- On Tuesday, the GBP/USD currency pair continued its upward movement. Although this rally was not as strong as last week's surge, the British pound kept rising steadily, with barely

Author: Paolo Greco

03:35 2025-04-16 UTC+2

0

The EUR/USD currency pair mostly remained flat throughout Tuesday. Although both pairs are in an upward trend, the euro and the British pound have recently not been trading in syncAuthor: Paolo Greco

03:35 2025-04-16 UTC+2

1

Trading planTrading Recommendations and Analysis for GBP/USD on April 16: The Pound Isn't the Euro — It Doesn't Show Weakness

On Tuesday, the GBP/USD currency pair continued its upward movement for most of the day. There were no significant reasons or fundamental grounds for this, but the entire currency marketAuthor: Paolo Greco

03:35 2025-04-16 UTC+2

5

- Trading plan

Trading Recommendations and Analysis for EUR/USD on April 16: The Dollar Took Advantage of the Tariff Pause

The EUR/USD currency pair began a long-awaited decline on Tuesday, although it didn't fall very far or for very long. It's worth noting that there were no fundamental reasonsAuthor: Paolo Greco

03:35 2025-04-16 UTC+2

8

The euro reacted negatively to the ZEW indices released on Tuesday, which reflected growing pessimism in the European business environment. The key indicators dropped into negative territory for the firstAuthor: Irina Manzenko

01:08 2025-04-16 UTC+2

8

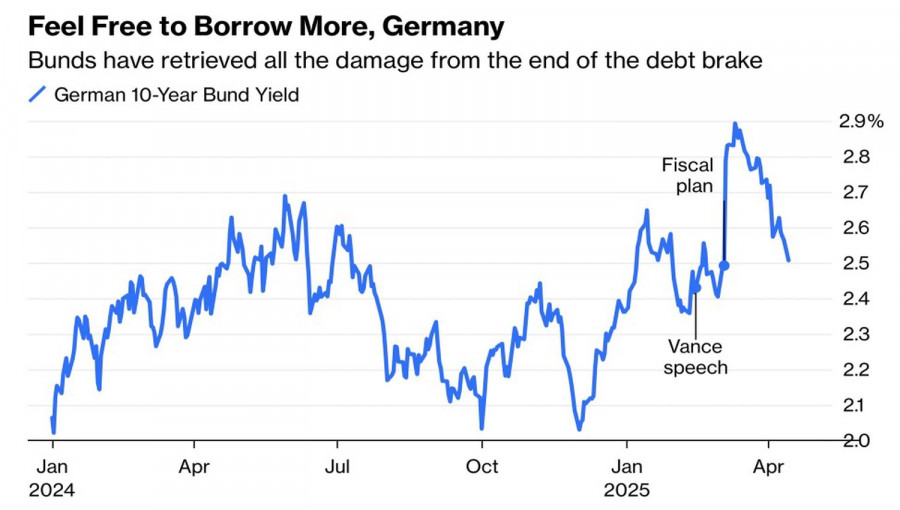

The euro's surge to the area of three-year highs became possible thanks to Germany's fiscal stimulus, Donald Trump's trade policy, and a capital outflow from North America into Europe. WhenAuthor: Marek Petkovich

01:08 2025-04-16 UTC+2

9

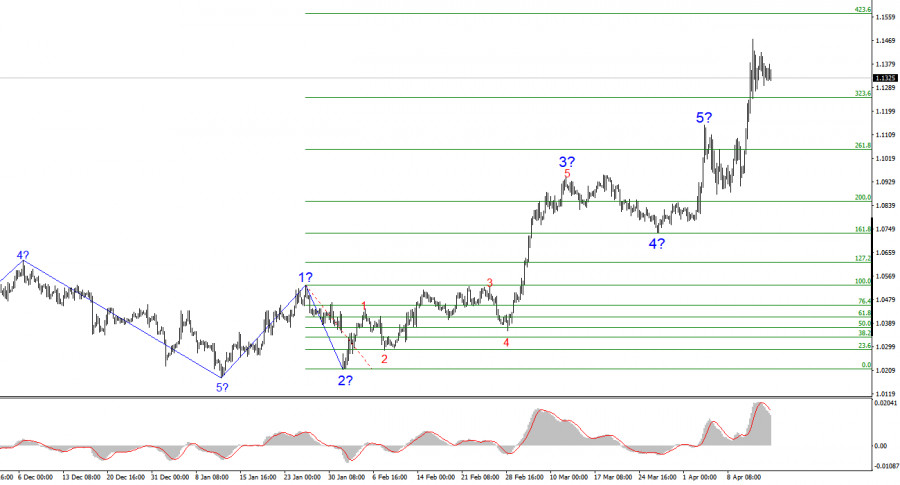

- The wave structure on the 4-hour chart for EUR/USD has shifted into a bullish formation. I believe there's little doubt that this transformation is entirely due to the new U.S

