- Fundamental analysis

What to Pay Attention to on April 28? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for Monday. If the market barely reacted to macroeconomic data last week, there is nothing to expect on Monday. Of course, Donald Trump could makeAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

4

Trading planHow to Trade the GBP/USD Pair on April 28? Simple Tips and Trade Analysis for Beginners

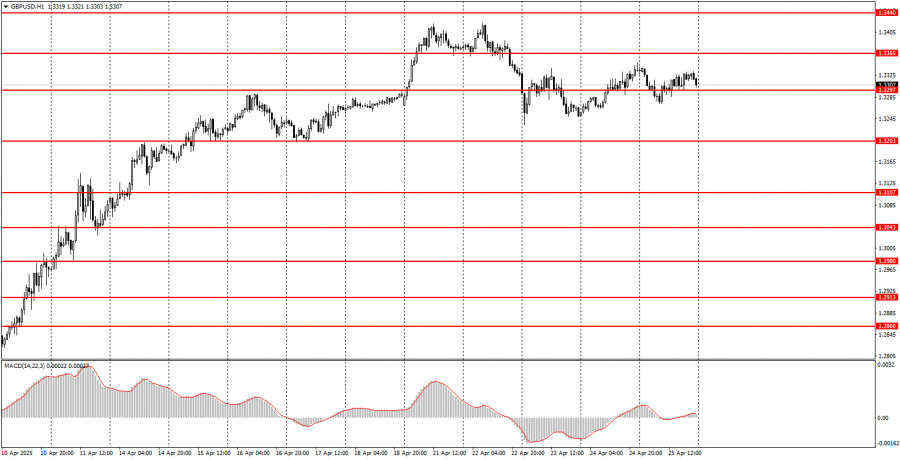

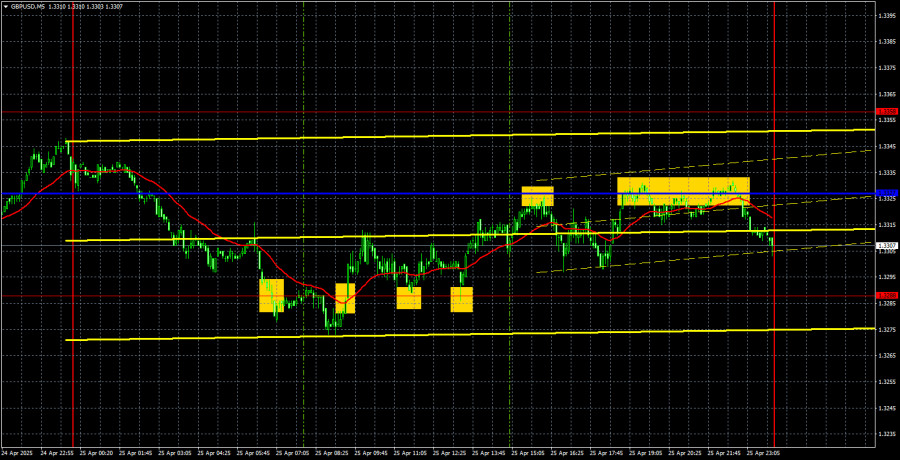

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair also showed no interesting movements on Friday. Like the euro, the British pound remained very close to a flatAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

6

Trading planHow to Trade the EUR/USD Pair on April 28? Simple Tips and Trade Analysis for Beginners

