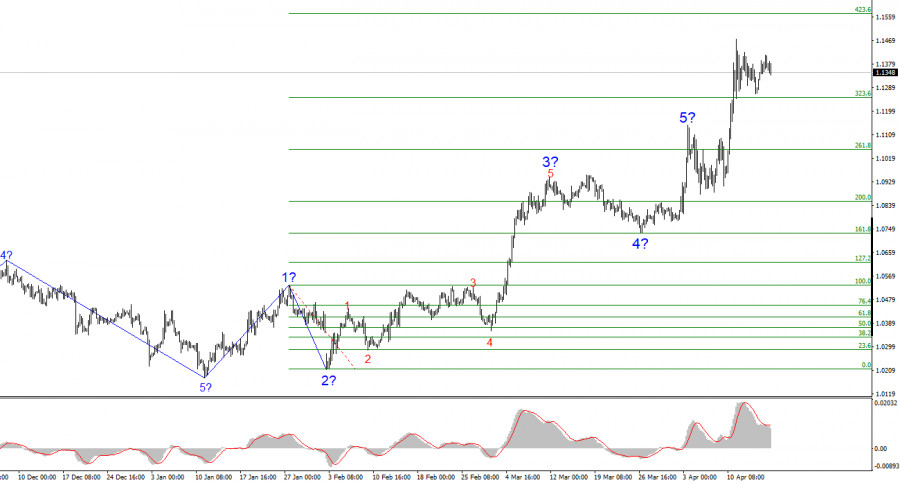

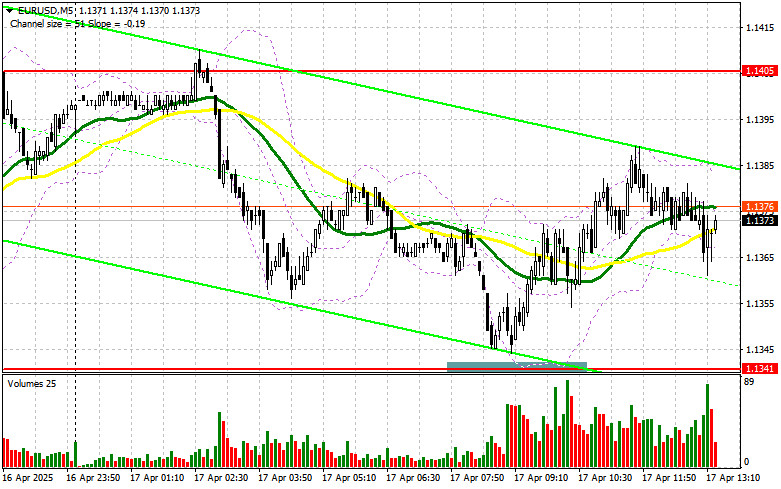

- The wave structure on the 4-hour EUR/USD chart has shifted into a bullish impulse formation. I believe there's no doubt this transformation occurred solely due to the new U.S. trade

Author: Chin Zhao

19:12 2025-04-17 UTC+2

4

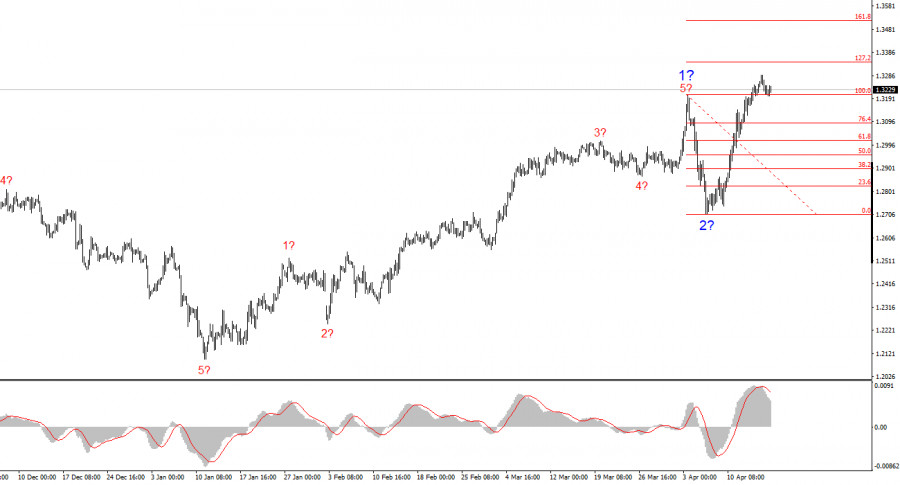

The GBP/USD pair remained unchanged on Thursday. While such market behavior might have been expected for Thursday, it was surprising not to see a decline on Wednesday, given the numberAuthor: Chin Zhao

