- Fundamental analysis

What to Pay Attention to on April 7? A Breakdown of Fundamental Events for Beginners

There are very few macroeconomic events scheduled for Monday. After last week's developments, we believe these events will have no impact on the movements of either currency pair. Nonetheless, today'sAuthor: Paolo Greco

07:03 2025-04-07 UTC+2

3

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair showed a sharp decline on Friday, which is extremely difficult to explain—even in hindsight. Yes, the British poundAuthor: Paolo Greco

06:57 2025-04-07 UTC+2

13

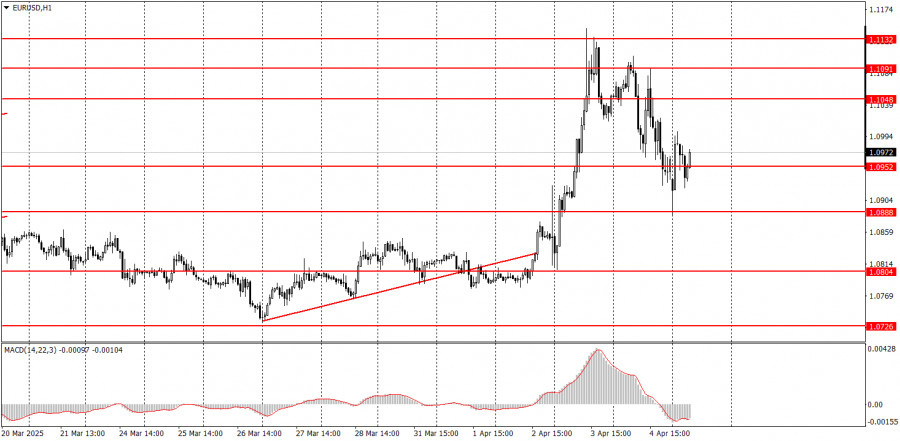

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair remained in stormy conditions on Friday. This time, a downward movement prevailed—but that didn't make things any easierAuthor: Paolo Greco

06:57 2025-04-07 UTC+2

3

- Fundamental analysis

EUR/USD Weekly Preview: U.S. Inflation Reports and the Fate of the "Big Tariffs"

The upcoming week promises to be just as volatile as the previous one. The so-called "big tariffs," which are set to take effect on April 9, are at the centerAuthor: Irina Manzenko

06:13 2025-04-07 UTC+2

8

Last Friday, global markets continued to decline — albeit unevenly: the S&P 500 fell by 5.97%, oil by 7.41%, commodity currencies lost around 2% on average, and the yieldAuthor: Laurie Bailey

05:20 2025-04-07 UTC+2

21

On Friday, the British pound collapsed by an impressive 200 pips. This morning, the price tested the target range of 1.2816/47, which it had slightly missed on FridayAuthor: Laurie Bailey

05:20 2025-04-07 UTC+2

11

- AUD/USD This morning, the Australian dollar reached the target support level at 0.5943. The day opened with a downward gap, which remains unfilled for now. The Marlin oscillator is beginning

Author: Laurie Bailey

05:20 2025-04-07 UTC+2

9

S&P 500 This morning, the futures contract on the U.S. stock index S&P 500 reached a strong support level at 4817 — the peak from 2021 (which will onlyAuthor: Laurie Bailey

05:20 2025-04-07 UTC+2

9

Fundamental analysisGBP/USD Pair Overview – April 7. The British Pound Delivered a Major Surprise on Friday

The GBP/USD currency pair rose 280 pips between Wednesday and Thursday, only to crash by 340 on Friday. These kinds of "flights" have become a regular occurrence lately. WhileAuthor: Paolo Greco

03:23 2025-04-07 UTC+2

15