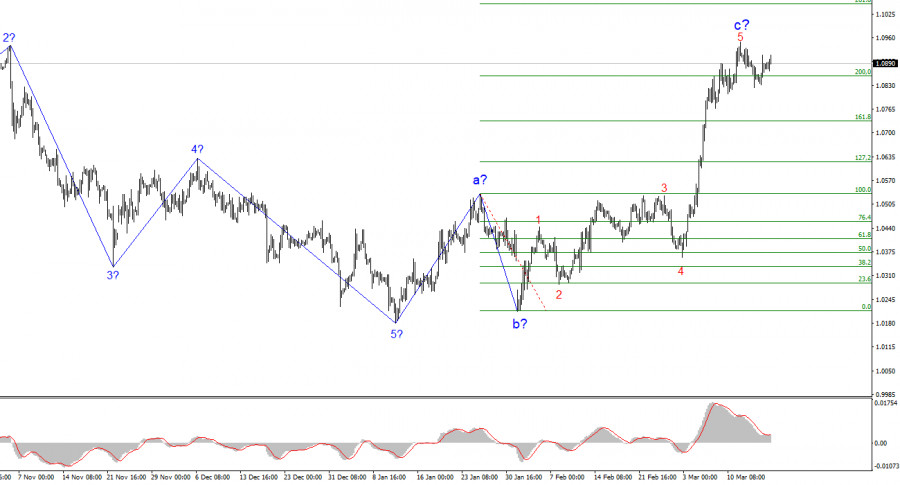

- The 4-hour wave analysis for EUR/USD is at risk of transforming into a more complex structure. A new downward trend began on September 25, taking the form of a five-wave

Author: Chin Zhao

18:34 2025-03-17 UTC+2

5

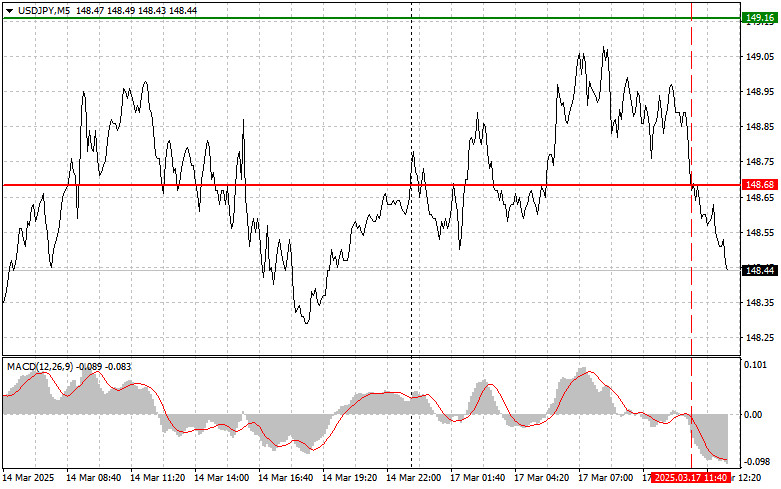

The test of the 148.68 level occurred when the MACD indicator had already moved significantly downward from the zero mark, limiting the pair's downward potential. For this reasonAuthor: Jakub Novak

