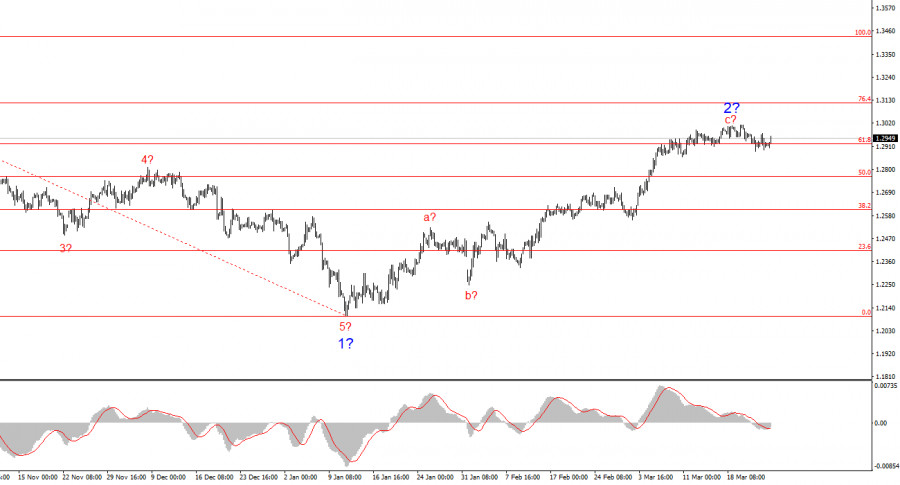

- The wave pattern for GBP/USD remains somewhat ambiguous but still manageable. Currently, there is a high probability of a long-term downward trend forming. Wave 5 has taken a convincing shape

Author: Chin Zhao

19:36 2025-03-25 UTC+2

21

Trade Breakdown and Tips for Trading the Japanese Yen The test of the 150.68 level occurred when the MACD indicator had just started moving upward from the zero line, whichAuthor: Jakub Novak

19:29 2025-03-25 UTC+2

5

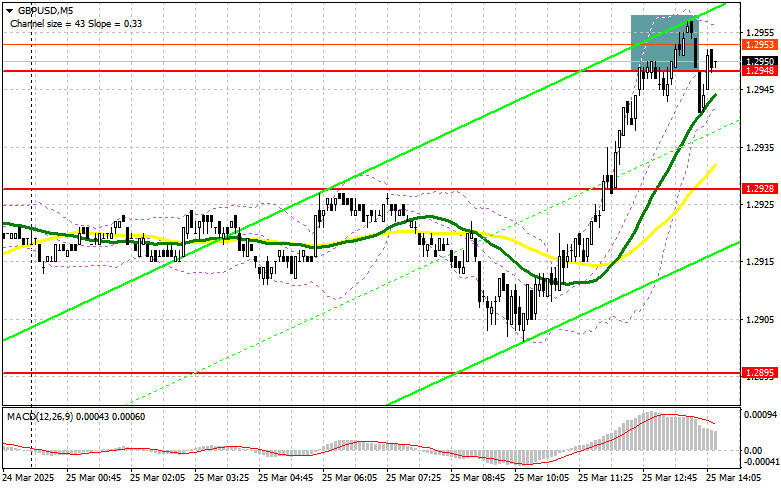

Trade Breakdown and Tips for Trading the British Pound The test of the 1.2911 level occurred when the MACD indicator had already moved significantly below the zero mark, which limitedAuthor: Jakub Novak

