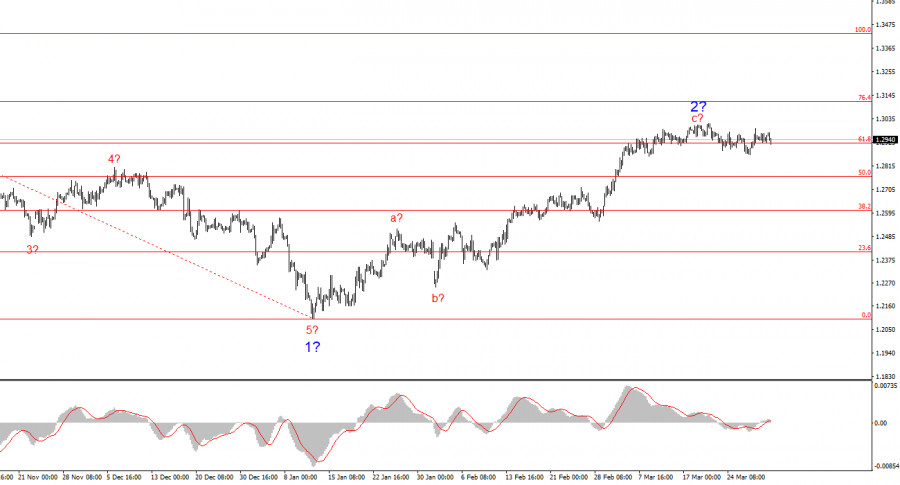

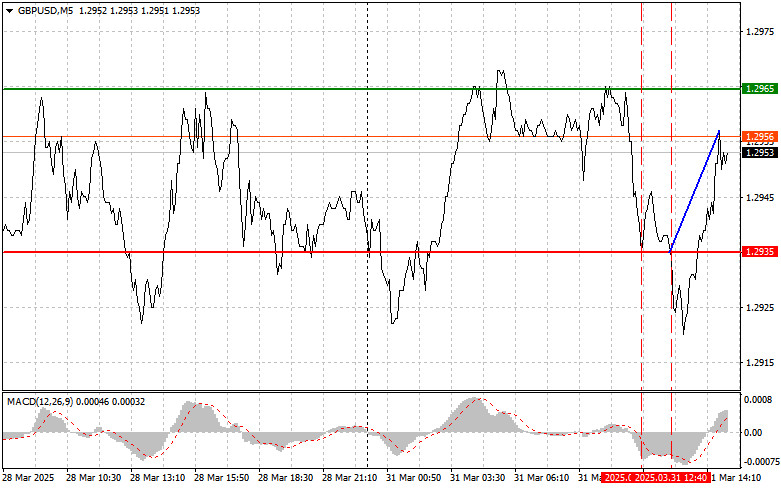

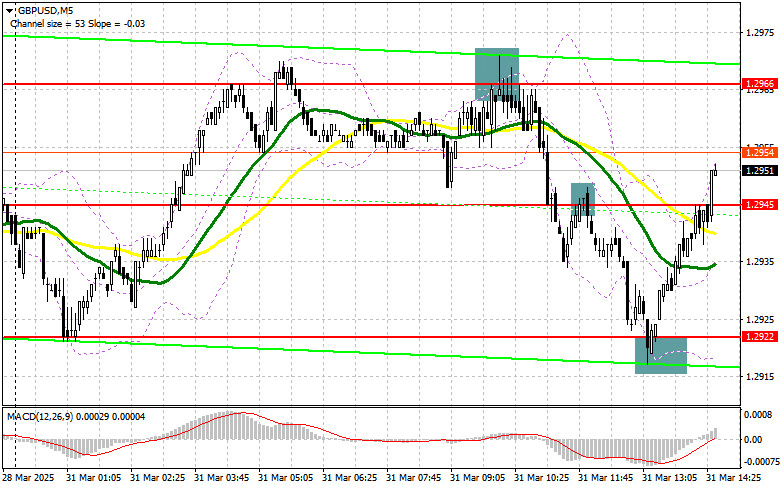

Investors are moving away from the dollar, and recent price movements suggest that some drivers who have been cheering on the dollar this year are starting to lose strength. If the dynamics will be the same, the "bullish" rally of the dollar will end. It is too early to talk about it, but the momentum is definitely downward. In 2018, there are 4 main factors that led to the growth of the dollar: a strong economic recovery, rising interest rates, pressure on the stock market, and a trade conflict. Although recent reports indicate an increase in consumer prices and consumer spending, which is growing at the fastest pace in the last five months, demand growth does not make such a strong impression. However, more importantly, the position of officials of the US Federal Reserve System (FRS) is becoming less hawkish. Last week, the head of the regulator Jerome Powell expressed his concern about the pressures on the economy that will be present in 2019, and Vice Chairman Richard Clarida said there are signs of a decline in global growth, which should be taken into account by the US Central Bank. So, R. Clarida does not expect a strong acceleration of inflation in 2018. Although both politicians are still confident in the American economy to raise rates again in December, there is a chance that next month's meeting will be accompanied by the publication of a less hawkish forecast. No major releases are foreseen for the United States this week, a change in sentiment of Fed policymakers may increase the pressure on the dollar in the thin market.The GBP will still hold close attention, since Theresa May, the prime minister of the United Kingdom, can be given a vote of no confidence. Last week, the pound sterling fell by more than 1.5% in one day, as the process of negotiating a deal to leave the country from the European Union is again at an impasse. The situation is still developing, however, according to one analyst, "Conservatives can get enough votes for a vote of no confidence in the prime minister who will be put to the vote in parliament. If the opposition gets votes, then the British government will plunge into an even stronger crisis. Even if Theresa May wins the vote, the general election is almost unavoidable, since the Prime Minister's coalition partners, represented by the Irish Democratic Unionist Party, are against the current draft of the deal and are likely to leave the government. The possibility of a general election on the eve of the March deadline for secession from the EU will create even greater chaos in the already volatile political arena. The first reaction of the market will be to reduce the pound to a level of 1.2500."Macroeconomic statistics has deteriorated, consumer inflation and retail sales have slowed. If this trend continues, the GBP will be difficult to support the upward movement.