18:32 2025-03-17 UTC+2

4

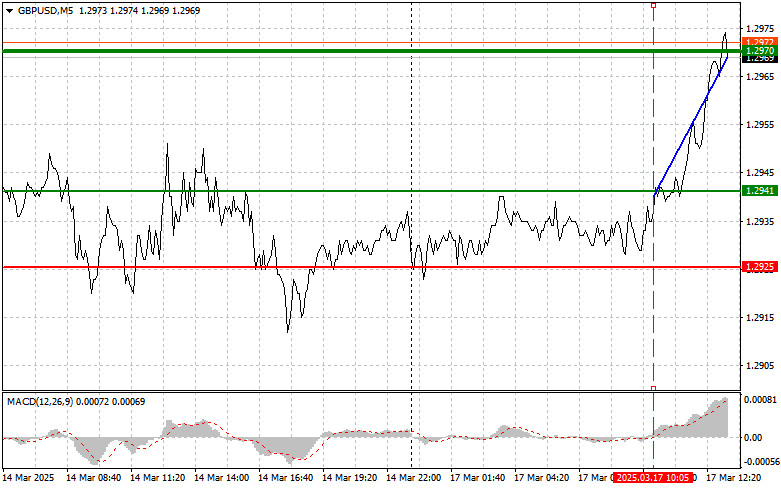

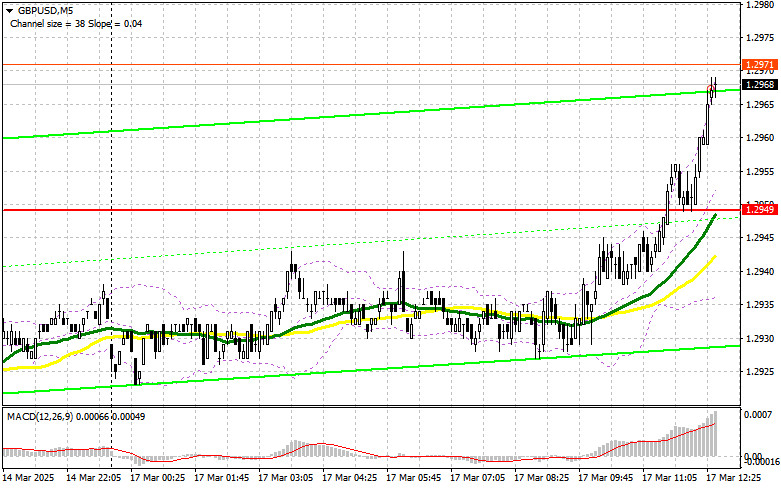

The test of the 1.2941 level occurred when the MACD indicator had just started moving upward from the zero mark, confirming a valid entry point. As a result, the pairAuthor: Jakub Novak

18:27 2025-03-17 UTC+2

5

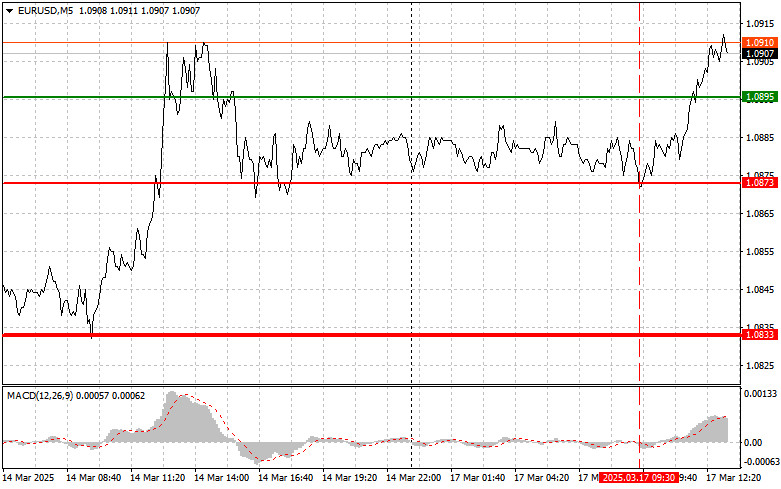

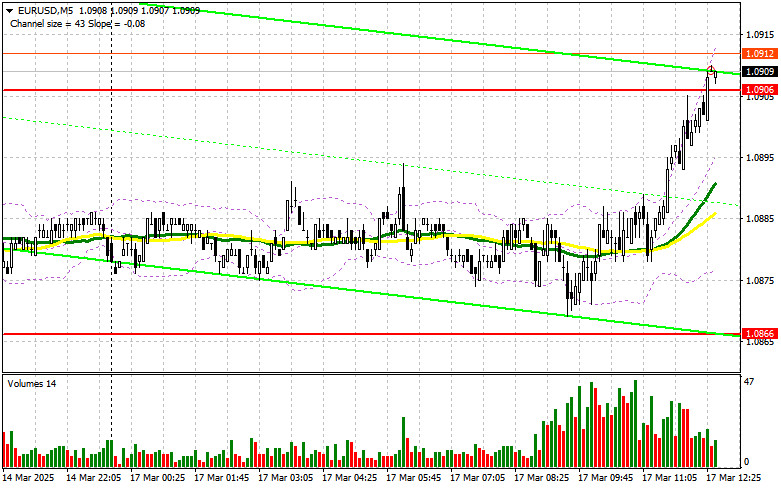

- The test of the 1.0873 level occurred when the MACD indicator had just started moving downward from the zero mark, confirming a valid entry point for selling. However, the expected

Author: Jakub Novak

18:23 2025-03-17 UTC+2

3

In my morning forecast, I highlighted 1.2949 as a key level for making market entry decisions. Let's analyze the 5-minute chart to see what happened. The price moved higherAuthor: Miroslaw Bawulski

18:20 2025-03-17 UTC+2

6

In my morning forecast, I highlighted the 1.0866 level as a key point for making entry decisions. Let's look at the 5-minute chart to analyze what happened. A declineAuthor: Miroslaw Bawulski

18:17 2025-03-17 UTC+2

4

- US markets rally on Friday: S&P 500 gains 2.1%, Nasdaq Composite rises 2.6% The US stock market ended the week on a high note, as if the recent turbulence never

Author: Natalia Andreeva

15:04 2025-03-17 UTC+2

20

Futures on US stock indices declined after Treasury Secretary Scott Bessent called the recent market drop "favorable," reinforcing expectations that the Trump administration is unlikely to intervene to stopAuthor: Jakub Novak

14:49 2025-03-17 UTC+2

21

The US stock market continues to experience turmoil, driven by uncertainty surrounding Donald Trump's stance on import tariffs. Investors are eagerly awaiting the Federal Reserve's meeting next week, hopingAuthor:

14:23 2025-03-17 UTC+2

10