我们的团队有超过700万的操盘手!

我们每天都在一起努力改善交易。我们得到了很高的成绩,并继续前进。

世界各地数以百万计的操盘手的认可是我们工作的最大赞赏! 您做出了您的选择,我们将尽一切努力来满足您的期望!

我们是一个共同的伟大团队!

InstaSpot. 自豪地为您工作!

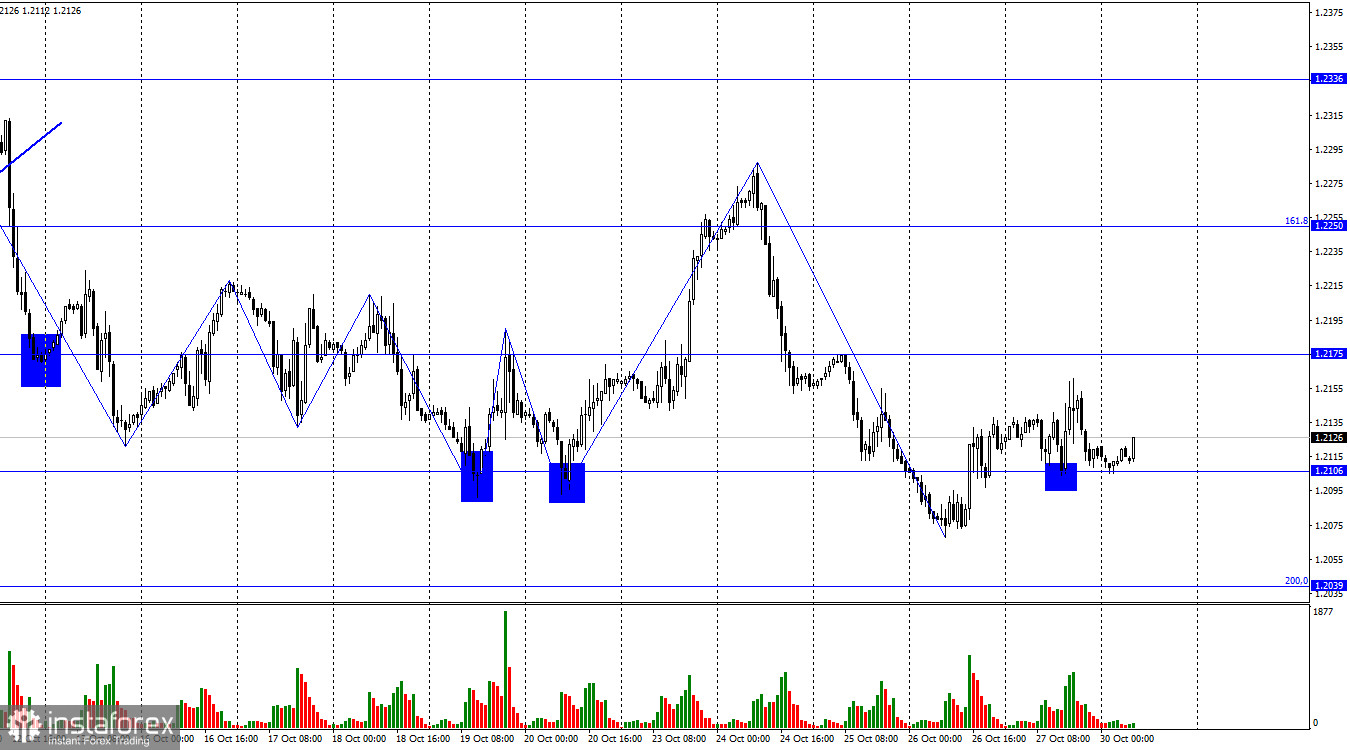

On the hourly chart, the GBP/USD pair rebounded from the level of 1.2106 on Friday and made a slight move towards 1.2175. However, they couldn't reach the target level, and by Monday morning, the quotes returned to the level of 1.2106. Now, a new bounce from this level will work in favor of the pound, leading to some growth towards 1.2175. If the pair's rate closes below 1.2106, we can expect a turnaround in favor of the US dollar and a decline towards the corrective level of 200.0% (1.2039).

The wave situation is currently quite ambiguous. Last week, we saw a strong downward wave that broke through the lows of the past four descending waves. Consequently, the "bearish" trend has been renewed. At the moment, an upward wave has begun to form, which is entirely natural. After its completion, I expect a new downward wave and a drop in the pair to the minimum of 1.2039. However, I also have a feeling that the current movement is horizontal.

The US report on Friday didn't support the bears, although it can't be called a complete failure. Personal income for Americans grew by 0.3%, with traders expecting 0.4%. Personal spending increased by 0.7% compared to the expected 0.5%. The core Personal Consumption Expenditure (PCE) Price Index increased by 0.3% as anticipated, and only the University of Michigan Consumer Sentiment Index was below expectations at 63.8. In my view, the key indicator for the market was the personal spending report because the more the population spends money, the greater the probability of inflation acceleration. Spending should decrease, not increase, for inflation to fall. In the United States, we see strong GDP growth, rising wages, and increasing expenditures. All of this encourages inflation to accelerate. The Federal Reserve has taken a less strict position than before, so the dollar was under pressure on Friday. However, this pressure is unlikely to prevent it from continuing to rise in the future unless more important statistics this week disappoint.

On the 4-hour chart, the pair rebounded from the corrective level of 50.0% (1.2289) and reversed in favor of the US dollar. A new decline towards the level of 1.2035 has begun. Quotes closed above the descending trend corridor, but it is still challenging to expect further growth in the pound. There are no emerging divergences with any indicators today. A bounce in the pair's rate from the level of 1.2035 will allow us to anticipate a new rise in the pound.

Commitments of Traders (COT) Report:

The sentiment of "non-commercial" traders in the latest report has become more "bearish." The number of long contracts held by speculators increased by 1582 units, while the number of short contracts increased by 9009 units. The overall sentiment of major players has shifted towards "bearish," and the gap between the number of long and short contracts is widening, but now in the opposite direction: 67,000 versus 86,000. In my opinion, there are excellent prospects for the pound to continue to decline. I still don't expect a strong rise in the British pound in the near future. I believe that over time, the bulls will continue to reduce their buy positions, as is the case with the European currency.

Economic Calendar for the United States and the United Kingdom:

On Monday, the economic events calendar is completely empty. The impact of the news background on market sentiment will be absent for the rest of the day.

Forecast for GBP/USD and trading advice:

Selling the pound is possible today if it closes below the level of 1.2106 on the hourly chart or on a bounce from 1.2175. Buying is possible on a bounce from 1.2106 with a target of 1.2175.

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

InstaSpot分析评论将让您充分了解市场趋势! 作为InstaSpot的客户,您将获得大量的免费服务以实现有效的交易。

电子邮件/短信

通知

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaSpot anyway.

We are sorry for any inconvenience caused by this message.