- Although the S&P 500 shows optimism, its growth since March 14 has been viewed as more of a correction. A move toward the target range of 5,881–5,910 becomes more likely

Author: Ekaterina Kiseleva

12:26 2025-03-20 UTC+2

58

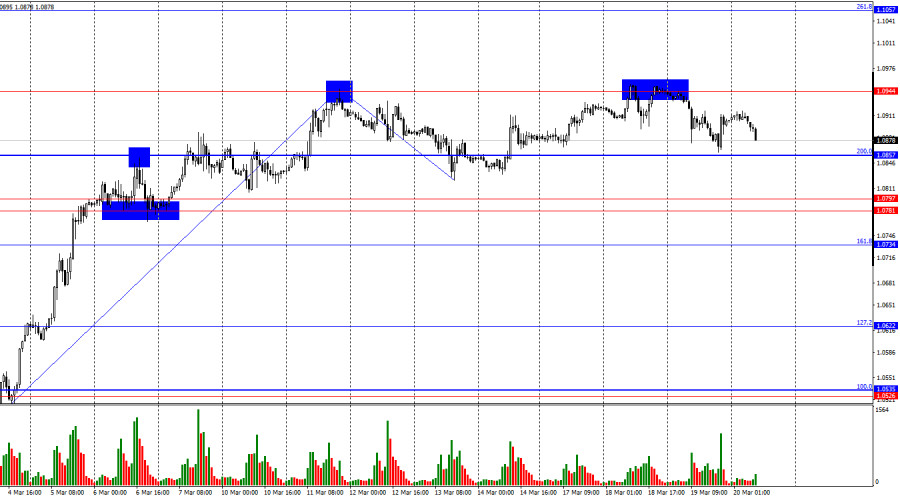

On Wednesday, the EUR/USD pair rebounded from the 1.0944 level for the third time and reversed in favor of the U.S. dollar, declining toward the 200.0% Fibonacci level at 1.0857Author: Samir Klishi

