交易员计算器

交易员计算器:

在本页上您能找到计算点值的公式。点值以给定货币对的当前价格为基础进行计算。

Note that 1 InstaSpot lot is 10000 units of base currency.

下面是计算货币对和差价合约点值的公式:

计算 1 点价值:

- 1. XXX/USD

- p.v. = 1 * (trade volume)

- 2. USD/XXX

- p.v. = 1 / (USD/XXX) * (trade volume)

- For USD/JPY p.v. = 100 / (USD/JPY) * (trade volume)

- 美元/卢布和欧元/卢布 p.v. = 10 / (美元/卢布) * (交易量)

- 3. AAA/BBB

- p.v. = (AAA/USD) / (AAA/BBB) * (trade volume)

计算差价合约 1 点的价值:

p.v. = 交易量 * 合同规模 * 最小价格变动

为什么InstaSpot公司用10000手代替标准的100000手?InstaSpot同时提供使用三种类型的账户交易的机会:微型外汇、迷你外汇和标准外汇。为了在技术上实现这一点,采用了非标准的10000手。这样就保证了交易量为0.01手时点值等于0.01美元,即绝对最小值。这让5000 - 10000美元的账户持有者可以有效地控制他们的风险。同时,10000手的规模可以方便开设头寸时的点值计算。

让我们来看看下面的数据:

0.01 InstaSpot手交易 = 0.01美元点价

0.1 InstaSpot手交易 = 0.1美元点价

1 InstaSpot手交易 = 1美元点价

10 InstaSpot手交易 = 10美元点价

100 InstaSpot手交易 = 100美元点价

1000 InstaSpot手交易 = 1000美元点价

The price of one point is indicated In the base currency of the quote.

计算简单加上三种类型的外汇交易合并在一个账户,InstaSpot手成为公司交易条件无法抵挡的优势之一。

See Also

- 2025-04-21 09:34:09CFTC Reports Significant Rise in Corn Speculative Net Positions to 234.2KQuick show2025-04-21 09:34:09New Zealand Dollar Speculators Cut Bearish Bets as NZD Positions ImproveQuick show2025-04-21 09:34:09Surge in Japanese Yen Speculative Positions as CFTC Reports Significant IncreaseQuick show2025-04-21 09:34:09Brazilian Real Sees Increase in Speculative Net Positions, Signals Boost in Market SentimentQuick show2025-04-21 09:34:09Australian Dollar Speculative Net Positions Improve, But Remain in the NegativeQuick show2025-04-21 09:34:09Swiss Franc Speculative Positions Narrow as Traders Eye Future DirectionQuick show2025-04-21 09:34:09CFTC Reports Decline in Speculative Net Positions for Mexican PesoQuick show2025-04-21 09:34:09Speculative Net Positions in CFTC Wheat Futures Narrow as Traders Adjust BetsQuick show2025-04-21 09:34:09Silver Speculative Net Positions Decline in Latest CFTC DataQuick show2025-04-21 09:34:09Speculative Sentiment on S&P 500 Declines as Net Positions Widen to -63.1KQuick show

- 2025-04-21 09:34:09Silver Rises as Weaker Dollar Spurs Safe-Haven DemandQuick show2025-04-21 09:34:09China Stocks Rise as PBOC Holds Rates SteadyQuick show2025-04-21 09:34:09Copper Hits 2-Week High on Weaker DollarQuick show2025-04-21 09:34:09Japanese Shares Slide as Stronger Yen Hits ExportersQuick show2025-04-21 09:34:09India Stocks Rise to 4-Month HighsQuick show2025-04-21 09:34:09Estonian Producer Inflation Eases SignificantlyQuick show2025-04-21 09:34:09Estonian Producer Price Inflation Sees Remarkable Cooldown in MarchQuick show2025-04-21 09:34:09Estonian PPI Dips in March, Marking a Surprise Shift to DeflationQuick show2025-04-21 09:34:09Indonesia Trade Surplus Beats EstimatesQuick show2025-04-21 09:34:09Indonesia Imports Hit 3-Month HighQuick show

