在接收档案之前,请设置必要的参数:交易工具、四种可用的时间框架中选择其一(H1、M15、M5、M1),以及日期。报价记录将以表格的形式显示所选时间框架内的开盘价和收盘价,以及最高价和最低价。

See Also

- 2025-03-28 18:34:04US Personal Income Takes a Slight Dip in February, Data ShowsQuick show2025-03-28 18:34:04U.S. Core PCE Price Index Shows Modest Rise in FebruaryQuick show2025-03-28 18:34:04Canadian Economy Grows: GDP Rises to 0.4% in January 2025Quick show2025-03-28 18:34:04Chile Jobless Rate Above ForecastsQuick show2025-03-28 18:34:04Mexico Jobless Rate Below ForecastsQuick show2025-03-28 18:34:04Brazil Unemployment Rate Rises to 6.8%Quick show2025-03-28 18:34:04Israel's M1 Money Supply Dips by 2.3% in February, Marking a Significant DownturnQuick show2025-03-28 18:34:04Spain Business Sentiment Improves in MarchQuick show2025-03-28 18:34:04India Infrastructure Output Growth Weakest in 5 MonthsQuick show2025-03-28 18:34:04Rising Unemployment Clouds Chile's Economic Skies in FebruaryQuick show

- 2025-03-28 18:34:04Week Ahead - March 31stQuick show2025-03-28 18:34:04Gold Keeps Smashing RecordsQuick show2025-03-28 18:34:04Ghana Lifts Key Policy Rate to 28%Quick show2025-03-28 18:34:04Dollar Slips Amid Growing Economic ConcernsQuick show2025-03-28 18:34:04Canada Government Budget Gap Widens in JanuaryQuick show2025-03-28 18:34:04Atlanta Fed GDPNow Forecast: U.S. Economic Outlook Dimmed for First Quarter 2025Quick show2025-03-28 18:34:04India Current Account Gap Widens Less than AnticipatedQuick show2025-03-28 18:34:04Ghana's Prime Interest Rate Climbs to 28%, An Increase from January's RateQuick show2025-03-28 18:34:04Canada’s Budget Balance Worsens in January, Revealing Deeper DeficitQuick show2025-03-28 18:34:04Canada's Budget Balance Plummets to -$5.13 Billion in January 2025Quick show

- 2025-03-28 18:34:04Baltic Dry Index Continues to FallQuick show2025-03-28 18:34:04US Michigan Consumer Sentiment Revised LowerQuick show2025-03-28 18:34:04Brazilian Real Slides as Labor Market Weakens and Trade Risks MountQuick show2025-03-28 18:34:04US Year-Ahead Inflation Expectations Revised Slightly UpQuick show2025-03-28 18:34:04Michigan Consumers Maintain a Steady Outlook Amid UncertaintyQuick show2025-03-28 18:34:04Consumer Sentiment Dips: Michigan Index Shows Decline in MarchQuick show2025-03-28 18:34:04Michigan 5-Year Inflation Expectations Rise to 4.1% in March 2025Quick show2025-03-28 18:34:04Michigan Consumer Sentiment Dips Slightly in March, Signaling Potential Market ConcernsQuick show2025-03-28 18:34:04Surge in Michigan 1-Year Inflation Expectations: March Data Shows Increase to 5.0%Quick show2025-03-28 18:34:04Ibovespa Slips as Rising Unemployment and Trade War Fears WeighQuick show

- 2025-03-28 18:34:04TSX Falls as Trade and Growth Concerns WeighQuick show2025-03-28 18:34:04US Stocks Fall on FridayQuick show2025-03-28 18:34:04Canada 10-Year Bond Yield Slips Amid Trade WarQuick show2025-03-28 18:34:04Canadian Dollar Eases Past 1.43 USDQuick show2025-03-28 18:34:04Dollar Little Changed after PCEQuick show2025-03-28 18:34:04Dallas Fed PCE Surges to 3.00% in February, Marking Significant IncreaseQuick show2025-03-28 18:34:04Nigeria's Foreign Reserves See Marginal Decline in March 2025Quick show2025-03-28 18:34:04Treasury Yields Fall from Recent HighsQuick show2025-03-28 18:34:04India's Foreign Debt Rises to $717.9 Billion in Q4 2024Quick show2025-03-28 18:34:04US Futures Point to Lower OpenQuick show

