Forecast for January 23:

Analytical review of currency pairs on the scale of H1:

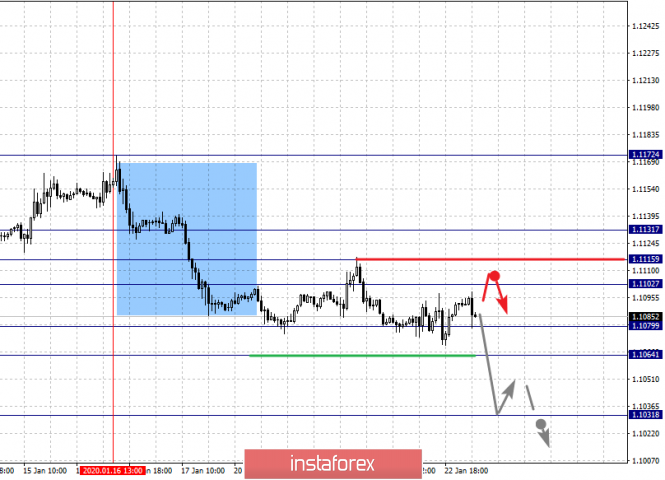

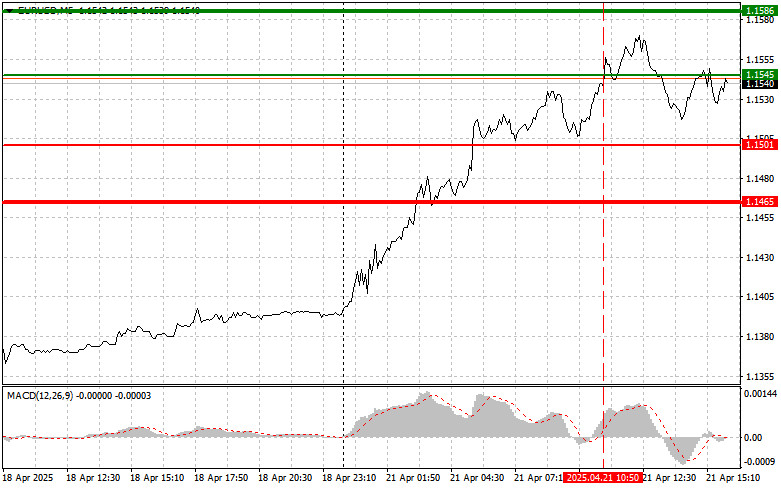

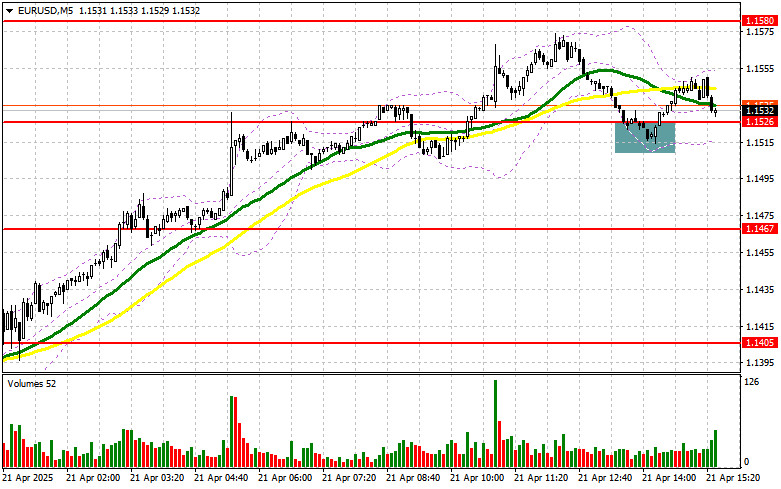

For the euro / dollar pair, the key levels on the H1 scale are: 1.1131, 1.1115, 1.1102, 1.1079, 1.1064 and 1.1031. Here, we are following the descending structure of January 16. Short-term downward movement is expected in the range of 1.1079 - 1.1064. The breakdown of the last value will lead to a pronounced movement. Here, the potential target is 1.1031. We expect a pullback to the top from this level.

Short-term upward movement is possibly in the range 1.1102 - 1.1159. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1131. This level is a key support for the downward structure.