- 2025-04-21 09:34:09Indonesia Exports Unexpectedly Rise in MarchQuick show2025-04-21 09:34:09US 10-Year Yield Rises Amid Fed UncertaintyQuick show2025-04-21 09:34:09Bitcoin Breaks Above $87,000Quick show2025-04-21 09:34:09Indonesia's Trade Balance Surges in March, Reaching $4.33 BillionQuick show2025-04-21 09:34:09Indonesia's Import Growth Surges to 5.34% in MarchQuick show2025-04-21 09:34:09Indonesia's Export Growth Faces Substantial Decline in March 2025Quick show2025-04-21 09:34:09Palm Oil Slips Further to Below MYR 3,950Quick show2025-04-21 09:34:09China 10-Year Bond Yield Steady After PBOC DecisionQuick show2025-04-21 09:34:09Australian Dollar Strengthens on Weaker GreenbackQuick show2025-04-21 09:34:09Offshore Yuan Rebounds as PBOC Stands FirmQuick show

- 2025-04-21 09:34:09NZ Dollar Gains as Greenback WeakensQuick show2025-04-21 09:34:09Japanese Yen Hits 7-Month HighQuick show2025-04-21 09:34:09China Warns Against U.S. Trade Deals at Its ExpenseQuick show2025-04-21 09:34:09China Stocks Climb as PBOC Holds Rates SteadyQuick show2025-04-21 09:34:09Gold Hits Record HighQuick show2025-04-21 09:34:09China Boosts Budget Spending in Q1 to Offset Trade War ImpactQuick show2025-04-21 09:34:09SK Won Gains on US-South Korea Trade TalkQuick show2025-04-21 09:34:09China Keeps LPR Rate Steady for 6th MonthQuick show2025-04-21 09:34:09China Maintains Loan Prime Rate Steady at 3.10% Amid Economic UncertaintyQuick show2025-04-21 09:34:09Dollar Drops on Concerns Over Fed IndependenceQuick show

- 2025-04-21 09:34:09South Korean Shares Start the Week HigherQuick show2025-04-21 09:34:09South Korea, U.S. to Launch Trade Talks This WeekQuick show2025-04-21 09:34:09China's 5-Year Loan Prime Rate Holds Steady at 3.60% Amid Economic StabilityQuick show2025-04-21 09:34:09Oil Retreats After US-Iran TalksQuick show2025-04-21 09:34:09Japanese Shares Slip on Trade CautionQuick show2025-04-21 09:34:09China Releases Plan to Further Open Services SectorQuick show2025-04-21 09:34:09US Futures Dip to Start the WeekQuick show2025-04-21 09:34:09Kuwait Inflation Rate Slows to 4-Month LowQuick show2025-04-21 09:34:09Israel’s M1 Money Supply Sees Sharp Decline in March 2025Quick show2025-04-21 09:34:09Soybeans Speculative Net Positions Swing Positive Amid Market OptimismQuick show

- 2025-04-21 09:34:09CFTC Reports Significant Rise in Corn Speculative Net Positions to 234.2KQuick show2025-04-21 09:34:09New Zealand Dollar Speculators Cut Bearish Bets as NZD Positions ImproveQuick show2025-04-21 09:34:09Surge in Japanese Yen Speculative Positions as CFTC Reports Significant IncreaseQuick show2025-04-21 09:34:09Brazilian Real Sees Increase in Speculative Net Positions, Signals Boost in Market SentimentQuick show2025-04-21 09:34:09Australian Dollar Speculative Net Positions Improve, But Remain in the NegativeQuick show2025-04-21 09:34:09Swiss Franc Speculative Positions Narrow as Traders Eye Future DirectionQuick show2025-04-21 09:34:09CFTC Reports Decline in Speculative Net Positions for Mexican PesoQuick show2025-04-21 09:34:09Speculative Net Positions in CFTC Wheat Futures Narrow as Traders Adjust BetsQuick show2025-04-21 09:34:09Silver Speculative Net Positions Decline in Latest CFTC DataQuick show2025-04-21 09:34:09Speculative Sentiment on S&P 500 Declines as Net Positions Widen to -63.1KQuick show