- 2025-03-28 18:34:04Canada's Economy Likely Stagnated in FebruaryQuick show2025-03-28 18:34:04US Personal Spending Below ForecastsQuick show2025-03-28 18:34:04US Personal Income Rises More than AnticipatedQuick show2025-03-28 18:34:04US Core PCE Prices Rise More than ExpectedQuick show2025-03-28 18:34:04US PCE Prices Rise 0.3%, Core Rise the Most in Over a YearQuick show2025-03-28 18:34:04U.S. Real Personal Consumption Rebounds to 0.1% in February 2025Quick show2025-03-28 18:34:04U.S. Personal Spending Sees Rebound in February with a 0.4% IncreaseQuick show2025-03-28 18:34:04U.S. PCE Price Index Holds Steady at 0.3% for February 2025Quick show2025-03-28 18:34:04U.S. PCE Price Index Holds Steady in February at 2.5% Year-over-YearQuick show2025-03-28 18:34:04U.S. Core PCE Price Index Edges Higher to 2.8% in FebruaryQuick show

- 2025-03-28 18:34:04US Personal Income Takes a Slight Dip in February, Data ShowsQuick show2025-03-28 18:34:04U.S. Core PCE Price Index Shows Modest Rise in FebruaryQuick show2025-03-28 18:34:04Canadian Economy Grows: GDP Rises to 0.4% in January 2025Quick show2025-03-28 18:34:04Chile Jobless Rate Above ForecastsQuick show2025-03-28 18:34:04Mexico Jobless Rate Below ForecastsQuick show2025-03-28 18:34:04Brazil Unemployment Rate Rises to 6.8%Quick show2025-03-28 18:34:04Israel's M1 Money Supply Dips by 2.3% in February, Marking a Significant DownturnQuick show2025-03-28 18:34:04Spain Business Sentiment Improves in MarchQuick show2025-03-28 18:34:04India Infrastructure Output Growth Weakest in 5 MonthsQuick show2025-03-28 18:34:04Rising Unemployment Clouds Chile's Economic Skies in FebruaryQuick show

- 2025-03-28 18:34:04Week Ahead - March 31stQuick show2025-03-28 18:34:04Gold Keeps Smashing RecordsQuick show2025-03-28 18:34:04Ghana Lifts Key Policy Rate to 28%Quick show2025-03-28 18:34:04Dollar Slips Amid Growing Economic ConcernsQuick show2025-03-28 18:34:04Canada Government Budget Gap Widens in JanuaryQuick show2025-03-28 18:34:04Atlanta Fed GDPNow Forecast: U.S. Economic Outlook Dimmed for First Quarter 2025Quick show2025-03-28 18:34:04India Current Account Gap Widens Less than AnticipatedQuick show2025-03-28 18:34:04Ghana's Prime Interest Rate Climbs to 28%, An Increase from January's RateQuick show2025-03-28 18:34:04Canada’s Budget Balance Worsens in January, Revealing Deeper DeficitQuick show2025-03-28 18:34:04Canada's Budget Balance Plummets to -$5.13 Billion in January 2025Quick show

-

Betting on AI: five high-potential stocks to watch

Betting on AI: five high-potential stocks to watch -

World’s top 5 CEOs according to Brand Finance

World’s top 5 CEOs according to Brand Finance -

Wall Street legends: top 10 investors of all time

Wall Street legends: top 10 investors of all time -

Main beneficiaries of stellar crypto rally in 2024

Main beneficiaries of stellar crypto rally in 2024 -

Some uncommon forecasts for crypto market

Some uncommon forecasts for crypto market -

Top 5 cryptocurrencies by market capitalization in 2024

Top 5 cryptocurrencies by market capitalization in 2024 -

Ten countries eyeing EU membership in 2025

Ten countries eyeing EU membership in 2025

InstaForex – Prime Sponsor of Traders Fair Lagos 2025!

InstaForex is proud to announce its participation in Traders Fair Lagos 2025 – one of the biggest financial events in Africa. As the Prime Sponsor, we warmly invite all traders, investors, and partners to visit our booth for unique opportunities, exclusive bonuses, and expert consultations. Why you can’t miss this event Traders Fair Lagos 2025 is not just an exhibition. It is a global platform to connect with leading financial experts. This event brings together traders, brokers, analysts, and investors from all over the world to explore trends, strategies, and technologies shaping the future of financial markets.

- The White House imposed 25% tariffs on automobiles and parts, triggering a sell-off in the auto manufacturing sector and broad declines in major stock indices. The Dow Jones, S&P

Author: Irina Maksimova

12:24 2025-03-28 UTC+2

18

The AUD/USD pair continues its sideways consolidation, remaining within a familiar range near the key psychological level of 0.6300. This movement is driven by several factors impacting global market sentimentAuthor: Irina Yanina

