Forecast for March 27 :

Analytical review of currency pairs on the scale of H1:

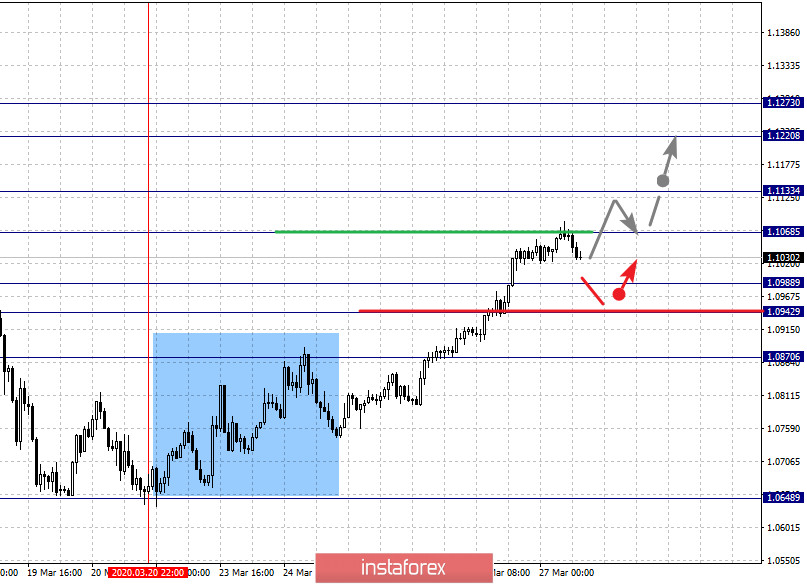

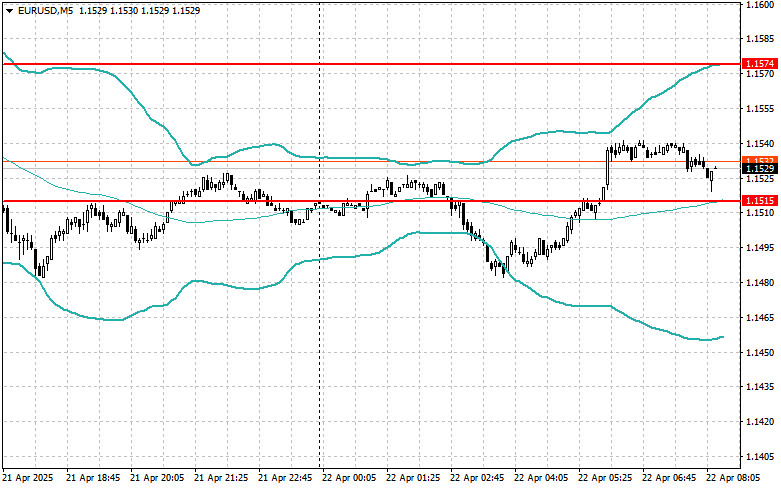

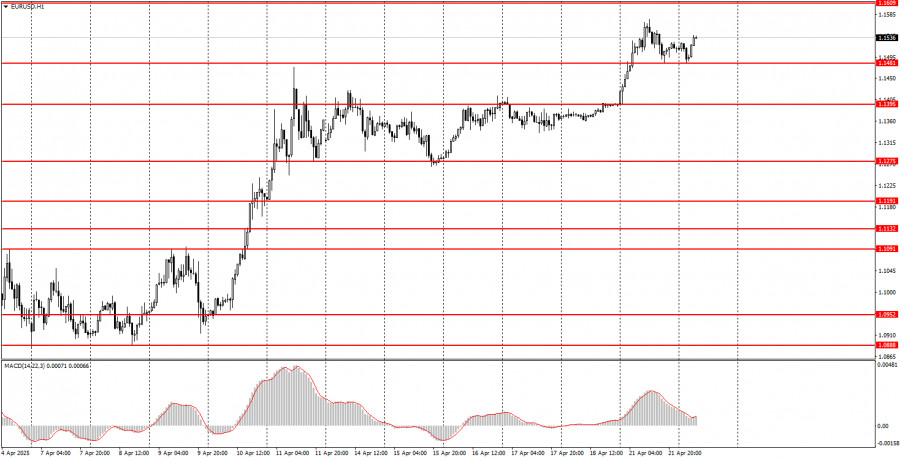

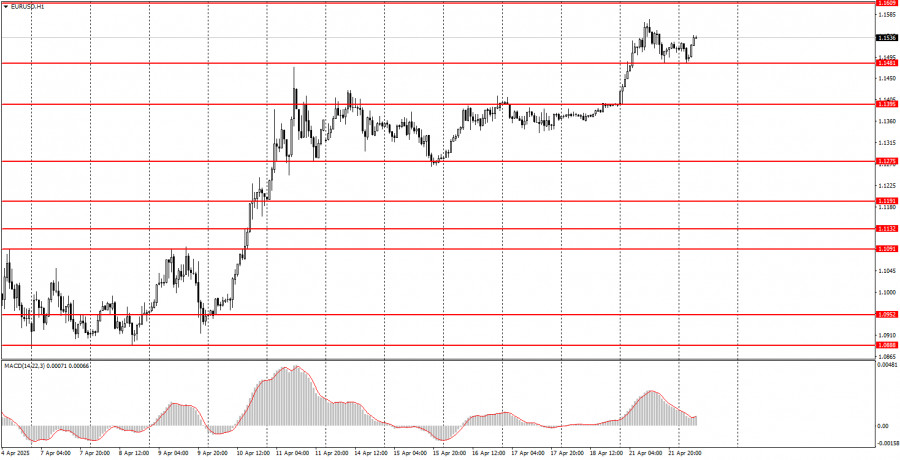

For the euro / dollar pair, the key levels on the H1 scale are: 1.1273, 1.1220, 1.1133, 1.1068, 1.0988, 1.0942 and 1.0870. Here, we are following the development of the ascending structure of March 20. Short-term upward movement is expected in the range of 1.1068 - 1.1133. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 1.1220. For the potential value for the top, we consider the level of 1.1273. Upon reaching which, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 1.0988 - 1.0942. The breakdown of the latter value will lead to an in-depth correction. Here, the potential target is 1.0870. This level is a key support for the top.

The main trend is the upward structure of March 20

Trading recommendations:

Buy: 1.1068 Take profit: 1.1130

Buy: 1.1135 Take profit: 1.1220

Sell: 1.0988 Take profit: 1.0944

Sell: 1.0940 Take profit: 1.0870

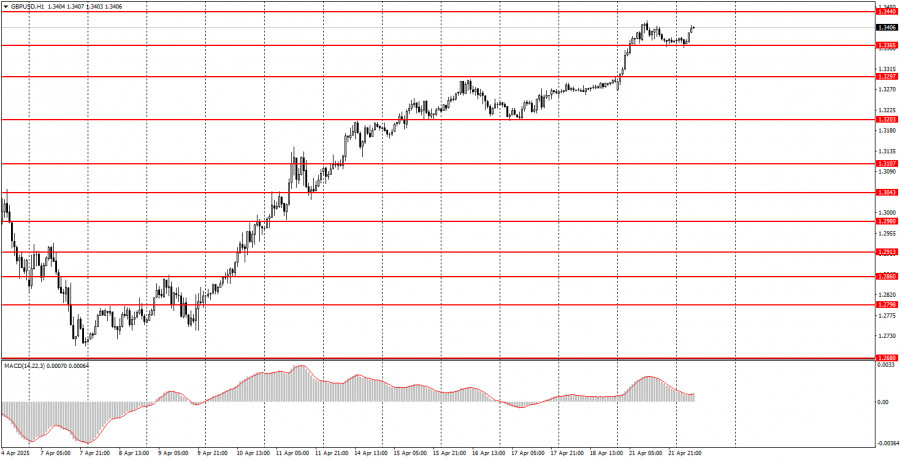

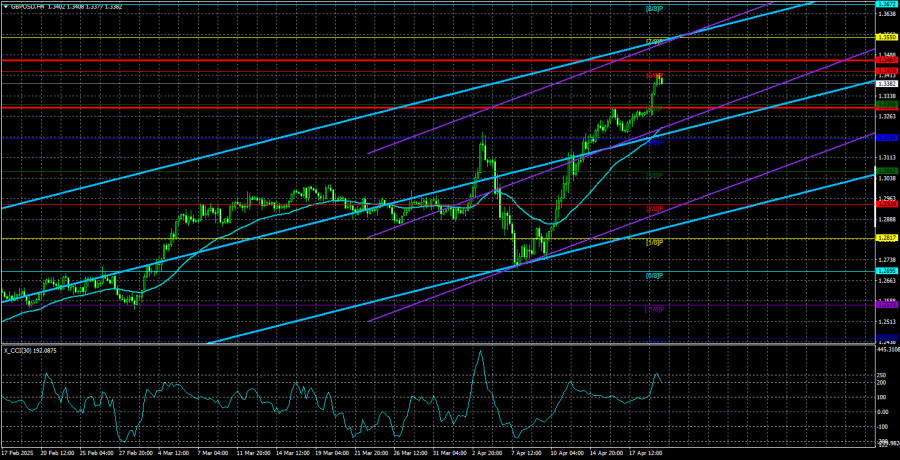

For the pound / dollar pair, the key levels on the H1 scale are: 1.2654, 1.2550, 1.2378, 1.2261, 1.2099, 1.1995 and 1.1851. Here, we are following the development of the upward cycle of March 19. Short-term upward movement is expected in the range of 1.2261 - 1.2378. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 1.2550. We consider the level of 1.2654 to be a potential value for the ascending structure. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is expected in the range of 1.2099 - 1.1995. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1851. This level is a key support for the top.

The main trend is the upward cycle of March 19

Trading recommendations:

Buy: 1.2261 Take profit: 1.2376

Buy: 1.2380 Take profit: 1.2550

Sell: 1.2099 Take profit: 1.1997

Sell: 1.1993 Take profit: 1.1855

For the dollar / franc pair, the key levels on the H1 scale are: 0.9734, 0.9682, 0.9647, 0.9579, 0.9533, 0.9464 and 0.9424. Here, we are following the formation of the descending structure of March 20. The continuation of movement to the bottom is expected after the breakdown of the level of 0.9579. In this case, the target is 0.9533. Price consolidation is near this level. The breakdown of the level of 0.9530 will lead to the development of pronounced movement. Here, the goal is 0.9464. For the potential value for the downward trend, we consider the level of 0.9424, upon reaching which, we expect a pullback to the top.

Short-term upward movement is expected in the range of 0.9647 - 0.9682. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.9734.

The main trend is the downward cycle of March 20

Trading recommendations:

Buy : 0.9647 Take profit: 0.9680

Buy : 0.9684 Take profit: 0.9734

Sell: 0.9579 Take profit: 0.9535

Sell: 0.9530 Take profit: 0.9466

For the dollar / yen pair, the key levels on the scale are : 110.30, 109.55, 109.04, 107.97, 107.34, 106.56 and 106.10. Here, we are following the development of the descending structure of March 25. Short-term downward movement is expected in the range of 107.97 - 107.34. The breakdown of the last value should be accompanied by a pronounced movement to the level of 106.56. For the potential value for the bottom, we consider the level of 106.10, upon reaching which, we expect consolidation, as well as a pullback to the top.

Short-term upward movement is possibly in the range of 109.04 - 109.55. The breakdown of the last value will lead to an in-depth correction. Here, the target is 110.30. This level is a key support for the downward structure.