19:09 2025-04-17 UTC+2

5

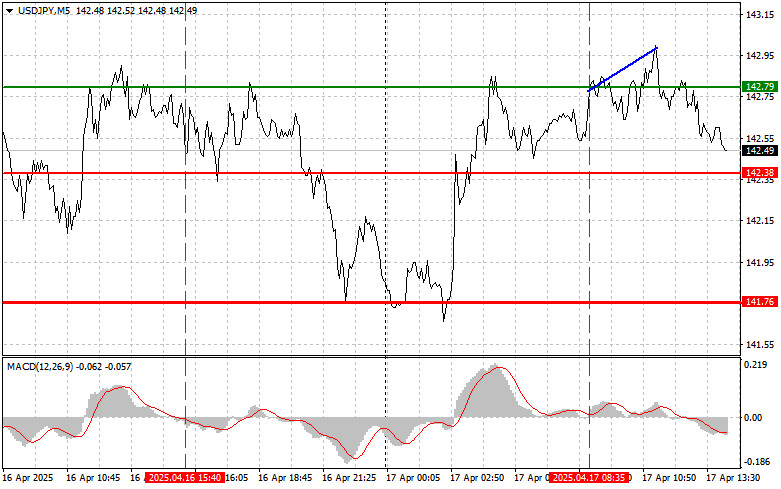

The test of the 142.79 level occurred when the MACD indicator had just started moving upward from the zero mark, which confirmed a valid entry point for buying the dollarAuthor: Jakub Novak

19:05 2025-04-17 UTC+2

4

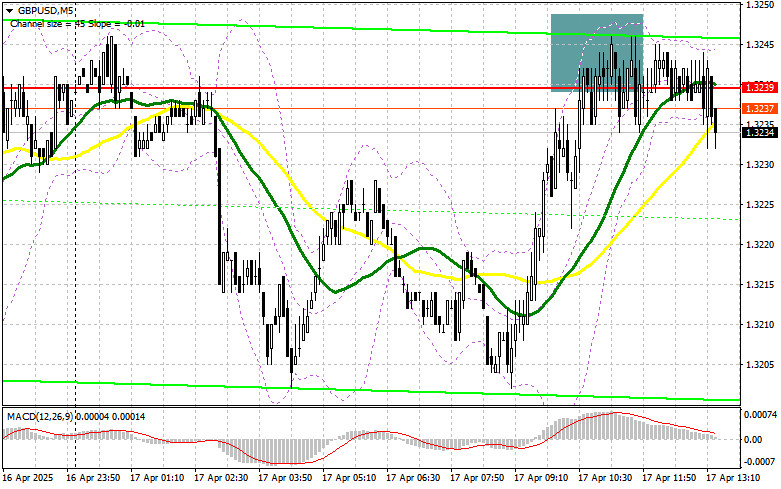

- The test of the 1.3230 level occurred when the MACD indicator had already moved well above the zero line, which limited the pound's upward potential. For this reason, I didn't

Author: Jakub Novak

19:02 2025-04-17 UTC+2

3

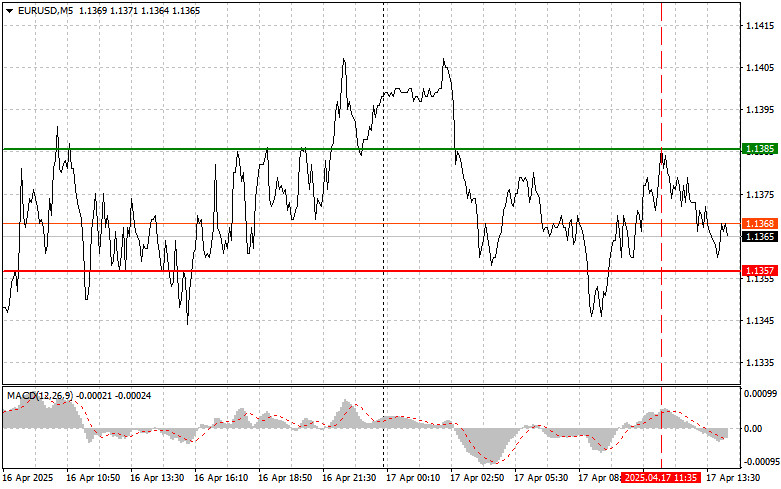

The test of the 1.1385 level occurred when the MACD indicator had already moved significantly above the zero mark, which limited the pair's upward potential. For this reasonAuthor: Jakub Novak

18:57 2025-04-17 UTC+2

4

In my morning forecast, I focused on the 1.3239 level and planned to base entry decisions around it. Let's look at the 5-minute chart and see what happened. A riseAuthor: Miroslaw Bawulski

18:53 2025-04-17 UTC+2

3

- In my morning forecast, I highlighted the 1.1341 level and planned to base my market entry decisions on it. Let's look at the 5-minute chart and analyze what happened

Author: Miroslaw Bawulski

18:50 2025-04-17 UTC+2

3

Gold is undergoing a corrective pullback today as traders take profits following its recent surge to a new all-time high. This decline, although moderate, is driven by several factors, includingAuthor: Irina Yanina

12:00 2025-04-17 UTC+2

21

regarding upcoming changes in monetary policy from both the European Central Bank (ECB) and the U.S. Federal Reserve (Fed). Anticipation of a 25 basis point rate cut by the ECB—itsAuthor: Irina Yanina

11:55 2025-04-17 UTC+2

26