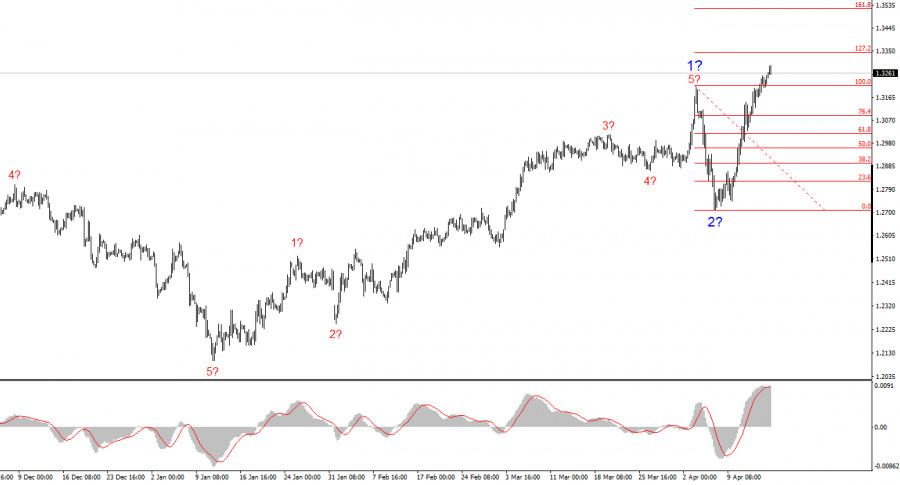

24-hour timeframe

The British pound with grief in half on the 24-hour timeframe is moving down. The most surprising thing is that before the start of the current downward trend, an upward trend was observed, which was quite strong, although we have repeatedly noted all the unfounded growth of the British currency. Recall that the last time the pound strengthened was due to the traders' expectations of Boris Johnson's victory in the parliamentary elections. Then this victory was identified with the long-awaited end of Brexit, with Brexit having a deal, since Johnson managed to come to an agreement with Brussels when no one else believed in it. Once again: these expectations provoked a full-blown growth of the British currency. February 2020 is now ending, that is, two and a half months have passed since those events. The probability of Britain leaving the EU at the end of 2020 with a deal fell to 20-30%, although there is a formal agreement with Brussels. Only now the parties have now to agree on how they will coexist with each other after 2020, and a huge number of problems have already emerged with this process, and the negotiations themselves have not even begun. Macroeconomic statistics continued to deteriorate in these 2.5 months, the Bank of England with outgoing Mark Carney surprised the markets, not one step closer to easing monetary policy, in general, there is still no reason to expect the emergence of fundamental support factors. But at the same time, traders are in no hurry to get rid of the UK currency. Either they expect it when really disappointing information begins to arrive, or now the GBP/USD pair has encountered a paradoxical situation in which the euro has been for several months. Recall that the paradoxical situation for the euro ended in a collapse of 300 points, which, with an average daily volatility of about 40 points, is quite a lot. Moreover, the euro fell by only 200 points for the whole of 2019. Thus, we believe that everything will ultimately end in a fall for the pound sterling. We continue to believe that it is the pound that remains extremely overbought paired with the US dollar, and not vice versa.

A large number of macroeconomic statistics were published in the UK last week. Someone could say that most of this package of statistics turned out to be positive. We believe that behind this whole "positive" wrapper lies a "negative" filling. Let's start with the average wage in the UK. And taking into account bonuses, and without taking into account thereof, the growth rate decreased. Inflation in January accelerated in annual terms to 1.8%, but in monthly terms it fell by 0.3%, which, in essence, means precisely deflation in January. Retail sales in Great Britain grew by 0.8% y/y and 0.9% m/m, exceeding forecast values. Only here the value of the previous month was higher, and the current annual growth rate of retail sales fell to the lows of October 2017. The CBI Industrial Orders Report also exceeded forecast values and amounted to -18. Finally, on Friday preliminary data on business activity for February in the sectors of services and production were published and only these data can really be considered positive and encouraging for the British pound. However, while in the manufacturing sector an increase was recorded to 51.9, then in the services sector, on the contrary, a decrease to 53.3. Thus, in fact, only one indicator of the week from the UK can be considered positive. These are the results of the past week. Of course, statistics from the United States helped the British pound a lot on Friday, as both Markit business activity indices declined, but it's too early to say that the US economy was starting to have problems, which could theoretically help the British currency.

