Analytics today

Popular analytics

EUR/USD: Simple Trading Tips for Beginner Traders on April 11th (U.S. Session)

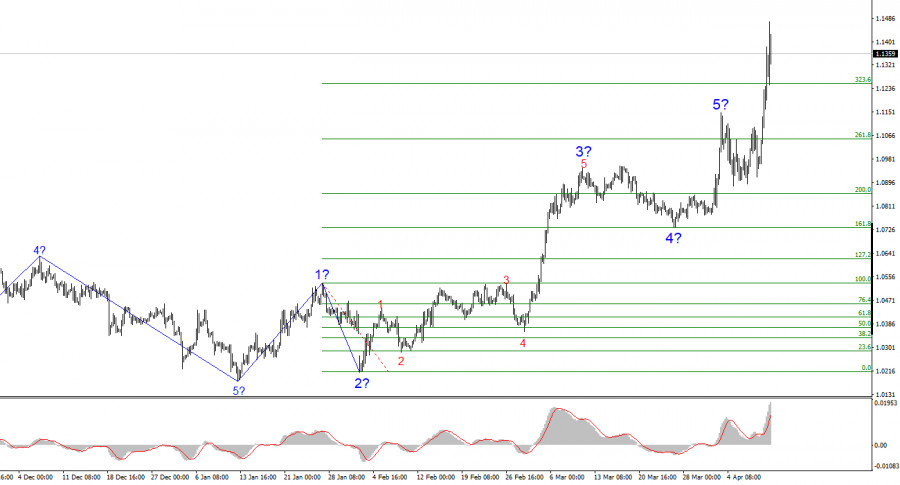

Trading Signals for EUR/USD for April 11-15, 2025: sell below 1.1470 (+2/8 Murray - overbought)

Trump makes another step towards crypto market

Trading Signals for GOLD (XAU/USD) for April 11-13, 2025: sell below $3,235 (+1/8 Murray - overbought)

Email Subscription

Do you want to receive Forex analytics newsletter to your email?

Subscribe to analytics newsletter and get fresh daily reviews prepared by InstaSpot professional analysts. You can choose which type of analysis and from what analysts you wish to recieve to your email address daily. Be on top of the Forex market events with InstaSpot!

US Market News Digest for April 11

AUD/USD. Analysis and Forecast

Update on US stock market on April 11. Major pullback after strong rally. Market regains consciousness.

Forex forecast 11/04/2025: EUR/USD, GBP/USD, SP500, NASDAQ, and Bitcoin

Trading Recommendations for the Cryptocurrency Market on April 11

Markets Face a Prolonged Period of Instability (USD/JPY and USD/CHF Likely to Continue Falling)

Technical Analysis of Intraday Price Movement of Polkadot Cryptocurrency, Friday April 11, 2025

We present to you the daily updated section of market analysis prepared by professional analysts of InstaSpot Company. Each of the specialists represented in this section, carries out analytical reviews in accordance with his/her vision of the current situation on foreign exchange and other markets. However, the outlooks below are only recommendations and not instructions to any actions; they contain analysis of the current situation on the currency market. In some cases the analysts' opinions to changes in the current market situation can differ, in this way, we recommend you to follow the publications of only one analyst, who in your view most clearly and correctly evaluates the situation on the international Forex market.