- 2025-04-21 09:34:09Silver Rises as Weaker Dollar Spurs Safe-Haven DemandQuick show2025-04-21 09:34:09China Stocks Rise as PBOC Holds Rates SteadyQuick show2025-04-21 09:34:09Copper Hits 2-Week High on Weaker DollarQuick show2025-04-21 09:34:09Japanese Shares Slide as Stronger Yen Hits ExportersQuick show2025-04-21 09:34:09India Stocks Rise to 4-Month HighsQuick show2025-04-21 09:34:09Estonian Producer Inflation Eases SignificantlyQuick show2025-04-21 09:34:09Estonian Producer Price Inflation Sees Remarkable Cooldown in MarchQuick show2025-04-21 09:34:09Estonian PPI Dips in March, Marking a Surprise Shift to DeflationQuick show2025-04-21 09:34:09Indonesia Trade Surplus Beats EstimatesQuick show2025-04-21 09:34:09Indonesia Imports Hit 3-Month HighQuick show

-

Trump hits pause, not stop: which tariffs remain in force

Trump hits pause, not stop: which tariffs remain in force -

Three female policymakers to change political landscape in EU

Three female policymakers to change political landscape in EU -

Seven most vibrant places on earth

Seven most vibrant places on earth -

Top 5 most populous megacities worldwide

Top 5 most populous megacities worldwide -

Top five countries for wine tourism

Top five countries for wine tourism -

Celebrities most frequently deepfaked by AI

Celebrities most frequently deepfaked by AI -

Seven unforgettable places in Australia

Seven unforgettable places in Australia

- The euro and the pound posted significant gains during today's Asian trading session, and there were objective reasons for this. The sharp weakening of the U.S. dollar during the Asian

Author: Miroslaw Bawulski

08:59 2025-04-21 UTC+2

2

Fundamental analysisWhat to Pay Attention to on April 21? A Breakdown of Fundamental Events for Beginners

No macroeconomic events are scheduled for Monday—not in the U.S., the Eurozone, Germany, or the U.K. Therefore, even if the market was paying attention to the macroeconomic backdrop, today, thereAuthor: Paolo Greco

06:30 2025-04-21 UTC+2

15

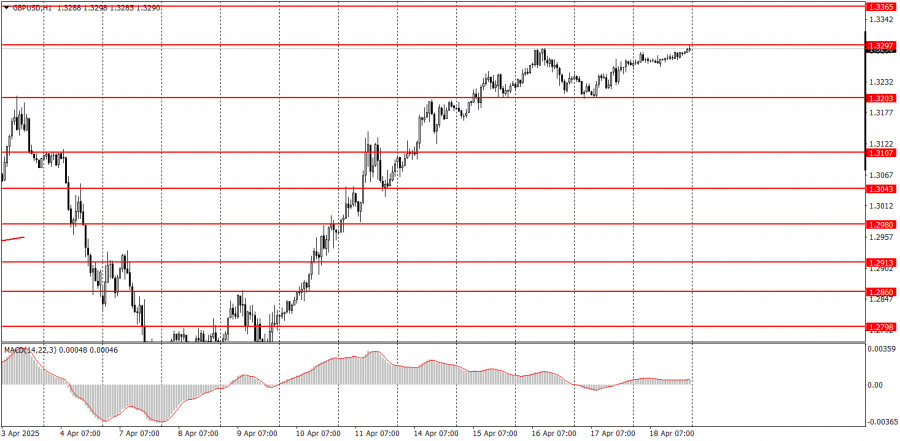

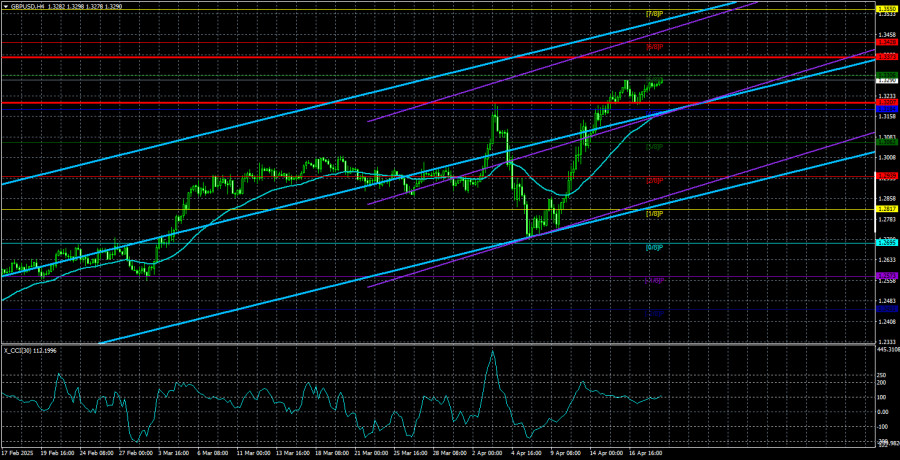

Trading planHow to Trade the GBP/USD Pair on April 21? Simple Tips and Trade Analysis for Beginners

