- The current panic in the markets may be overblown. If tomorrow's tariffs prove to be less damaging than expected, we could witness a short but sharp rebound, particularly

Author: Anna Zotova

11:03 2025-04-01 UTC+2

1

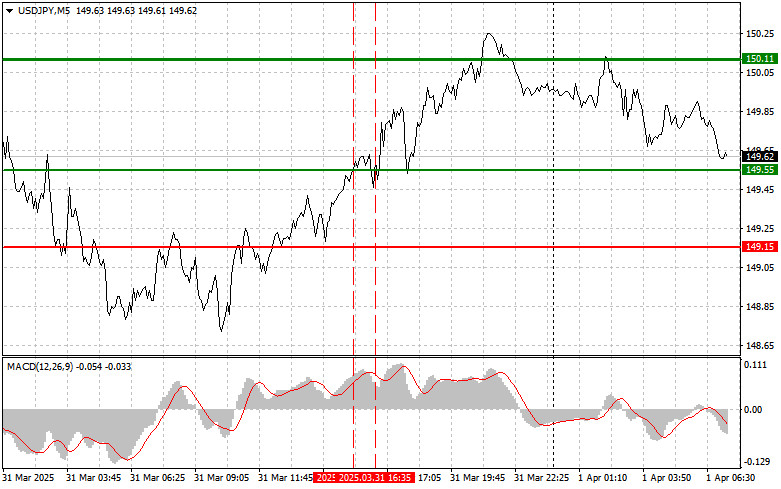

ForecastUSDJPY: Simple Trading Tips for Beginner Traders on April 1 – Review of Yesterday's Forex Trades

Trade Review and Trading Tips for the Japanese Yen The test of the 149.55 level occurred at a moment when the MACD indicator had already moved significantly above the zeroAuthor: Jakub Novak

10:58 2025-04-01 UTC+2

5

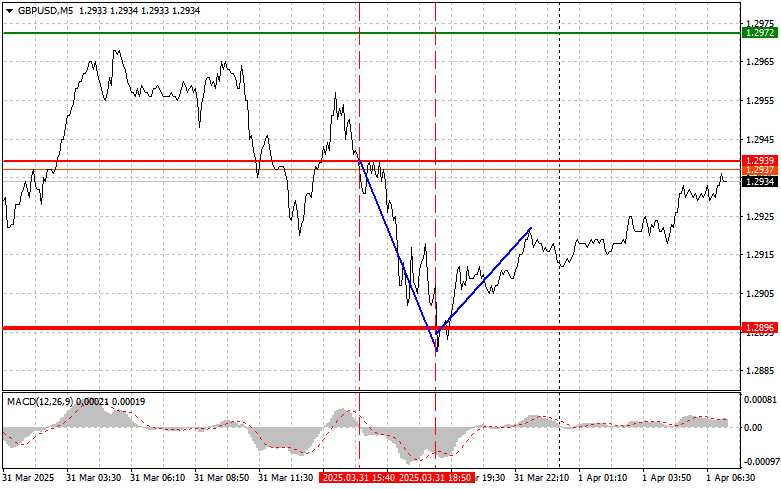

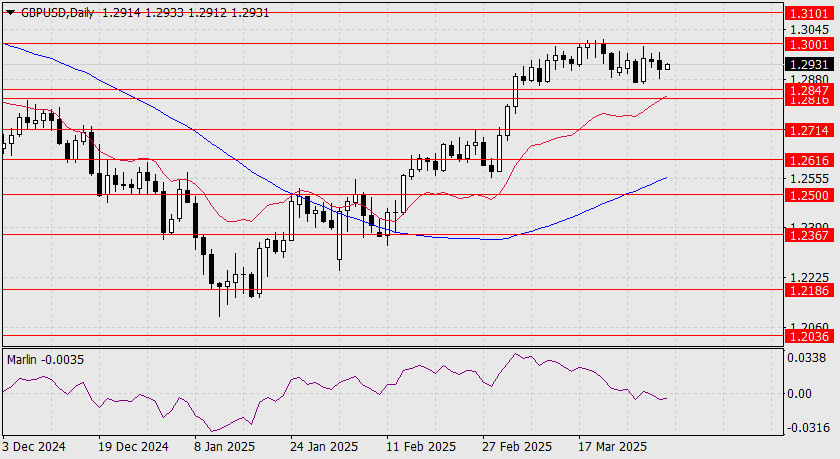

Trade Review and British Pound Trading Tips The test of the 1.2939 level occurred just as the MACD indicator began moving down from the zero line, confirming a correct entryAuthor: Jakub Novak