11:41 2025-03-20 UTC+2

52

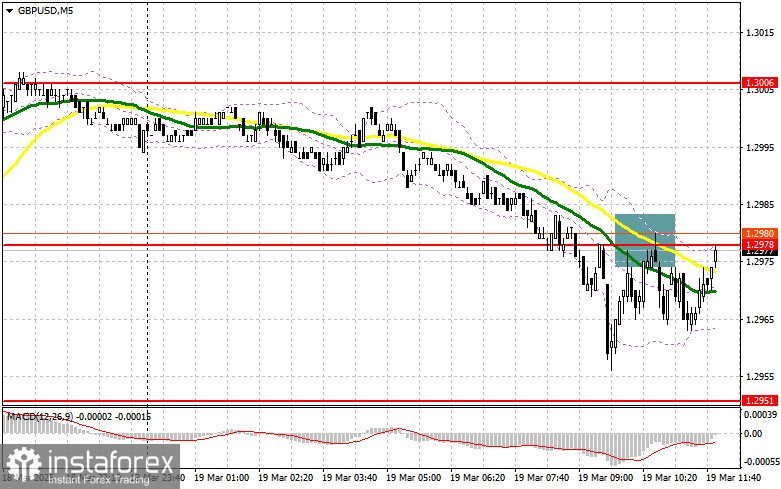

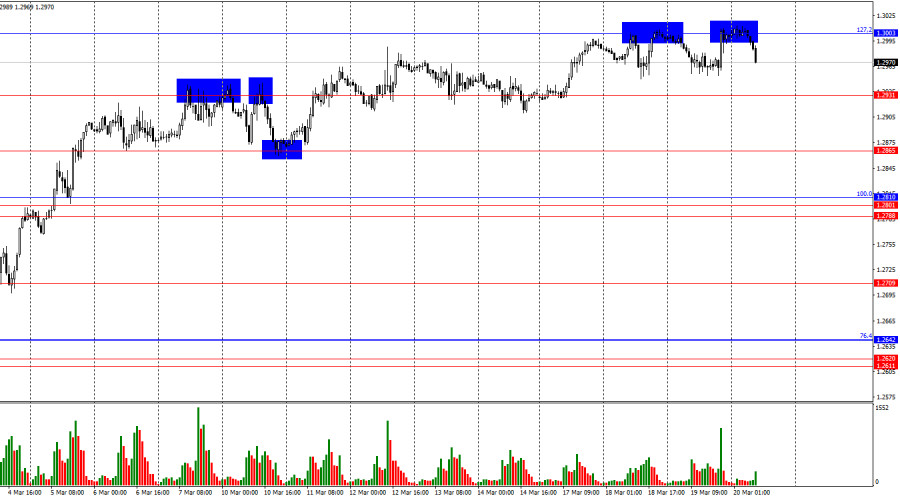

On the hourly chart, the GBP/USD pair rebounded from the 127.2% Fibonacci retracement level at 1.3003 on Wednesday, followed by a slight decline. Shortly after, the pair returned to 1.3003Author: Samir Klishi

11:36 2025-03-20 UTC+2

60

- The Japanese yen maintains its bullish bias, driven by expectations that the Bank of Japan will continue raising interest rates this year. A strong increase in wages could boost consumer

Author: Irina Yanina

11:31 2025-03-20 UTC+2

60

Gold is experiencing a slight decline after reaching a new all-time high, remaining in a defensive stance. Currently, bullish traders are exercising caution, as indicated by overbought conditionsAuthor: Irina Yanina

11:29 2025-03-20 UTC+2

44

Fed Leaves Rates Unchanged, As Expected Central Bank to Reduce Balance Shelf Life Powell Signals Impact of Tariffs Is Difficult to Determine Gold Hits Record High of $3,057.21 an OunceAuthor: Thomas Frank

11:26 2025-03-20 UTC+2

19

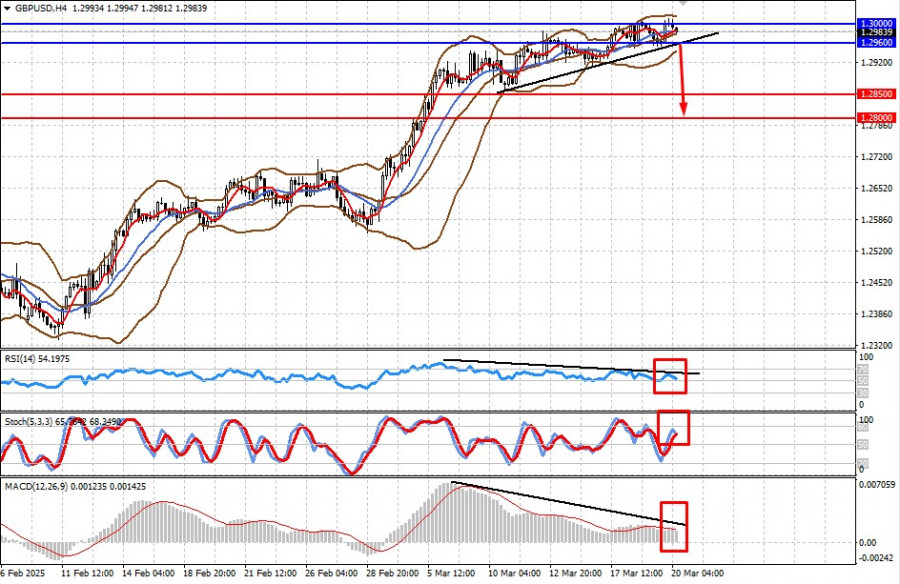

- The British currency has recently gained significantly against the dollar due to two key factors: the weakness of the U.S. currency amid recession risks in America and uncertainty about

Author: Pati Gani

11:25 2025-03-20 UTC+2

42

Following yesterday's Federal Reserve meeting, where the central bank ran out of strong arguments to keep interest rates high, Bitcoin and Ethereum have resumed their bullish movement. Despite the Fed'sAuthor: Jakub Novak

10:32 2025-03-20 UTC+2

34

US stock indices ended the day with solid gains. The S&P 500 climbed by 1.1% and the Nasdaq 100 closed 1.41% up. At the moment, S&P 500 futuresAuthor: Jakub Novak

10:30 2025-03-20 UTC+2

38