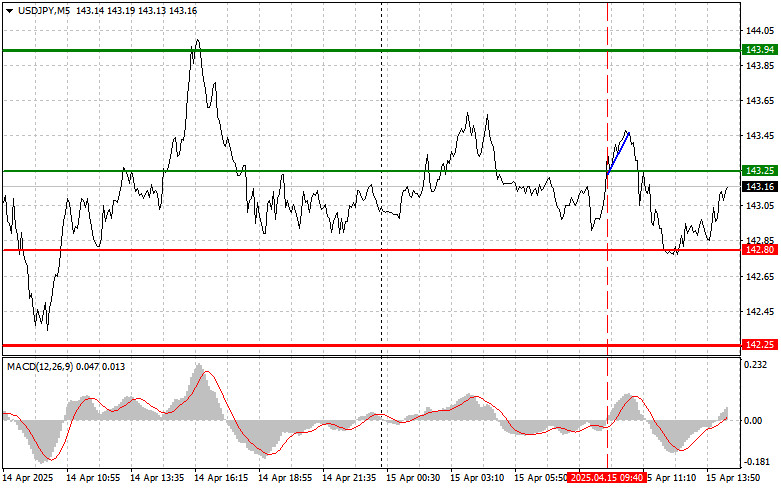

- Trade Review and Tips for Trading the Japanese Yen The test of the 143.25 level occurred at a time when the MACD indicator had just started moving up from

Author: Jakub Novak

18:53 2025-04-15 UTC+2

0

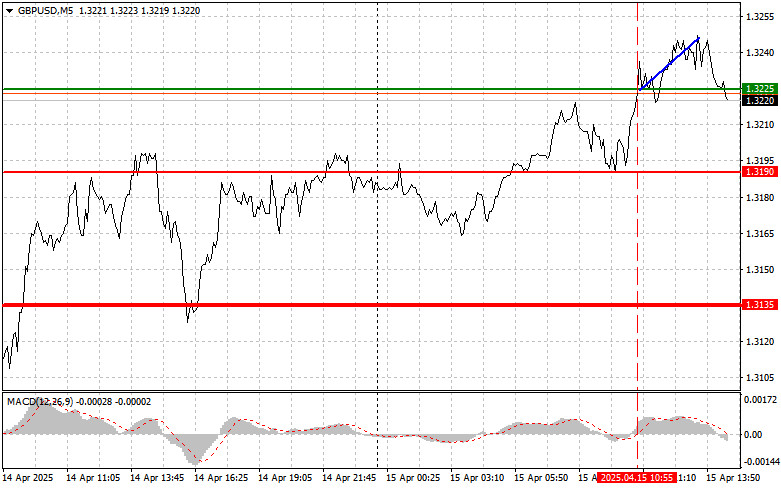

Trade Review and Tips for Trading the British Pound The test of the 1.3225 level occurred just as the MACD indicator was beginning to rise from the zero mark, confirmingAuthor: Jakub Novak

18:51 2025-04-15 UTC+2

0

Trade Review and Euro Trading Tips The test of the 1.1336 price level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the downwardAuthor: Jakub Novak