Thus, from our point of view, the general conclusions for the British pound remain disappointing. There is still no fundamental reason for growth. The Bank of England still has to seriously consider reducing the key rate, although it will no longer do so with Carney at the head. A sufficient number of potential risk situations may arise in 2020, and the British economy continues to lose 70 billion a year.

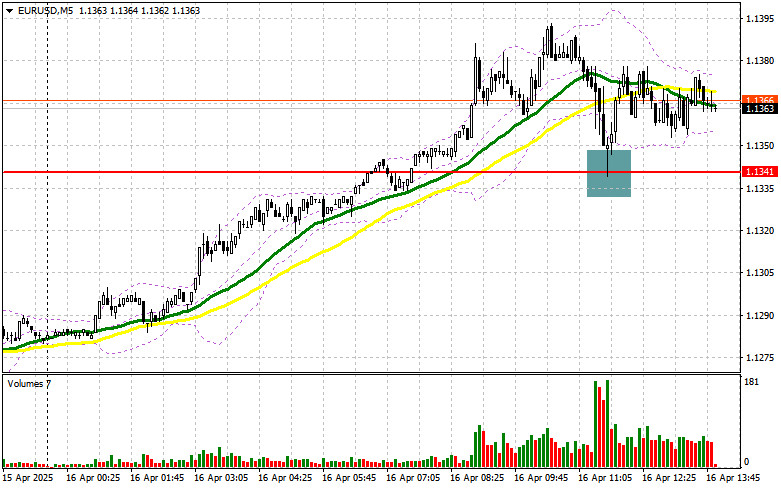

From a technical point of view, the next round of correctional movement against the Dead Cross began on the 24-hour timeframe. Bollinger Bands continue to remain down. Thus, sell orders remain relevant in general. From a fundamental point of view, until traders receive really important and really strong information, one cannot count on the continued growth of the British pound.

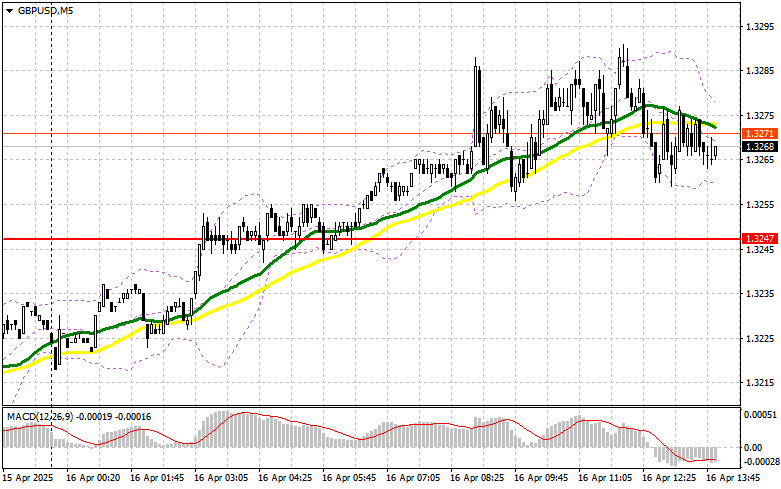

Trading recommendations:

The pound/dollar pair started an upward correction on the 24-hour timeframe. Thus, at the moment, the sale of the pound is recommended with the target support levels of 1.2838 and 1.2724, but after the correction is completed, that is, after the price rebounds from the critical Kijun-sen line. Shorts are also relevant on the 4-hour timeframe, but only if there is a Dead Cross and the price is below the critical line.

Explanation of the illustration:

Ichimoku indicator:

Tenkan-sen is the red line.

Kijun-sen is the blue line.

Senkou Span A - light brown dotted line.

Senkou Span B - light purple dashed line.

Chikou Span - green line.

Bollinger Bands Indicator:

3 yellow lines.

MACD indicator:

Red line and bar graph with white bars in the indicators window.