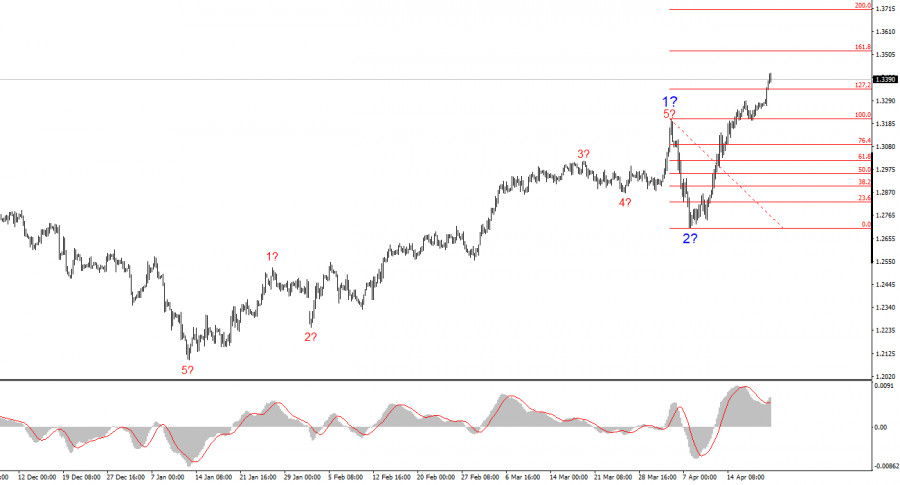

The United States has covered a second wave of coronavirus infection, which is associated with mass protests and acts of civil disobedience provoked by the assassination of George Floyd, as well as the early discovery of certain sectors of the American economy. Having reached a daily low of 17.5 thousand people on June 8, the number of cases began to increase rapidly and by June 23 doubled to 34.7 thousand cases per day. Moreover, the increase in the incidence of COVID-19 is on an accrual basis, which indicates the beginning of the second wave of the epidemic in the United States (Fig. 1). At the same time, the total number of cases as of June 25 was 2,425,000 people.

Responding to these terrifying numbers, President Donald Trump complained that the United States is conducting too many tests for coronavirus, taking first place in the world for this indicator, which, as usual, is only partly true. The US really did the largest number of tests among other countries, and their total number has so far reached 29.572 million. However, only 8.93% of the population has been tested, and according to this indicator, American health care occupies only 26th place in the world. And in terms of mortality per a million people, America is confidently among the top ten countries, being in 9th place with the result of 373 deaths per million people. France is located higher than the US in terms of deaths - 455 people/million, Sweden - 511 people/million, Italy - 573 people/million, Spain - 606 people/million, and the United Kingdom with a sad result of 632 people per million and a total of fourth place in the list of tragedies.

Fig. 1: US daily coronavirus cases

In recent days, an increase in the number of cases has been recorded in Brazil, which ranked second in the world in terms of the number of infected people - 1.146 million, and in India, which occupies fourth place, where the number of patients is already 456,000 people. Russia ranks third in the number of infected people, where the total number of patients with coronavirus infection exceeded 606,000 people, and testing was conducted in 12.2% of the population. However, a powerful second wave of infection is observed only in the United States; in all other countries, the incidence is either declining or increasing along with the amount of testing conducted. All this jeopardizes the global economy, which depends on the US dollar as its primary reserve currency and key funding currency.

While the COVID-19 epidemic is raging in the US, China decided to take advantage of the situation and came up with new initiatives aimed at depriving the dollar of the status of the main reserve currency and strengthening the role of the renminbi in international settlements. On Monday, June 22, Vice Chairman of the PRC Securities Regulatory Commission Fang Xinghai announced the need to create its own system of international and clearing settlements, similar to the SWIFT and CHIPS systems under US control.

SWIFT is the abbreviation of the Society for Worldwide Interbank Financial Telecommunications, a nonprofit organization headquartered in Brussels, Belgium. In fact, this is not a payment system, but rather a communication or message system used to inform the bank about the transfer of funds from a specific account to a specified account in another bank. Then the actual transfer of funds is carried out through clearing systems such as Fedwire or CHIPS.

Fedwire is the US Federal Reserve's money transfer system, which is most often used for electronic transfers by member banks of the Federal Reserve and other financial depository institutions to transfer funds from a bank account to a bank account in another bank. Fedwire is also used for transfers between banks of the Fed, for purchases and sales of assets held by the US central bank.