19:26 2025-03-25 UTC+2

4

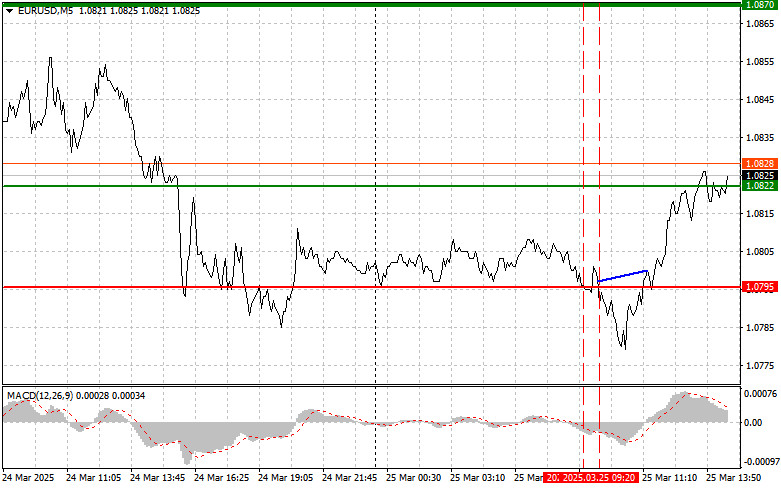

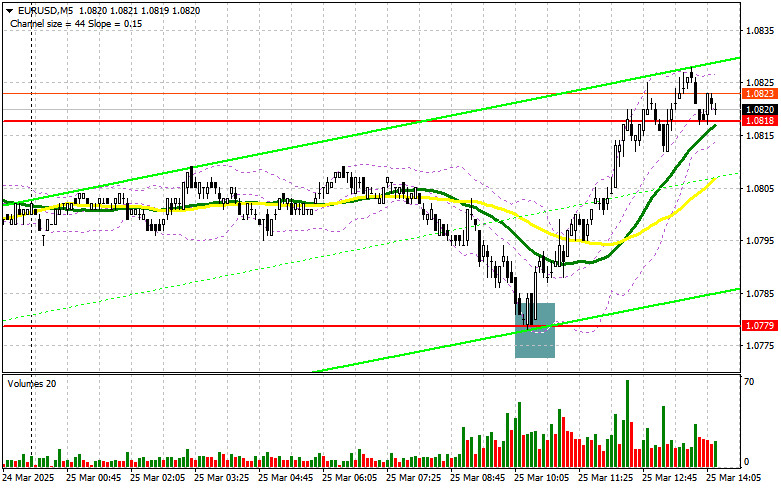

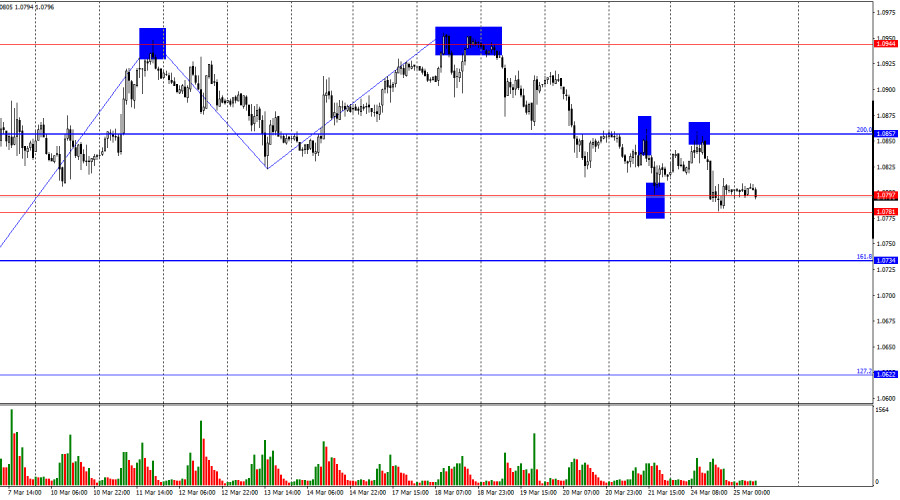

- Trade Analysis and Tips for the Euro The test of the 1.0795 level occurred when the MACD indicator had already moved significantly below the zero mark, which limited the downward

Author: Jakub Novak

19:20 2025-03-25 UTC+2

2

In my morning forecast, I drew attention to the 1.2948 level and planned to make trading decisions from it. Let's look at the 5-minute chart and see what happenedAuthor: Miroslaw Bawulski

19:15 2025-03-25 UTC+2

5

In my morning forecast, I highlighted the 1.0779 level and planned to make trading decisions based on it. Let's look at the 5-minute chart and examine what happened thereAuthor: Miroslaw Bawulski

19:13 2025-03-25 UTC+2

5

- The USD/JPY pair is retreating from the psychological level of 151.00, reached earlier on Tuesday, though this pullback is not accompanied by significant selling pressure. The Japanese yen is attracting

Author: Irina Yanina

19:09 2025-03-25 UTC+2

1

Today, silver is attracting new buyers following an indecisive flat close in the previous session, demonstrating steady intraday gains. The white metal is currently up 0.80% on the day, graduallyAuthor: Irina Yanina

19:07 2025-03-25 UTC+2

2

On Monday, the EUR/USD pair rebounded from the 200.0% Fibonacci retracement level at 1.0857, reversed in favor of the U.S. dollar, and declined toward the support zone of 1.0781–1.0797Author: Samir Klishi

19:04 2025-03-25 UTC+2

2