The main trend is the descending structure of January 16

Trading recommendations:

Buy: 1.1102 Take profit: 1.1113

Buy: 1.1116 Take profit: 1.1130

Sell: 1.1078 Take profit: 1.1065

Sell: 1.1063 Take profit: 1.1034

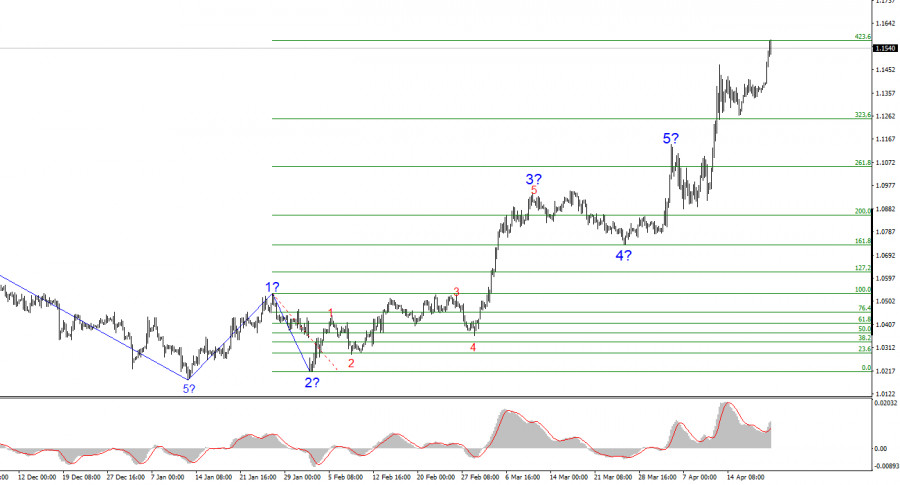

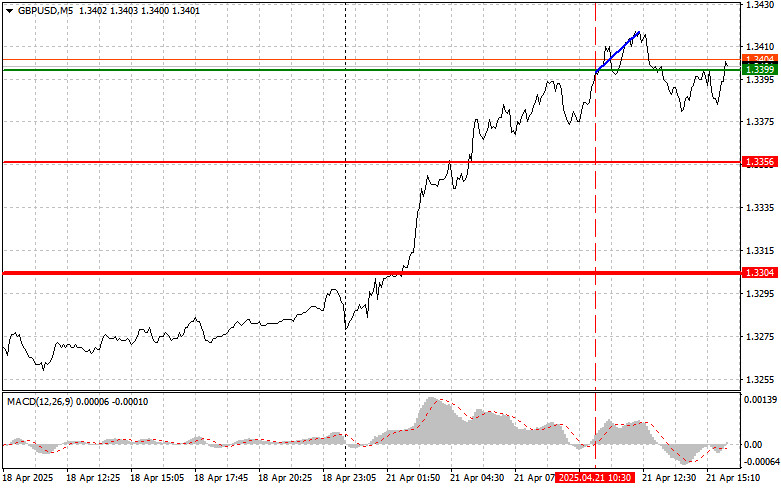

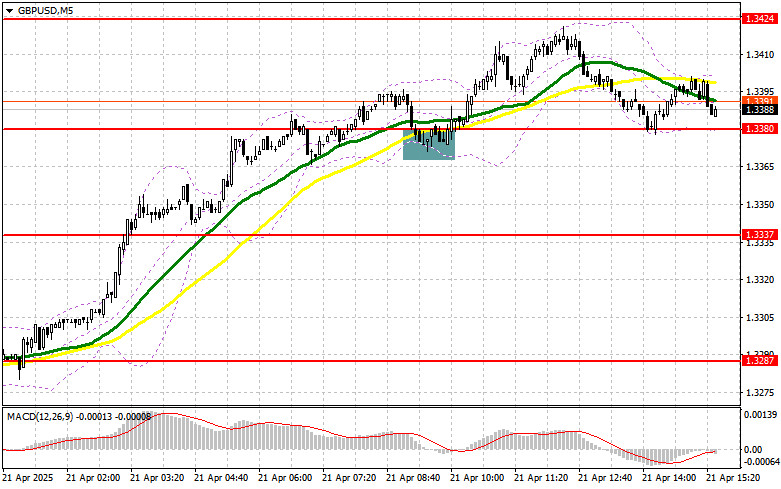

For the pound / dollar pair, the key levels on the H1 scale are: 1.3251, 1.3207, 1.3174, 1.3128, 1.3108, 1.3080 and 1.3035. Here, we continue to follow the upward cycle of January 20. Short-term upward movement is expected in the range 1.3174 - 1.3207. The breakdown of the latter value will lead to movement to a potential target - 1.3251. We expect a pullback to the bottom from this level.

