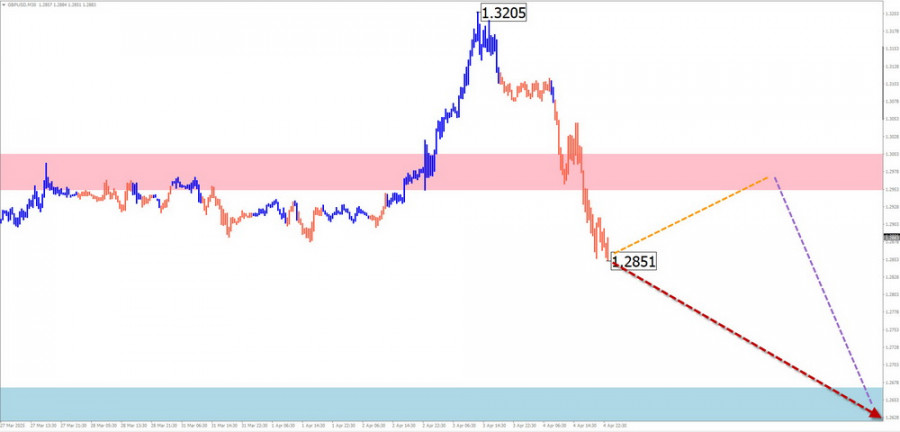

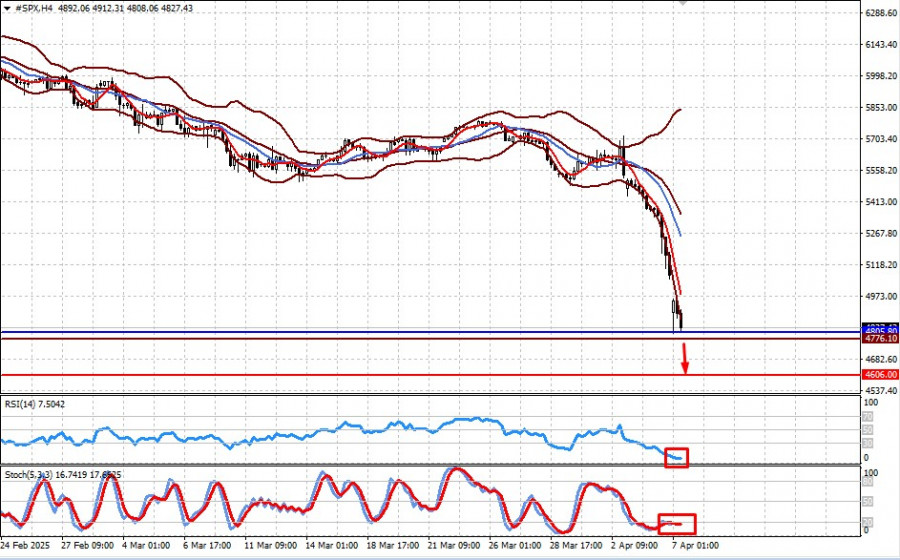

4-hour timeframe

Technical details:

Higher linear regression channel: direction - sideways.

Lower linear regression channel: direction - sideways.

Moving average (20; smoothed) - sideways.

CCI: 10.4497

The EUR/USD currency pair starts in a downward correction on Tuesday, May 5. The day before, the euro/dollar pair worked out the moving average line, so it keeps the chances of resuming the upward movement. However, we believe that after overcoming the moving average, the pair will rush to the Murray level of "0/8"-1.0742, which is also the lower border of the side channel. We also note that the lower channel of linear regression is directed sideways, while the higher channel turns down, which also increases the probability of overcoming the moving average line. Also, the US dollar may be in demand due to the heat of passions between China and the US, and in such cases, the US currency is often in demand as the most secure, according to investors and traders.

Meanwhile, the United States led by Donald Trump, who already feels that the chances of winning the election in November 2020 are rapidly falling, continue to "investigate" the leak of "coronavirus" from a Chinese laboratory in Wuhan. We deliberately put the word "investigation" in quotation marks, because in fact, no ordinary citizen can say with certainty whether there is any investigation at all. The White House can say anything and show no evidence of it. In fact, in most cases, Donald Trump and his supporters do so. Thus, we have little doubt that Washington will find evidence of anything in China. It is clear that the whole world, including the United States, is suffering from the "Chinese" pandemic. Even if the virus broke free completely by accident and there was no malicious intent or deliberate concealment of the facts on the part of Beijing, in any case, China is to blame for the leak of the infection, due to which the whole world is now suffering. Therefore, it is also possible to understand all the countries of the world that are now making claims to the Chinese side. The economies of all countries have suffered, and a series of bankruptcies of airlines and oil companies is expected, not to mention small and medium-sized businesses. Thus, Washington has the right to make claims. And no one will ever know the truth. No one will ever know whether the virus escaped from the Wuhan laboratory by accident or whether it was deliberately spread, whether the Chinese rulers were hiding and are now hiding the real scale of infection and mortality? And the most important question is, what is the current situation with the pandemic in China? Despite the fact that China has done a great job in quarantining and localizing the virus, it is very difficult to believe that in recent months there have been no new cases of infection. And according to official information, this is exactly the case.