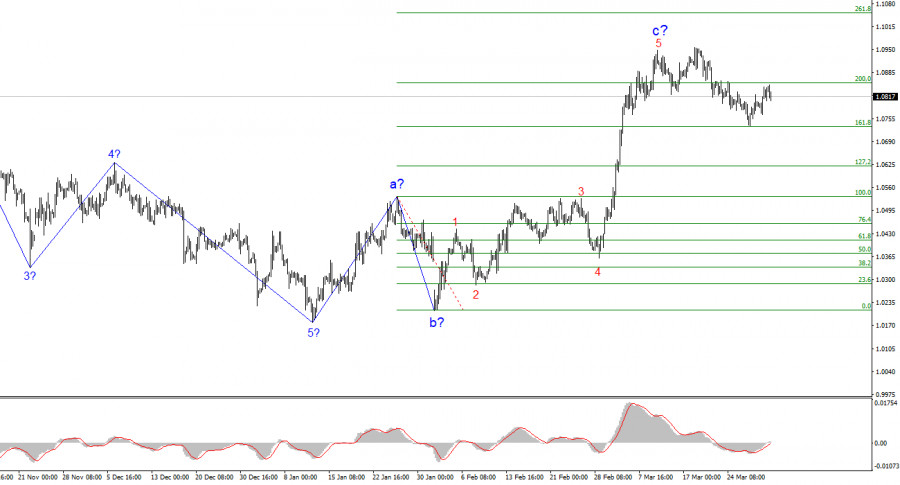

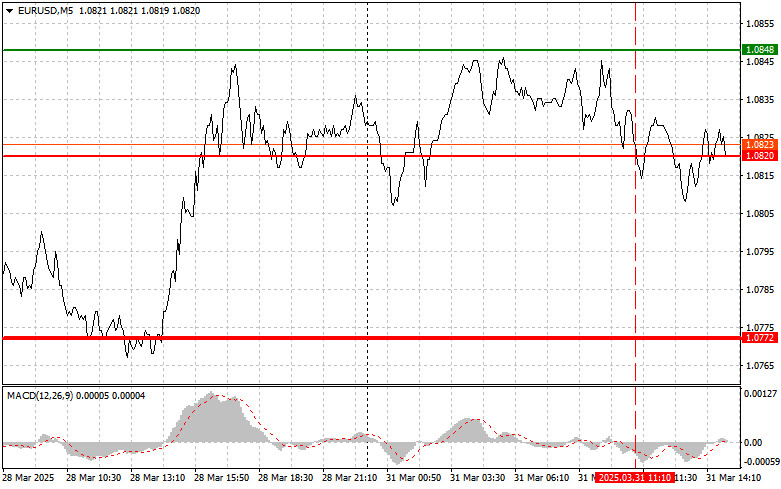

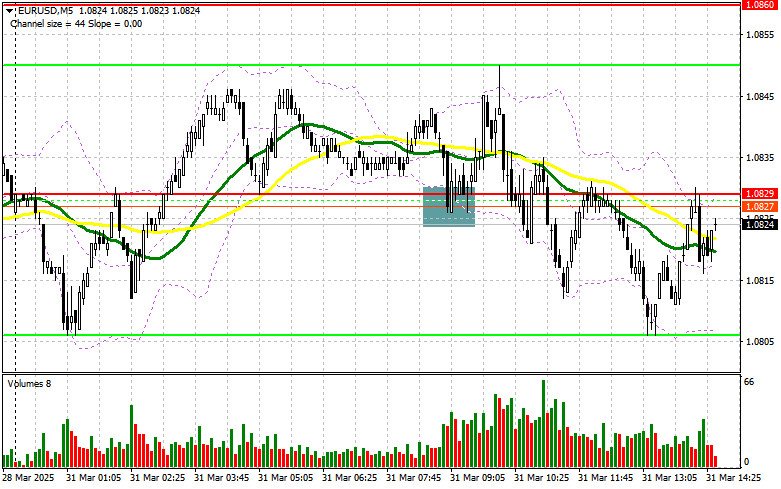

Despite the difficulties in the UK, the past week was excellent for the single European currency, which for the first time in a month, passed the 20-day moving average. The euro did not pay attention to the weakness of last week's macro statistics, including the ZEW survey for Germany, GDP for Q3 and the trade balance of the Euro block. EUR is almost completely dependent on the demand for the dollar and risk appetite. It is predicted that this week, the dynamics will not change, as the currency will be indifferent to any weakness in the reports on producer prices in Germany or business activity in the eurozone. It is expected that the growth of the EUR / USD pair will rise to 1.15, and probably even 1.1550, helped by the recovery of the stock market and the reduction of the dollar.

Last Friday, all three commodity currencies were trading in the "green zone". The Australian dollar rose to a two-month high, the New Zealand dollar, to a maximum of four months. AUD and NZD have grown amid hopes that Donald Trump will not introduce a new round of tariffs for China. Since the mid-term elections, the rhetoric of the American leader regarding the PRC has softened. The president said that the Chinese government sent a list of changes, which are ready to go to trade for a deal. D. Trump believes that the list is quite complete, stating that the United States also hopes for a deal, but so far there are no acceptable conditions for this. The American president said that the United States may not have to introduce new tariffs for Beijing. Something similar has happened more than once, so there is no reason to think that the trade war has come to an end until both parties make an official announcement. In the meantime, two weeks are left before the G20 summit, and it seems that optimism about trade negotiations will lead to an increase in AUD and NZD.In a pair of USD / CAD on a technical basis, the pair reached a maximum of 1.3260. Having risen to a maximum of three months last week, the USD / CAD rally has declined amid the weakness of the US currency. Taking into account the recent losses of the currency and the reduction in oil prices, it is not even believed that the Central Bank of Canada remains resolute. During their last monetary policy meeting, Canadian officials said that "The interest rate should be adjusted to the norm in order to achieve the target inflation rate. This view will be tested at the end of this week, as expected output of consumer price index and retail sales of Canada. Strong data will confirm optimism and lead the pair to the level of 1.30."