- Nützliche Links: Meine anderen Artikel sind in diesem Bereich verfügbar InstaForex-Kurs für Anfänger Beliebte Analytics Handelskonto eröffnen Wichtig: Einsteiger im Forex-Handel müssen besonders vorsichtig sein, wenn sie Entscheidungen über

Autor: Sebastian Seliga

10:18 2025-04-18 UTC+2

2

Wird das Weiße Haus den Rubikon überschreiten, indem es die Entlassung von Jerome Powell von seinem Posten als Vorsitzender der Federal Reserve einleitet? Das würde den Finanzmärkten einen weiteren SchlagAutor: Marek Petkovich

09:16 2025-04-18 UTC+2

0

Fundamental analysisWarum Sind Die Märkte Eingefroren und Worauf Warten Sie? (Es besteht die Möglichkeit einer fortgesetzten Konsolidierung von Bitcoin und Ethereum in seitlichen Bereichen)

Heute ist Karfreitag, ein Tag, den Christen weltweit und in allen Konfessionen begehen. Die Marktaktivitäten haben sich im Vorfeld der Osterfeiertage merklich verringert, aber das ist nicht der HauptgrundAutor: Pati Gani

09:00 2025-04-18 UTC+2

0

- Bitcoin und Ethereum bleiben innerhalb ihrer Seitwärtskanäle, und das Unvermögen, aus diesen Bereichen auszubrechen, könnte die Aussichten auf eine breitere Erholung des Kryptowährungsmarktes gefährden. Allerdings würde jegliche neue Verkaufswelle eine

Autor: Miroslaw Bawulski

09:00 2025-04-18 UTC+2

0

Analytical NewsIst Powell in Gefahr? Kann Trump den Fed-Chef entlassen und was bedeutet das für die Märkte?

Donald Trump hat erneut die Federal Reserve ins Visier genommen und ihren Vorsitzenden Jerome Powell beschuldigt, in der Geldpolitik versagt zu haben und gedroht, ihn zu entlassen. Aber was stecktAutor: Аlena Ivannitskaya

08:43 2025-04-18 UTC+2

0

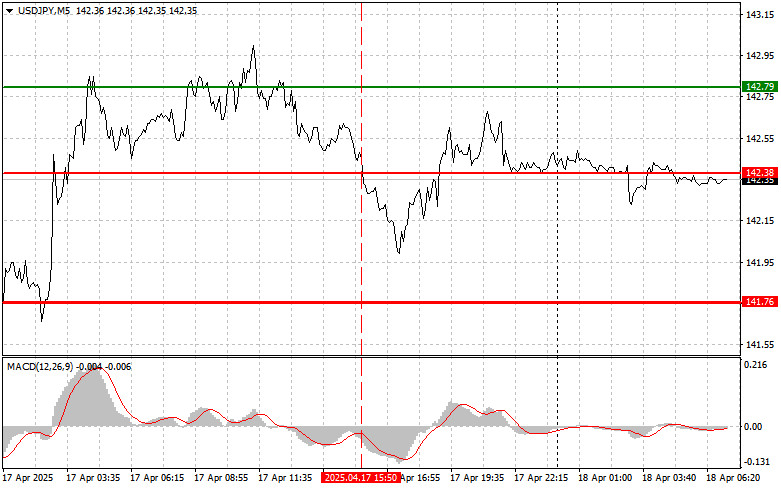

ForecastUSD/JPY: Einfache Handelstipps für Anfängerhändler am 18. April. Rückblick auf die Forex-Handel des Vortags

Der Test des Niveaus von 142,38 fiel mit einem Zeitpunkt zusammen, als der MACD-Indikator bereits deutlich unter die Nullmarke gefallen war, wodurch das Abwärtspotenzial des Paares begrenzt wurde. Aus diesemAutor: Jakub Novak

08:33 2025-04-18 UTC+2

0

- Forecast

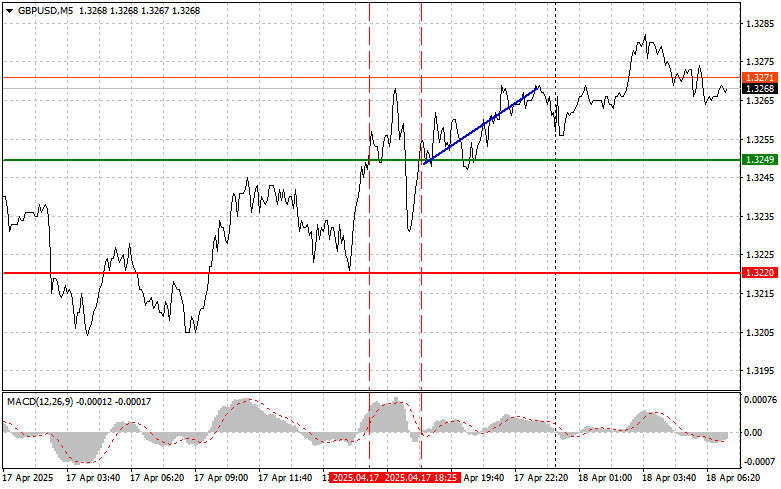

GBP/USD: Einfache Handelstipps für Anfänger am 18. April. Rückblick auf die Forex-Geschäfte von gestern