Donald Trump is considering the introduction of new sanctions and duties against China seriously. In one of the regular interviews that Trump gives out every day, he hinted that raising trade duties is one of the tools in negotiations with Beijing. "We all play a difficult game: chess or poker... It's not checkers, that's what I'll tell you," Trump said, hinting that China will be held accountable to the full extent of American laws. At the same time, the US special services conducted an investigation and concluded that China in early January really hid the scale of the epidemic and the high degree of contagion of the new virus in order to more easily purchase medical protection and necessary medicines. US intelligence agencies concluded that China reduced exports of some medical products in January and increased its imports while hiding and denying these facts.

In turn, Secretary of State Michael Pompeo said that China deliberately misinformed the West. "This is a classic attempt at Communist disinformation," Mr. Pompeo said. "Beijing has done everything possible to prevent Western countries from learning in time about the true scale of the epidemic, or about the health threat posed by coronavirus infection." Pompeo also said that China has denied the West access to American doctors and specialists to the data and location of the new virus. So they're not going to cooperate. Thus, whether it is true or not, the United States already formally have the evidence on their hands. Now it is the turn for sanctions or, more simply, retaliatory actions. From our point of view, relations between China and the United States are now becoming complicated many times. If China's economy has already begun to recover from the quarantine and epidemic, the US economy continues to fall and will begin to recover at best in the third quarter. Thus, the American economy will lose much more than the Chinese one. Considering the fact that before this, two years trade negotiations between Beijing and Washington were held, which, according to many experts, were primarily beneficial to America, China delivered a good retaliatory strike, though not only in the United States, but around the world.

Based on all the above, we believe that as soon as the "coronavirus" epidemic ends, and it is still very early to talk about it, a new battle will begin, which may affect the most developed countries of the world. It will be called "confrontation with China". Especially if there is no second wave of the epidemic in the Middle Kingdom. Especially if the total loss of the economy in China is much smaller than that of their main competitors. It is possible that China will fall into an economic blockade if it does not want to voluntarily "pay damages" for its negligence or criminal negligence. Thus, unfortunately, the world economy is unlikely to return to a state of rest in the near future.

On Tuesday, May 5, the European Union is scheduled to publish an economic growth forecast - a summary of forecasts for key economic indicators. And in the United States on this day, the publication of business activity indices in the service sector according to the Markit and ISM versions is planned. The service sector is expected to decline from 52.5 to 32 points in May according to ISM and 27 points according to Markit. However, from our point of view, these figures do not matter now. They are in any case talking about the strongest decline in the service sector. Thus, we believe that market participants will ignore them, which means that today will again be empty in terms of the macroeconomic background. News, as always, should be expected from Donald Trump and from America in general. And technical factors will remain in the first place in terms of the degree of influence on the currency market.

![Exchange Rates 05.05.2020 analysis]()

The volatility of the euro/dollar currency pair as of May 5 is 91 points. Thus, the indicator remains average in strength, close to high, and there is still no reason to expect a new wave of panic. Today, we expect quotes to move between the levels of 1.0818 and 1.1000. A reversal of the Heiken Ashi indicator upward may signal the end of a downward correction.

Nearest support levels:

S1 – 1.0864

S2 – 1.0742

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0986

R2 – 1.1108

R3 – 1.1230

Trading recommendations:

The EUR/USD pair continues to be adjusted. Thus, traders are advised to open new purchases of Eurocurrency with targets at levels of 1.0986 and 1.1000, but only in case of a price rebound from moving. It is recommended to consider selling the euro/dollar pair no earlier than fixing the price below the moving average line with targets at 1.0818 and 1.0742.

Explanation of the illustrations:

The highest linear regression channel is the blue unidirectional lines.

The lowest linear regression channel is the purple unidirectional lines.

CCI - blue line in the indicator window.

Moving average (20; smoothed) - blue line on the price chart.

Murray levels - multi-colored horizontal stripes.

Heiken Ashi is an indicator that colors bars in blue or purple.

Possible variants of the price movement:

Red and green arrows.