Short-term downward movement is possibly in the range of 1.3128 - 1.3108. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3080. This level is a key support for the top, its passage at the price will lead to the formation of initial conditions for the downward movement. In this case, the goal is 1.3035.

The main trend is the upward structure of January 20

Trading recommendations:

Buy: 1.3175 Take profit: 1.3205

Buy: 1.3208 Take profit: 1.3250

Sell: 1.3128 Take profit: 1.3109

Sell: 1.3106 Take profit: 1.3080

For the dollar / franc pair, the key levels on the H1 scale are: 0.9809, 0.9778, 0.9758, 0.9727, 0.9686, 0.9667 and 0.9643. Here, we are following the development of the ascending structure of January 16. The continuation of the movement to the top is expected after the breakdown of the level of 0.9727. In this case, the target is 0.9758. Short-term upward movement, as well as consolidation is in range of 0.9758 - 0.9778. We consider the level of 0.9809 to be a potential value for the upward movement; upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 0.9686 - 0.9667. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9643. This level is a key support for the top.

The main trend is the upward cycle of January 16

Trading recommendations:

Buy : 0.9727 Take profit: 0.9756

Buy : 0.9758 Take profit: 0.9776

Sell: 0.9665 Take profit: 0.9645

Sell: 0.9640 Take profit: 0.9616

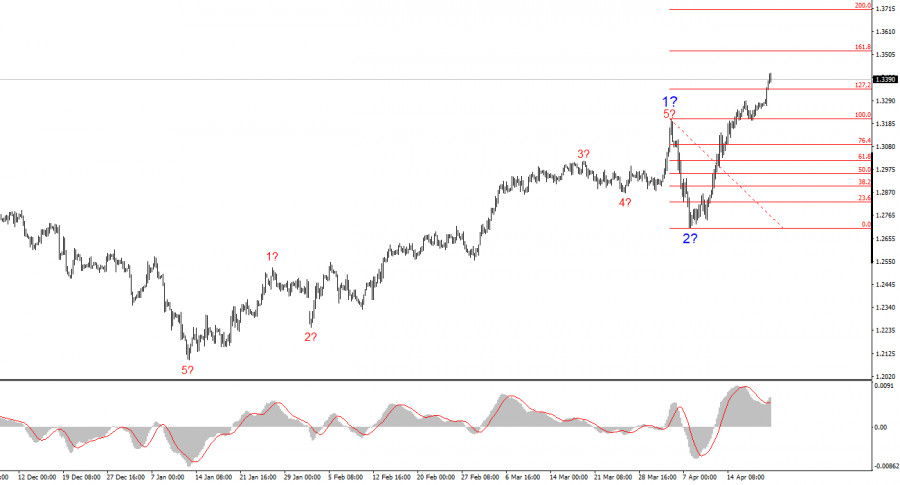

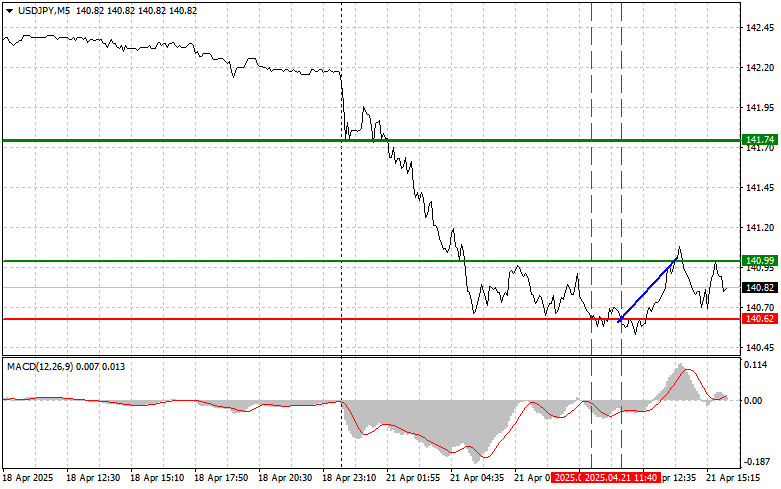

For the dollar / yen pair, the key levels on the scale are : 111.38, 110.78, 110.39, 109.81, 109.58 and 109.23. Here, the price holds the downside potential of January 20. Short-term downward movement, as well as consolidation are possible in the range 109.81 - 109.58. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 109.23. This level is a key support for the top.

The continuation to the top is possibly after a breakdown of the level of 110.39. In this case, the first target is 110.78. The breakdown of the level of 110.80 should be accompanied by a pronounced upward movement. Here, the potential target is 111.38.

Main trend: potential downward structure of January 20

Trading recommendations:

Buy: 110.40 Take profit: 110.76

Buy : 110.80 Take profit: 111.35

Sell: Take profit:

Sell: 109.55 Take profit: 109.25

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3234, 1.3193, 1.3178, 1.3159, 1.3126, 1.3109 and 1.3083. Here, the price registered the local upward structure of January 22. The continuation of the movement to the top is expected after the breakdown of the level of 1.3160. In this case, the target is 1.3178. Price consolidation is near this level. Passing at the price of the noise range 1.3178 - 1.3193 will lead to a movement to a potential target - 1.3234. We expect a pullback to the bottom from this level.

Short-term downward movement is possibly in the range of 1.3126 - 1.3109. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3083.