18:46 2025-04-15 UTC+2

0

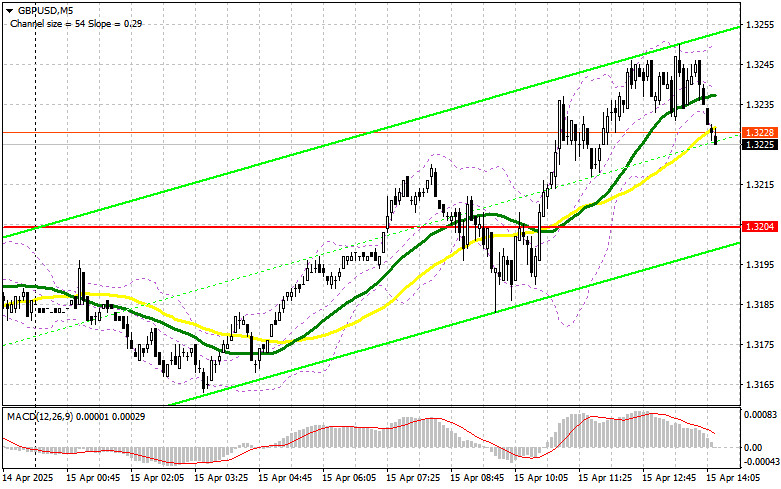

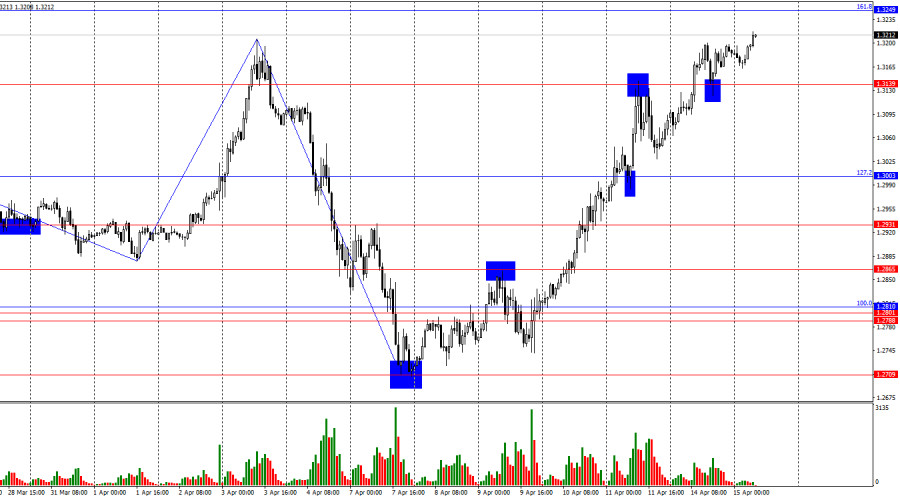

- In my morning forecast, I focused on the 1.3204 level and planned to make trading decisions from it. Let's look at the 5-minute chart and see what happened. A breakout

Author: Miroslaw Bawulski

18:44 2025-04-15 UTC+2

0

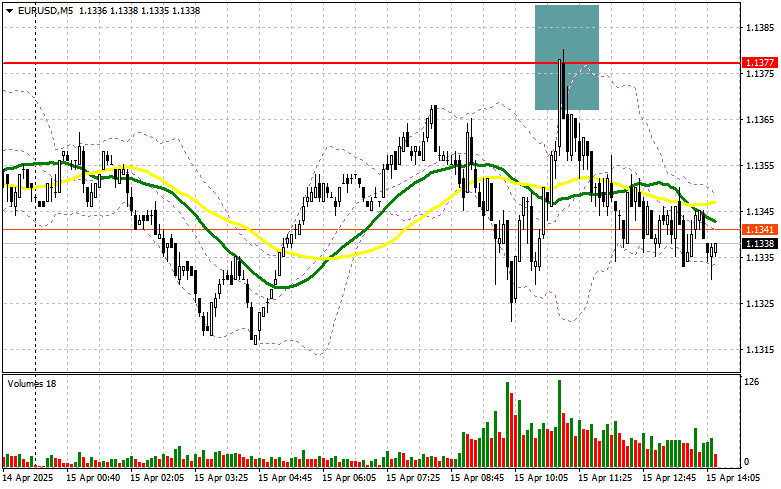

In my morning forecast, I highlighted the 1.1377 level and planned to make trading decisions from there. Let's look at the 5-minute chart and break down what happened. A riseAuthor: Miroslaw Bawulski

18:40 2025-04-15 UTC+2

1

Technical analysisTrading Signals for GOLD (XAU/USD) for April 15-18, 2025: sell below $3,220 (+1/8 Murray - 21 SMA)

Early in the American session, gold is trading around 3,220, showing signs of exhaustion. A further technical correction toward the 21SMA is likely in the coming hoursAuthor: Dimitrios Zappas

14:05 2025-04-15 UTC+2

24

- Today, gold is rising, trading near the all-time high reached the previous day, amid growing uncertainty surrounding the US-China trade wars. Gold is gaining ground today, remaining close

Author: Irina Yanina

12:18 2025-04-15 UTC+2

34

Today, the Japanese yen is struggling to extend its gains due to optimistic developments regarding trade negotiations and the postponement of tariffs. President Trump's statement about possible exemptionsAuthor: Irina Yanina

12:08 2025-04-15 UTC+2

24

On the hourly chart, the GBP/USD pair continued rising on Monday and secured a position above the 1.3139 level. Thus, the upward movement may continue toward the next Fibonacci correctiveAuthor: Samir Klishi

11:59 2025-04-15 UTC+2

24