CHIPS is an abbreviation of the Interbank Payments System. This system is managed by the New York Clearing House Association and provides 90% of all international money transfers. Banks using CHIPS maintain accounts with the Federal Reserve Bank of New York, and final settlement is made by adjusting these accounts.

Having such a powerful tool as the US dollar, controlling all its transactions, the U.S. administration is in fact able to suspend payments made by China and other countries, as well as limit payments on U.S. treasury bonds by freezing payments to any country. The problem has become even more urgent in connection with the policies of Trump, the trade war and the calls to fine China for spreading the COVID-19 epidemic, blaming its own miscalculations on a geopolitical competitor.

The statements by Fang Xinghai, essentially a minor official from China, should be understood as the determination of the second world economy to challenge the US dollar by offering the world a new reserve currency - the Chinese yuan or its counterpart, independent of the whims of the Washington administration. The moment for this statement was chosen more than successfully, and it is naive to believe that China only took care of this problem at the beginning of this week. Most likely, work in the direction of building its own payment system has been carried out by China for a long time, it's just now the time has come to announce this publicly, inflicting a significant image blow on the United States and warning the geopolitical adversary about the consequences of its hostile actions.

In fact, the understanding that the dollar is critically important and at the same time ailing currency has long existed in the Chinese Communist party. In March 2018, China began trading Shanghai Crude oil for yuan with the possibility of their subsequent conversion to gold, having built a trading infrastructure on the Shanghai Energy exchange (INE) with American help, which deprived the dollar of its status as a settlement oil currency.

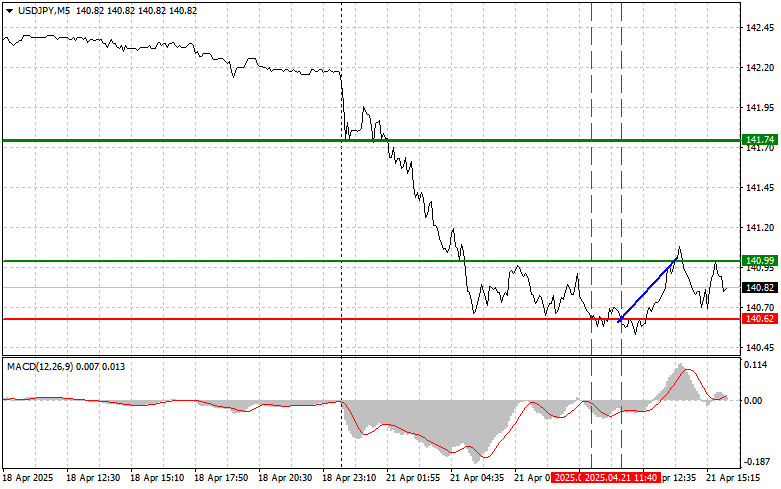

Since the start of trading on the Shanghai International Exchange, oil trading volumes there have grown substantially and are approaching half the volume of oil trading on the NYMEX. In May 2020, the total trading volume of transactions on the INE amounted to 5677100 contracts at the Open Interest level of 176872 thousand contracts, in June there are similar indicators (Fig. 2), and this is not the toys of the Chinese Communists, but a challenge and an alternative pricing structure.

Figure 2: SC Yuan Oil Trading, Futures August 2020

Despite the skepticism of some commentators who claimed two years ago that the Chinese Communists could not come up with anything worthwhile, the correctness of the yuan oil trade was proved in April 2020, when the price of oil of the American grade WTI, traded on the NYMEX exchange, assumed negative values. At the same time, the cost of SC oil in China remained at 280 yuan, which was equivalent to $40. This allowed China to avoid the negative trends associated with negative oil prices.

Now, communist China, declaring the need to popularize and implement settlements in RMB, is taking the next step, depriving the dollar of its last advantage as a global unit of account and means of funding. This path will not be simple and quick, but in the end, on June 22, a death knell rang on the US dollar. It is clear that the dollar will not give up its positions quickly, it will take a lot of time, unless, of course, the United States falls into separate states this fall after the election of the next president. However, it is quite possible that soon the US debt will grow not only in dollars but also in RMB, and this will be a completely different story in which the United States of America will not have a happy ending. Let's not build illusions, the US will remain a leading economic power for a long time, however - the Moor has done its duty, the Moor can go.