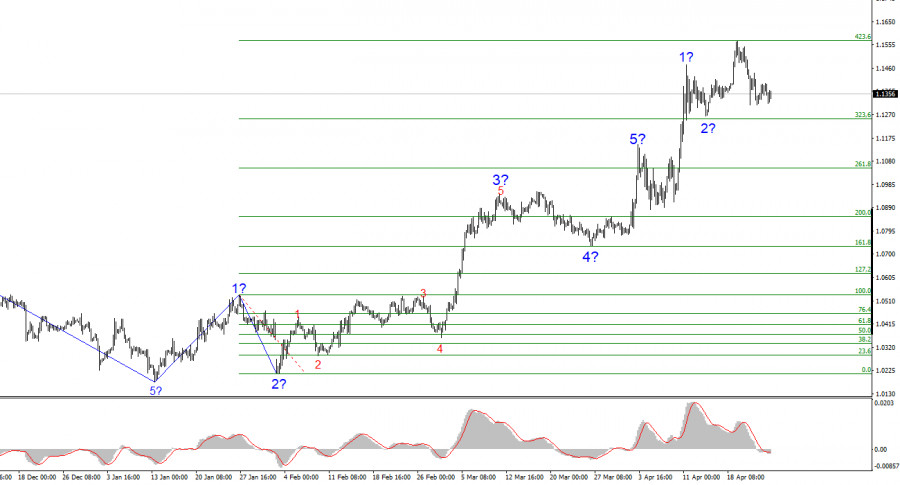

The United States is facing an important week, but it is unlikely to be important for the U.S. dollar. Significant reports on the labor market, job openings, unemploymentAuthor: Chin Zhao

01:05 2025-04-28 UTC+2

13

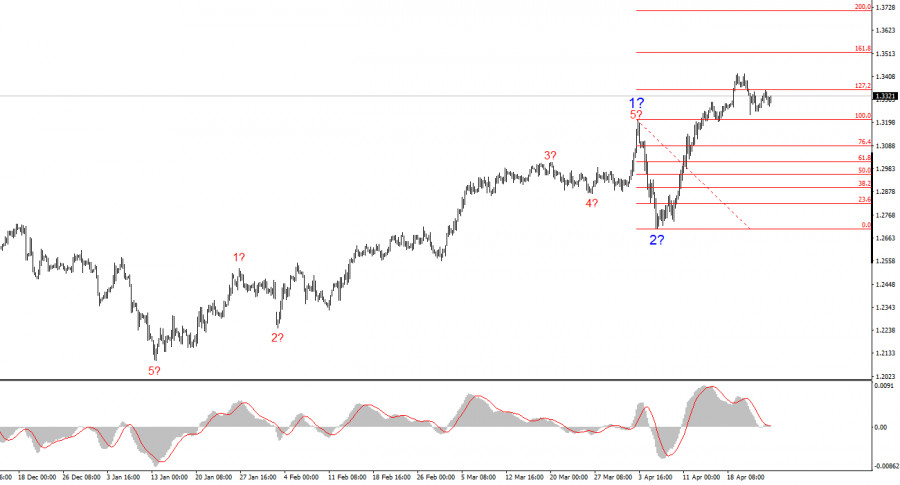

The British pound is doing even better than the euro. The market keeps finding additional reasons to increase demand for the pound, even when the euro remains stagnant. Therefore, evenAuthor: Chin Zhao

01:05 2025-04-28 UTC+2

8

- The wave pattern on the 4-hour EUR/USD chart has shifted into a bullish formation. It's safe to say that this transformation occurred solely due to the new U.S. trade policy

Author: Chin Zhao

20:26 2025-04-25 UTC+2

140

The wave pattern on the GBP/USD chart has also transformed into a bullish, impulsive structure—"thanks" to Donald Trump. The wave picture closely resembles that of the EUR/USD pair. Until FebruaryAuthor: Chin Zhao

20:21 2025-04-25 UTC+2

106

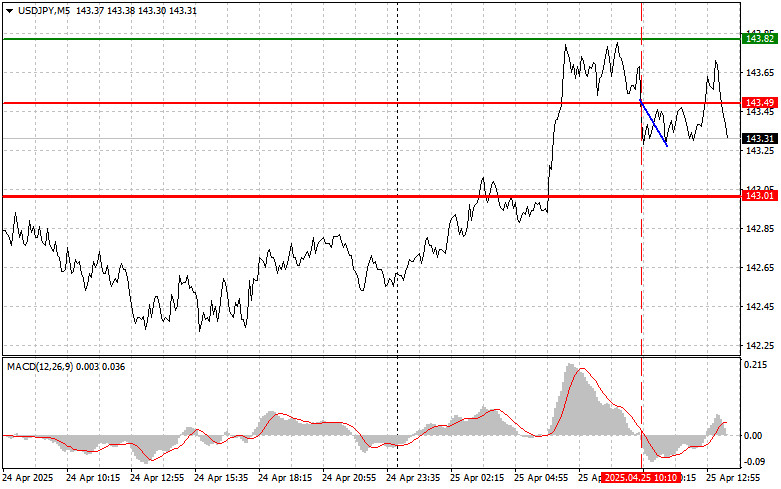

Trade Analysis and Guidance for the Japanese Yen The price test at 143.49 occurred just as the MACD indicator began moving down from the zero line, confirming a valid entryAuthor: Jakub Novak

20:09 2025-04-25 UTC+2

115