Long-term review

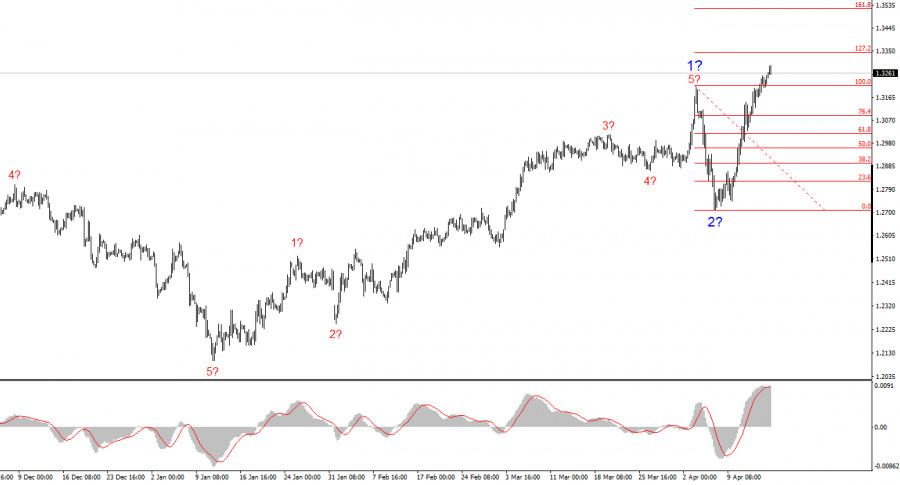

The euro/dollar pair has every chance to exit the price range 1.2250-1.2360, within which traders have traded for the second week already. Speech by Fed Chairman Jerome Powell in the Senate is the most important event of the month, capable of turning the pair 180 degrees or supporting the upward trend.

The release of key macroeconomic data significantly changed the fundamental picture of the dollar. The rise in the average wage level, as well as the consumer price index, caused a stir among traders. The market started talking about accelerating rates of rate hike (up to four times this year), especially in the light of tax reform, which hypothetically should strengthen price pressure against the backdrop of strengthening the labor market.

Such prospects have affected the yield of 10-year bonds and, accordingly, the stock market, strengthening the American currency. However, the dispositions at the beginning of February could not keep the dollar afloat. Following the euphoria came disappointment in the form of an increasing deficit of the US budget and the current balance of payments account. In addition, the ambiguous policy (or rather the comments) of the White House regarding the exchange rate of the national currency is confusing dollar bulls, who already feel extremely insecure because of the protectionism of Donald Trump.

A contradictory fundamental background restrained the euro/dollar pair within the 100-point price range: for its breakthrough, bears and bulls of the EURUSD need a powerful news impulse. This week there will be a lot of significant information guides, however, in the first place among them - tomorrow's speech of the Fed Chairman in the Senate. It is worth noting that for the first time, Jerome Powell will address the senators as the head of the Federal Reserve, so it's kind of a benefit for them.

Traders are now in a state of confusion because of an array of conflicting factors. Jerome Powell can answer many questions of the market, first of all - concerning the prospects of monetary policy. The minutes of the January meeting of the Federal Reserve made it clear that the members of the regulator are ready to stick to the main scenario for this year (three rate increases), while continuing to monitor the state of the economy. No one was going to accelerate the pace of tightening of monetary policy in January, however, one point needs to be taken into account here: this meeting was held before the release of the positive CPI and strong non-financials. The head of the Federal Reserve, in turn, will submit his report with this information in mind.

On the other hand, Powell probably will take into account another fact: speculations of a faster rate of rate hikes have overwhelmed the main indexes of Wall Street to multi-year lows. This fact can affect the tone of the statement of the head of the Fed. Jerome Powell has always been a very reserved and cautious official when he was still a "member" of the Fed. Now the value of his position has increased significantly, so it is unlikely he will talk about the probability of four rounds of rate hikes tomorrow , which will provoke unnecessary volatility. Most likely, Powell's speech will be habitually reserved, with a lot of "ifs" or "buts." The market interprets this line of behavior as indecisiveness, even if the head of the Fed agrees with a triple rate hike by the end of this year.

In other words, the logic of recent developments in the currency and stock markets suggests a high likelihood of bearish trends against the US currency - and the euro/dollar pair will not be an exception.

Undoubtedly, the European currency is also in expectation of bearish factors. On Wednesday, the consumer price index of the eurozone will be published, which, according to preliminary forecasts, will show negative dynamics. Inflation in Europe is slowing again - this time, analysts expect a release at 1.2% (for comparison - in November last year, the CPI was at 1.5%). If the forecast is justified, the euro will again be under pressure, as traders are again concerned about the fate of the stimulus program.

