Over the past three weeks, Bitcoin has been in a correction phase, which should be viewed as a profit-taking cycle after a long and uninterrupted rally. The approval of the spot BTC-ETF was the event that triggered a massive sale of BTC coins, but the current trading week showed that this process might be prolonged and intensified. Despite the strong positions of buyers, the cryptocurrency price broke the $40k level, significantly weakening the structure of the upward trend.

At the end of yesterday's trading day, the asset managed to recover above $40k, after retesting $38.5k and further recovering to $39k. This event should be seen as a positive sign, however, it remains questionable whether the reversal above $40k will lead to a reversal of the local trend and the end of the correction. Such a possibility exists, but as of January 25, there are too few signals in the market for such a development.

Fundamental factors

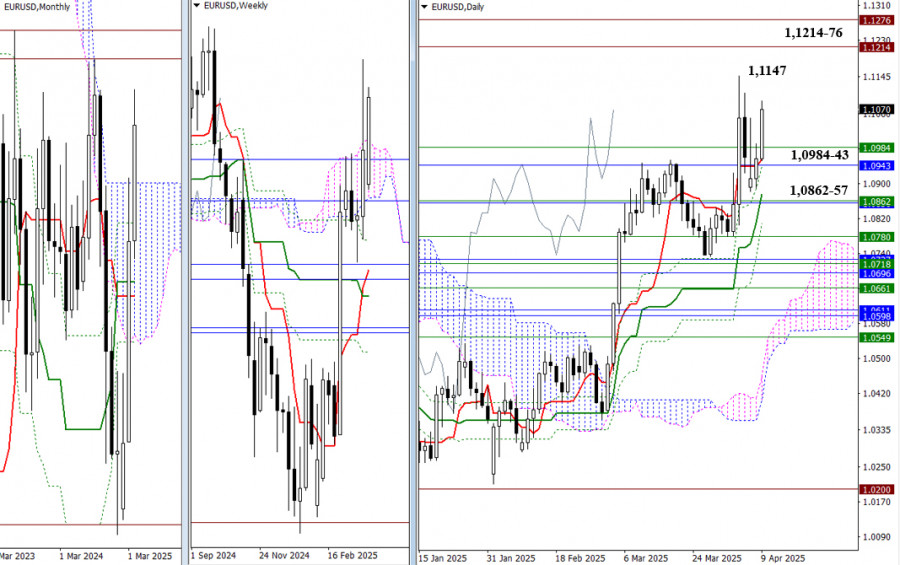

Macroeconomic indicators in the USA have shown disheartening growth dynamics in business activity and consumer goods prices. This means that inflation will at least show resilience by the end of January, and at most, the indicator will continue to grow towards 3.5%. At the same time, a significant reduction in the U.S. GDP in the fourth quarter from 4.9% to 2% is expected, which could positively affect investment assets and provoke a decrease in the U.S. dollar index.

![Exchange Rates 25.01.2024 analysis]()

In such a case, markets can expect long-term positivity, as it will most likely mean that the Federal Reserve will begin easing monetary policy earlier than the second half of 2024. The U.S. leading indicators index has been declining for 21 consecutive months, indicating an approaching recession, which can also be interpreted as a signal for a quicker transition to lowering the interest rate. However, if the U.S. GDP turns out to be above 2%, it will provoke a strengthening of the U.S. dollar and a decrease in Bitcoin and other investment assets.

Bitcoin above $40k

The cryptocurrency managed to consolidate and close the previous trading day above $40k. At the moment, the cryptocurrency price reached the $40.5k mark, which now plays the role of a key resistance level. This event indicates high bullish sentiments in the BTC market and increasing buying volumes. Among buyers, it's worth highlighting BlackRock, which purchased an additional 4,079 BTC for its BTC-ETF, bringing the company's total balance to 44,004 BTC worth $1.7 billion.

Bitcoin has given an important bullish signal, but it's still too early to talk about the end of the local downward trend. If the cryptocurrency manages to hold the $40k level and continue its upward movement towards $40.5k, the chances of a full reversal will significantly increase. However, ideally, the cryptocurrency needs to consolidate above $42k to neutralize selling pressure. As of January 25, there are clearly not enough bullish volumes for such a powerful upward impulse.

![Exchange Rates 25.01.2024 analysis]()

At the same time, the possibility of further downward movement remains. If we assess Bitcoin's growth in terms of an upward correction in the structure of the downward trend, it appears that the cryptocurrency's movement is logical. On the 4H chart, when constructing the correction according to Fibonacci, we see that the asset's price clearly reached the classic zone where the correction ends—between the 0.618 and 0.5 levels. This means that if BTC does not consolidate above $40.5k in the shortest term, another downward impulse will begin, with the potential to reach $37k.

Conclusion

The macroeconomic background is still in a state of uncertainty, as are the financial markets, but a resolution is near. Bitcoin maintains the structure of a downward trend, and if the asset doesn't make a bullish leap above $40.5k in the coming days, the likelihood of a deeper correction with a full plunge below $40k will significantly increase. Much of the situation will depend on the macroeconomic data from the U.S., which can either give BTC another chance for recovery or accelerate the start of a new downward impulse.

*这里的市场分析是为了增加您对市场的了解,而不是给出交易的指示。

立即从分析师的建议受益

充值交易账户

开设交易账户

InstaSpot分析评论将让您充分了解市场趋势! 作为InstaSpot的客户,您将获得大量的免费服务以实现有效的交易。

赚取InstaSpot的加密货币利率变化

下载MetaTrader 4并开始您的第一笔交易