Analysis of Friday's Trades 1H Chart of GBP/USD On Friday, the GBP/USD pair showed extremely low volatility, yet the British pound steadily crept upward even with such market conditionsAuthor: Paolo Greco

05:36 2025-04-21 UTC+2

8

- Trading plan

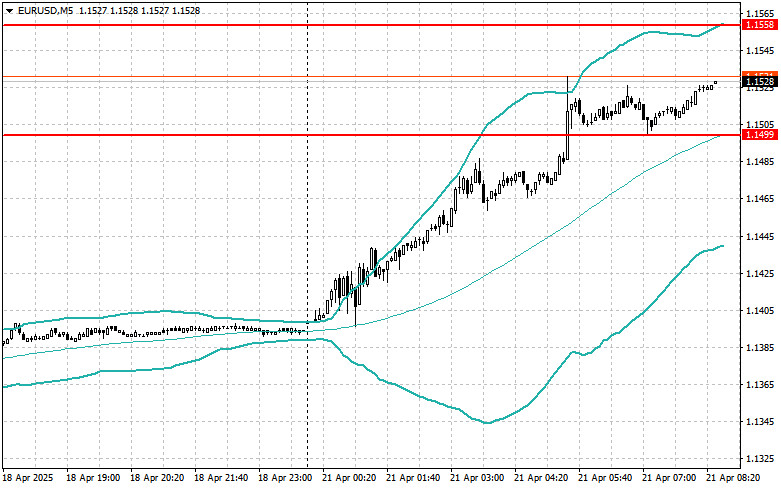

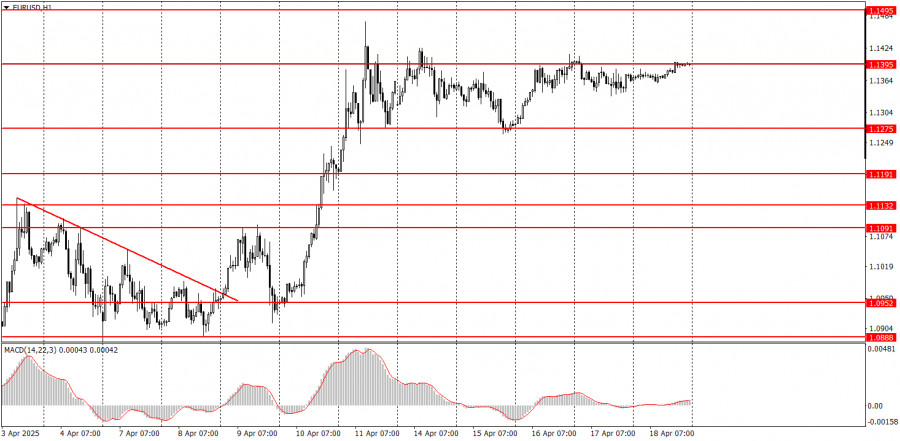

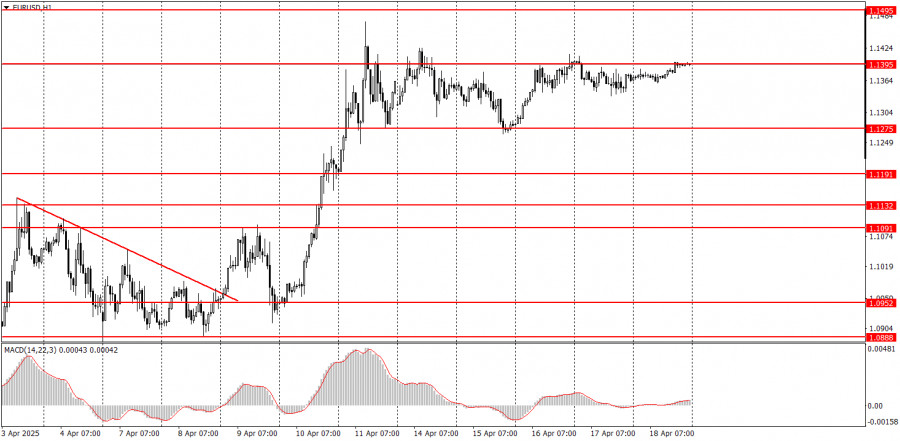

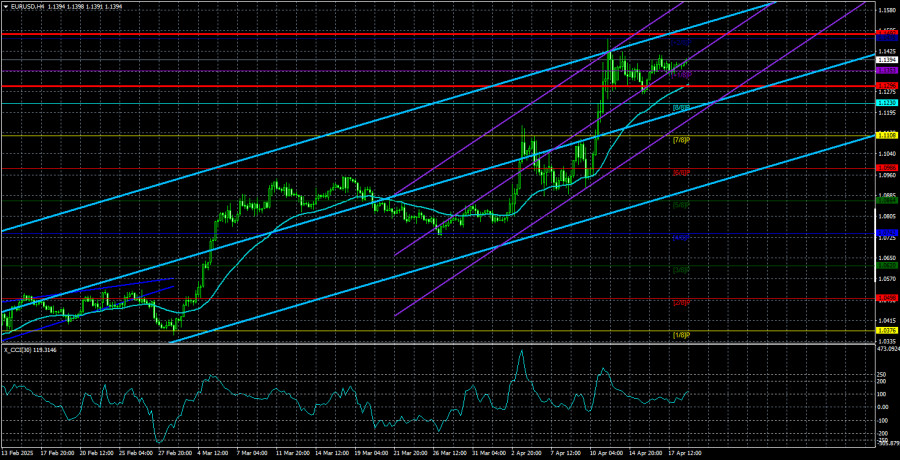

How to Trade the EUR/USD Pair on April 21? Simple Tips and Trade Analysis for Beginners

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed no movement on Friday. It was Good Friday, and Easter Sunday followed. As a result, many countriesAuthor: Paolo Greco

05:36 2025-04-21 UTC+2

5

Technical analysisTechnical Analysis of Intraday Price Movement EUR/GBP Cross Currency Pairs, Monday April 21, 2025

From what is seen on the 4-hour chart, the EUR/GBP cross currency pair appears to be moving above the EMA (100), which indicates that Buyers dominate the currency pairAuthor: Arief Makmur

04:19 2025-04-21 UTC+2

15

Technical analysisTechnical Analysis of Intraday Price Movement USD/JPY Main Currency Pairs, Monday April 21, 2025.

With the appearance of Convergence between the price movement of the main currency pair USD/JPY with the Stochastic Oscillator indicator and the position of the EMA (100) which is aboveAuthor: Arief Makmur

04:19 2025-04-21 UTC+2

12