Main trend: The downward trend of March 25

Trading recommendations:

Buy: 109.04 Take profit: 109.53

Buy : 109.57 Take profit: 110.30

Sell: 107.95 Take profit: 107.36

Sell: 107.30 Take profit: 106.56

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4344, 1.4215, 1.4119, 1.3956, 1.3747, 1.3615 and 1.3425. Here, we are following the development of the descending cycle of March 19. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3956. In this case, we expect a pronounced movement. Here, the target is 1.3747. Short-term downward movement, as well as consolidation is in the range of 1.3747 - 1.3615. For the potential value for the bottom, we consider the level of 1.3425. Upon reaching this level, we expect a pullback to the top.

Short-term upward movement is possibly in the range of 1.4119 - 1.4215. The breakdown of the latter value will lead to an in-depth correction. Here, the potential target is 1.4344. This level is a key support for the downward structure.

The main trend is the descending structure of March 19.

Trading recommendations:

Buy: 1.4120 Take profit: 1.4215

Buy : 1.4217 Take profit: 1.4344

Sell: 1.3954 Take profit: 1.3750

Sell: 1.3745 Take profit: 1.3620

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6596, 0.6511, 0.6352, 0.6241, 0.6031, 0.5935 and 0.5779. Here, we are following the development of the upward cycle of March 19. At the moment, we expect a movement to the level of 0.6241. Short-term downward movement, as well as consolidation is in the range of 0.6241 - 0.6352. The breakdown of the level of 0.6352 will lead to a pronounced upward movement. Here, the potential target is 0.6595. Price consolidation is in the range of 0.6595 - 0.6511.

Short-term downward movement is possibly in the range of 0.6031 - 0.5935. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.5779. This level is a key support for the top.

The main trend is the upward structure of March 19

Trading recommendations:

Buy: 0.6241 Take profit: 0.6350

Buy: 0.6354 Take profit: 0.6511

Sell : 0.6030 Take profit : 0.5935

Sell: 0.5933 Take profit: 0.5780

For the euro / yen pair, the key levels on the H1 scale are: 124.47, 123.42, 121.83, 120.62, 119.35, 118.66, 117.73 and 116.27. Here, we are following the development of the ascending structure of March 12. Short-term upward movement is expected in the range of 120.62 - 121.83. The breakdown of the last value will lead to a pronounced movement. Here, the target is 123.42. For the potential value for the top, we consider the level of 124.47. Upon reaching which, we expect consolidation, as well as a pullback to the bottom.

Short-term downward movement is possibly in the range of 119.35 - 118.66. The breakdown of the latter value will lead to an in-depth correction. Here, the goal is 117.73. This level is a key support for the top.

The main trend is the upward structure of March 12

Trading recommendations:

Buy: 120.62 Take profit: 121.80

Buy: 121.85 Take profit: 123.40

Sell: 119.35 Take profit: 118.70

Sell: 118.62 Take profit: 117.75

For the pound / yen pair, the key levels on the H1 scale are : 140.54, 138.12, 136.99, 134.93, 133.59, 131.58, 129.78 and 127.47. Here, we are following the development of the upward cycle of March 18. Short-term upward movement is expected in the range of 133.59 - 134.93. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 136.99. Price consolidation is in the range of 136.99 - 138.12. For the potential value for the top, we consider the level of 140.54. Upon reaching this level, we expect a pullback to the bottom.

Short-term downward movement is possibly in the range of 131.58 - 129.78. The breakdown of the latter value will lead to in-depth movement. Here, the target is 127.47. This level is a key support for the upward structure.

The main trend is the upward cycle of March 18

Trading recommendations:

Buy: 133.60 Take profit: 134.90

Buy: 134.95 Take profit: 136.99

Sell: 131.58 Take profit: 129.80

Sell: 129.70 Take profit: 127.50