Dear colleagues.

For the Euro / Dollar currency pair, the upward trend continuation is expected after the breakdown of 1.1470 and we consider the downward movement as a correction. For the currency pair Pound / Dollar, we increase the potential for the upward movement to the level of 1.3350. For the currency pair Dollar / Franc, we are following the development of the downward structure from October 31 and we expect a further downward movement after the breakdown of 0.9994. For the currency pair Dollar / Yen, the breakdown level of 113.80 must be accompanied by a pronounced upward movement. For the Euro / Yen currency pair, we follow the ascending structure of October 26 and we expect a further upward movement after the breakdown of 130.05. For the currency pair Pound / Yen, the price is near the limiting values for the ascending structure of October 26, and therefore, we expect a departure to the correction after the breakdown of 148.16.

Forecast for November 8:

Analytical review of H1-scale currency pairs:

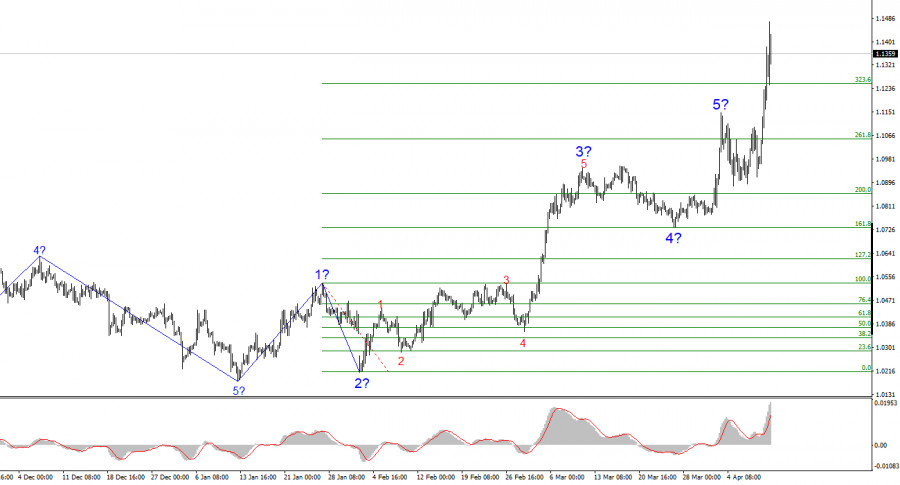

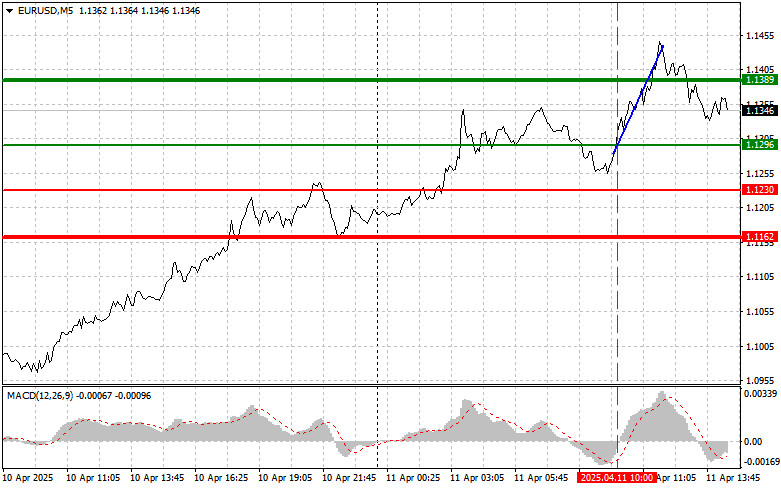

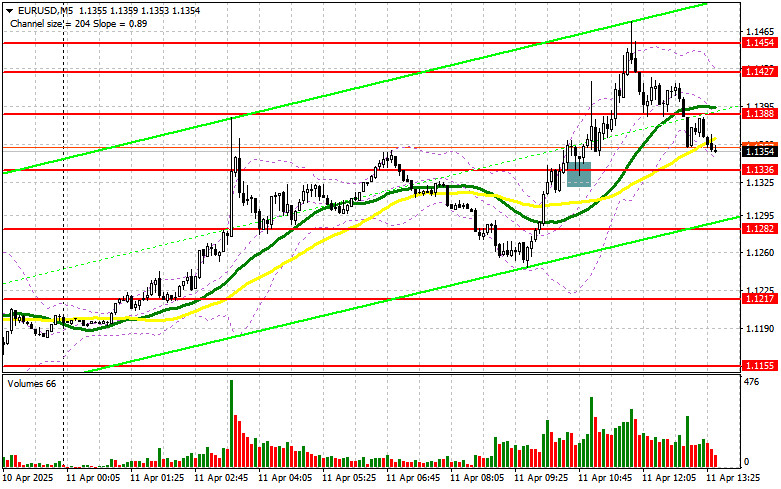

For the Euro / Dollar currency pair, the key levels on the H1 scale are: 1.1582, 1.1538, 1.1508, 1.1470, 1.1424, 1.1403, 1.1371 and 1.1344. Here, we are following the ascending structure of October 31. We continue the upward movement after the breakdown of 1.1470. In this case, the first target is 1.1508 and the breakdown of which will allow us to count on the movement to the level of 1.1538, near this value is the price consolidation. The potential value for the top is considered the level of 1.1582, upon reaching which we expect a rollback downwards.

The short-term downward movement is possible in the range of 1.1424 - 1.1403 and the breakdown of the latter will lead to the development of a protracted correction. Here, the target is 1.1371 and this level is the key support for the upward structure. Its breakdown will have to form the initial conditions for the downward cycle. In this case, the potential target is 1.1344.

The main trend is the ascending structure of October 31.

Trading recommendations:

Buy 1.1470 Take profit: 1.1505

Buy 1.1509 Take profit: 1.1536

Sell: 1.1424 Take profit: 1.1404

Sell: 1.1400 Take profit: 1.1374

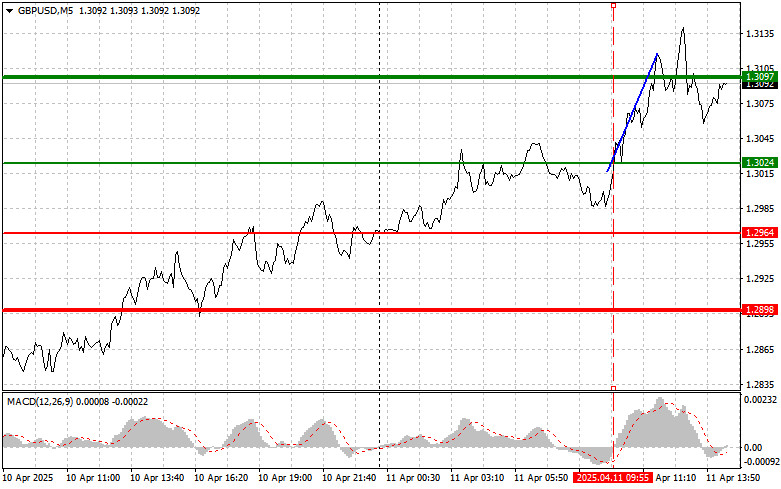

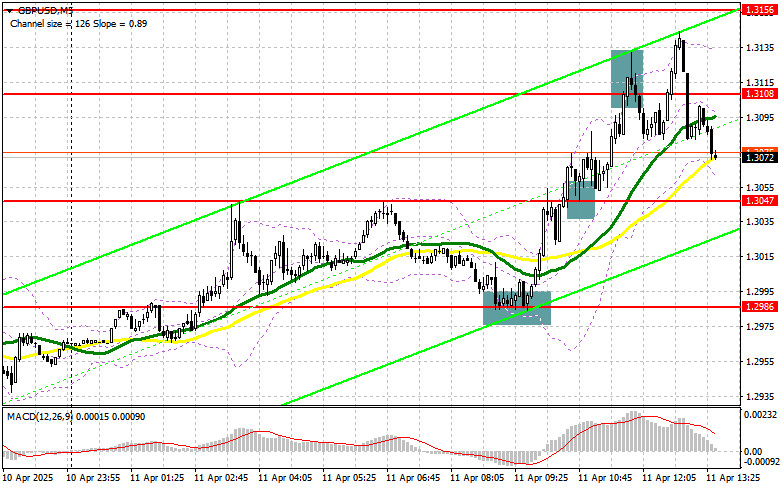

For the Pound / Dollar currency pair, the key levels on the H1 scale are: 1.3350, 1.3259, 1.3174, 1.3090, 1.3035 and 1.2938. Here, we are following the ascending structure of October 30. The upward movement is expected after the breakdown of 1.3174. In this case, the target is 1.3259, price consolidation is near this level. The potential value for the top is considered the level of 1.3350, upon reaching which we expect a rollback downwards.

The short-term downward movement is possible in the range of 1.3090 - 1.3035 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.2938 and this level is the key support for the top.

The main trend is the ascending structure of October 30.

Trading recommendations:

Buy: 1.3174 Take profit: 1.3257

Buy: 1.3260 Take profit: 1.3350

Sell: 1.3090 Take profit: 1.3038

Sell: 1.3032 Take profit: 1.2944

For the Dollar / Franc currency pair, the key levels on the H1 scale are: 1.0093, 1.0057, 1.0037, 0.9994, 0.9964, 0.9944 and 0.9918. Here, we are following the downward structure of October 31. The continuation of the