Unser Team hat mehr als 7.000.000 Trader! Jeden Tag arbeiten wir daran zusammen, das Trading zu verbessern. Wir erzielen hohe Ergebnisse und entwickeln uns ständig weiter.

Die Anerkennung von Millionen der Trader weltweit ist die höchste Einschätzung unserer Arbeit! Sie haben Ihre Wahl getroffen und wir werden unser Bestes tun, um Ihre Erwartungen zu erfüllen!

Wir sind ein tolles Team zusammen!

InstaSpot. Wir sind stolz darauf, für Sie zu arbeiten!

Schauspieler, Mixed-Martial-Arts- Weltmeister und ein echter russischer Recke! Ein Mann, der sich selbst gemacht hat. Ein Mann, mit dem wir den gleichen Weg haben. Das Erfolgsgeheimnis von Taktarow ist die ständige Bewegung zu seinem Ziel.

Entdecken Sie Ihr Talent! Lernen Sie, versuchen Sie, machen Sie Fehler, aber halten Sie nicht auf!

InstaSpot - hier beginnt die Geschichte Ihrer Siege!

The price of gold moved modestly higher during trading on Wednesday as traders reacted to the latest U.S. consumer price inflation data.

After climbing $15.20 or 0.8 percent to $2,019 an ounce in the previous session, gold for June delivery edged up $5.90 or 0.3 percent to $2024.90 an ounce.

The uptick in the price of gold came amid a continued decrease in the value of the U.S. dollar, with the U.S. dollar index falling by 0.7 percent.

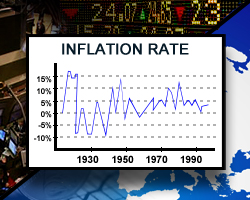

Gold moved higher and the dollar fell following the release of the Labor Department's highly anticipated report on consumer price inflation in the month of March.

While the report showed consumer prices rose by less than expected, many economists said they still expect the Federal Reserve to raise interest rates by another quarter point early next month.

The Labor Department said its consumer price index inched up by 0.1 percent in March after climbing by 0.4 percent in February. Economists had expected consumer prices to rise by 0.3 percent.

The report also showed the annual rate of consumer price growth slowed to 5.0 percent in March from 6.0 percent in February.

The year-over-year growth was slower than the 5.2 percent expected by economists and marks the smallest 12-month increase since May 2021.

Meanwhile, the report also said core consumer prices, which exclude food and energy prices, rose by 0.4 percent in March after advancing by 0.5 percent in February. The increase matched economist estimates.

The annual rate of growth by core consumer prices accelerated to 5.6 percent in March from 5.5 percent in February, which was also in line with expectations.