10:55 2025-04-01 UTC+2

3

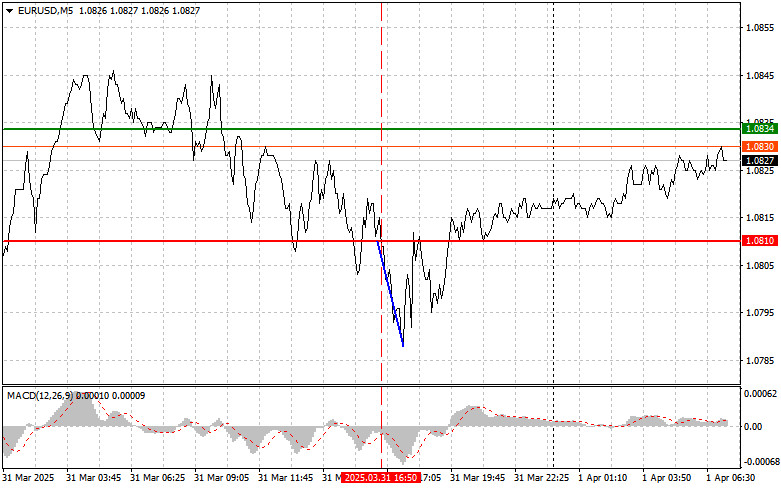

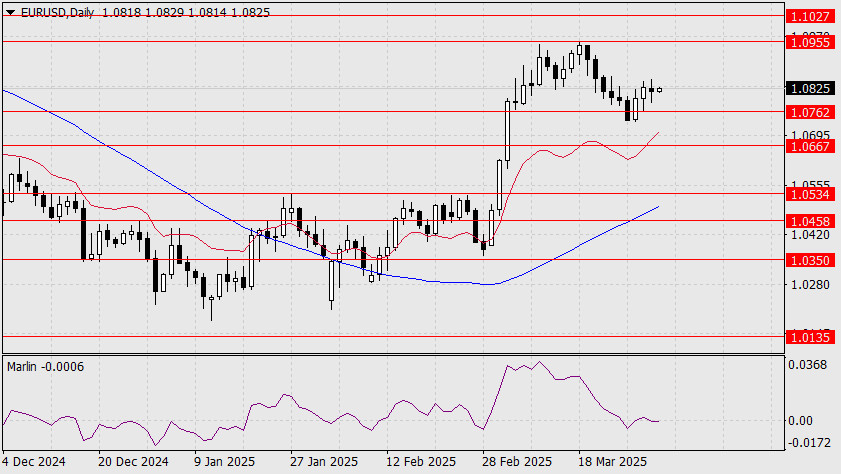

- Trade Review and EUR Trading Advice The test of the 1.0810 level occurred just as the MACD indicator began to move down from the zero mark, confirming a valid entry

Author: Jakub Novak

10:53 2025-04-01 UTC+2

2

Panic in the stock market is beginning to subside. Yesterday, by the end of the session, the main indices posted gains. The euro declined by 11 points. Notably, by thisAuthor: Laurie Bailey

10:47 2025-04-01 UTC+2

6

Bitcoin's price has stabilized around the $83,000 mark as investors brace for a major announcement from US President Donald Trump on tariffs, expected to be made tomorrow. Other leading cryptocurrenciesAuthor: Jakub Novak

10:44 2025-04-01 UTC+2

1

- GBP/USD Only one day remains before President Trump imposes expanded tariffs on all "unfair" U.S. trade partners. The British pound remains uncertain about the UK's position on Washington's partnership list

Author: Laurie Bailey

10:42 2025-04-01 UTC+2

4

Bitcoin and Ethereum have fallen in response to a further decline in the US stock market. Currently, BTC and ETH exhibit an obvious correlation with US stock indices. However, tradingAuthor: Miroslaw Bawulski

09:31 2025-04-01 UTC+2

5

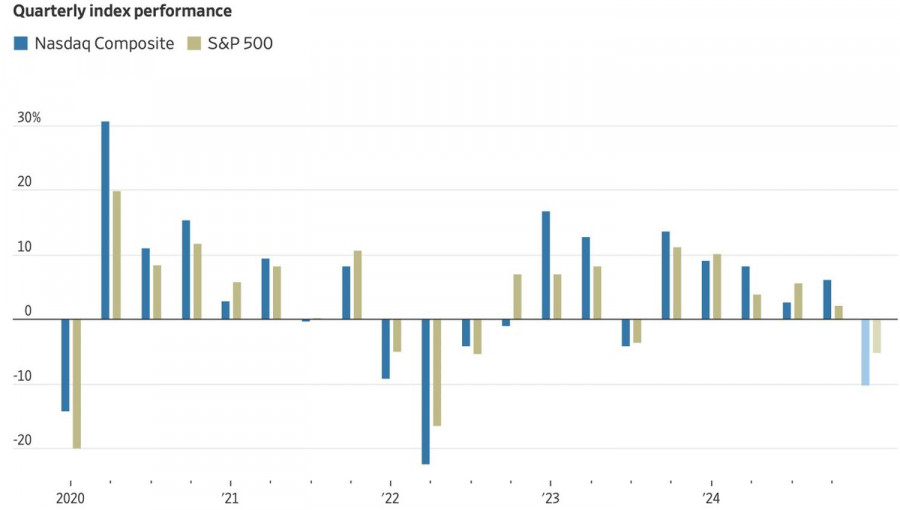

The S&P 500 had its worst quarter in three years. Investors are shifting capital from North America to Europe. Once-booming US tech stocks have collapsed. Major banks and respected institutionsAuthor: Marek Petkovich

09:13 2025-04-01 UTC+2

9