The main trend is the local ascending structure of January 22.

Trading recommendations:

Buy: 1.3160 Take profit: 1.3178

Buy : 1.3194 Take profit: 1.3234

Sell: 1.3126 Take profit: 1.3110

Sell: 1.3107 Take profit: 1.3085

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6885, 0.6867, 0.6853, 0.6820, 0.6867 and 0.6885. Here, we are following the development of the descending structure of January 16. Short-term downward movement is expected in the range 0.6820 - 0.6803. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 0.6781. For the potential value for the bottom, we consider the level of 0.6763. Upon reaching which, we expect consolidation, as well as a rollback to the top.

Short-term upward movement is expected in the range of 0.6867 - 0.6885. The breakdown of the latter value will lead to the formation of initial conditions for the top. In this case, the potential target is 0.6910.

The main trend is the descending structure of January 16, the correction stage

Trading recommendations:

Buy: Take profit:

Buy: 0.6868 Take profit: 0.6883

Sell : 0.6820 Take profit : 0.6804

Sell: 0.6802 Take profit: 0.6784

For the euro / yen pair, the key levels on the H1 scale are: 122.68, 122.27, 122.00, 121.47, 121.06 and 120.59. Here, we are following the descending structure of January 16. The continuation of movement to the bottom is expected after the breakdown of the level of 121.45. In this case, the goal is 121.06. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 120.59. Upon reaching which, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 122.00 - 122.27. The breakdown of the last value will lead to the formation of initial conditions for the top. In this case, the potential target is 122.68.

The main trend is the descending structure of January 16

Trading recommendations:

Buy: 122.00 Take profit: 122.25

Buy: 122.30 Take profit: 122.65

Sell: 121.45 Take profit: 121.10

Sell: 121.04 Take profit: 120.60

For the pound / yen pair, the key levels on the H1 scale are : 146.41, 145.92, 144.99, 144.53, 143.92, 143.51 and 143.09. Here, we determined the next goals for the top from the local structure on January 21. Short-term upward movement is expected in the range of 144.53 - 144.99. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 145.92. For the potential value for the top, we consider the level of 146.41. Upon reaching this level, we expect consolidation, as well as a pullback to the bottom.

A short-term downward movement is possibly in the range of 143.92 - 143.51. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 143.09. This level is a key support for the top.

The main trend is the local ascending structure of January 21

Trading recommendations:

Buy: 144.53 Take profit: 144.95

Buy: 145.00 Take profit: 145.90

Sell: 143.90 Take profit: 143.54

Sell: 143.50 Take profit: 143.10