Hello, dear colleagues. It's been a month since my publication wherein I suggested that gold may try to push support at $ 1,860 per Troy ounce and fall to new lows in November and December 2020. However, we must admit that, despite all the efforts of the bears, the bulls still manage to hold the last line of defense. Moreover, in early November, they launched a deadly counterattack trying to raise the price of gold to the level of 2000 again. They even managed to reach the level of 1950, but news of a vaccine developed by Pfizer pushed them back to the initial level of $ 1,860 per Troy ounce, where the warring parties slowed down again in local clashes.

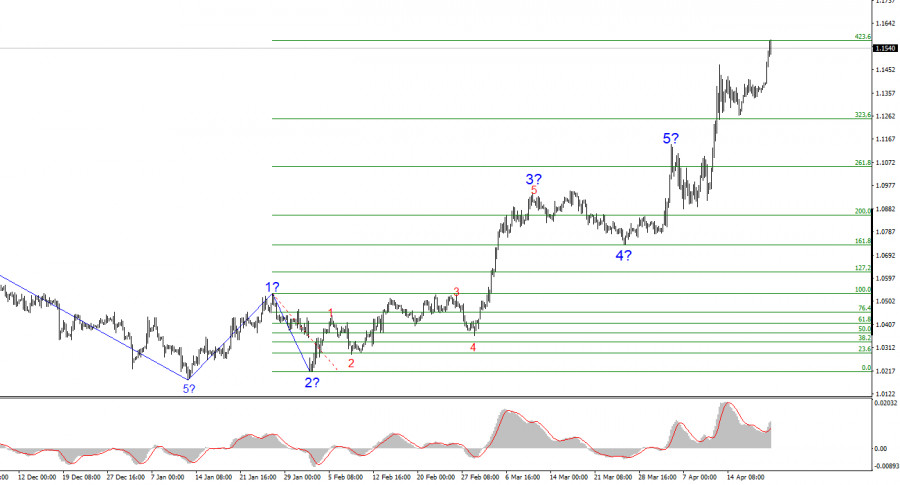

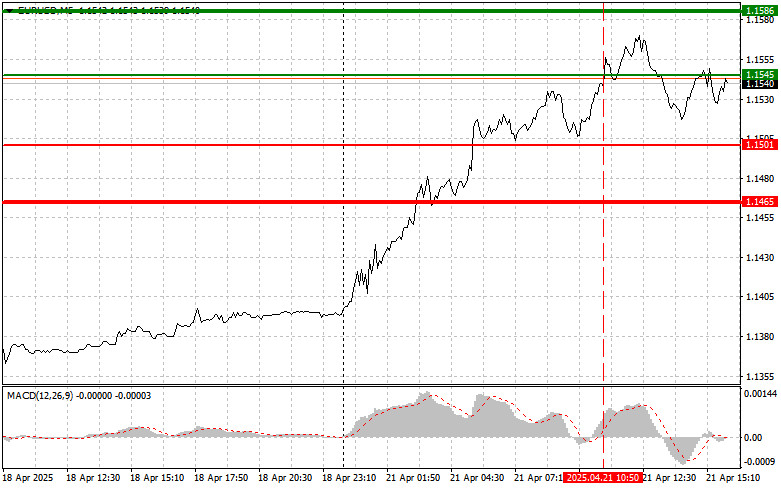

We can expect that in the near future, the bears will take a decisive assault on the 1860 level given the Pfizer vaccine that requested emergency registration in the United States was helped on Friday by a vaccine from Moderna, which also announced a successful third stage of testing. In this case, the bulls will have to retreat to the next line of defense of $ 1,750 per Troy ounce, and then up to the level of 1,700 is at hand (Fig. 1). The main thing is that the retreat does not turn into a stampede to the zone of values of 1,450 to 1,500, and this scenario is becoming more likely as the situation develops.

Fig. 1: Technical Analysis of Gold Price - Daily Time, 1-3 months Prospects

Considering the current balance of power, the defeat of gold buyers can be devastating as their camp left the last allies. According to the reports from COT, the US Commodity Futures Commission demands for gold that now stands at 875.2 thousand contracts and is at its lowest levels since June 2020, when it was 874.5 thousand contracts. A little more demand in the futures market fell to the level of June 2019, when gold was worth $ 1,400 per Troy ounce. Moreover, the positions of speculators, namely the main buyers of gold in the futures market, have already fallen to the level of the summer of 2019, i.e. they are ahead of the General drop in demand.