- The GBP/USD currency pair continued its upward movement on Friday. If we had seen such price action away from peak levels, there would have been no questions. In essence

Author: Paolo Greco

04:01 2025-04-21 UTC+2

9

On Friday, the EUR/USD currency pair made no notable movements whatsoever. This was unsurprising, as Friday marked Good Friday, and Sunday was Easter. Many banks and trading venues were closedAuthor: Paolo Greco

04:01 2025-04-21 UTC+2

9

Trading planTrading Recommendations and Analysis for GBP/USD on April 21: The Pound Rises Even on Holidays

The GBP/USD currency pair traded higher again on Friday, albeit with minimal volatility. Despite the lack of important events in the U.S. or the U.K. that day (unlike earlierAuthor: Paolo Greco

04:01 2025-04-21 UTC+2

11

InstaForex to Participate in Money Expo Abu Dhabi 2025 as a Diamond Sponsor

InstaForex is proud to announce its participation in one of the largest events in the finance and trading industry — Money Expo Abu Dhabi 2025, taking place on April 23–24 in the very heart of the United Arab Emirates. Money Expo Abu Dhabi is an international platform that brings together thousands of industry professionals — investors, traders, brokerage firms, financial institutions, and tech startups. This two-day event will become a true hub for everyone interested in the latest trends, cutting-edge solutions, and emerging opportunities in the financial markets.