- Trading plan

Trading Recommendations and Analysis for GBP/USD on March 25: The Roller Coaster Continues

The GBP/USD currency pair managed to move both upward and downward on Monday. We can't say that these movements were triggered by macroeconomic data, because they weren't. The UK's businessAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

8

Trading planTrading Recommendations and Analysis for EUR/USD on March 25: The Dollar Strengthened Against the Odds

On Monday, the EUR/USD currency pair initially showed an upward move, followed by a decline, making the entire trading day somewhat contradictory. Volatility remained low despite the releaseAuthor: Paolo Greco

03:41 2025-03-25 UTC+2

5

On Monday, EUR/USD traders concentrated on factors that benefitted the U.S. dollar, while negatively impacting the euro. Insider reports from U.S. media concerning the "April 2 tariffs" supported the pair'sAuthor: Irina Manzenko

01:00 2025-03-25 UTC+2

9

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 24-27, 2025: sell below $3,032 (21 SMA - overbought)

Early in the American session, gold is trading at 3,026, below the 21st SMA and below the 7/8 Murray level. We expect consolidation below this area in the coming hoursAuthor: Dimitrios Zappas

17:44 2025-03-24 UTC+2

24

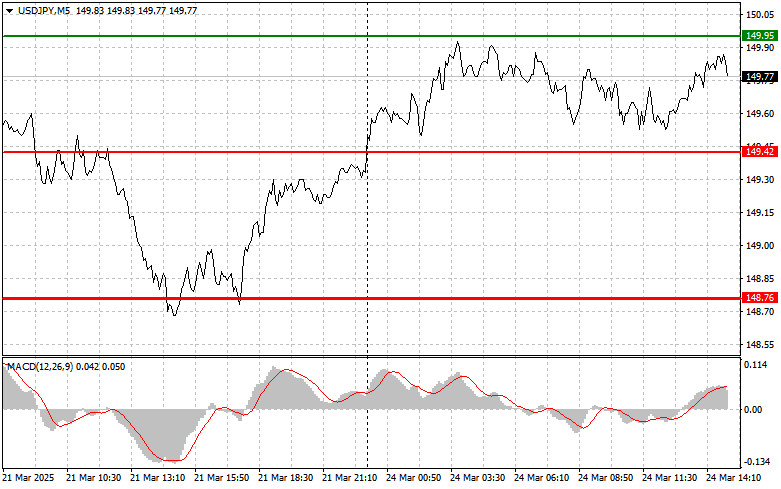

Trade Analysis and Tips for Trading the Japanese Yen The levels I outlined were not tested during the first half of the day. The volatility seen immediately after the releaseAuthor: Jakub Novak

17:13 2025-03-24 UTC+2

27

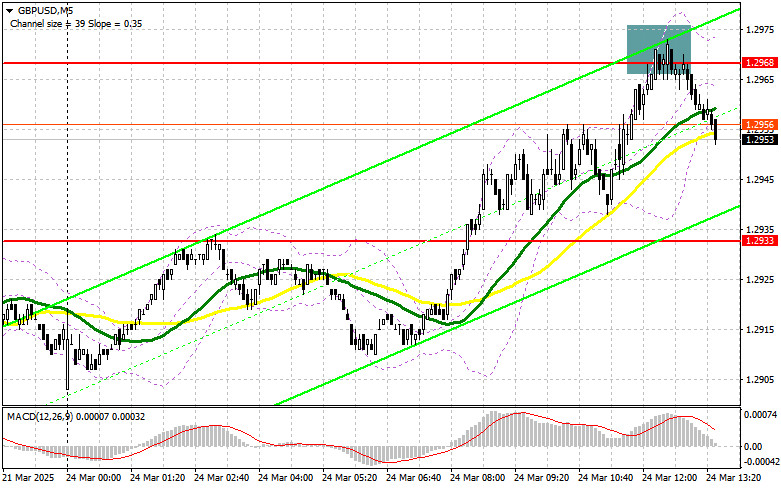

Trade Analysis and Tips for the British Pound The test of the 1.2935 level occurred when the MACD indicator had already moved significantly above the zero line, which limitedAuthor: Jakub Novak

17:10 2025-03-24 UTC+2

14

- Trade Analysis and Tips for the Euro The test of the 1.0842 level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's

Author: Jakub Novak

17:07 2025-03-24 UTC+2

12

In my morning forecast, I highlighted the level of 1.2968 and planned to make trading decisions based on it. Let's look at the 5-minute chart and analyze what happenedAuthor: Miroslaw Bawulski

17:05 2025-03-24 UTC+2

17

In my morning forecast, I highlighted the level of 1.0856 and planned to make trading decisions based on it. Let's take a look at the 5-minute chart and see whatAuthor: Miroslaw Bawulski

17:01 2025-03-24 UTC+2

6