12:16 2025-03-28 UTC+2

19

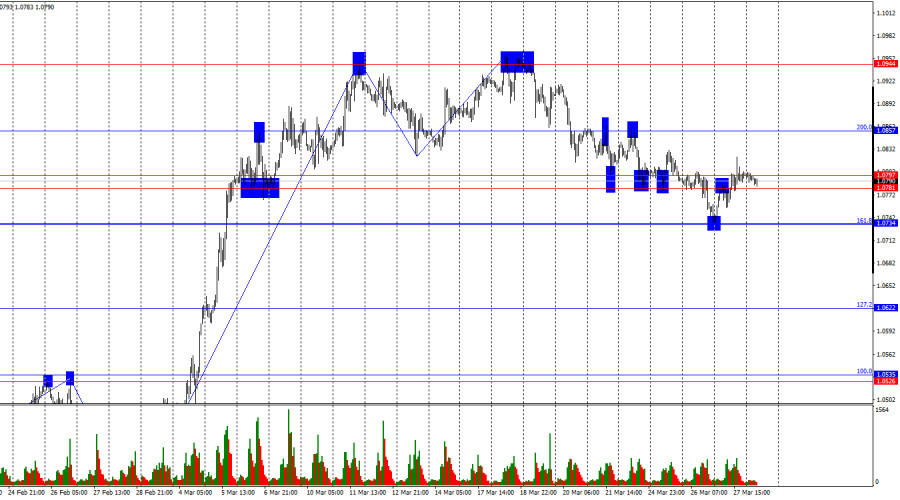

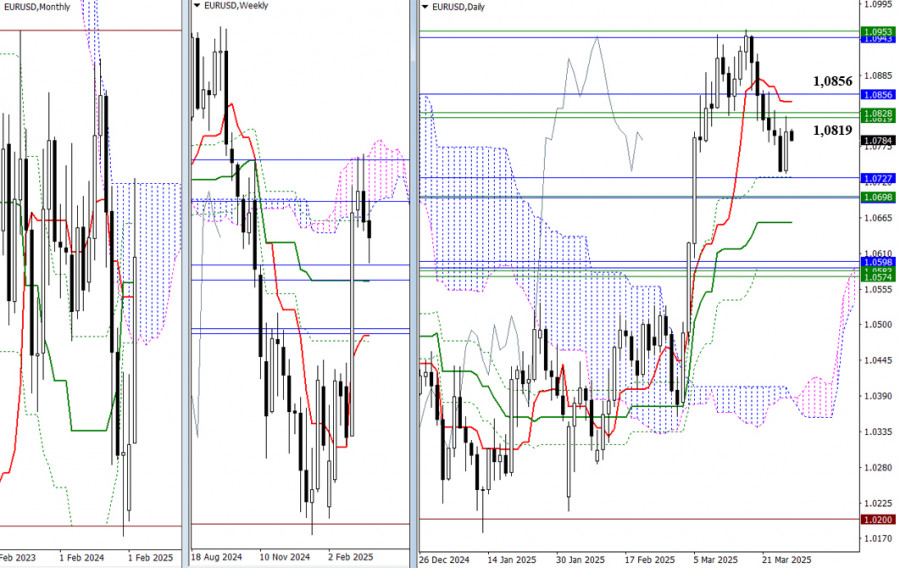

On Thursday, the EUR/USD pair rebounded from the 161.8% Fibonacci retracement level at 1.0734 and rose to the resistance zone of 1.0781–1.0797. A rebound from this zone would favorAuthor: Samir Klishi

11:48 2025-03-28 UTC+2

26

- Today, the EUR/USD pair is consolidating near the key psychological level of 1.0800, showing no intention of retreating below 1.0780 as traders and investors await the release of the U.S

Author: Irina Yanina

11:45 2025-03-28 UTC+2

19

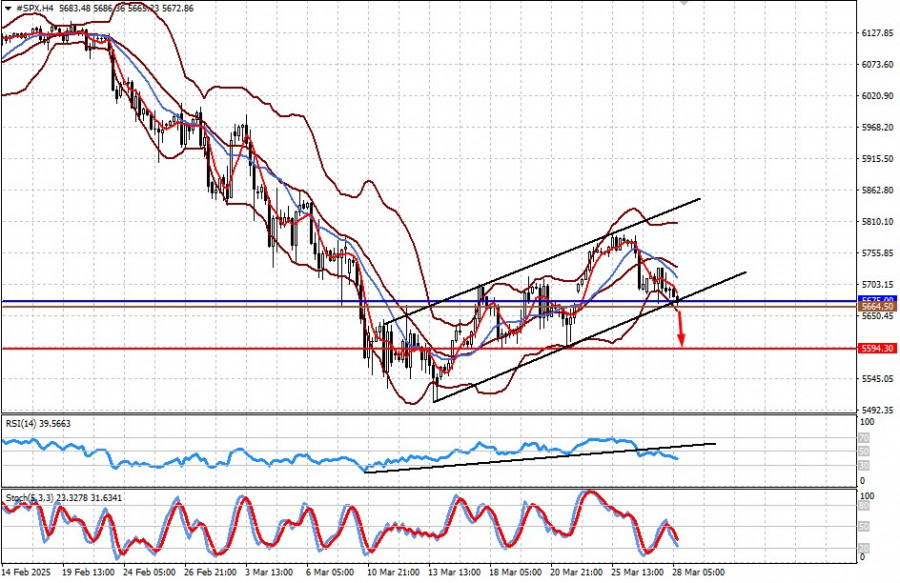

Fundamental analysisMarkets at a Crossroads Ahead of Tariff Announcement by D. Trump (Possible Decline in CFD Contracts on #SPX and #NDX Futures)