![Exchange Rates 27.02.2018 analysis]()

Also, the European currency may be under pressure of political problems. In Germany, the fate of the coalition government will soon be finally decided, and in Italy, parliamentary elections will be held at the weekend. Thus, on March 2, the procedure for voting of regular members of the German Social Democratic Party will be completed regarding the formation of a coalition with the party of Angela Merkel. At the moment, 20% of the members of the SPD have already voted (total of 470,000 people). This quantitative threshold has a legal meaning: Now the will is declared valid, regardless of the final number of voters.

The stakes are high: if the rank and file Social Democrats agree to a coalition, Merkel will become the Chancellor for the fourth time, and nothing will change in the context of the currency market. But in case of a negative result, Germany (and Europe as a whole) will face a strong political crisis, in the light of the uncertain prospects for new re-elections.

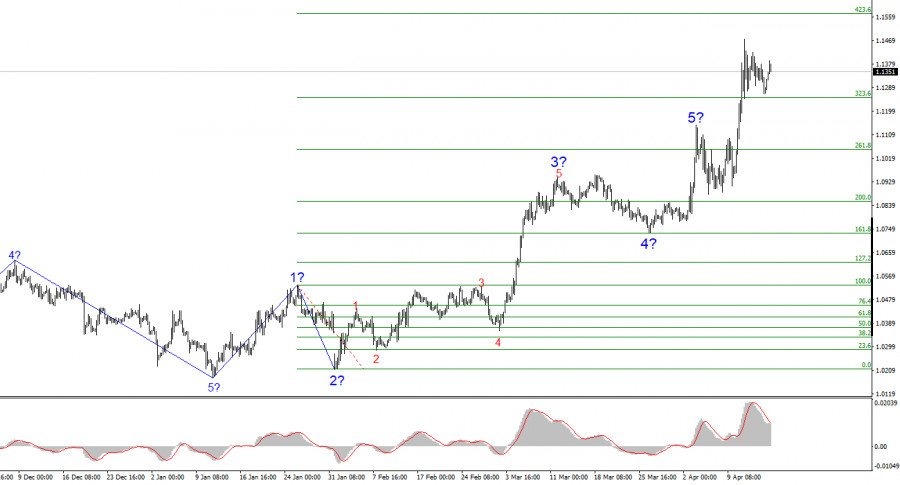

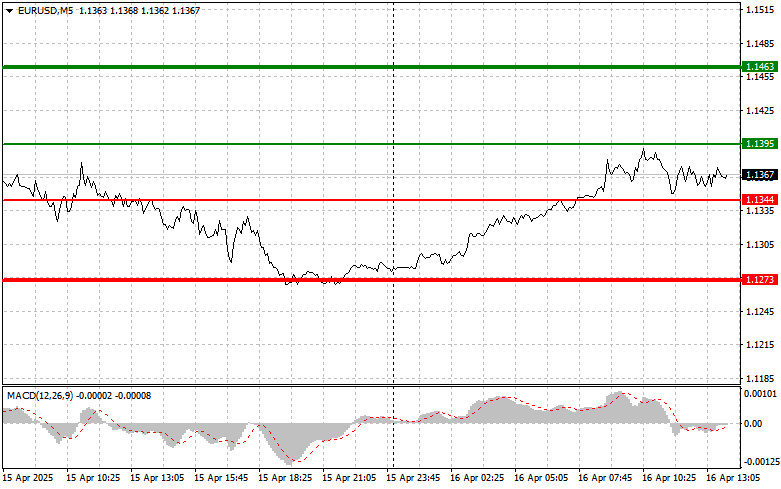

Thus, the euro/dollar pair is in anticipation of key events that will determine the vector of further movement. The technical picture of EURUSD echoes the fundamental background: the main indicators are silent, demonstrating uncertainty. To continue the upward trend, the pair's bulls need to gain a foothold above 1.2405, in which case the Ichimoku Kinko Hyo indicator will form a bullish "Parade Line" signal, opening the way to 1.2515 (the upper line of the Bollinger Bands indicator on the daily chart).

For EURUSD bears, the key mark is the price of 1.2200: a breakthrough of this level will reduce the pair in the area of the 20th figure, at least to 1.2080 (the upper limit of the Kumo cloud on D1).

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Benefit from analysts’ recommendations right now

Top up trading account

Open trading account

InstaSpot analytical reviews will make you fully aware of market trends! Being an InstaSpot client, you are provided with a large number of free services for efficient trading.