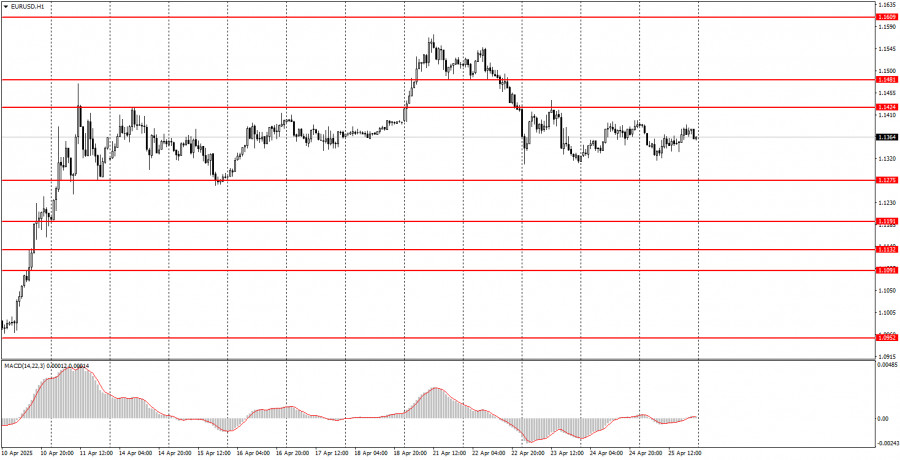

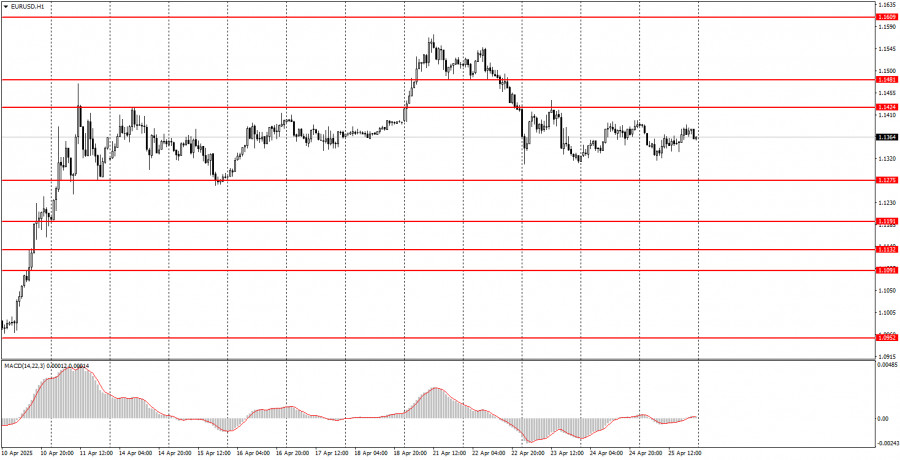

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade sideways on Friday. The market continues to ignore all macroeconomic data, and last week onceAuthor: Paolo Greco

05:51 2025-04-28 UTC+2

2

- Trading plan

Trading Recommendations and Analysis for GBP/USD on April 28: The Pound Does Not Believe in De-escalation

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highs. The fact that the British pound refuses even a slight downward correction shows the market's disbeliefAuthor: Paolo Greco

04:14 2025-04-28 UTC+2

7

The EUR/USD currency pair continued trading sideways throughout Friday. In the second half of last week, the euro traded exclusively between the levels of 1.1321 and 1.1391, although the overallAuthor: Paolo Greco

04:13 2025-04-28 UTC+2

9

Last week, the market updated the low, but the sellers failed to continue the downward movement fully. This may have been because the previous week's low (141.63) was reinforcedAuthor: Evangelos Poulakis

03:51 2025-04-28 UTC+2

18

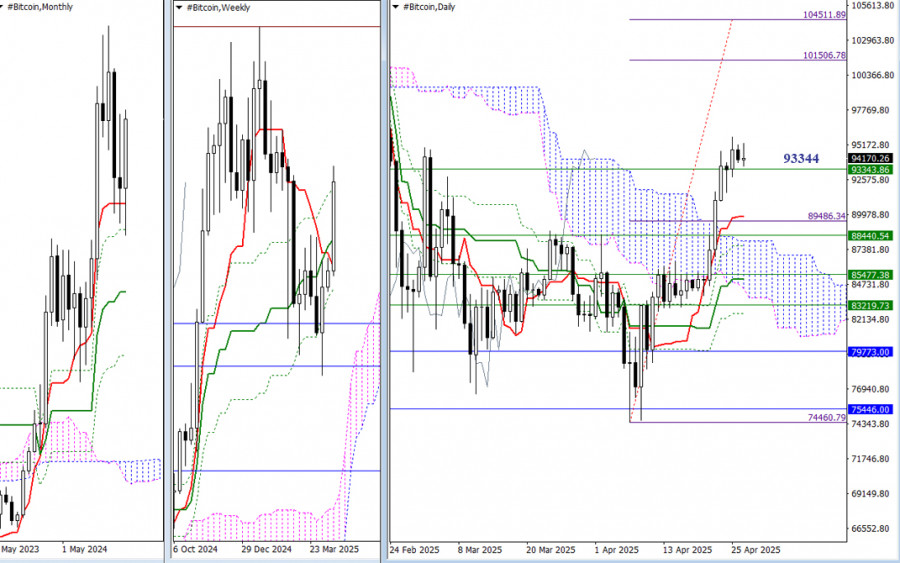

- Currently, bullish players are attempting to change the situation and achieve bullish optimism for April. Last week, resistance at the final level of the weekly Ichimoku cross (93344) was tested

Author: Evangelos Poulakis

03:51 2025-04-28 UTC+2

6

The United States is facing an important week, but it is unlikely to be important for the U.S. dollar. Significant reports on the labor market, job openings, unemploymentAuthor: Chin Zhao

01:05 2025-04-28 UTC+2

18

The British pound is doing even better than the euro. The market keeps finding additional reasons to increase demand for the pound, even when the euro remains stagnant. Therefore, evenAuthor: Chin Zhao

01:05 2025-04-28 UTC+2

13