Markets are now fully convinced that the U.S. President will follow through on his plans to implement severe customs tariffs aimed at closing the domestic market and, in doingAuthor: Pati Gani

11:39 2025-03-28 UTC+2

16

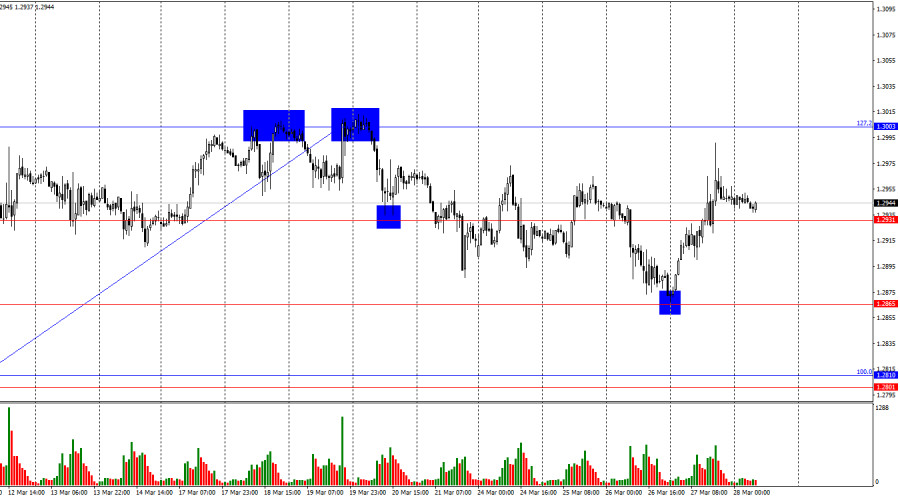

On the hourly chart, the GBP/USD pair on Thursday rebounded from the 1.2865 level, reversed in favor of the pound, and rose above the 1.2931 level, which carries no weightAuthor: Samir Klishi

11:36 2025-03-28 UTC+2

18

- At the close of yesterday's regular trading session, U.S. stock indices ended in the red. The S&P 500 dropped by 0.33%, the Nasdaq 100 fell by 0.53%

Author: Jakub Novak

11:29 2025-03-28 UTC+2

14

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirmAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

19

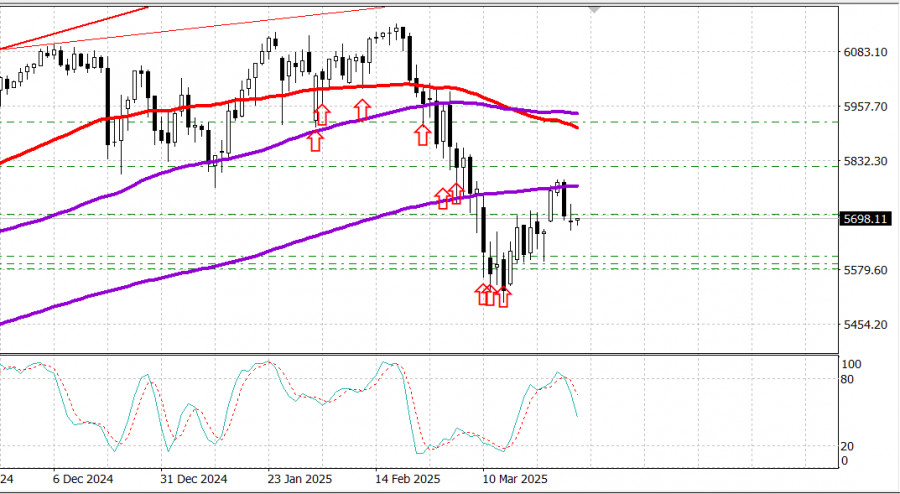

Stock MarketsUS stock market: Trump's tariffs halt uptrend, so benchmark stock indices consolidating. PCE data on investors' radars today

S&P500 Market update on March 28 US stock market: Trump's tariffs halt uptrend, so benchmark stock indices consolidating. PCE data on investors' radars today Snapshot of US stock marketAuthor: Jozef Kovach

09:46 2025-03-28 UTC+2

12