Author: Chin Zhao

19:03 2025-04-15 UTC+2

41

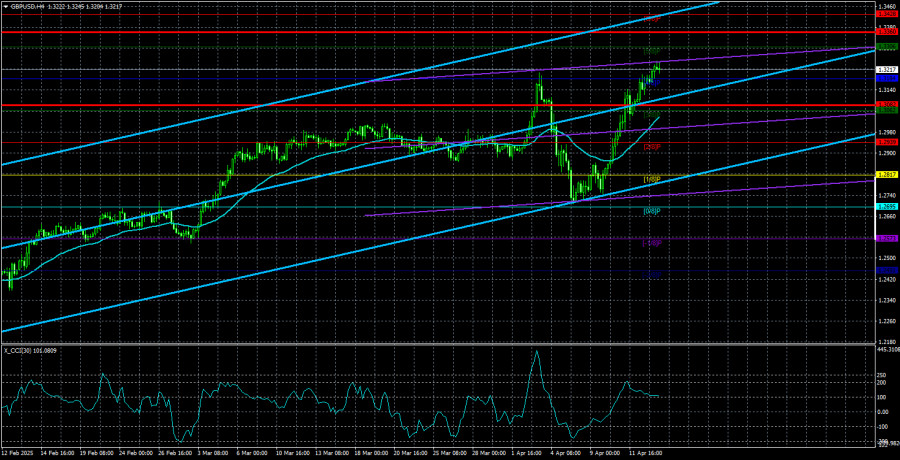

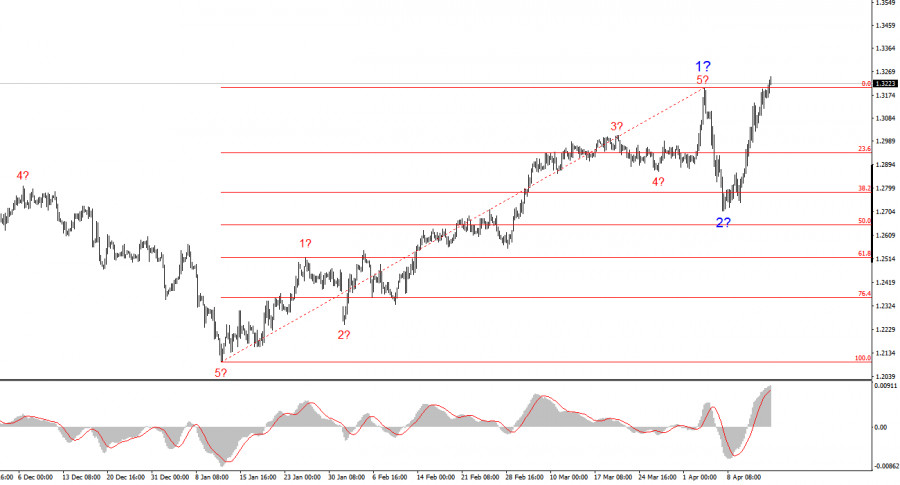

The wave structure for GBP/USD has also transformed into a bullish, impulsive formation — "thanks" to Donald Trump. The wave pattern is almost identical to that of EUR/USD. Until FebruaryAuthor: Chin Zhao

18:56 2025-04-15 UTC+2

34

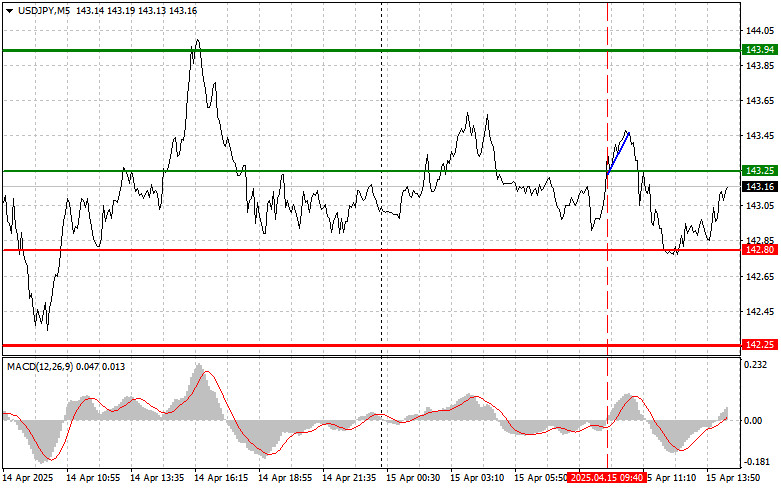

Trade Review and Tips for Trading the Japanese Yen The test of the 143.25 level occurred at a time when the MACD indicator had just started moving up fromAuthor: Jakub Novak

18:53 2025-04-15 UTC+2

23