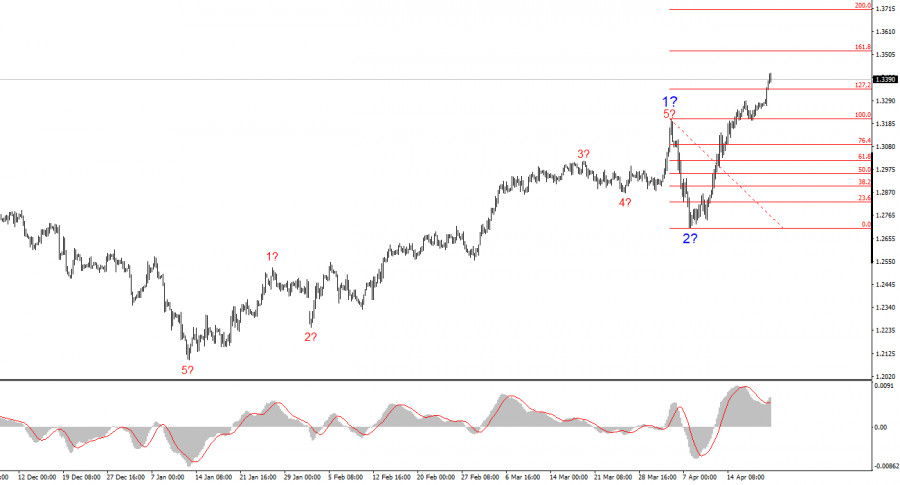

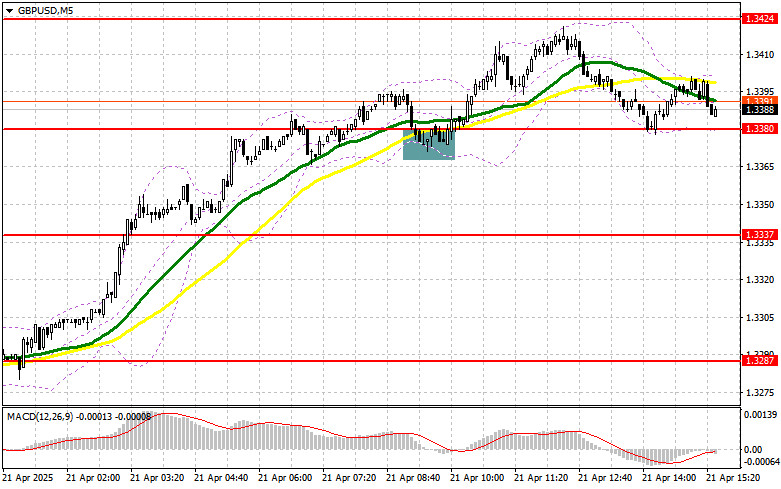

An equally depressing picture is emerging in the market of exchange - traded funds. In October 2020, the purchases of exchange - traded funds Gold backed ETFs fell to the lowest values since December 2019 according to the World Gold Council. Exchange - traded funds from the United States bought only 1.8 tons of gold and if not for European buyers who bought 20.2 tons, the demand for gold in this segment would have gone into negative territory (Fig.2).

Fig. 2 Purchases of exchange-traded funds investing in gold

Last Friday, November 20, US State Treasurer Steven Mnuchin, delivered an unexpected blow to gold holders, about the limits on the credit line issued in the spring to fight the pandemic that will expire on December 31, 2020. He said in a letter to Fed Chairman Jerome Powell "I demand that the Federal reserve return unused funds to the Treasury," refusing to extend programs that the Central Bank considers critical to providing credit to all sectors of the economy. The announcement came as a surprise to Federal Reserve Officials, who just days earlier had said that programs to support the economy should be extended.

The question seems to be what does gold have to do with it? However, there is still a link between the Fed's funding and the price of gold. Monetary emission programs undertaken by the World's Main Central Bank stimulated the growth of the stock market and the purchase of gold by American investors. These same programs have partly led to a weakening of the dollar, which is now trading at 92 against a basket of foreign currencies and 1.19 against a European competitor. If the US Federal Reserve and Treasury under the leadership of Trump's henchman, Steven Mnuchin, will enter a phase of confrontation and eliminate the stimulus programs, until the administration of President-Appointed Joe Biden decides on a new stimulus, the global stock market will collapse.

If this happens, it will cause a sharp strengthening of the US dollar and the sell-off in the markets will affect all assets including gold. Unfortunately, the global financial system is designed so that it can only feel good when the US dollar is relatively cheap and the cheaper the dollar, the better the world economy feels. This is due to the fact that the dollar is the main funding currency, as well as the main currency in which the value of most assets is determined. Therefore, the cheaper the dollar, the higher their cost. When markets fall, there is a so-called credit squeeze, when the dollar begins to rise sharply in price, which leads to a drop in the value of all assets without exception. In the future, against the background of negative events, gold may again begin to rise in price as a safe haven from risks, but until then, the expensive dollar may send it to where we are even afraid to look today.

But is it really that bad that gold has no chance? I'm afraid it is. Demand for physical gold in Asian countries has not yet recovered as the previously launched unprofitable mines continue to produce metal. There is a delicate balance in the gold market, which was mainly supported by buyers of exchange - traded funds, coins and bullion. Central banks have suspended purchases and the demand from technology is at the lowest due to the economic downturn of the global economy. The only consolation for the fans of gold in the short term, could probably be lower prices, that will only happen if the price of gold will decrease at all. The fact that the market can put any wise man to shame and the information I have may be incomplete.

Be careful and follow the rules of money management.

P.S. When the article was already written about the successful trial of the vaccine, the company AstraZeneca said, the price of gold collapsed.