downward movement is expected after the breakdown of 0.9994. In this case, the target is 0.9964 and in the range of 0.9964 - 0.9944 is the price consolidation. The potential value for the bottom is considered the level of 0.9918, after reaching which we expect a rollback to the top.

The short-term upward movement is possible in the range of 1.0037 - 1.0057 and the breakdown of the latter value will have to form an ascending structure. In this case, the goal is 1.0093.

The main trend is the downward structure of October 31.

Trading recommendations:

Buy: 1.0037 Take profit: 1.0055

Buy: 1.0063 Take profit: 1.0090

Sell: 0.9994 Take profit: 0.9967

Sell: 0.9962 Take profit: 0.9948

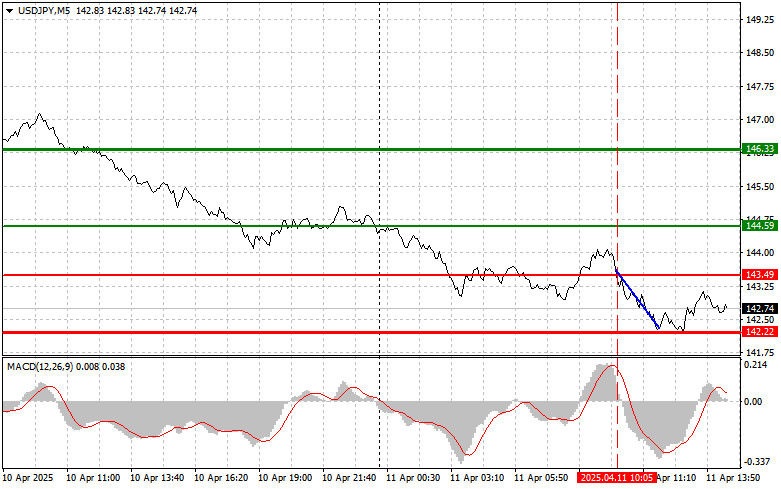

For the Dollar / Yen currency pair, the key levels on the scale of H1 are: 114.48, 114.21, 113.77, 113.46, 112.88, 112.44 and 112.13. Here, we are following the development of the ascending cycle of October 26. The short-term upward movement, as well as consolidation, is possible in the range of 113.46 - 113.77 and the breakdown of the latter value should be accompanied by a pronounced upward movement. Here, the goal is 114.21. The potential value for the top is considered the level of 114.48, after reaching which we expect a rollback downwards.