Der Test des Preisniveaus von 1.3249 erfolgte, als sich der MACD-Indikator bereits deutlich über der Nulllinie bewegt hatte, was das Aufwärtspotenzial des Paares beschränkte. Aus diesem Grund habeAutor: Jakub Novak

08:31 2025-04-18 UTC+2

1

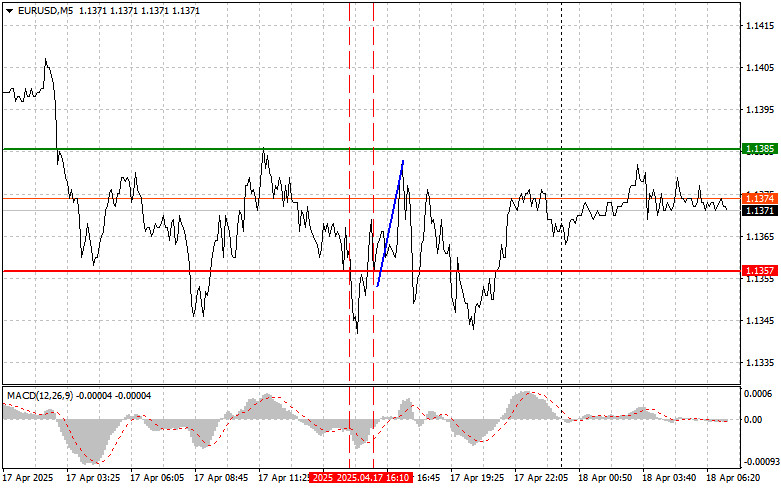

ForecastEUR/USD: Einfache Trading-Tipps für Anfänger am 18. April. Rückblick auf die gestrigen Forex-Trades

Der Test des Preisniveaus von 1,1357 erfolgte, als der MACD-Indikator bereits deutlich unter die Nulllinie gefallen war, was das Abwärtspotenzial des Paares begrenzte. Aus diesem Grund habe ich den EuroAutor: Jakub Novak

08:30 2025-04-18 UTC+2

0

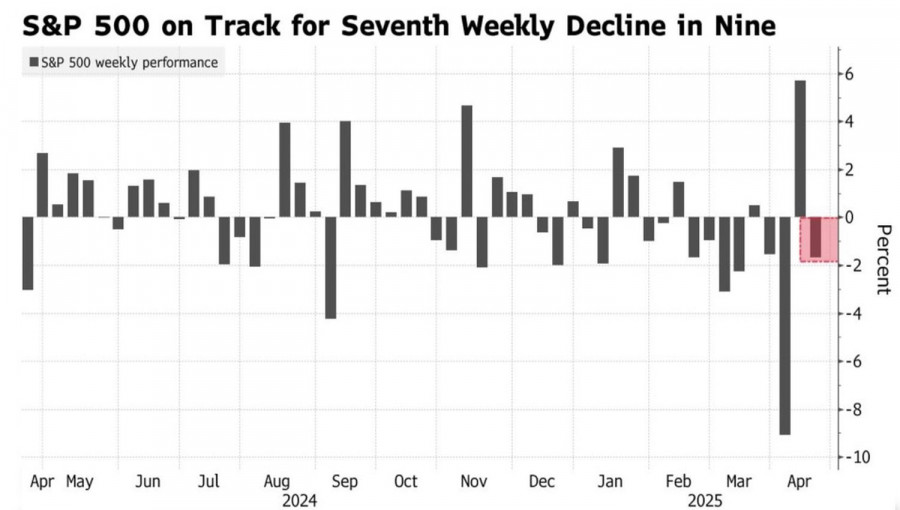

Stock MarketsAktienmarktausblick für den 18. April: S&P 500 und NASDAQ versuchen, sich zu stabilisieren

Zum Ende der vorherigen regulären Handelssitzung schlossen die US-Aktienindizes uneinheitlich. Der S&P 500 stieg um 0,13%, während der Nasdaq 100 um 0,13% fiel. Der Industrieindex Dow Jones verlor 1,33%. AsiatischeAutor: Jakub Novak

08:00 2025-04-18 UTC+2

0