Exit to correction is expected after the breakdown of 112.88. In this case, the goal is 112.44 and in the range of 112.44 - 112.13 is the short-term downward movement. To the level of 112.13, we expect registration of the initial conditions for the downward cycle.

The main trend: the ascending cycle of October 26.

Trading recommendations:

Buy: 113.48 Take profit: 113.75

Buy: 113.80 Take profit: 114.20

Sell: 112.85 Take profit: 112.55

Sell: 112.42 Take profit: 112.15

For the Canadian dollar / Dollar currency pair, the key levels on the H1 scale are: 1.3269, 1.3222, 1.3191, 1.3168, 1.3089, 1.3060 and 1.3021. Here, the situation entered into an equilibrium state. In order to continue moving upward, it is necessary to design the local structure. The upward movement is expected after the price passes the range of 1.3168 - 1.3191. In this case, the first target is 1.3222 and consolidation is near this level. The potential value for the top is considered the level of 1.3269, upon reaching which we expect a rollback to the correction.

The short-term downward movement is possible in the range of 1.3089 - 1.3060, hence a high probability of a reversal upwards. The breakdown of the level of 1.3060 will lead to a prolonged correction. Here, the target is 1.3021.

The main trend is the equilibrium situation.

Trading recommendations:

Buy: 1.3191 Take profit: 1.3220

Buy: 1.3224 Take profit: 1.3269

Sell: 1.3089 Take profit: 1.3062

Sell: 1.3058 Take profit: 1.3024

For the currency pair Australian dollar / Dollar, the key levels on the H1 scale are: 0.7344, 0.7313, 0.7288, 0.7260, 0.7238 and 0.7209. Here, we are following the rising structure of October 26. The continuation of the upward movement is expected after the breakdown of 0.7288. In this case, the target is 0.7313, from this level, the likelihood of a downward rollback is high. We consider the level of 0.7344 to be a potential value for an uptrend, upon reaching which we expect a departure to a correction.

The short-term downward movement is possible in the range of 0.7260 - 0.7238 and the breakdown of the latter value will lead to a prolonged correction. Here, the target is 0.7209 and this level is the key support for the top.

The main trend is the upward cycle of October 26.

Trading recommendations:

Buy: 0.7288 Take profit: 0.7110

Buy: 0.7115 Take profit: 0.7342

Sell: 0.7260 Take profit: 0.7240

Sell: 0.7236 Take profit: 0.7212

For the Euro / Yen currency pair, the key levels on the H1 scale are: 131.60, 130.86, 130.48, 130.05, 129.48, 129.16 and 128.56. Here, we continue to monitor the ascending structure of October 26. The upward movement is expected after breakdown of 130.05. In this case, the goal is 130.48 and in the range of 130.48 - 130.86 is the short-term upward movement, as well as consolidation. The potential value for the top is considered the level of 131.60, the movement to which is expected after the breakdown of 130.90.

The short-term downward movement is possible in the range of 129.48 - 129.16 and the breakdown of the last value will lead to a prolonged correction. Here, the goal is 128.56 and this level is the key support for the top.

The main trend is the upward structure of October 26.

Trading recommendations:

Buy: 130.05 Take profit: 130.45

Buy: 130.53 Take profit: 130.82

Sell: 129.48 Take profit: 129.20

Sell: 129.10 Take profit: 128.60

For the Pound / Yen currency pair, the key levels on the H1 scale are: 148.16, 147.51, 147.02 and 146.22. Here, we are not considering further targets for the upward movement, and we expect a rollback to correction to take place, which should occur after the breakdown of 148.16. In this case, the first target is 147.51. The short-term downward movement is possible in the range of 147.51 - 147.02 and the breakdown of the latter value will lead to the movement to the level of 146.22 and design of the expressed initial conditions for the downward cycle.

The main trend is the upward cycle from October 26, we expect to go into correction.

Trading recommendations:

Buy: Take profit:

Buy: Take profit:

Sell: 148.16 Take profit: 147.55

Sell: 147.46 Take profit: 147.04